Have you heard before that buy house in Singapore is “An Escalator To Wealth“?

Buying a home may be the biggest purchase you ever make, and you want to be sure the one you choose is one you can afford.

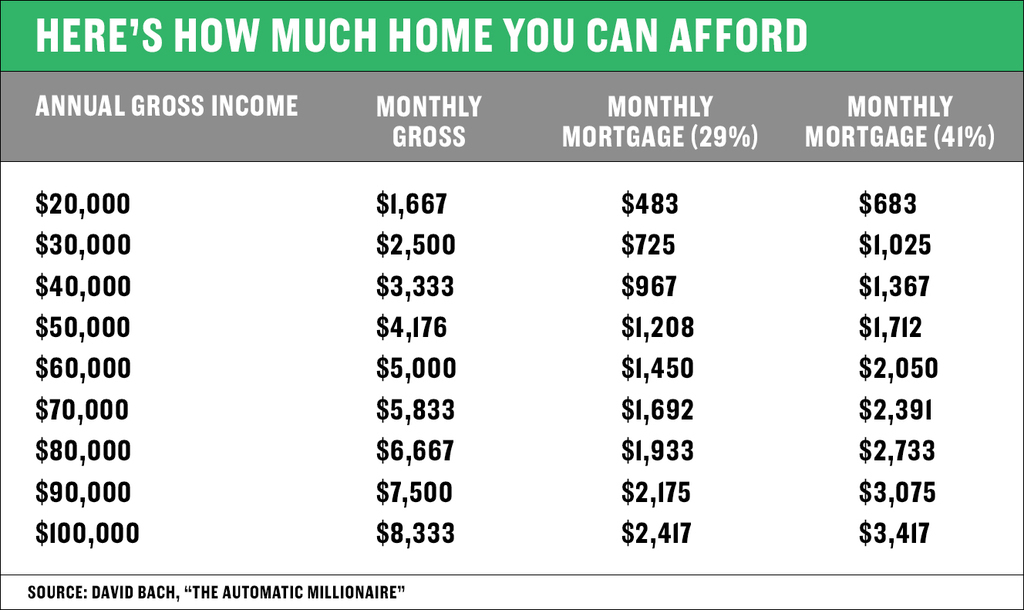

As for monthly payments, a good rule of thumb is that most people can afford to spend 29% of their gross income on housing expenses — as much as 41% if they have no debt.

You’ll want to take into account more than just the sticker price. Home-ownership costs include mortgage interest, taxes, insurance, maintenance, and any renovations you might want to make.

#unlockrealestatewealthnow #clientsforlife #futureofrealestate #singaporerealestateinsider

Submit your details below and we’ll get Back to you within 24 hours