Better to get hurt by the TRUTH than comforted with a lie. – Khaled Hosseini

It is necessary to be realistic and precise while dispelling common misconceptions concerning freehold and leasehold properties.

The truth may force you to question what you thought you knew about freehold vs leasehold properties, however, knowing the truth will lead you down the correct route to make the right judgments about your property.

If you haven’t read Part 1 of Freehold vs. Leasehold Property: Misconceptions Debunked, you may do so here.

Let’s continue with the common misconceptions about freehold vs. leasehold properties.

3. Freehold properties are pricier than leasehold properties.

This statement is true. Freehold properties tend to be pricier than leasehold properties due to the fact that the freehold properties are very rare in Singapore, as 80% of the land is state-owned.

If you can’t afford the high premium (which is often 10% to 20% more) to own a freehold property, your alternative is the leasehold property.

4. Property lease value depreciates as the lease shortens.

You must be thinking, “Will my property value depreciates as my lease shortens?

There is a misconception circulating in the property market about leasehold properties. Yes, it may have some truth to it, but it always depends on many other factors. Let’s take a look at this example:

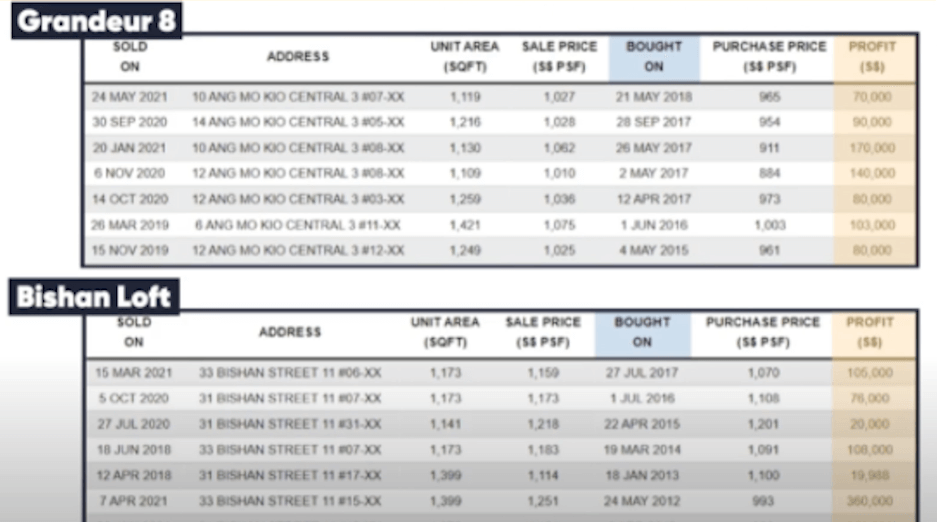

If you look at Ang Mo Kio’s Grandeur 8 and Bishan’s Bishan loft, both are 99-year leasehold properties, and there is absolutely no other supply in its surrounding. Due to this fact, resale buyers who purchase there still make a decent amount of profit.

Take a look at the capital gains of the buyers who purchased resale units in these condos. The performance of this property is largely dependent on the supply and demand surrounding it.

These 99-years leasehold properties still made a decent amount of profits because there’s no other surrounding project nearby.

5. All freehold properties have more capital gains than leasehold properties.

Let me show you the performance of freehold and leasehold properties in the same location.

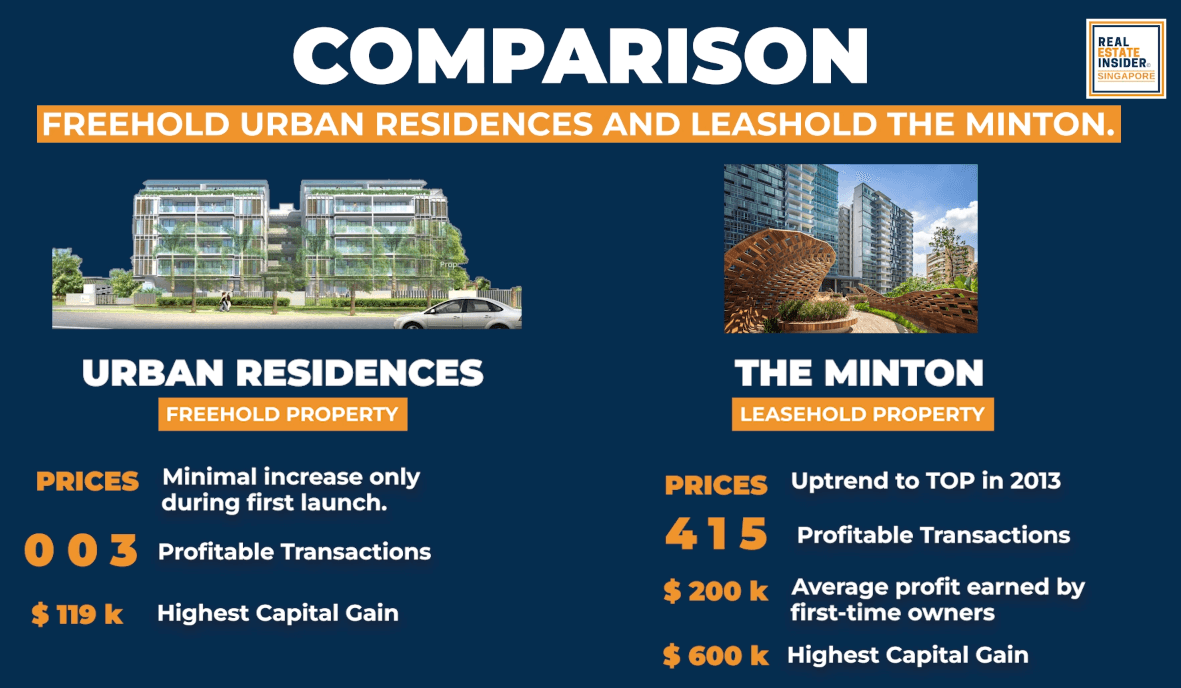

The picture above shows you a freehold property called Urban Residences and a leasehold called The Minton.

Both condos are located in Hougang, just one street apart from each other. The prices of Urban Residence did not move much since its first launch. But we did see an uptrend for The Minton upon TOP (Temporary Occupation Permit) in 2013.

Owners of The Minton also profit more, although it is a leasehold property.

There were 415 profitable transactions in The Minton, with first-time owners earning an average of $200k profit each, and the highest capital gain was over $600k.

But of course, don’t rush into buying The Minton just because you have seen the prices have been stable after the surge.

Why is this happening?

One of the key factors limiting Urban Residences’ performance is that it is a small development.

Do you know that buyers are more willing to invest at a premium price for a big plot of land? This is because big plots of land offer amenities that small-sized condos will not be able to offer.

There are also limited units on sale for small developments from time to time. When resale buyers wish to make an offer, they will be constrained by the amount of data they can refer to, such as past transactions.

So now you see: Freehold Properties don’t always have more capital gains than leasehold properties because certain factors affect a property’s gain, whether it is leasehold or freehold.

- It is dependent mainly on the location of your unit. The location plays a vital role in determining the property’s value, not just by its tenure.

- A leasehold condo located in a prime area will yield better than a freehold property somewhere else.

- One thing to note as well is based on data, buyers are more willing to pay higher premiums as long as the development has a big plot.

There you have it! I hope I have debunked the common myths about leasehold and freehold properties and shed more light on its truth. I wish I had helped you better understand these two so you can decide which one will be of an advantage to you.

***

If you want to know more about how busy professionals and homeowners like you can make 6-figure profits from property safely, we have a private group where we share traits and strategies behind it.

Just click on the button below to join.

Disclaimer: All information presented is based on personal opinions. Singapore Real Estate Insider is not liable for any losses and expenses whatsoever related to investment decisions made by the audience. The ideas presented are here for reference and educational purposes only.