If you own an executive condo, this article is for you, so keep reading!

Whatever property you are investing in, to make an informed decision regarding EC after the MOP, you should carefully consider your financial goals, personal circumstances, and the current real estate market.

While you may hesitate to upgrade your home due to high-interest rates, it is crucial to recognize the potential opportunities you could be missing out on in the current property market.

Here are 4 points you can take back for your own property knowledge here.

For instance, upgrading to a new property could prove advantageous if property prices continue to climb, resulting in larger long-term profits.

Even though interest rates are high, there are still some benefits to upgrading your property. First of all, upgrading gives you the opportunity to enjoy a wonderful living environment with upgraded amenities and extra space to meet your growing needs.

Additionally, when you choose to upgrade during a high-interest-rate period, you have the opportunity to secure a fixed interest rate for the long term. This can be advantageous if interest rates keep increasing in the future.

Lastly, consider upgrading during a slow market as it can give you more negotiating power and potentially lead to better deals on your new property.

Not everything is so rosy as well and we also need to weigh out some of the cons.

Just a friendly reminder that upgrading during a high-interest-rate period may have some risks to consider. Higher interest rates can lead to higher borrowing costs, which might affect your monthly mortgage payments.

In addition, it's important to keep in mind that property prices can be influenced by market conditions. So, it's a good idea to think carefully about how this could potentially affect the value of your property before making any decisions.

You must weigh your options thoughtfully and seek professional advice before making any decisions after the MOP. Singapore Real Estate Insider is here for you!

Once you've reached your EC's MOP, what should you do next? Stay in your EC, especially considering the current high-interest rates? Or should you sell and move on to your next investment?

What would you do in this situation?

Many individuals are postponing their investment plans due to the volatile nature of prices and rates. However, it's essential to recognize that waiting may not be a viable option, particularly if your objective is to generate a substantial profit.

But how can you ensure such a profit?

Allow me to introduce you to the REI method.

You can possess the key to unlocking property growth through a proven and tested approach. We at Singapore Real Estate Insider can assist you in transforming your property journey, transitioning from being ordinary homeowners to becoming real estate winners, while accomplishing three crucial goals:

- Grow wealth

- Accumulate wealth

- Preserve wealth

Take a glimpse of the potential earnings as an executive condo owner:

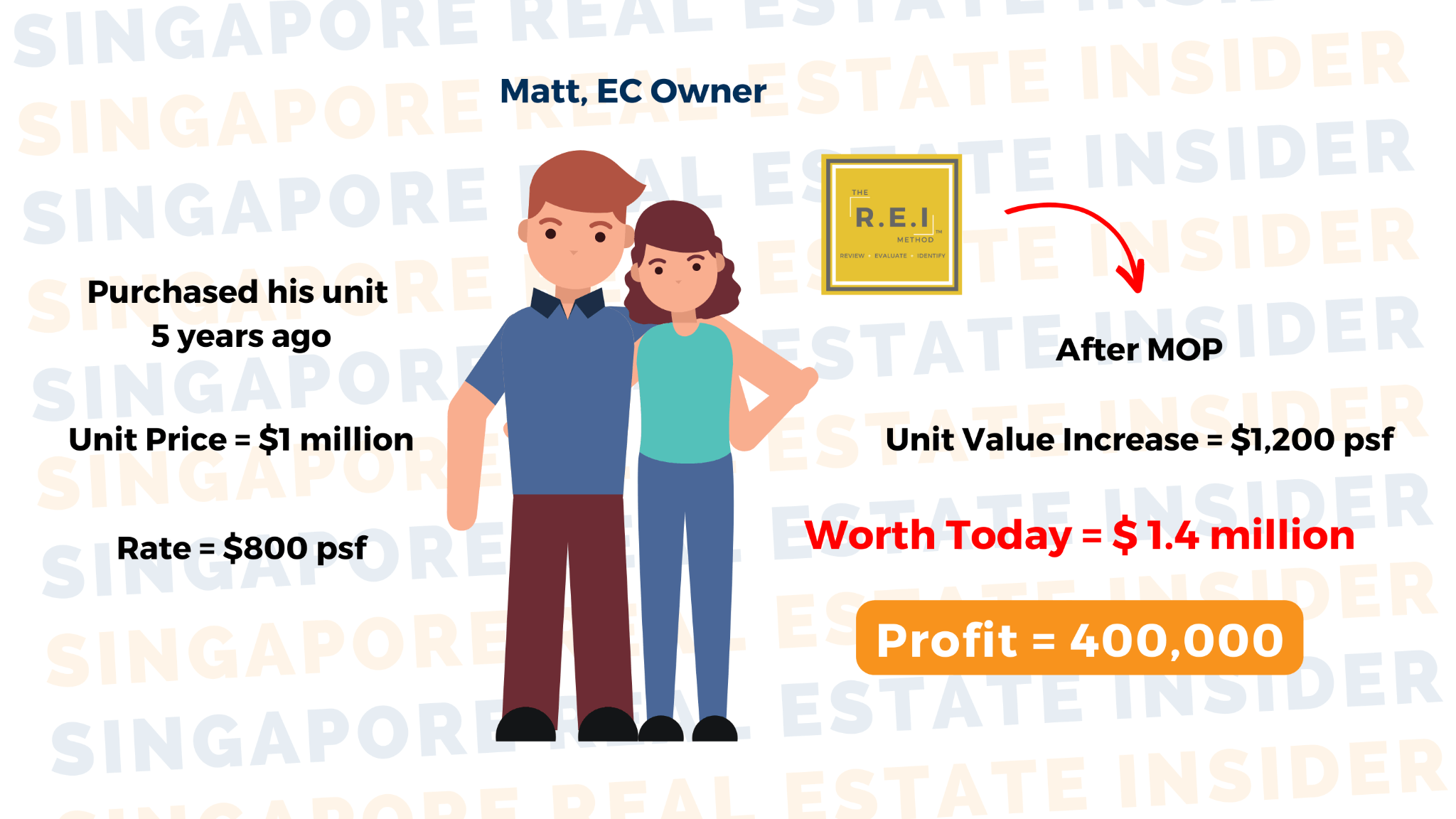

Matt, an EC owner, purchased his unit five years ago for $1 million, with a prevailing rate of $800 per square foot (psf).

With coaching from me and applying the REI Method, Matt and his wife engaged in proper financial planning, ensuring their monthly payments were manageable while accommodating their desired lifestyle.

After the MOP, Matt's unit's value increased to $1,200 psf. Consequently, its total worth is now $1.4 million, resulting in a profit of $400,000 without experiencing any significant difficulties.

So when things are great, there are also more decisions to make. Agree?

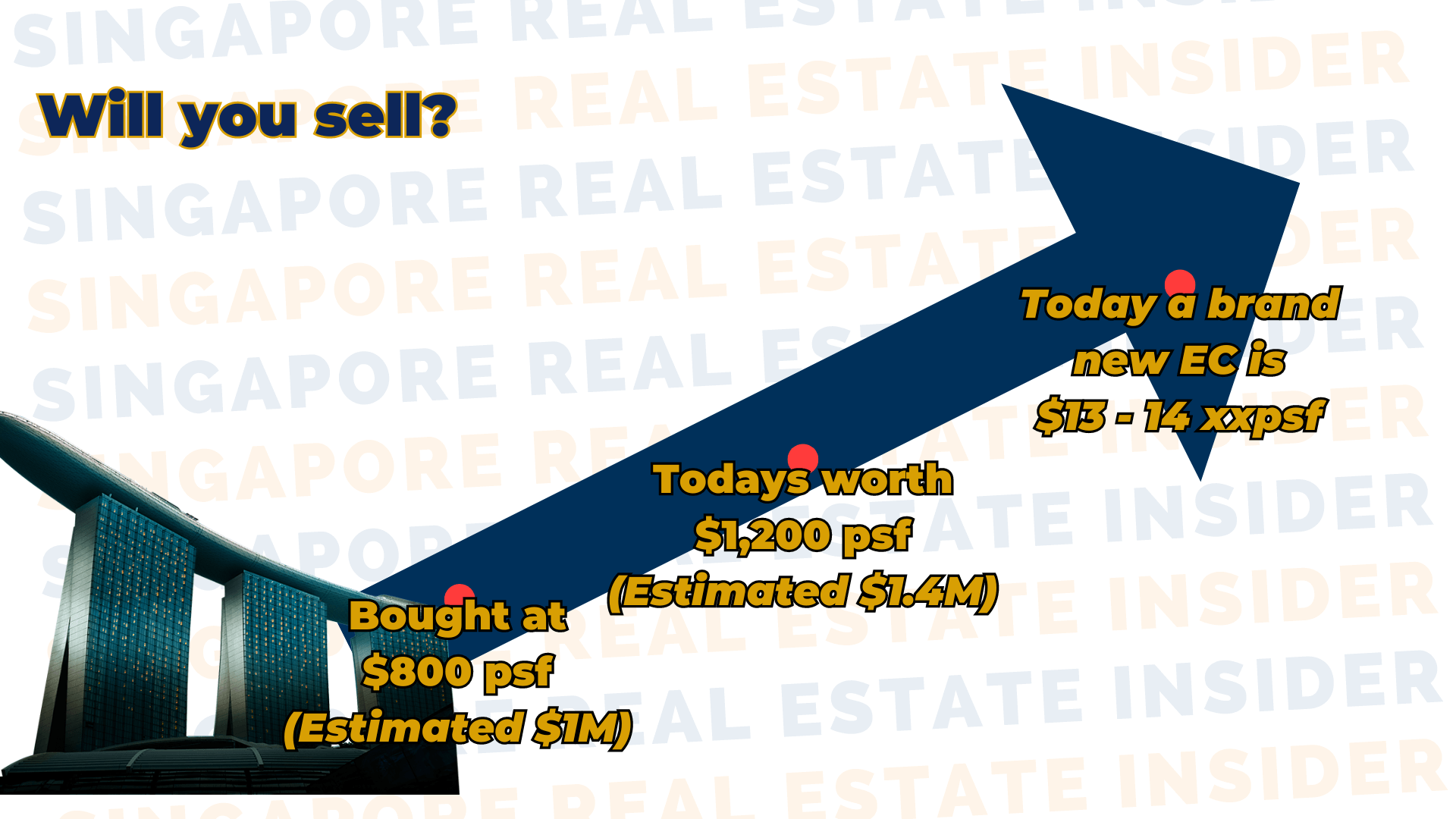

Now, Matt is at a crossroads where he needs to make a decision.

Should he sell his EC and acquire a new one at a rate ranging from $1,300 to $1,400 per square foot (psf)? Above his current property value for the space and better location?

This is precisely where the REI method comes into play, providing you with the necessary calculations.

Property investments inherently involve risk, but that doesn't mean you have to proceed blindly. With the REI method, we collaborate to thoroughly assess your situation, calculate, and determine the ideal timing, offering you a solid foundation for a more profitable opportunity.

Going back to Matt: he purchased his Lake Life EC at $843 psf in 2018. After the TOP, some owners began selling their units at $1,200 psf, resulting in a comfortable profit of $400,000.

And this is the most common mistake EC owners make: you are worried and concerned, assuming you won't have another chance to acquire the next property at such a low price of $800 psf. Right?

You are not alone.

Many homeowners are fearful of this assumption too. Many believe that selling would mean purchasing a new one at a higher price, compounded by the challenges of dealing with high-interest rates and cooling measures.

Nothing wrong with thinking this way. But let me share another perspective before you make your decision. That's our role to guide you in making informed decisions.

Instead of making that detrimental move, I propose that Matt safeguards his profit.

Here's how:

Matt could purchase a new property valued at $1.8 million.

Wait, WHAT?

I know what you mean, but hear me out: in Matt's case, the earnings from his current EC would contribute to the down payment of the new unit.

What we have done is unlock 2 things out in this process

1-Your initial capital

2-Your profits gain

While it's impossible to predict the real estate market's future trajectory accurately, this strategy ensures that Matt secures his profit and capital for another opportunity—a $1.8 million asset with potential earnings over the next five years.

And don't forget by then, your income would have increased as well for a higher, safer leverage in loan as well.

With these 3 factors to build a strong asset, you increase your net worth immediately from $1m to in just 5 years. All without using additional savings.

On the other hand, if Matt decides to hold on to his EC, Matt risks the property losing value.

What do I mean?

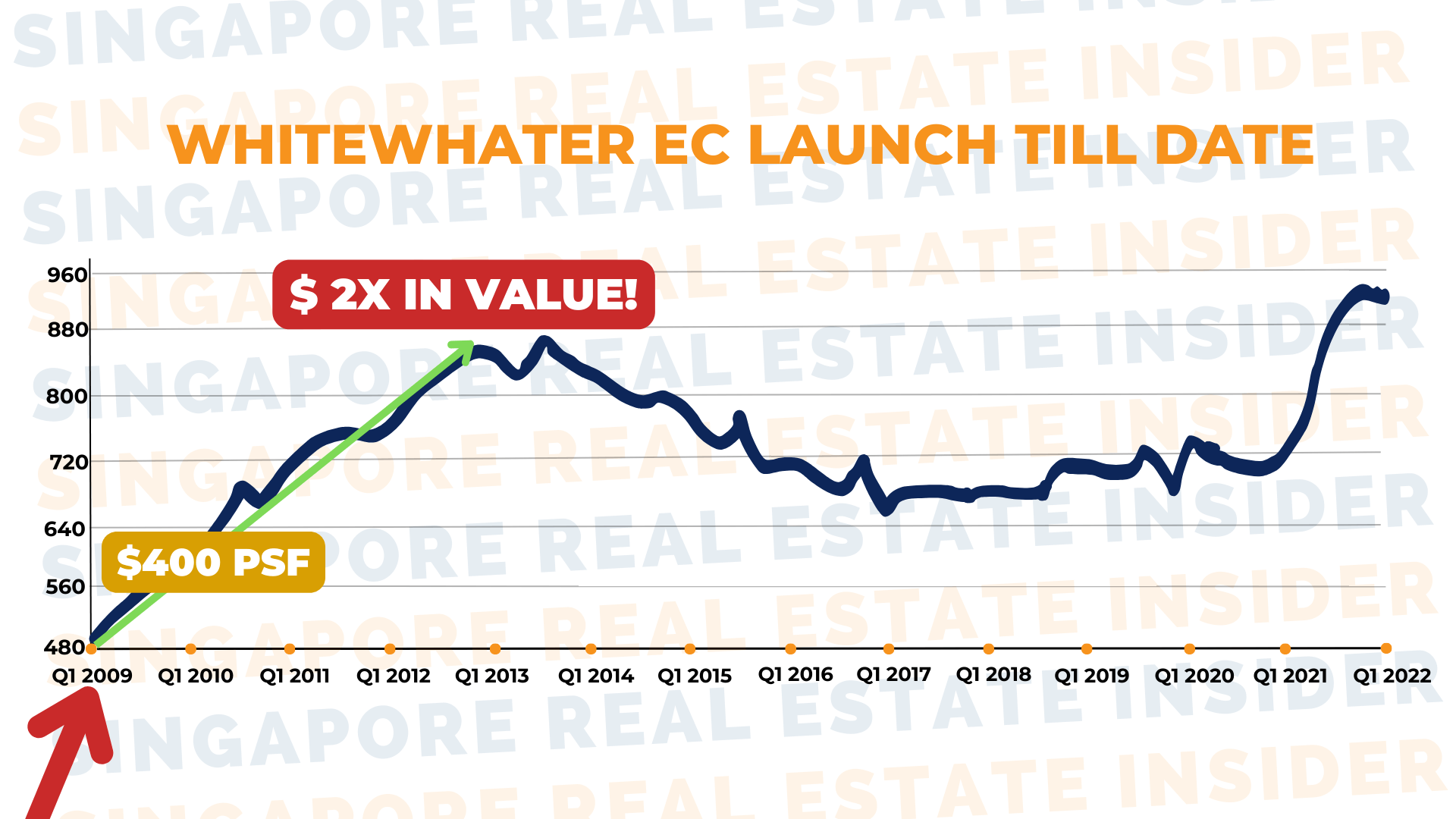

Historically, properties tend to experience a slowdown in value growth after the MOP.

As depicted in the chart, this particular unit was acquired at $400 psf in 2013 and doubled in value within four years. However, it subsequently experienced a decline and underwent sluggish growth for nine years before peaking again. By that time, the profit would have diminished in purchasing power, considering the impact of inflation.

And why does this happen?

Because every property will experience something we call

EXPIRY DATE.

So which would you prefer to be in the property game: a profit loser or a winner?

At Singapore Real Estate Insider, we want our clients to emerge as winners and fulfill their dreams of maximizing their financial potential through intelligent and well-informed property investment choices.

Take a step towards your success by contacting us today to schedule a consultation! Click here to book.