Are you an HDB owner and wonder if your property can help secure retirement? Or perhaps your parents have been nagging you to buy an HDB flat first?

There are many elements to look at other than the price increases in property research. As you know, a bull run is happening in the property market, and it’s most likely that it will continue to soar. Recently, we have seen the current trend in newly launched private properties averaging more than $2,000 PSF–a far cry from the average $1,200 to $1,500 PSF just a few years ago.

Despite the increase in prices, we have also seen the growth in private property sales as new generations upgrade from HDB to condo units, mainly as they start a new family or grow.

If you’re curious about what upcoming HDB or private property owners think about, it’s mostly these 5 points:

- Mortgage

- More expenses

- Interest rates

- Monthly capacity to cover all expenses

- Which is better, HDB or private property?

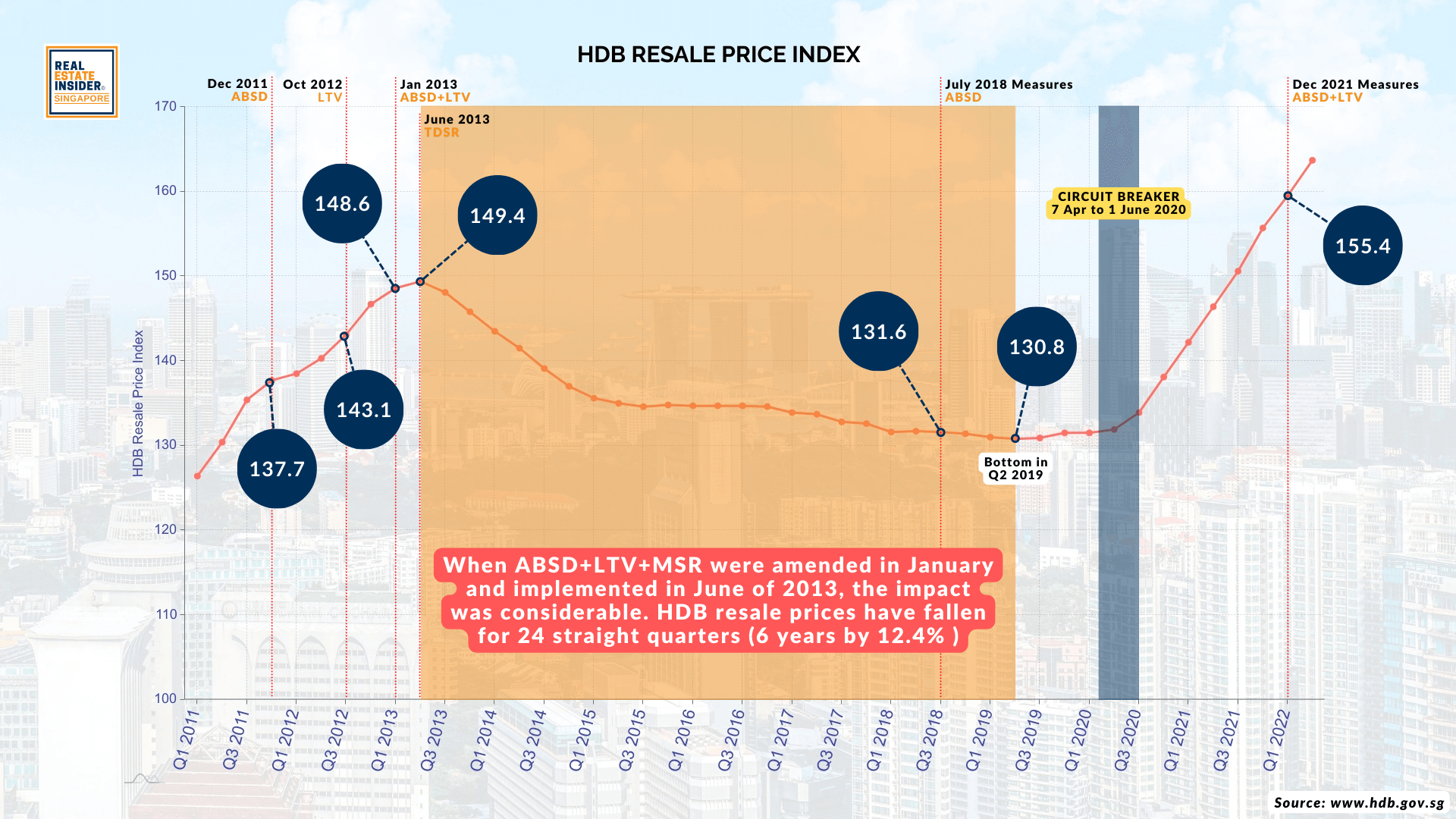

To answer this question soundly, let’s look at the data in the chart below. It shows the quarterly resale price index for HDBs from 2011 to 2021. You can see quite a long dip in prices from 2013 to 2018. This is mainly caused by the cooling measures that the government introduced to slow the HDB resale prices.

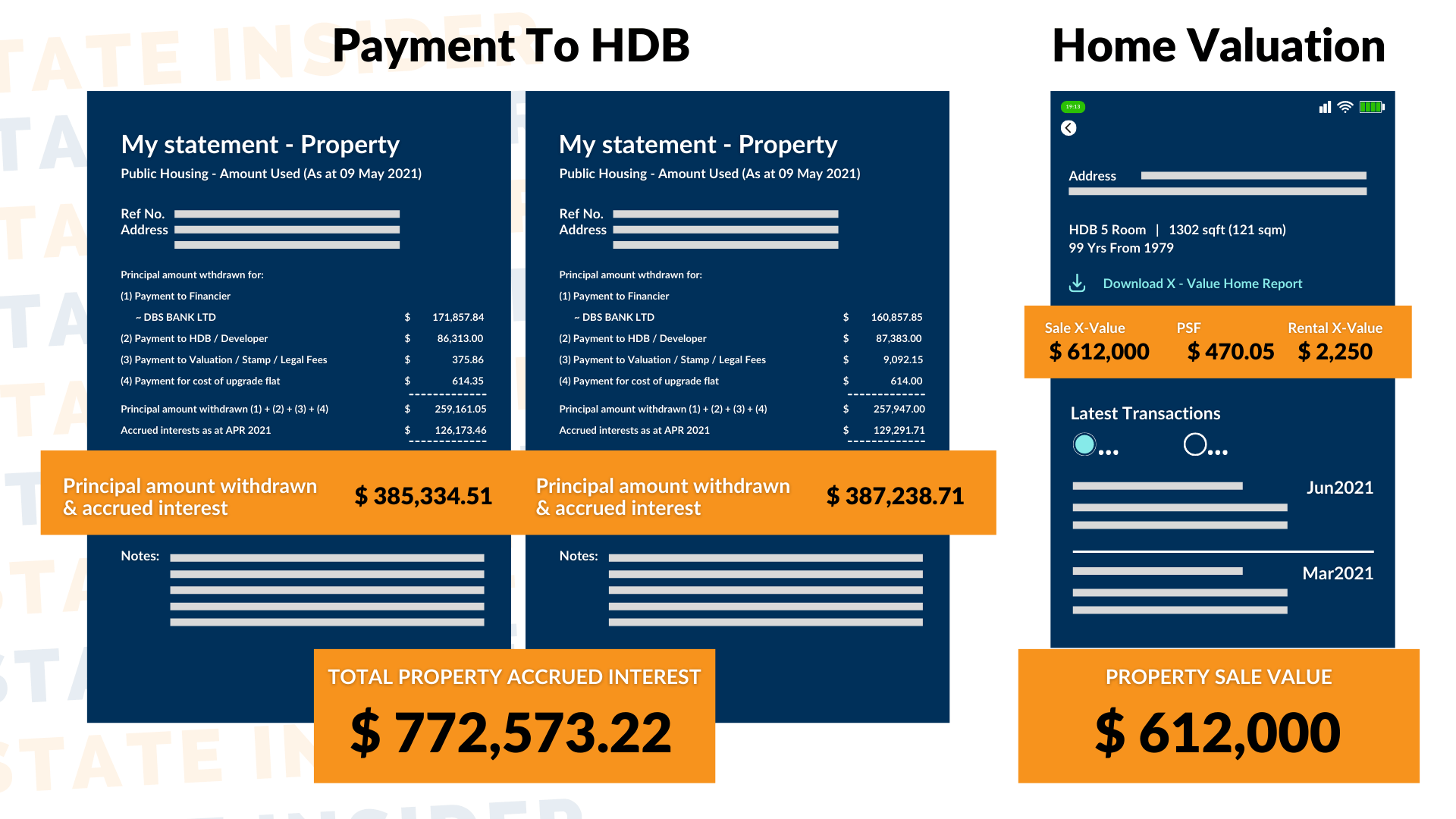

Now, let’s look at that data in actual figures. Consider this couple who bought their flat and chose to hold on to it for 30 years, believing its value would appreciate.

At the same time, the compounding effect of the loan, CPF, came to more than $700,000. And yes, your property value would have increased after 30 years. But because of the market situation, it was valued at a sad $612,000.

That’s a huge loss of $160,000.

We know it’s common advice to buy an HDB first. But looking at the figures we just saw, is this what you want to happen to your hard-earned money when your retirement age comes? Think again.

We experienced another round of cooling measures in 2021, at the height of the pandemic. Everyone clamored for a bigger space as most of us worked from home, and our kids were learning from home. This move by the government made a tiny dent in the HDB market. While we have yet to find out if the HDB prices will continue to rise in the future, what is the safest, wisest move HDB owners can make?

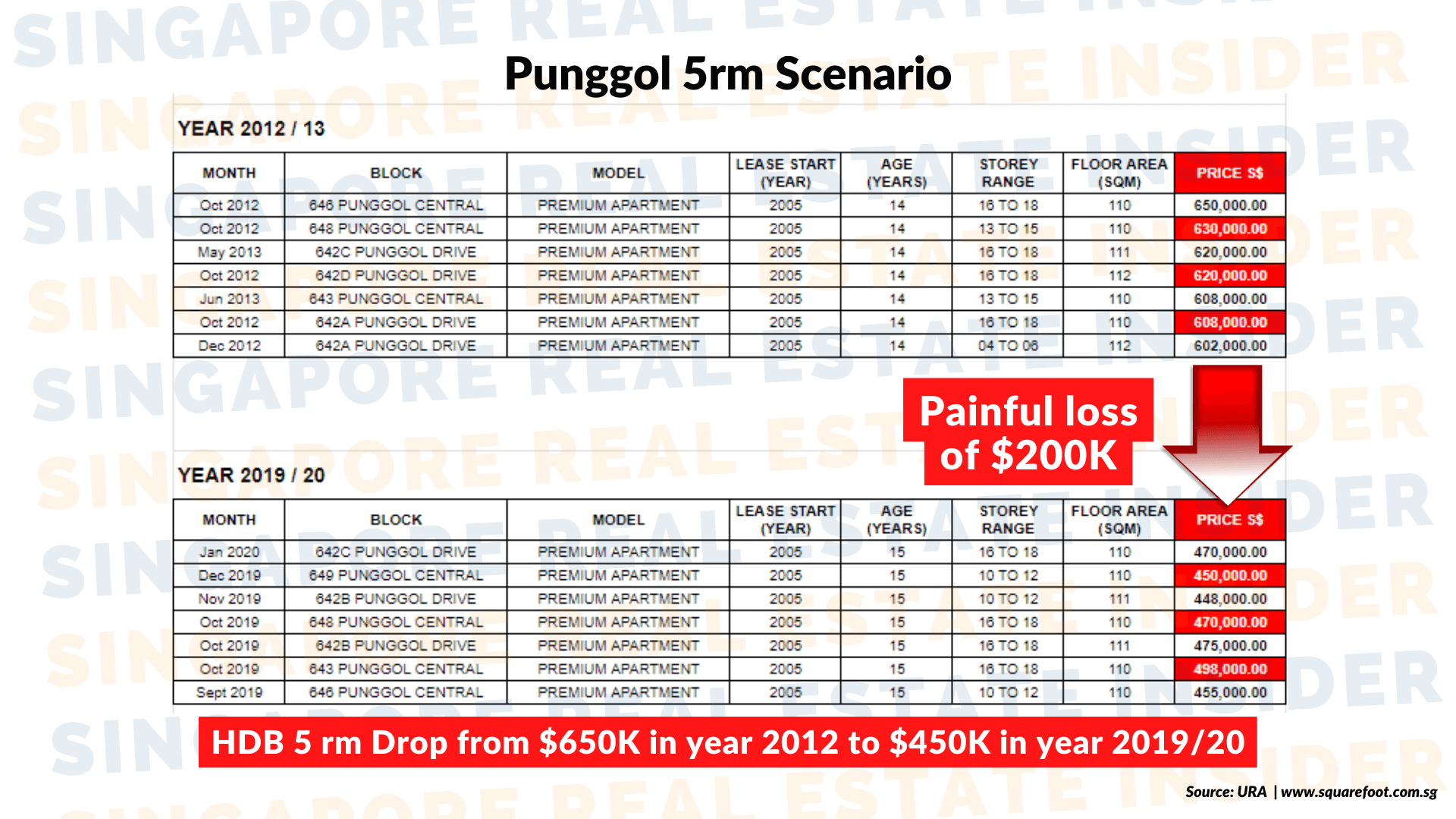

Come and see another real-life scenario:

Here is a comparative study of a 5-bedroom flat in Punggol a decade ago since 2012/2013 & comparing them to 2019 and 2020. Do you see the $200,000 dive? Ouch. That’s a huge loss!

No doubt prices have since went back up to previous highs in 2022, can you imagine waiting more than 6 years for the price to go back up, only to be at the same price as how you purchase them before?

How much time was lost?

How many opportunities were lost?

During the same period

We may agree that we may not look at selling and moving from our current house, but would you rather be able to have your property value increase instead?

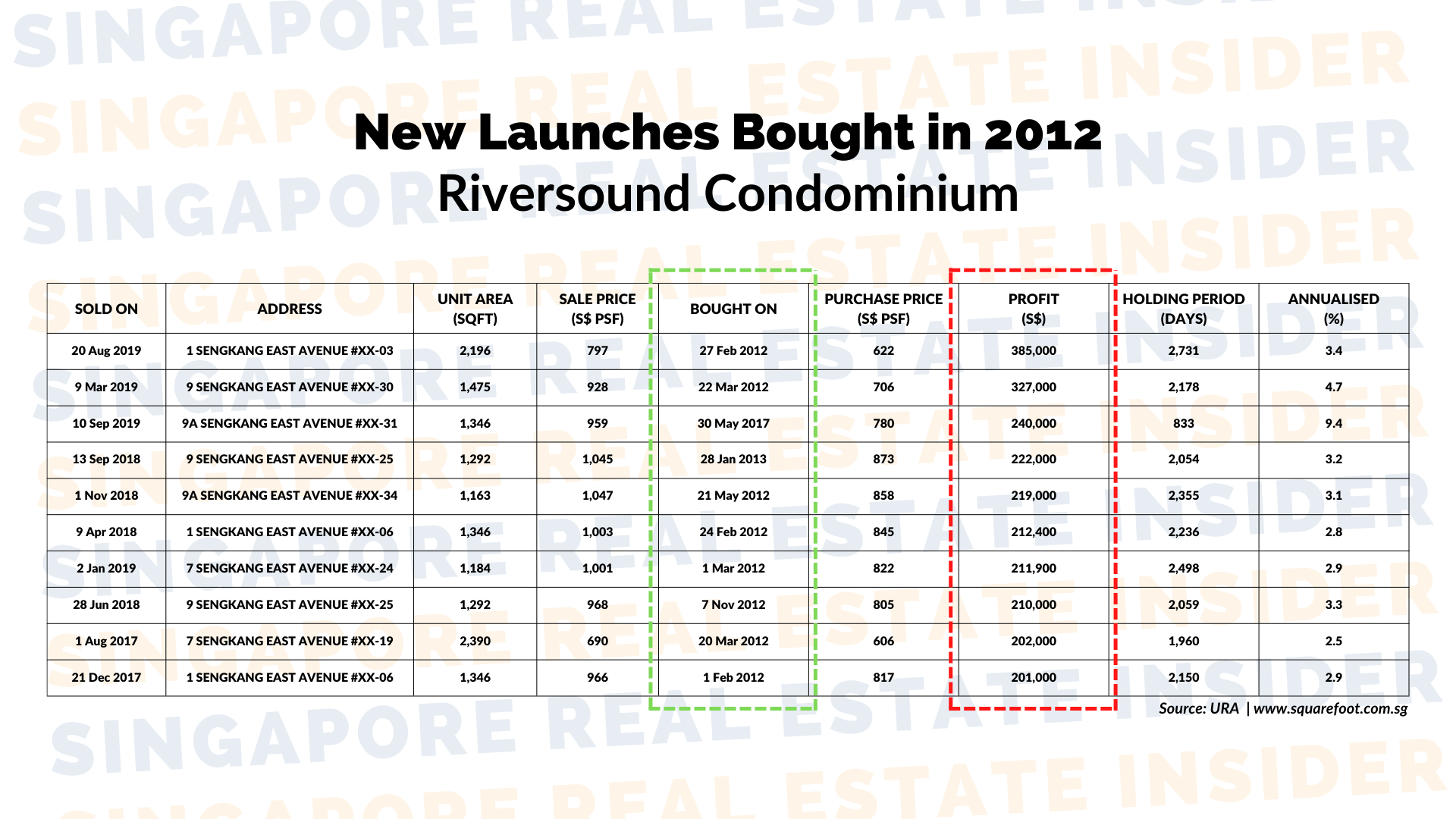

Now what if, instead of choosing a HDB back in 2012/2013, you had decided on a private property instead?

It’s a very similar high point like today 2022 and what you did was to tap on this opportunity.

Bought a private property in the same location in Punggol, smartly re-invest the money into a newly launched private property, you could have landed yourself on a profit of at least $300,000 in the same period. Wow!

A lost of $200,000 vs a gain of $300,000

Which would be your choice?

By now, many of you are probably thinking this is easy to say looking at all these charts and figures in retrospect.

One of the biggest concerns you’d probably have is if you could pay off the monthly mortgage loans without over-leveraging?

Well, fact is, it might not seem easy when you do not know what options are available for you!

The important thing when making such decisions is to work out a financial plan. With a full-proof plan, many HDB owners managed to upgrade hassle-free and live without the stresses of mortgage loans.

Hit me up if you hope to avoid being in the same situation as the unfortunate case of the couple above or want to know how to avoid losing unnecessary money.

Watch out for another article for you on how to steer clear of all these mistakes and how you can actually take advantage of your HDB flat given the appropriate timing.

***

Join us in our private group where we help busy professionals and homeowners make six-figure profits in their property, safely.

Property is an ongoing process and journey because they are constantly changing and different strategies must be applied at different times.

Therefore in this group, we not only do weekly live coaching on property, we also cover a wide range of property knowledge and information that we as homeowners must know and be educated on to make informed decisions.

Just click on the button below to join.

Disclaimer: All information presented is based on personal opinions. Singapore Real Estate Insider is not liable for any losses and expenses whatsoever related to investment decisions made by the audience. The ideas presented are here for reference and educational purposes only.