As a Singapore PR (Permanent Residence) status holder, buying property must have crossed your mind. It’s a great way to maximize your PR status and a wise, safe move to invest your money. Here, we’ll explain why it’s critical to seize the chance to acquire property today, especially with the current cooling measures in place.

In my years in the industry, I have been asked many questions about making 6-figure profit by buying private property, mainly from my Malaysian friends and colleagues. They have built their careers in the country, accumulated sizeable savings, and now, they are looking to take it a step further by buying a property.

Still, you might have qualms about the processes and how you can buy without complications regardless of the market conditions.

Let me walk you through the five essential factors.

Five Important Factors to Consider when Buying Property as a PR

Now is the best time to buy property in Singapore, despite the additional buyer stamp duty, because:

Singapore Property Market Supply is Highly Regulated

Since Singapore is a small country, spanning a total land area of 724.2 square kilometers, land is scarce. Therefore, the government closely monitors property sales. In fact, there are only two options in buying a land here: one is through the yearly, controlled Government Land Sales, and two, through En bloc Sales, which means developers purchase existing buildings and re-design them.

With this in mind, you can deduce that buying property in Singapore is not a walk in the park. Yet, it’s a benefit for possible buyers because this control over the industry keeps the property prices in optimal value and sustainably increase over time.

Effective Cooling Measures in place when you Buy Property

The Singapore government implements its cooling measures well whenever they see that the market is moving too fast. Because of these, the interventions compel the industry to keep property prices affordable and continuously grow over time.

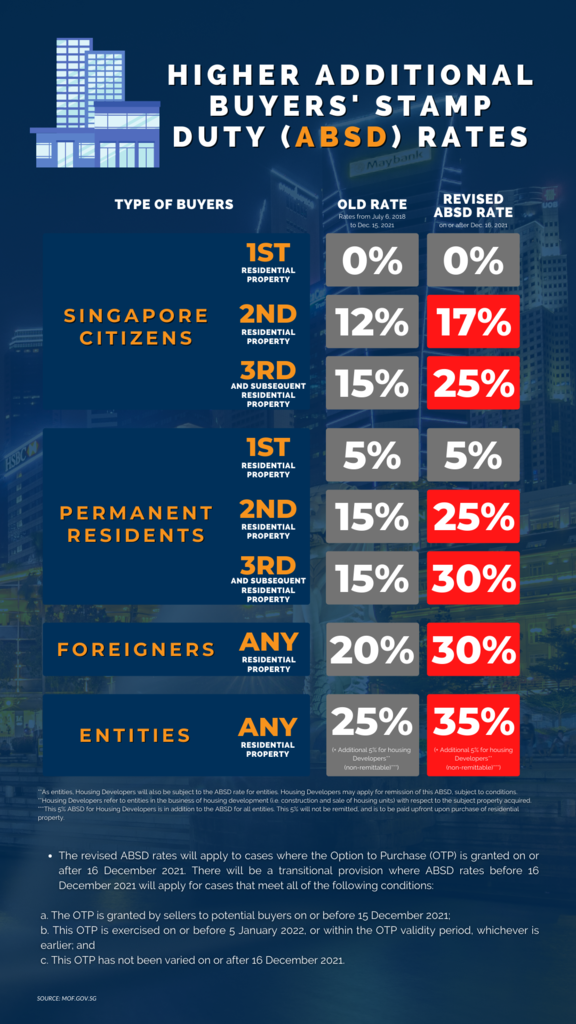

The ABSD and TDSR

In a nutshell, the TDSR (Total Debt Servicing Ratio) lowers your purchasing power as a first-time private property buyer. If this decreased ratio is a concern for you, make sure to start considering properties within your means first. It will be a catastrophic mistake if you over leverage yourself. Of course, there are ways to increase your TDSR limits, such as adequately structuring your finances.

Now, ABSD (Additional Buyer’s Stamp Duty) is an additional tax you need to pay for the properties you buy. It is computed based on your citizenship status and your Singapore property assets. As of date, Singapore Citizens pay 17% of their second property, 25% of their third property, and so on.

That’s a considerable rise compared to the previous 12% and 15% risk. On the other hand, PR status holders will need to pay an additional ASBD of 25% for buying second property and 30% for the subsequent ones. Foreigners pay 30% ABSD for each residential property.

It is quite a leap from the flat 15% for Singapore Citizens and PRs in the past. Yet, it is good to note that these measures are beneficial in the long run, despite the seemingly outright added expense, because it slows down the rise of prices, thereby giving first-time buyers the chance to afford a property. Your first real estate purchase will only incur 5% ABSD.

The facts and figures in this factor have compelled PRs to forego renting in place of purchasing a property because they worry that the ABSD rates will further increase.

Long-term Savings When Buying Property

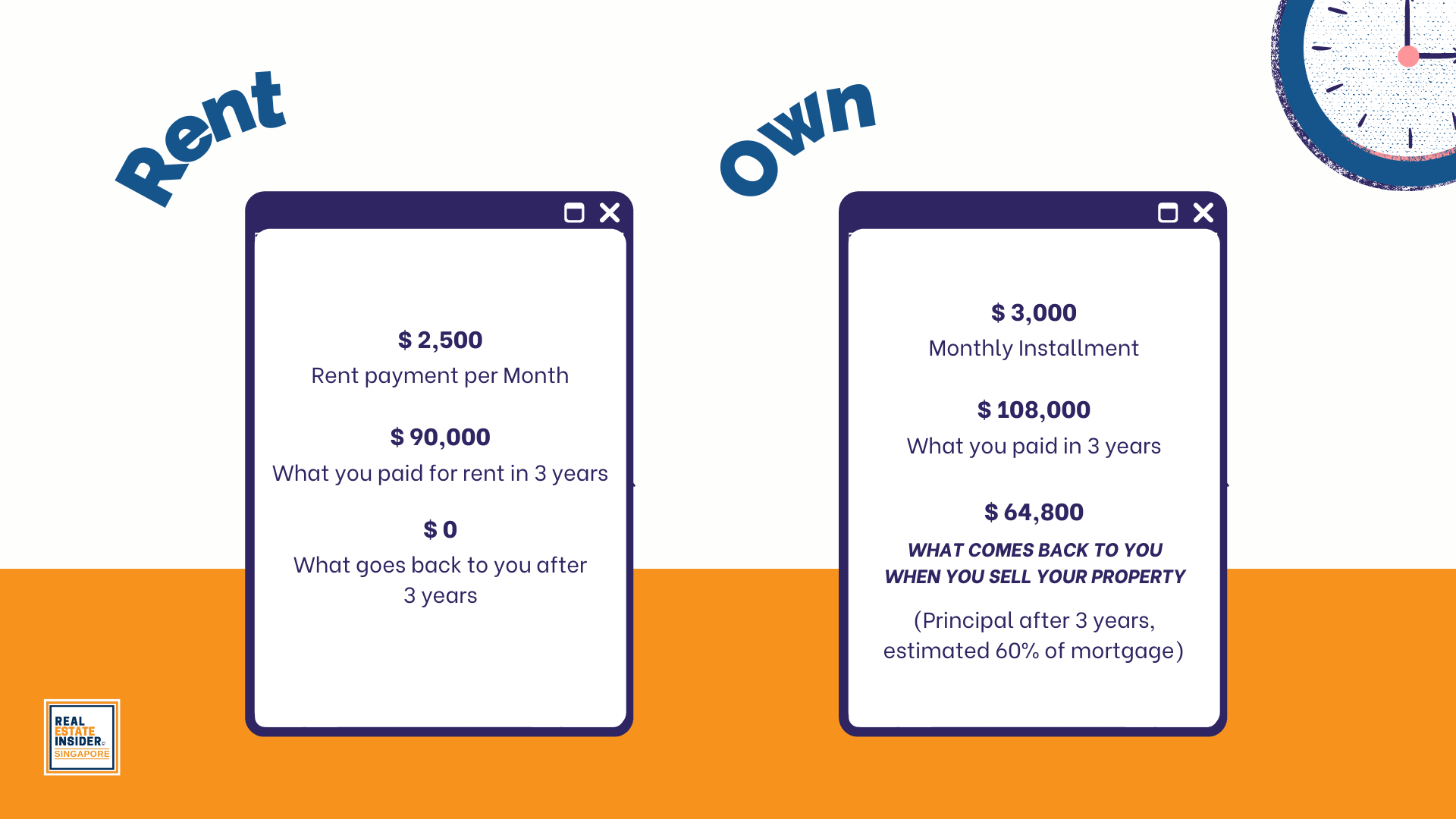

Most of the PRs who have lived in Singapore for many years settle for renting based on the idea that they can save on them. But here is the deal: it’s an expense rather than an investment. Whatever you pay in cash is an expense. Let’s say you’re paying $2,500 every month for your rent. Over three years, that’s an accumulated $90,000.

Remember, buying a property is savings into a property. Strategize accordingly, and it will be as if you have been paying rent at a discount instead. The worst-case scenario is not earning in the first year.

Here’s a numbers comparison between renting and buying property:

Imagine that your monthly installments for your property are at $3,000 every month. In three years, you will need to pay $108,000. Keep in mind that installments are split into principal and interest. You will regain your principal when you sell your property. On average, the principal after three years will be $64,800, with an estimated 60% of mortgage.

Count in your $43,200 as interests—$ 43,200 versus $90,000, saving you more money.

You can earn a six-figure profit by investing in the right property with the right strategy. You can even get so much from the capital gain–and the best part is, there’s no capital gain tax in Singapore. That shows that even if you do get started with a small property, it can grow exponentially bigger over time.

So, always remember: you must own something even if you still intend to continue renting!

Stability of Singapore Currency

I will never forget my conversation with one Malaysian investor. When I asked him why he is willing to buy properties in Singapore, he said, “Although it’s a lot of money, the currency’s stability is a major factor I am confident in.”

Can you imagine your gain if your property increases even by 5% annually? That’s three times as much currency exchange in profits back in Malaysia! Because of this, he encouraged his son to purchase private property in the Marina Bay area.

Lastly, Singapore has one of the lowest interest rates. That is why many are maximizing it. It is extremely attractive to borrow, combined with the robust currency exchange.

IN SUMMARY

The five factors to consider when buying property are:

- Singapore’s land is limited. The government imposes control over the supply every year.

- Cooling measures keep the property prices stable and affordable.

- The effects of TDSR on your borrowing capacity as a PR.

- Work within your means and start with a smaller property first to pay free rent or discounted rent in the future.

- Strong currency exchange and the interest rate environment are very attractive.

Please contact us if you need assistance in structuring your finances so that you could begin making 6-figure profits from property, safely. We tailor our strategy to your specific requirements and property plans.

If you are a busy professional and home buyer and want to earn 6-figure profits through property safely, we have a private group where we share traits and strategies behind it. Just click on the button below.