Is increasing your loan capacity possible despite TDSR limitations?

For more than a decade, multiple busy professionals and homeowners have benefited from our property solutions to make six-figure profits safely.

Even with the introduction of 2013 cooling measures and subsequent additional measures later on. Many are still able to do well in their property profits because of these two methods that I’m gonna walk you through step by step.

Read on, if you want to learn the traits to use little money, to triple your ability in a property purchase.

We’ve talked about it in a recent article, about how the latest cooling measures have affected each profile of buyers and their property.

Are you one of those home buyers affected by the new TDSR framework?

Here I will share with you, even though there are limitations to your loan ability. There are ways you can increase your loan capacity, regardless of any cooling measures.

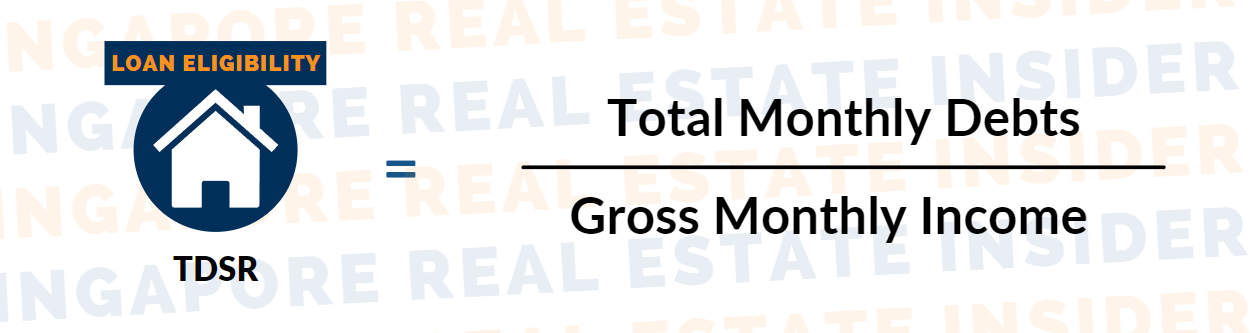

Let me give you a quick overview of what TDSR is.

TDSR our Total Debt Servicing Ratio is a cooling measure that was initially introduced in June 2013, that regulated a borrower’s maximum property loan eligibility, regardless of purchase or refinancing.

TDSR is computed as this. Your TDSR is calculated by dividing your total monthly debt obligations over your gross money income.

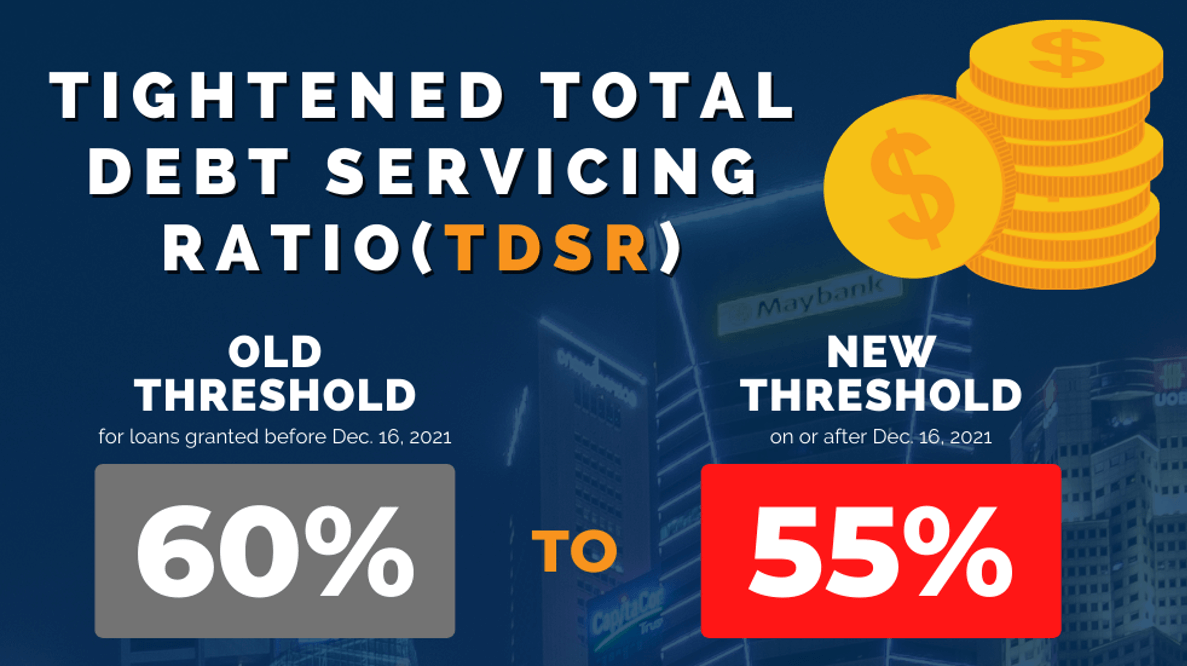

According to MAS (Monetary Authority of Singapore), a person’s TDSR must be less than 55% of their gross money income. This 55% is the new TDSR rate effective last December 16th, 2021.

As opposed to its old rate of 60% with the new TDSR rate, what happened is it lowers the total amount a person can borrow.

This can be a problem for homebuyers who are eyeing a property that’s more than their loan eligibility. Let me give you an example of how the new TDSR affects first-time buyers.

If you are a young couple, 30 years old and buying your first home and you have a combined income of $12,000, here’s the difference between your loan eligibility from the old and the new TDSR with the old TDSR of 60%, you are eligible for a $1.6 million loan.

Today, with the new TDSR rate of 55%, you will only be eligible for a $1.47 million loan. That’s a difference of $130,000!

And because of this, most will not want to stretch their capacity and opt for either a smaller size property or in a different location, resulting in a final property that may not be what is most ideal for their living lifestyle and making some compromises because of the overall cost involved.

If you really want to purchase your first property worth $1.6 million, you may need to either borrow or continue to save more in order to do that.

Now, what if there is a way to bridge this gap and come up with this additional $130,000 to make up the difference in this example, without the need to borrow or take on an extra cash line, will you think that this will open up more opportunities to buy the property that the family can be comfortable with and still make six figure profits in future safety?

There are ways to structure your finances to bridge this gap provided that you’re working within your means, and you have the knowledge to do it safely.

Here, I will show you two ways how you can bridge the gap and increase your loan capacity, through the Financial Insider Strategy to increase your loan capacity.

PLEDGE FUND

The first option is for you to PLEDGE FUND.

There are two types of pledge assets, namely liquid assets, such as Singapore dollar deposits, and savings and other securities like stocks, bonds, foreign currency deposits, and gold.

When buyers have no or inadequate income to back their loan application, this kind of property financing works.

Despite the fact that they have a lot of money, the lack of income makes it difficult for banks to approve the loan of a home buyer.

As a result, asset pledging assists them in increasing their income to levels that meet the TDSR requirements and allows them to qualify for property purchases that might not be able to afford otherwise.

Assets that have been pledged for at least four years are valued at their full worth.

If they’re pledged for fewer than four years, they will get a 70% discount right away.

Now, going back to our example, you just need to pledge $50,000 to the bank financing alone so that they can lend you the $130,000 gap.

As a precaution, keep in mind that not all banks allow this type of financing scheme. So it’s always better to consult professionals who are familiar with financial strategies to work out the numbers in details before doing it.

Take note too that almost all banks that provide assets pledging will want you to show the assets at the point of application.

UNPLEDGING

Let’s head on over to the next option, which is UNPLEDGING, or in simple terms, SHOW FUNDS.

If you have a large sum of money stored away, you can show funds to the bank to demonstrate that you have the financial means to repay the loan.

Banks usually take a haircut or discount from the amount shown though, they do not consider the full.

Using this method for our example, you may have to show $170,000 to the bank for them to grant you the loan difference of $130,000.

You may ask me if I have $170,000 on hand, why would I still need to borrow $130,000 instead?

Why?

Depending on what’s your objective of the property, as well as the funds on hand, we do have clients opting for this so that they can have further usage of the funds instead of being locked up for four years.

If you’re short of a certain amount in terms of loan differences, do reach out to us so that we can help you structure your finances and advise you specifically according to your property situation.

***

Join us in our private group where we help busy professionals and homeowners make six-figure profits in their property, safely.

Property is an ongoing process and journey because they are constantly changing and different strategies must be applied at different times.

Therefore in this group, we not only do weekly live coaching on property, we also cover a wide range of property knowledge and information that we as homeowners must know and be educated on to make informed decisions.

Just click on the button below to join.

Disclaimer: All information presented is based on personal opinions. Singapore Real Estate Insider is not liable for any losses and expenses whatsoever related to investment decisions made by the audience. The ideas presented are here for reference and educational purposes only.