What was your memory of the property market in 2003?

1. Low transaction rates

2. Prices drop drastically

3. No property deals done

4. Land prices reduced

If you cannot recall what are the relation between Covid-19 and 2003 Sars, read here as we cover Covid-19: The unexpected factor in a Property Market 2020?

So,

What kind of impact the SARS virus had on Singapore’s economy back in 2003?

Many had consider what we are undergoing now is to be compared to 2003. As that is the first time, Singaporeans experienced a pandemic.

And because its so serious given the situation than, many would have felt that the entire property market is on a downward spiral but is it true?

Lets draw some data shall we?

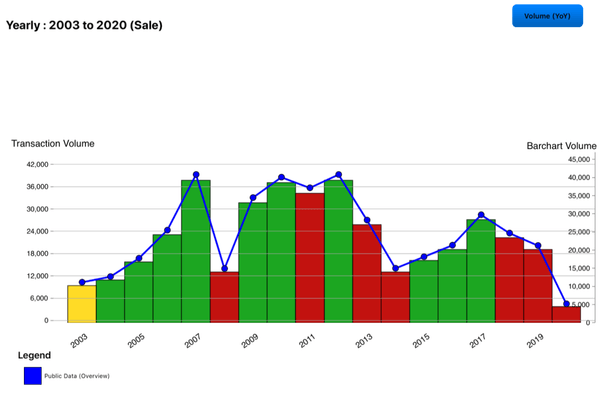

Interestingly, despite the SARS virus situation, there were still 10,269 private residential property transactions that year (See below). Information based on caveats collated by SRX. And this is only based on Private Property. The same year, if we were to include 31,115 HDB transactions, you do the math.

What this show us is that irregardless of the SARS situation, things are still continuing for the property market and transactions of sales and purchases still continues. One strategy we adopt in The REI Method during our research has direct significance to why property volume stays healthy year on year. Lets leave this to another session.

Have you actually thought before, in current situation or in previous times where you are always hoping that the property market will turn the other way? And somehow feel that transactions are not moving or had come to a total standstill?

But in actual fact, is that accurate based on data?

What are we basing on to derive such theory about the property market that when there is a ‘crisis’, there would be ‘FIRE SALES’, ‘cheap properties to buy’, ‘owners will be selling at huge loses’?

Where did all this claims come from?

Based on our feelings?

Hear says?

Media?

When there are panics and concerns around, I always still go back to fundamentals that are driving Singapore economy and property market. Information that can be explained and proven with data and numbers. Because Singapore Property can be predictable only when we stick to the fundamentals.

I have to admit, at times like this, transaction volume will be affected and on year to year comparison (As seen above), will be lower. Yet there is one key factor that many missed during times like this that can will make all the difference. I am going to share with you now.

We go back 2 more years before SARS virus happen and you can see that the volume (green) in 2002 came down to (red) in 2003 sighting there is a drop in volume.

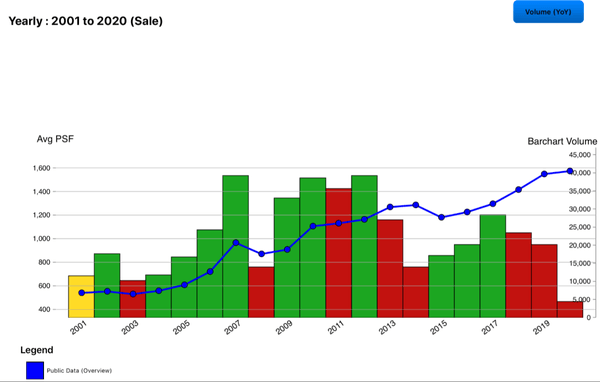

The key note here is although volume did came down, have you notice the one factor that is more important for every property assessment is the PSF? The average PSF was not too significantly impacted by SARS although we ‘wish’ otherwise that they will nose dive downwards when there are some negative news, be it Covid-19 or some economy uncertainties.

The margin was so insignificance that both the volume and PSF gradually go back up after SARS virus.

While many are reading the trends based on just volume and perhaps PSFs too, is this the only reason to justify that we should just buy property at anytime? That buying a property is bound to be safe because the long term horizon is always up?

I am afraid if real estate is that simple, I would be out of the business already.

Besides looking at past data and trends, there are many other consideration factors we adopt in The REI Method to help us assess for the hundreds of families we had consulted with.

Looking at this trend, it also suggests that if any families had entered the market back in 2003, they would have managed to ride the property boom of the 2000s. Are you one of them?

Edmund Tan

Your Singapore Real Estate Insider

The REI Method

Whatsapp Here

[…] continue in A lesson from 2003 SARS Virus in year 2020 as we dive into the research to draw relation between SARS virus 2003 and COVID-19 virus 2020. What […]