While we can't predict the future, as buyers and/ or sellers, we can use data to predict our next move with only a minimal margin of error.

Let me show you some facts to make you aware of what is happening right now. I will share with you 4 Facts about the housing market which ultimately involves the 3 Rs:

- Recovery

- Recession

- Real Estate

Recovery

We're all on the same boat if you're asking “ When will the global economy recover post-Covid-19?” And frankly, even our economists could not put a final word on the economic recovery timeline.

Because - there's nothing perfectly close to what transpired should we consult history, There's no one way of telling how it should happen.

Experts say that it might come in a "V" type of economic recovery.

By definition, a V-shaped recovery means that there will be a stark improvement in the economy after a sharp decline; thus, the resemblance to the letter V.

It is good to know that previous pandemics, such as the black plague and cholera, took on the same form of recovery.

It is said that since the times have changed so much compared to the historical pandemics, businesses and economies will be able to survive and regain momentum a quarter after the pandemic is done.

Financial leaders in the U.S. are hopeful that the economy will be bouncing back soon.

Recession (Covid-19 & Recession)

As you know, periods of recession are impermanent to economic declines because of lesser trade and industrial activities. The number of business and industry closures due to lockdowns can attest to that.

But let me assure you that recessions do not mean that a housing crisis is in the works too.

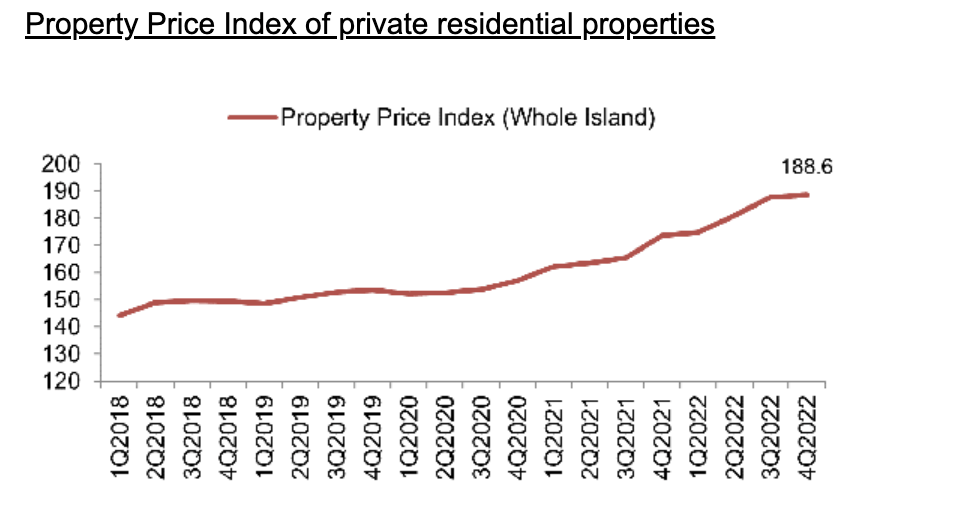

Home prices saw a steady increase even when the pandemic started as we can see in the chart.

Photo Courtesy of URA

But you - people still ask “Will it be 2008 all over again?” And who can blame them right? The infamous great recession in 2008, a.k.a housing crash, has traumatized people worldwide.

So it's only fair to validate concerns around this area. Did the recession cause the housing crisis or the other way around?

Real Estate

Here are four facts about the housing market

1. The factors that drove us to the housing bubble - COLLAPSED the financial market.

It’s a scary thing to recall - that the short sales and foreclosures were rampant during the crash in 2008, ultimately dragging home values down by 25%—the culprit: disadvantageous mortgages, swelling home prices and value, maxed-out equities, and oversupply.

But I always make it a point to remember that history prepares us for a better way forward.

2. 2023 is not 2008.

If there are two strengths I can pinpoint about Singapore, it's our ability to learn from our mistakes and our resilience. Our country is known for good governance and strategy that has kept us afloat, if not thrive, despite the crisis. We have many policies and cooling measures right now to safeguard the property market and its owners.

And right now, they are serving their purpose.

This should provide all of us with some assurance that history won’t just repeat itself.

3. Home values will not plunge with recession.

Similar to what I mentioned previously, a recession does not mean there's a housing crash. Take it from the leading property analyst Zelman & Associates, who announced that according to their careful analysis, “Home prices would expect a slower but consistent appreciation this year at 3%. “

This latter part is still good news and shows how strong and reliable the property market is.

4. High-Interest Rates & low employment due to COVID-19 are temporary and will not affect the property market.

Building on point number 3, economists trust that it won’t last long.

Companies and even governments worldwide have taken this wave into account and have made adjustments to accommodate the concerns of people affected by them.

Data from the last three decades do not show a direct correlation to the housing market either.

With interest rates slowing down as we speak, what will happen?

And this my friends, brings us to our last R of discussion - Real Estate and where we tackle the elephant in the room:

Is it a good idea to purchase property right now?

There is no uniformity in each market, so in the world of investing, one needs a thorough understanding of the work and a bird's eye view of the market.

It's beneficial to clear the air around the recession, so we can be better informed when it comes to major decisions such as a property investment.

This brings us back to my main point earlier, THAT WE SHOULD ALWAYS REFER TO DATA.

Data and research are our key weapons. It is our main guide in making the right moves to gain traction in this industry. And this is where, my friends, Singapore Real Estate Insider, can help you. Reach out to us and let's strategize for your property investment goals today.

Click here for a complimentary 20-minute consult with us.