Here’s the continuation of the New Cooling Measures Hack you can use. Read until the end for a strategy that can help you outwit the new cooling measures, legally.

If you haven’t read PART 1 yet, you can do so HERE.

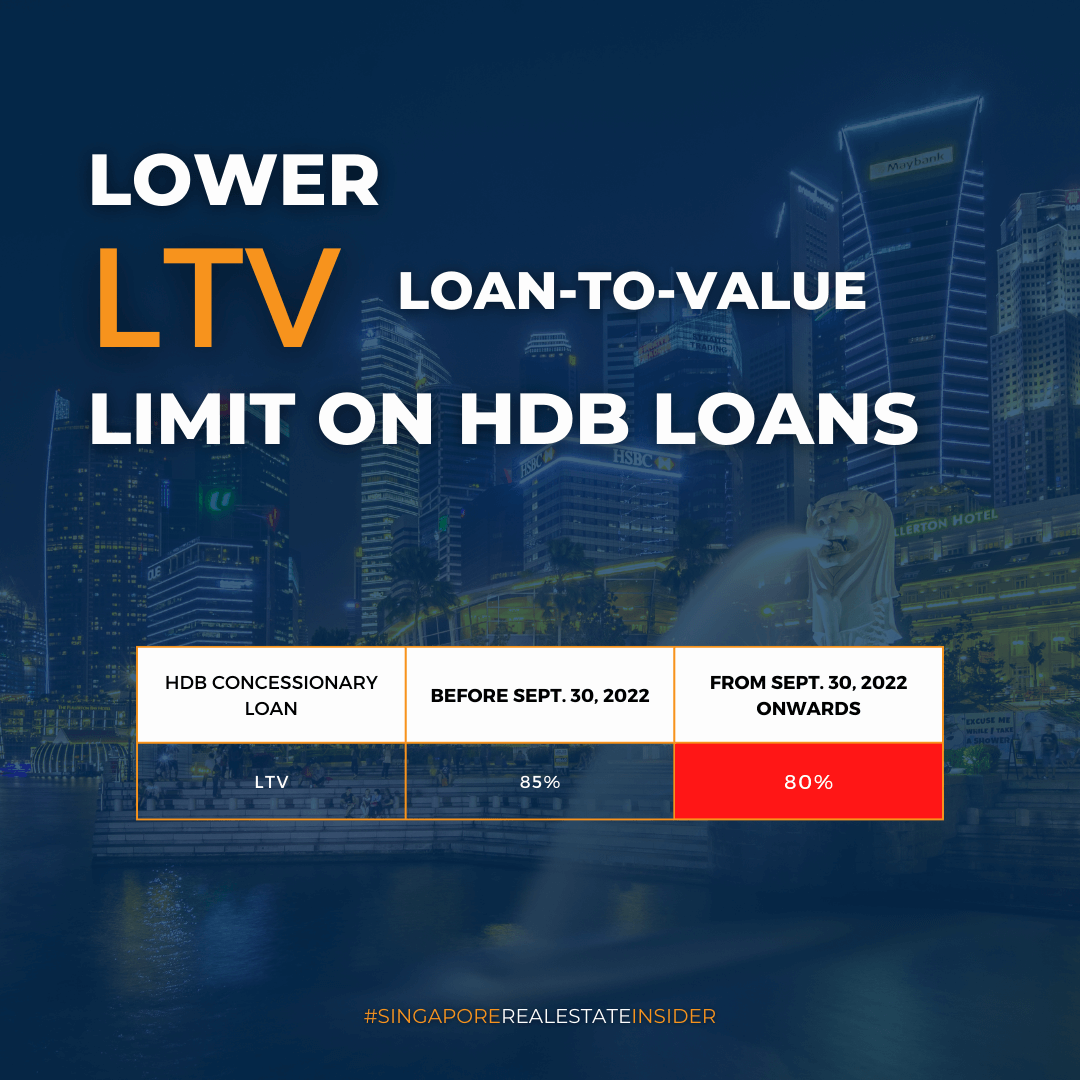

Change of HDB Loan LTV from 85% to 80%

As you know, the Loan-to-Value limit dictates how much a homeowner could borrow. Lowering the LTV floor from 85% to 80% means homebuyers needs to shell out more in cash for the down payment.

Let’s assume you’re having a 600K HDB flat. In the previous 85% LTV, it would mean a Loan quantum of up to 510K

Now, with an LTV of 80%, it would come up to a loan quantum of up to 480K.

*Subject to TDSR/MSR.

This is by far what I believe to be the biggest impact for HDB buyers as every cent counts in a purchase.

As far as we understand on the ground. It is already not easy for young couples in their late 20s or early 30s to acquire their 1st property

Not so much their inability to loan but always the down payment. With this change, buyers need to fork out additional 5% more which can mean 2 things

1- you put off your plan, work harder and save more

2- you borrow from family first

I would strongly suggest point 2. Because by the time you work hard to save that difference, the price might already climb higher again too.

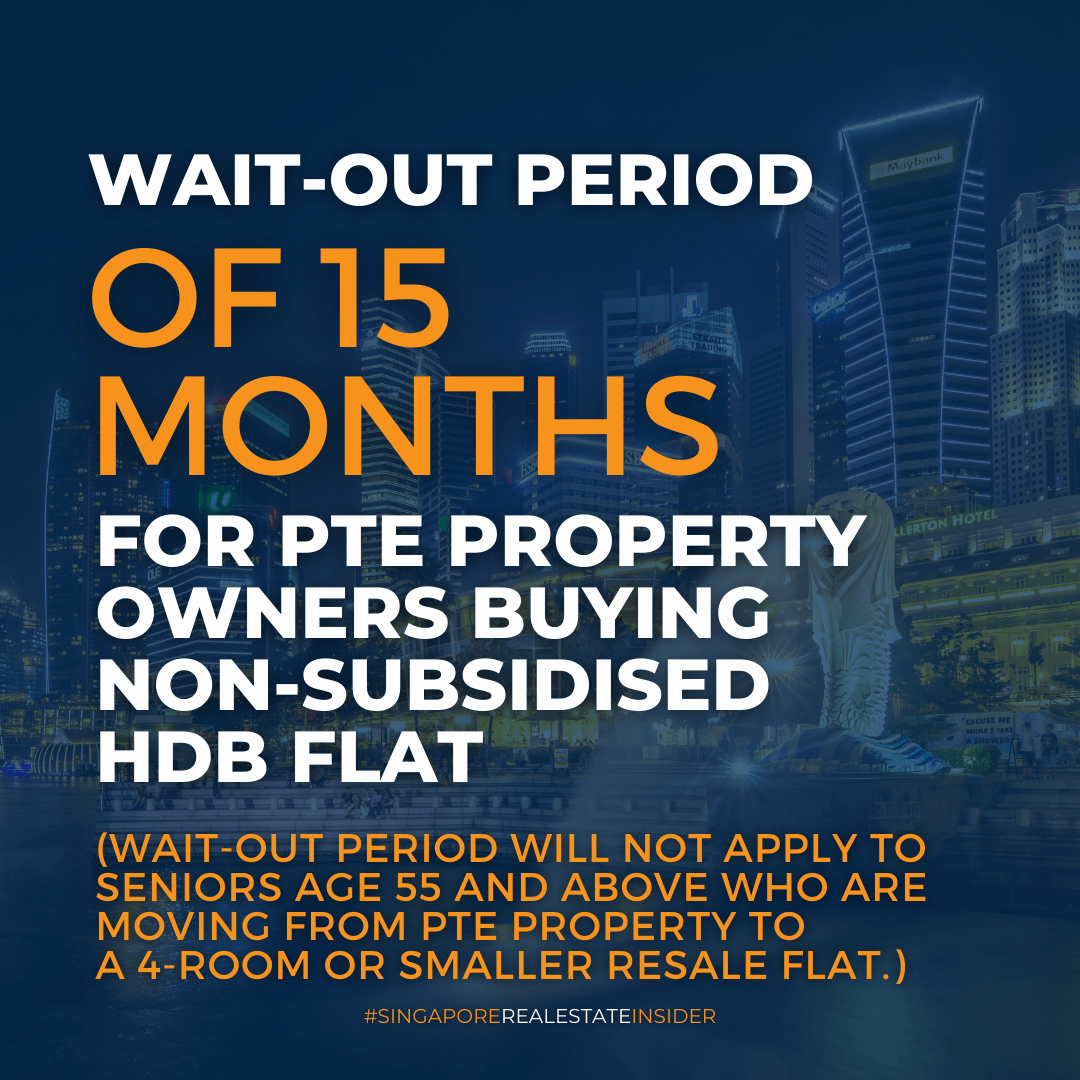

How does the 15-month wait-out period for private residential property owners (PPOs) and ex-PPOs to buy a non-subsidised HDB resale flat impact me if I’m below 55 years old?

If you have sold you current private property or are in the midst of marketing your private property and are considering to relocate to an HDB, there may be changes towards your financials, loan affordability, timeline for sale and next purchase, and options for your next place of residence, etc., due to the recent measures.

Since the announcement, we have met with multiple families to make adjustments and find solutions that can help them continue the plan they set forth.

It would be good to reach out to us and discuss this to reassess and plan for what are the next steps forward for you and your family.

Because many are hugely affected by the numbers shown before, are you concerned about it too?

What if there is a way that CHANGES NOTHING for you EVEN with these newly announced measures that you don’t need to worry about the limitations of your purchasing ability?

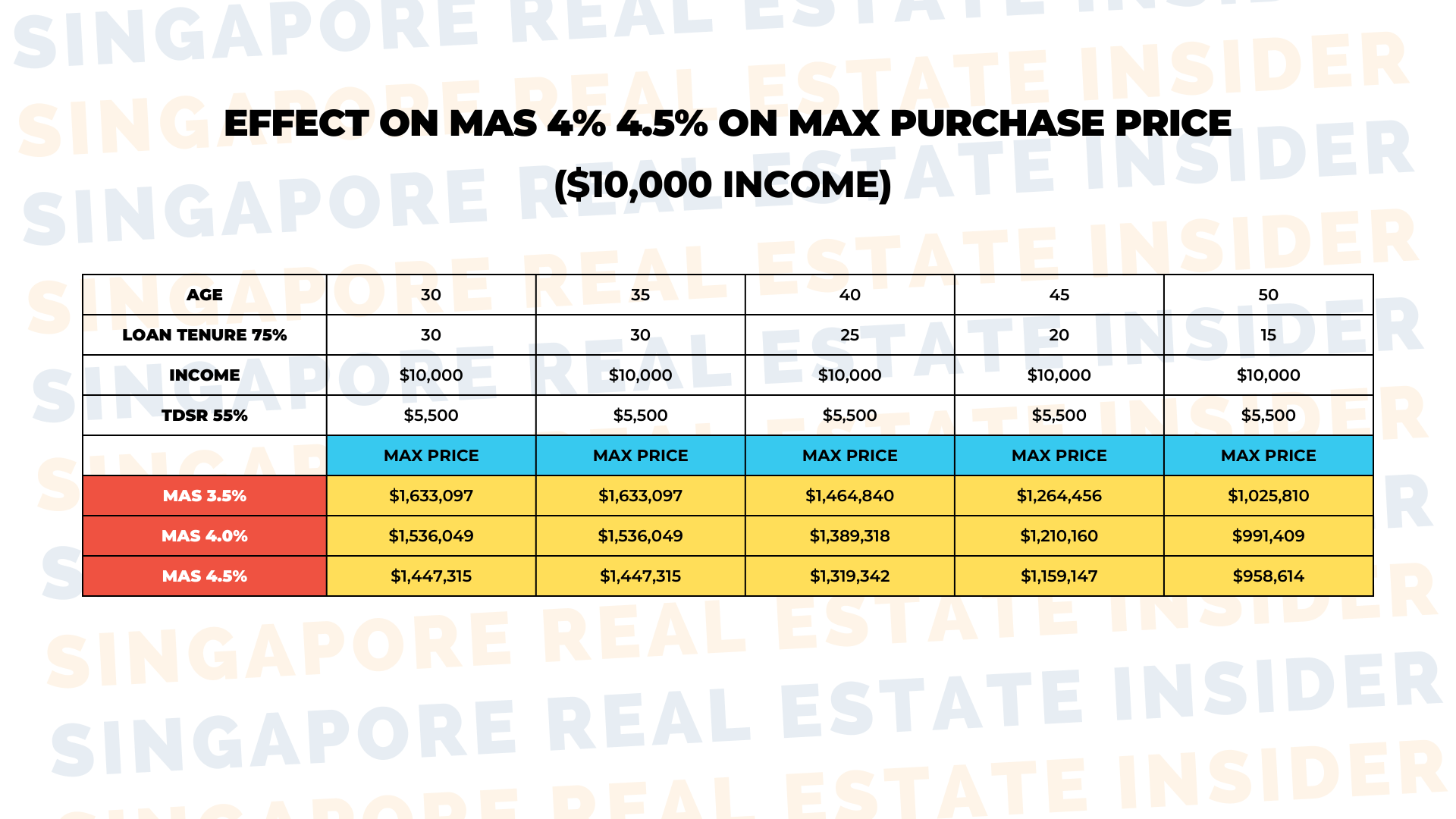

How am I affected by the Stress Test Medium Term Interest Rate for Private Property?

For those taking a bank loan, the TDSR remains at 55%.

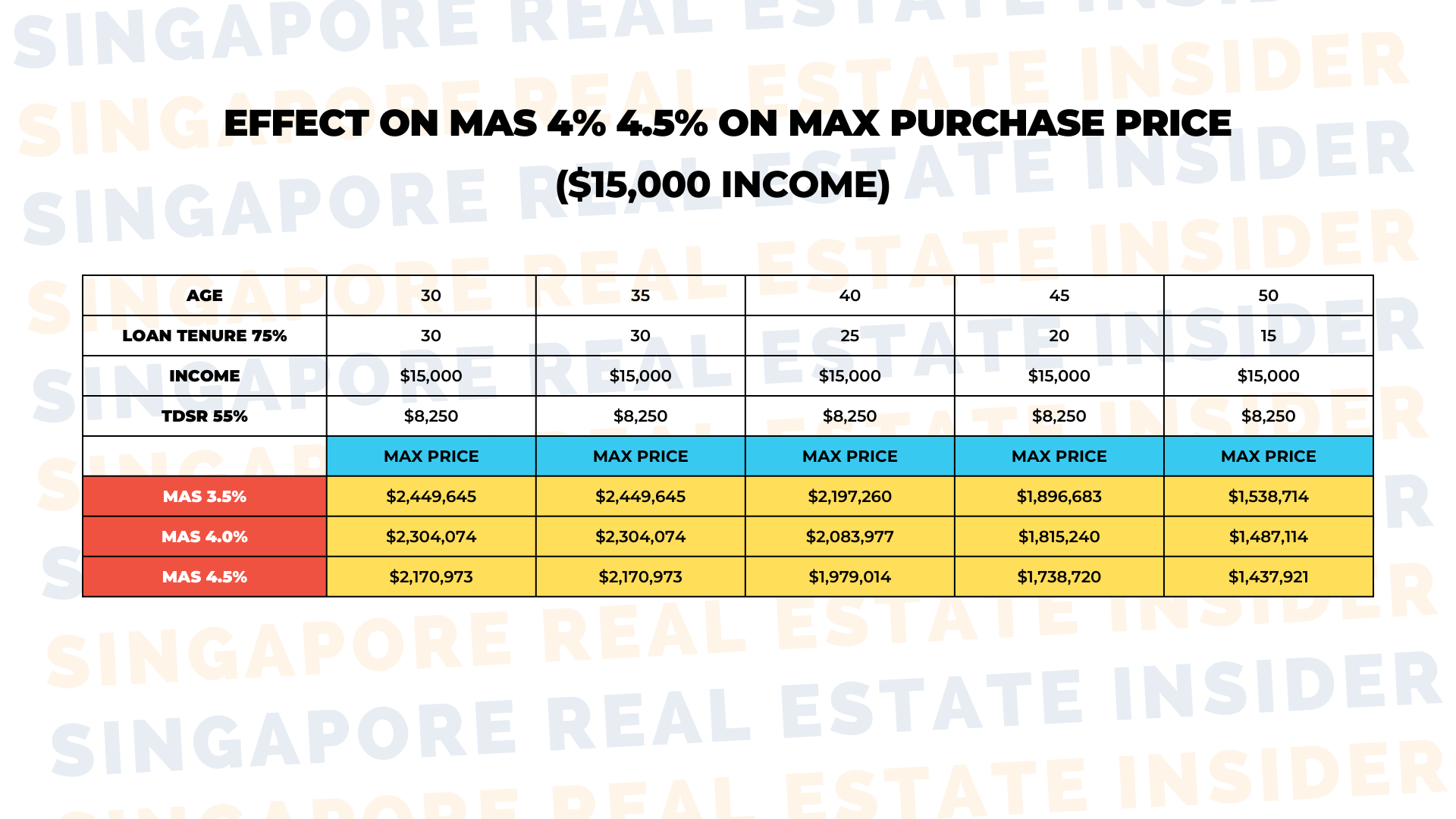

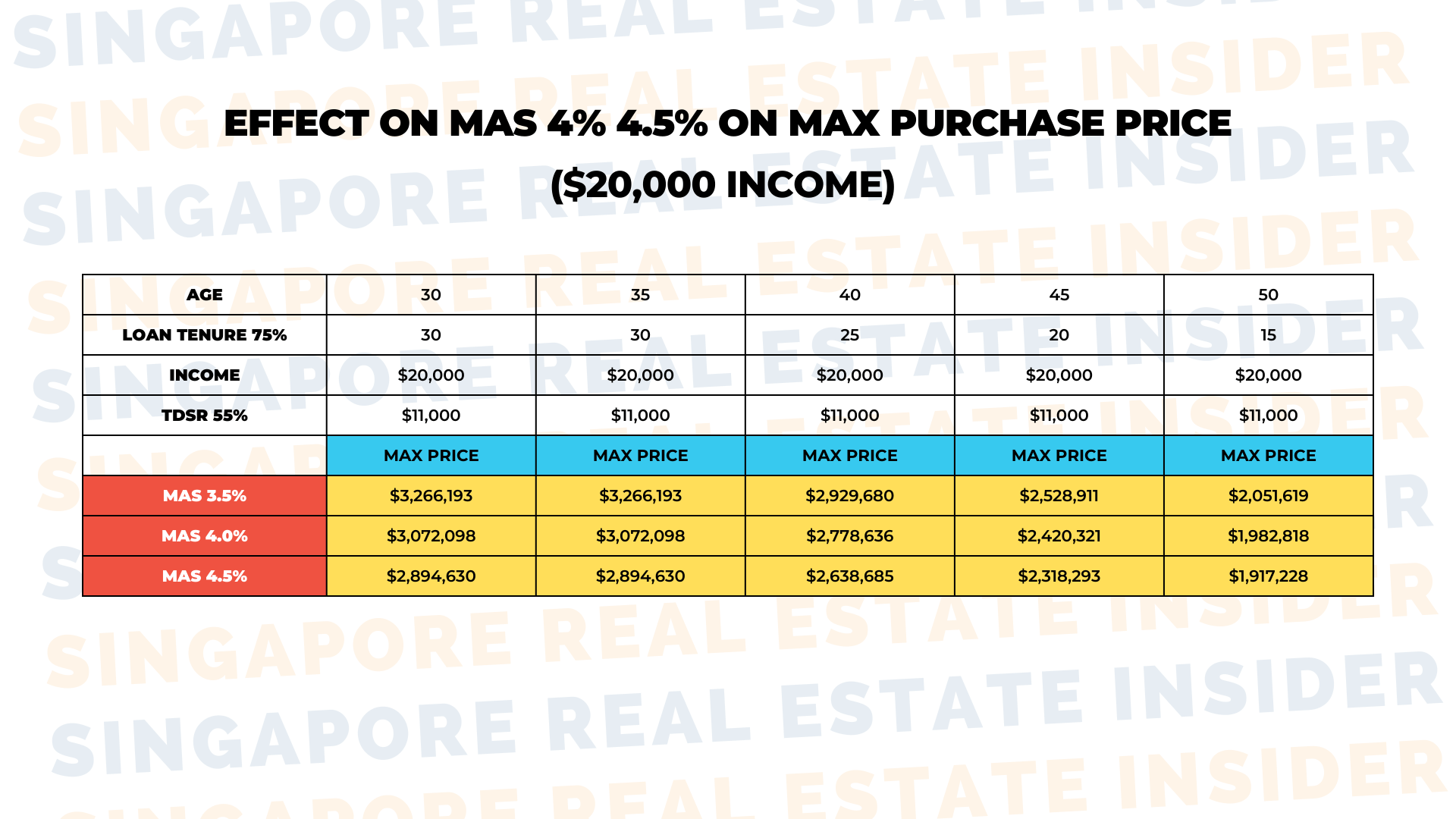

However, the stress test interest rate used to calculate Loan affordability for Residential Private Property will be raised by 0.5%, to a total of 4%.

Many are not aware that since the 2013 cooling measure, there is this component already built into our TDSR calculation. This additional 0.5% will not be too much of an impact.

Let’s look at this scenario: A 35-year-old individual with a monthly $10,000 income has a MAS of 3.5%. His overall purchase price ability reduces as the MAS rate climbs up. From $1.63m, it goes down to $1.53m. That is a $100,000 difference!

As for a 40-year-old making $20,000 monthly income, her ability reduces from $2.92m to $2.77m. A striking more than $200,000 difference.

If you do not have the $100,000 or $200,000 difference, then because of the overall affordability, you might need to reduce your purchase price, and settle for a smaller size to fit this new guideline. Otherwise, you can consider changing your location to accommodate these new measures.

This is going to be a huge problem for many, especially when you already have big plans for a better environment and lifestyle for your family, right?

Now, what if there is a way for you to not worry about the limitations of your purchasing ability?

A safe, secure way for the new cooling measures to not affect you?

A way for your plans to remain untouched? A safe strategy that instead of needing $100,000 or $200,000 difference, you could bridge the difference with HALF of those amount?

It’s called the Financial Insider Strategy. A very important video guide where you can potentially ignore cooling measures totally while others worry about it.

A disclaimer, this strategy might not work for everyone therefore it’s still good to do your assessment with us 1st before we can guide you on the right solution.

So book your complimentary 20-min call so we can assess your current property situation and provide you with a personalized property solution.

***

Join us in our private group where we help busy professionals and homeowners make six-figure profits in their property, safely.

Property is an ongoing process and journey because they are constantly changing and different strategies must be applied at different times.

Therefore in this group, we not only do weekly live coaching on property, we also cover a wide range of property knowledge and information that we as homeowners must know and be educated on to make informed decisions.

Just click on the button below to join.

Disclaimer: All information presented is based on personal opinions. Singapore Real Estate Insider is not liable for any losses and expenses whatsoever related to investment decisions made by the audience. The ideas presented are here for reference and educational purposes only.