Have you been waiting for the massive property price discounts this year? I don’t want to rain on your parade, but the chances of that happening in 2022 is low. Why is this happening?

It seemed like it was only yesterday when Singapore Straits Times announced a property glut back in 2019.

According to Cushman & Wakefield’s Singapore and South-East Asia’s head of research, Ms. Christine Li, Singapore’s oversupply of private homes of approximately 31,948 overhang units might take at least four years before getting sold.

It was already a menace in 2019, considering the uncertain economic look–until Covid-19 happened. This prompted a call for “property curbs to be eased, including lowering the 20% stamp duty for foreign buyers and getting more time to sell apartments before being hit with punitive levies.” Said Ms. Christine Sun, head of research at OrangeTee & Tie.

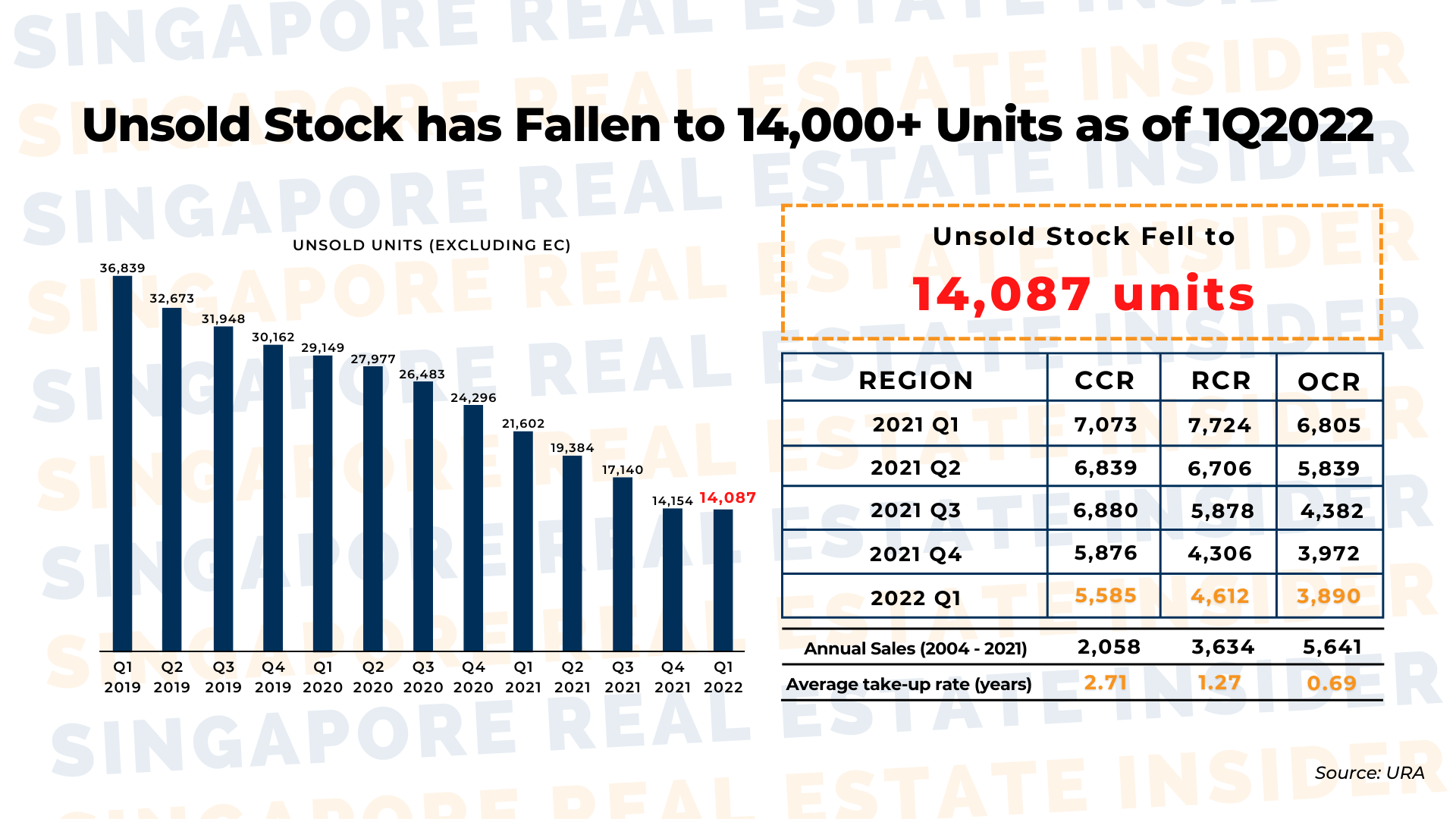

Fast forward to 2022, the remaining number of the overhang is 14,087 unsold properties. Ironically, the demand for homes has been hot since the pandemic started. Nobody would have ever predicted such behavior from the market since the pandemic wreaked havoc on the global market and compelled many businesses to lay off their employees, if not close down altogether.

So amidst the crisis and raised anxiety about everything that’s going on, it’s such an irony that people are taking the dive to purchase a property.

Needless to say, this was brought about by the overwhelming need for space when the temporary solution to our everyday lives under Covid-19 was implemented: work-from-home arrangements and online learning.

Since the surplus of homes from 2019 is halved in less than (the previously) predicted four years, it’s most likely that the discounts on these properties won’t be realized anytime soon.

Why? There are two things:

1. The demand is still high. There are primarily 3 main groups that fuel the demand.

1 – Those who are not affected by the cooling measures like 1st time buyers

2 – families looking for an upgrade and a need to move for size or location

3 – what we are experiencing on the ground are also the PRs. as the latest 2021 Dec cooling measures did not have any effect on them. Thus their 5% ABSD is still the same.

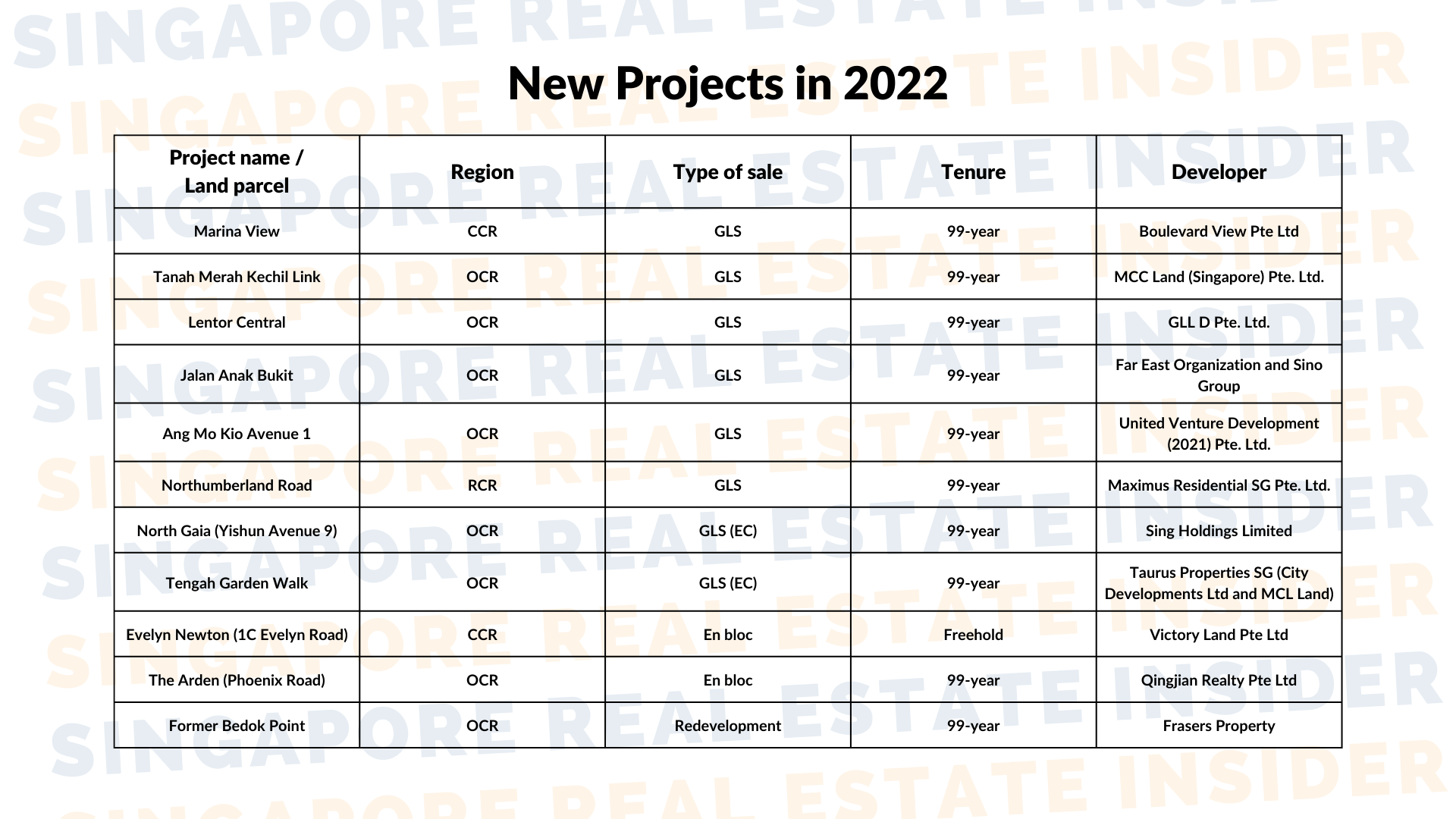

2. Developers opt for smaller spaces. Developers have only five-year to deplete their inventory. Otherwise, they will have to pay more taxes. To err on the safe side, most developers today are looking for smaller-sized projects, thereby creating a lesser number of units or homes that might not suffice the growing demand.

What will this mean for you as a homebuyer?

1. The intensified cooling measures might not work vs. the low supply of properties. As I have mentioned in my previous articles, Singapore’s cooling measures are designed to slow the price growth of properties whenever the market turns too hot.

However, in our current scenario, we are looking at increased Additional Buyer Stamp Duties (ABSD) that discourage people from purchasing properties too quickly while the number of available units is low. As we know, the high demand and low supply means increase in prices.

While there are existing properties in the market, the future supply are limited as more units are been snapped up.

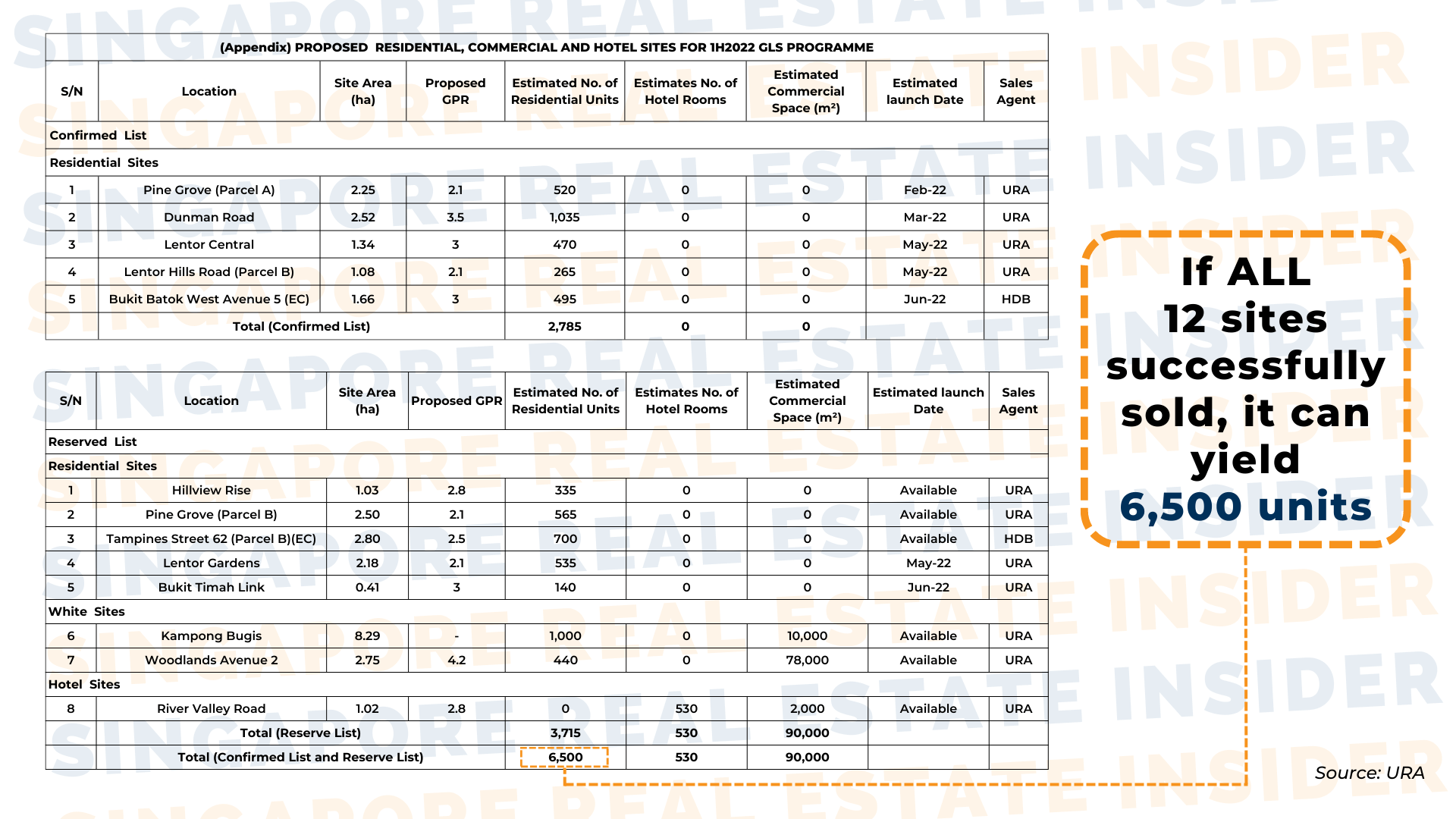

Even if we combined the upcoming confirmed and reserved government land sites available here, the estimated no of units in the pipeline will only be about 6,500.

2. Do not expect huge property price discounts. Since the pandemic has brought about new measures and interventions, the cost of developing properties is higher and the completion slower.

While developers might still manage their prices well, we will not be expecting anything crazy amounts.

a. Fiercer competition for buyers. With the advent of buyers looking for new properties or an upgrade for their families, you will probably experience more competition for that space you are looking for. You will need to study about your target home better and act faster.

b. The resale market is an option. . If you’re a buyer of a larger unit, and have been waiting for the “right time” to sell, this year might be a good opportunity. Since there are fewer property launches than ever before, buyers opt for resale properties, particularly larger units to fit a family. Its a good time to swap that property out for a younger, bigger property.

Please note that these analyses are made during the current situation, without the impending consequences of the Ukraine-Russia concerns.

As always, thoroughly review what you need, your purpose, and your available options before purchasing a property. It is best to consult professionals before diving into a major investment. The Singapore Real Estate Insider is here for you if you need one. Do drop us a message.

***

Join us in our private group where we help busy professionals and homeowners make six-figure profits in their property, safely.

Property is an ongoing process and journey because they are constantly changing and different strategies must be applied at different times.

Therefore in this group, we not only do weekly live coaching on property, we also cover a wide range of property knowledge and information that we as homeowners must know and be educated on to make informed decisions.

Just click on the button below to join.

Disclaimer: All information presented is based on personal opinions. Singapore Real Estate Insider is not liable for any losses and expenses whatsoever related to investment decisions made by the audience. The ideas presented are here for reference and educational purposes only.