Read the 5 Costly Mistakes Homebuyers Make when Buying Private Property – Part 1 here.

Let’s continue with Part 2.

Watch it HERE.

The 5 Costly Mistakes When Buying Private Property

3. Not doing enough research.

This is related to the mistake mentioned above, which is not doing enough research.

Aside from checking the obvious such as the proximity of the MRT, accessibility to transport, and surrounding amenities, another important thing to do is to check the other projects surrounding the property that you want to buy.

Consider:

- What is their performance?

- What is their starting price?

- Could you be buying higher than your neighbors?

- What are the risks if you have to exit when your price is highest in that project?

These are the questions you need to ask because you need to ensure that you are buying and paying your property at the best price. Otherwise, look for the options that will give you the best value for your money and how you can determine the growth potential of the property in the future, too.

If you want to know more about this, watch my previous vlog where I used Jervois Mansion as an example of how data and numbers are crucial when buying a property and how they can be included in your research.

What if you did not base your decisions on data and numbers and bought an overpriced property? Won’t that put you at risk when selling in the future? What if you didn’t hold on to your property longer?

With current trends and data transparency, we are putting ourselves at a disadvantage if we never do enough to determine the right property that can make profits in the future.

4. Ignoring the opportunity.

This is the most common mistake that homebuyers make. There are times that there are possible options that you can go for safety, but you are not grabbing that opportunity because of the “what ifs.”

You may be saying, “I want to check in with my friends first,” or asking, “will the market go up or down?”

This is completely valid. We totally understand that buying a property is a daunting task. It’s such a big-ticket.

As consultants, our role is to guide you so that you can make informed decisions in the end based on data or numbers. We study them carefully, providing a personalized solution for your property journey.

Let’s look at this scenario:

Due to increasing land bids over time, there is no choice but for property prices to go up in the future.

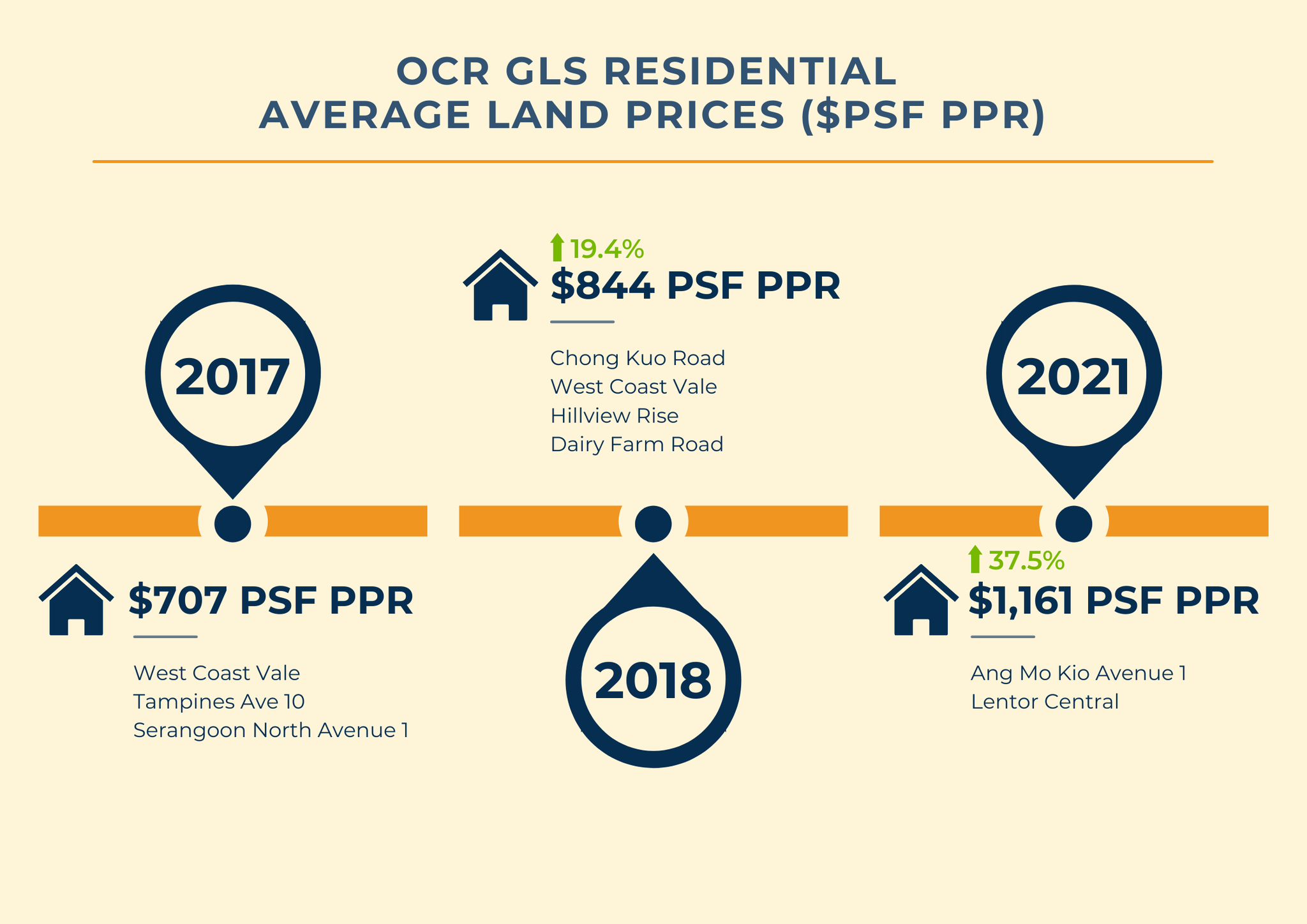

Here, you can see how the prices in 2017, which average $707 per square foot per plot ratio, have increased by 19.4% to an average of $844 per square foot per plot ratio—moving forward to $1,161 per square foot per plot ratio beyond 2021.

These are one of our consults where we rely on data and numbers based on proper research to make a sound decision.

Does that sound good, or would you rather be half-guessing your way throughout your purchase? Or based on your gut feel for what “seems” like potentially better for you and your family? Which route is safe, one that is backed up by data and numbers or second-guessing?

When good property presents itself after going through the various points I have mentioned here, you will be in a better position to make a wise decision when purchasing a property.

5. Not having the holding power to keep the property.

We must ensure the means to sustain the monthly mortgage and not forego the property because we can’t pay for it anymore. We buy property to wait. Not wait to buy property.

Overleveraging yourself and not having enough buffer is a big NO when buying a property.

You need to have holding power and not be in bad debt because of your property. A good guideline I always share is to have a minimum of three years of monthly mortgage as your safety buffer. So that if anything happens–unemployment, medical emergencies–the property can still be paid for using your buffer.

In summary, you may be experiencing some doubts and fear largely because you are unfamiliar with real estate properties, and there is a knowledge gap.

Singapore Real Estate Insider’s role is to help you understand properties better and go from point A to point B confidently. Check out our videos on YouTube, blogs on this site, or even better, contact us so we can guide you through your investment process.

***

If you want to know more about how busy professionals and homeowners like you can make 6-figure profits from property safely, we have a private group where we share traits and strategies behind it.

Just click on the button below to join.

Disclaimer: All information presented is based on personal opinions. Singapore Real Estate Insider is not liable for any losses and expenses whatsoever related to investment decisions made by the audience. The ideas presented are here for reference and educational purposes only.