It’s common for property buyers to take their time before purchasing. They look through units and units during the new launch phase, even for months on end, and when they do find an ideal one, they would have second thoughts about going for it or not.

By the time they decide to purchase the property, it’s already gone.

Does this scenario sound familiar? Maybe you did some property hunting yourself and ended up with the same fate, or worse, you still have not started your investment.

Unless you live under a rock, you would know the line, “the early bird catches the worm.” This catch-all phrase rings true throughout humanity’s existence.

How does this saying apply to your real estate investment?

Let’s take a deep dive into why individuals such as yourselves need to act fast when new properties are launched and the benefits of buying them early on.

Studies show that purchasing a property during its pre-launch far outweighs the risks. Here are some reasons why you should go for it now:

Higher Profitability

The usual practice among developers is to price their units lower during new launch phase because it will start the ball rolling, sales-wise.

So when you purchase at the moment the property is launched, you’re securing its lowest possible rate. Some research observes that the first takers gained about 31.8% gains on average (and take note, across all unit sizes), compared to those who purchased later, and only 28.7% profit.

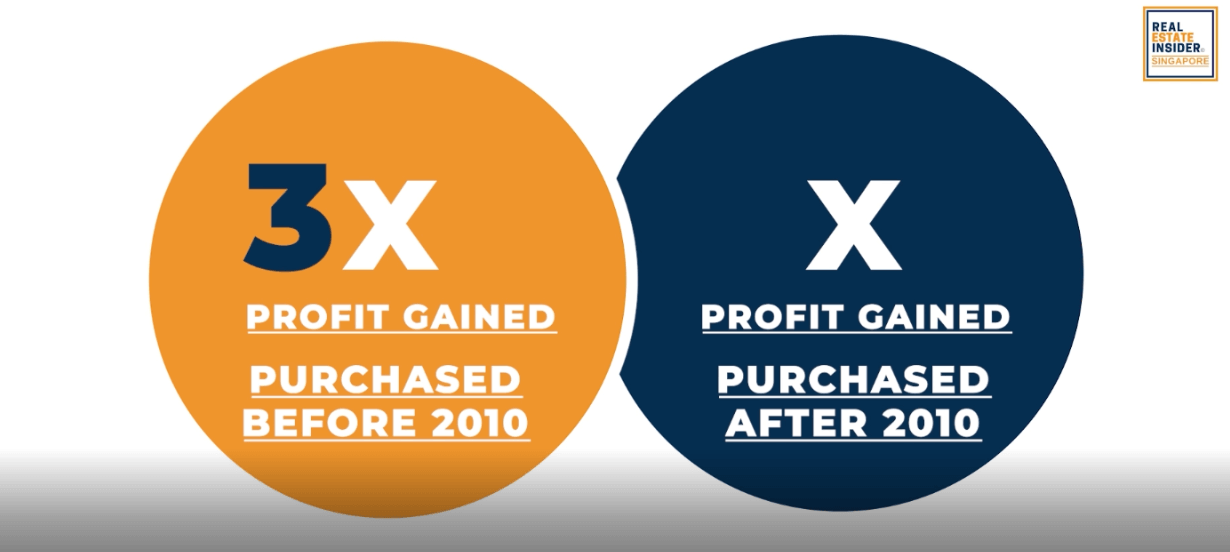

Let me take you through the trend of buyers before and after 2010.

Individuals who purchased before 2010 had three times as many gains compared to those after 2010. There are many factors to this, but it can be mostly attributed to the Singapore Government’s cooling measures.

In my previous article, I talked about the government’s efforts to “cool down” the market. These are additional stamp duties imposed upon new buyers and a restructured loan program to slow down property purchases.

When too many people can afford to buy properties, it inflates the market prices, which, in the end, could cause real estate properties to soar too high for anyone to afford.

These cooling measures are beneficial in the long run, but they are an additional expense for the buyers and minimize the profit margins.

Value Growth

This is probably a given for everyone who’s investing already, but let’s look at the numbers to validate this factor: property values grow over time.

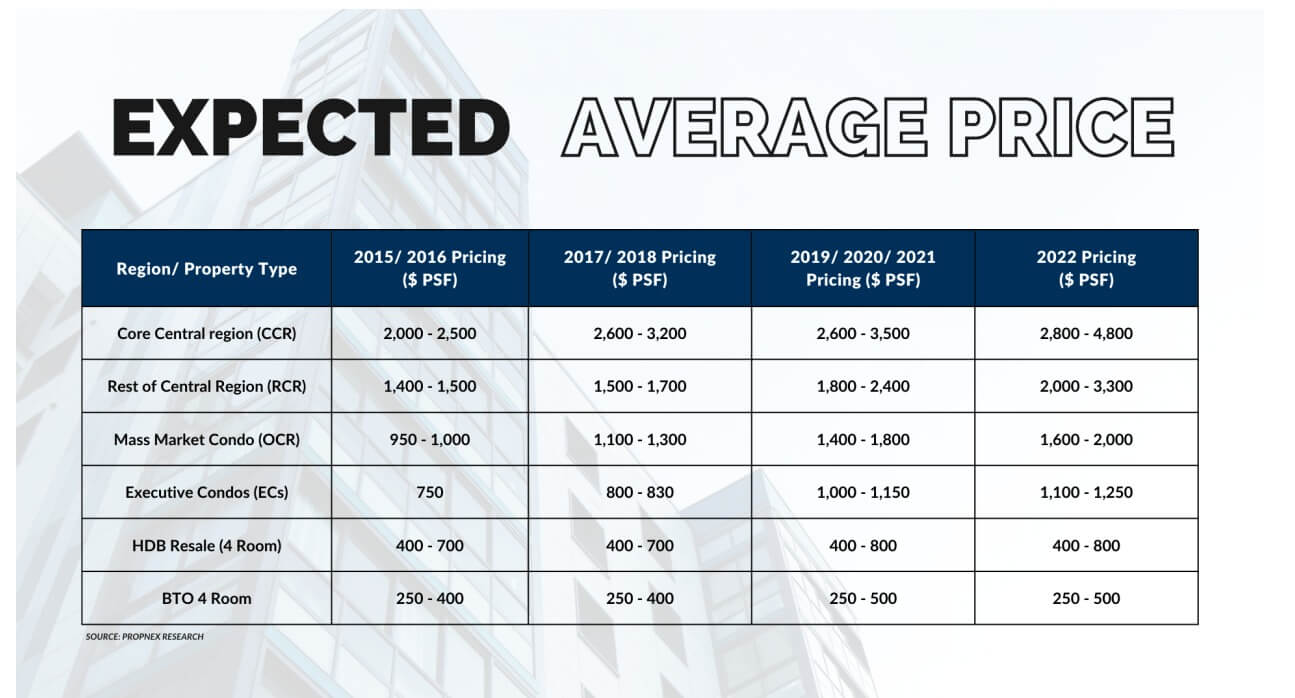

Let’s look at the pricing in RCR (Rest of Central Region) from 2015 to 2022.

In 2015 and 2016, properties in RCR are sold at $1,400 to $1,500 per square meter.

It grew from that figure to $1,500 to $1,700 per square meter from 2017 to 2018. Next thing we know, it’s a step higher at $1,800 to a whopping $2,400 per square meter in 2019/2020/2021–and yes, that’s even when the pandemic started!

And now, in 2022, a property in RCR would start at $2,000 to $3,300 per square meter. Can you imagine buying a property in 2015, when it was half of the price compared to today? Wow.

Buying early gives investors so much vantage point regarding profit margin.

Sure, the values in different regions and developers may not have the same growth rate, but it is sure to do so sustainably.

You may be thinking of “waiting it out” when the market is down.

But the downside to that is that there’s no telling if the market is at its lowest, and it’s not something that can be predicted accurately.

No one can say if the low prices are at their peak.

And ask this: by the time it goes down, will you have as much purchase power when the time comes? Most would prioritize other things when they do.

Well, how about waiting for the next pre-launch? You may be asking, “Should I just wait for the next one when I missed the sweet spot in buying a property?” Not exactly.

Here’s an example: the pre-launch rate of a developer offered their condos at $1,300 per square meter. After that promo period, the rate increased as time passed. When it goes up, for example, at $2,000 per square meter, the next pre-launch would be priced at the same rate–and that’s their discounted rate already. Sadly, we cannot turn back time.

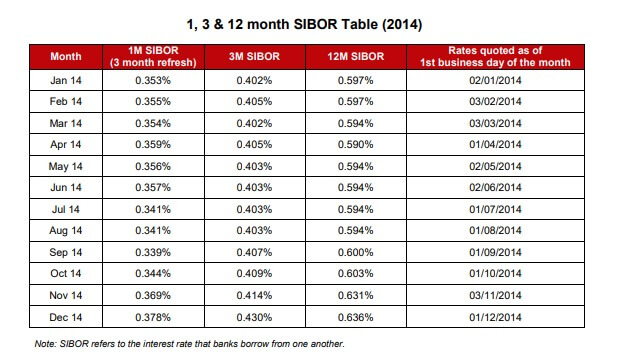

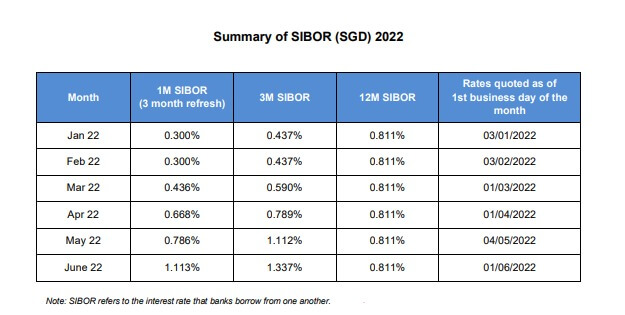

Interest Rate Only Climbs Up

Sure, the property prices can fluctuate at times, but here’s one sure thing: interest rates only climb up.

Flashback to 2014, when the SIBOR rates were only 0.406. In 2022, it has gone up to 0.691. You can only expect it to keep rising in the future. Keep that in mind whenever you decide to invest.

You Get Less Options When You Buy Late

The best units usually get sold out first upon launching.

So when you dilly-dally about getting a property, you would find yourself with the “leftovers,” as the prime spots would have been taken already.

You will still enjoy the perks of the amenities but probably not get that unit with the best views.

Discounted Stay

If you intend to live in the unit you have purchased, you are giving yourself a discounted rent.

A three-bedroom unit now in Singapore could cost around $6000 a month. But when you crunch in the numbers of purchasing a property now and consider the inevitable economic inflation in the future, it’s as if you have given yourself discounts less than half of its original value!

CONCLUSION

The next time you find yourself at a pre-launch of a condominium, have these five points in mind.

Remember that growth and transformation go hand-in-hand, and they do so with time.

If you have been contemplating investments and would like to learn more, book a discovery call with us.

Our mission is to help you make the most of life’s opportunities. Seneca, a Roman Philosopher, said, “Luck is what happens when preparation meets opportunity.” So let’s help you strike that balance.

***

If you want to know more about how busy professionals and homeowners like you can make 6-figure profits from property safely, we have a private group where we share traits and strategies behind it.

Just click on the button below to join.

Disclaimer: All information presented is based on personal opinions. Singapore Real Estate Insider is not liable for any losses and expenses whatsoever related to investment decisions made by the audience. The ideas presented are here for reference and educational purposes only.