I know, I know, I've been talking about making strategic decisions in property investments, and yes, each of us needs to do thorough research, data, and numbers on anything we want to invest in.

But you may ask, "Isn't there an answer key or some guidelines of some sort for making property investment decisions?"

Some secret sauce? Well, lucky for you, yes, there is.

There are many forms of real estate in Singapore right now. Many different developers and different types for different objectives. Which one to choose?

The first thing to go back to is your WHY. Why do you want to purchase a property right now?

Your answer to this question will be your compass for all the decisions you will be making as you move forward.

Here are three things to keep notes of:

Valuation

Property value is largely influenced by the number of transactions going around the market, the project density, and the property's current owner's profile.

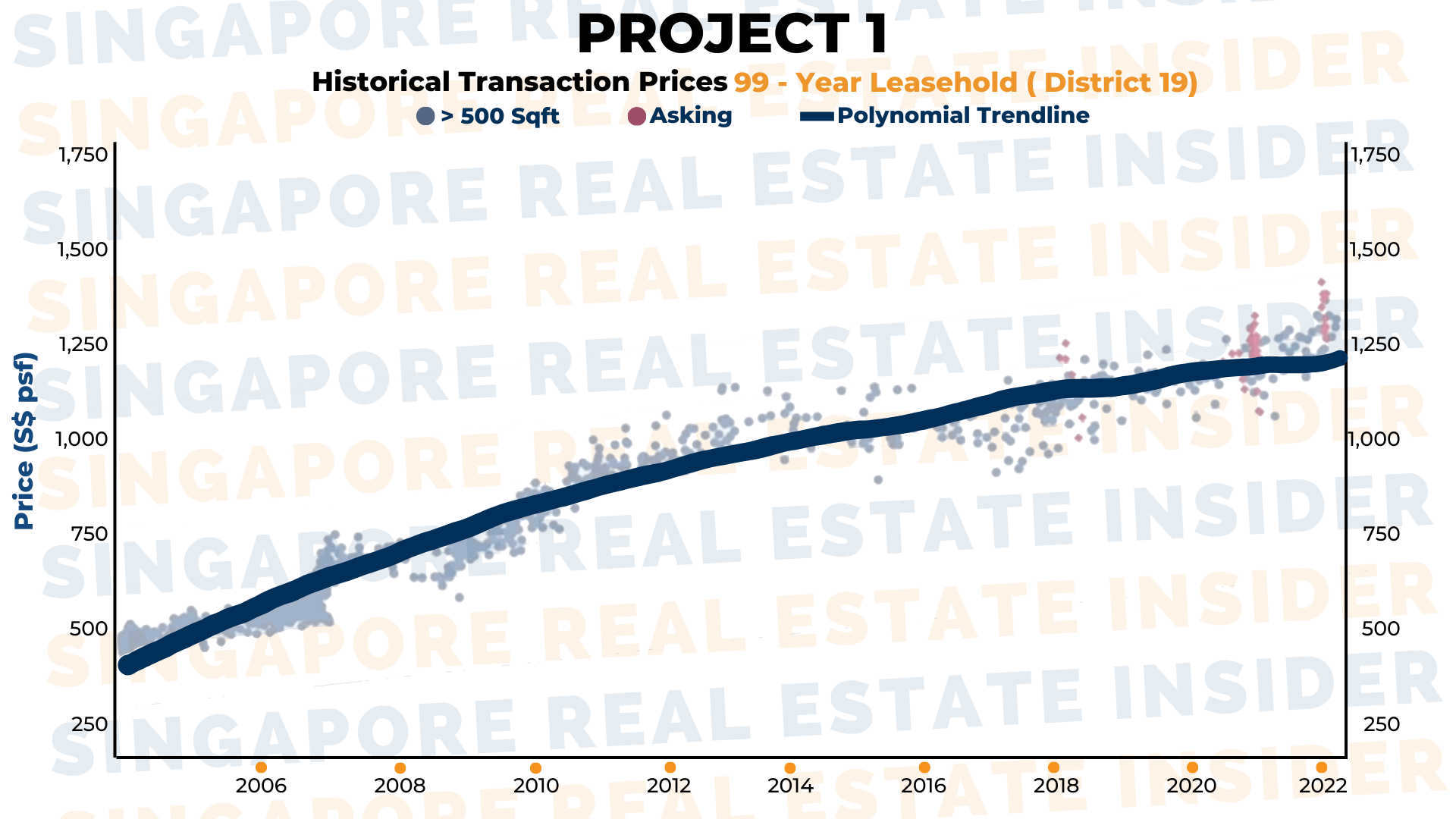

To make a point, let's look at this 18-year-old 99-year tenure property in District 19. It was launched in 2004 at $500 psf. It has had a lovely, stable yearly increase from its TOP selling at $700psf, and even now at $1,400 psf.

Now, will this property continue to appreciate from here onwards?

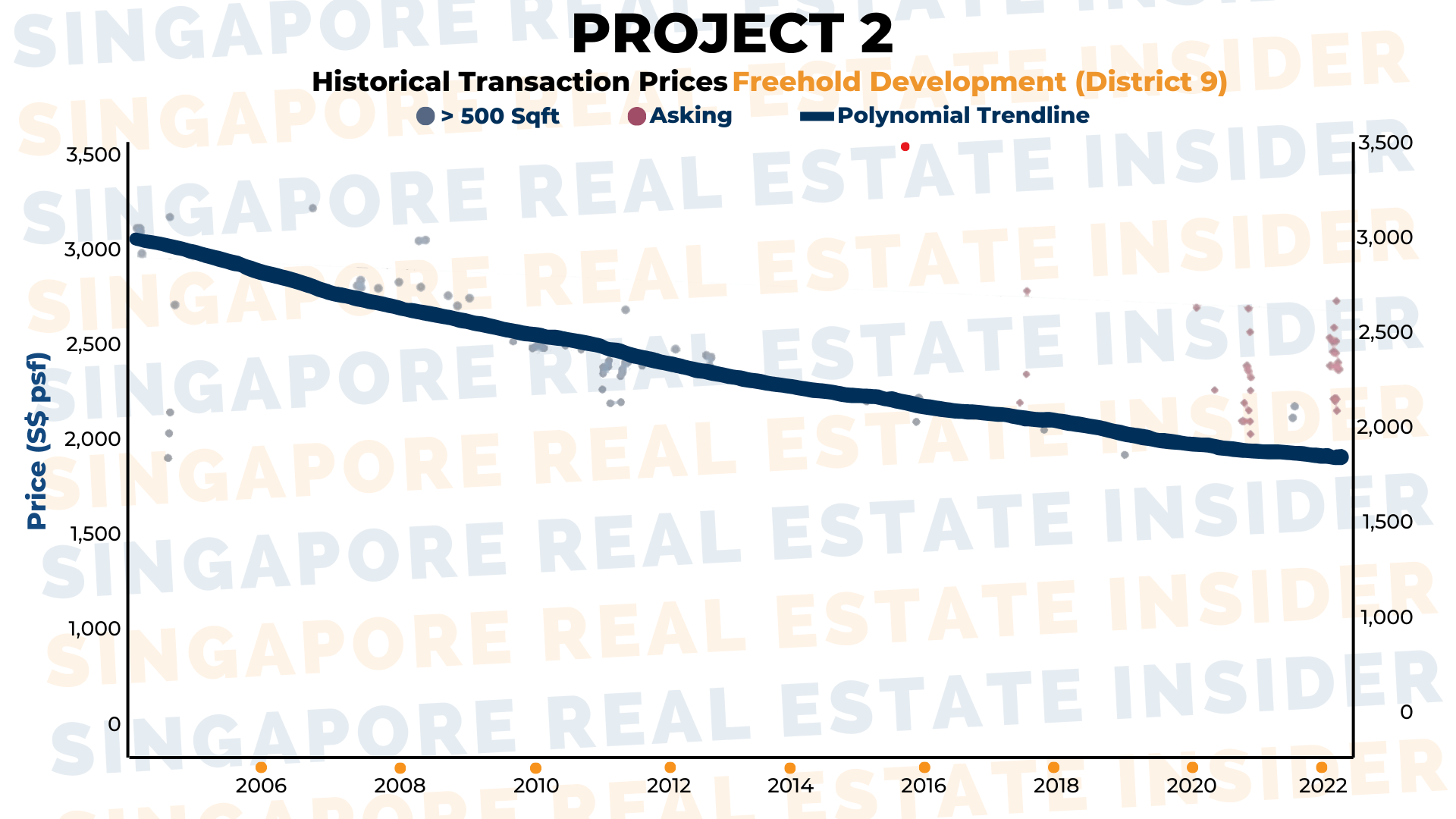

Let's compare it to a freehold property in District 9 with less than 100 units. Sadly, when they launched in 2007 at $3,000 psf, it only went downhill up to 2022 with only $2,000 psf. That's a heartbreaking downward trend for 14 years.

Is there a chance for this property to recover at all?

You see, it's not always a matter of just deciding on a new launch or resale property. One of the most critical factors in instances like these is the profile and margin of the current owners.

In the case of the second property in a downward trend, it depends on the owners' behavior. If the owners say, "You know what, I'm just going to sell right now. I can't wait for this property to recover." Then the attitude might be the same for the other owners. Therefore, selling at a loss will also be the trend for the valuation.

However, if the owners choose to wait it out, there might be a chance for the property to climb up in value. Because real estate is a cycle.

But here's the thing:

We will be exchanging time for the value to climb up. And it might be that the properties around would already be worth twice or thrice as much by the time the market moves up.

As for the first property, the continuous rise motivates its owners to keep pricing them higher. Once buyers accept these higher prices, it will cause a further upward trend for the entire project's value.

Potential buyer audience

Whenever you plan to purchase a property, try to imagine yourself in three, five, or ten years when you exit your property. And try to get an idea about how huge your buyer audience would be by then. Who would be interested in your property, and what is their general profile?

When you buy a property, strike a balance between your family's needs and your property investment. The home should first serve your needs, as in room requirements, proximity to lifestyle needs, etc.

But balance it out with investment-forward factors so that when you exit at the right time, you'll have an enormous scope of buyers who would be interested in your investment.

That’s the reason why one needs to strike a balance if the property objective is one's own stay with family needs & and criteria or purely investment for profits only.

If you keep going for both, it is likely that the property you have been finding will lose you money or worse, you will end up with nothing!

Understanding Singapore Real Estate

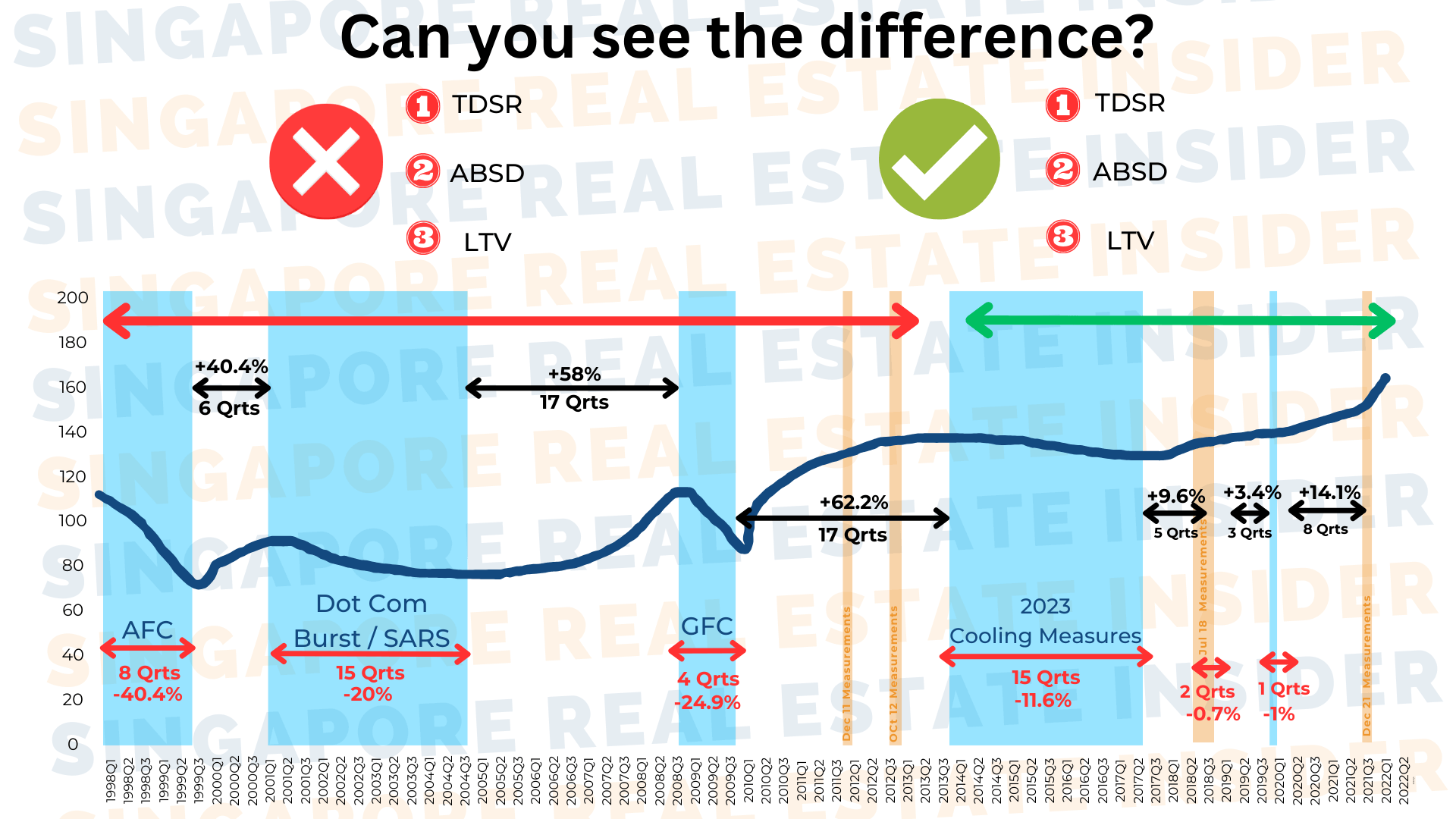

As you know, Singapore has its own, very unique, progressive real property eco-system. From its cooling measures, TDSR, and so on.

The objective is very clear. To ensure stability in property prices so we do not repeat what happened in 1997, 2008 financial crisis.

And I can tell you, Singapore is doing a fantastic job on this, else, we will be talking about other things than property.

While we are somehow having a roller coaster ride where the market is very much influenced by global market conditions, we have come a long way since cooling measures were introduced in 2013.

You can see a huge difference between the before and after 2013 period.

Before 2013, we can see a huge increase spike and deep drop that causes a lot of uncertainty in the housing market where many are overleveraging and overborrowing at that time.

Although after the 2013 period, we still have ups and downs, but they are moderate.

You can see the adjustments % drop are min compared to the upswing that comes after that. The pent-up effect is very real here.

While everyone loves to wait for prices to come down before they make a decision -

Will you be able to capture the lowest point before the upswing effect kicks in without warning?

Before you jump into your own thoughts that the market is at your disadvantage.

Study the trends properly before you start your property journey. This is extremely important when you do your research to understand better.

There are many ropes and hurdles for homeowners and investors, and it can be a nuisance to some degree.

So this is where we at Singapore Real Estate Insider come in to help you work through the ropes, save on costs, and maximize profits safely and securely.