Indeed, just a few weeks back, there were elevated fear in the markets, panic buying of household goods, limited number of events, closing down of entertainment venues, cinemas. and advising against gathering of more than 10 people at any 1 time.

And everywhere I go, I hear people saying –

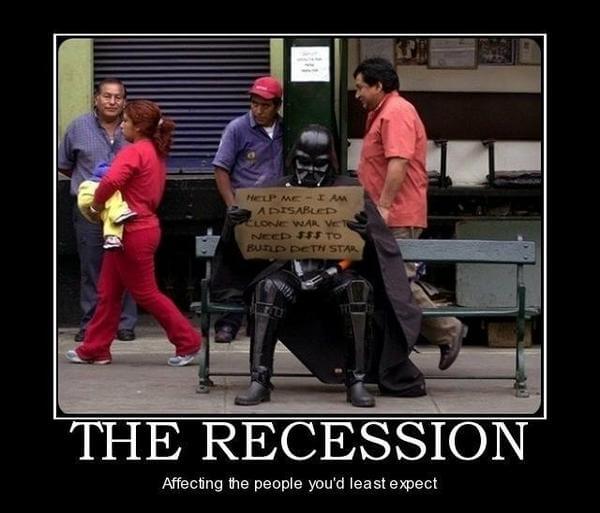

‘Cham, die liao economy, confirm recession liao’

recession 2020

Now with the most recent updates on the resilience budget for the current situation is a relief to many of us, i am sure.

Before I continue, I am not trying to play down the seriousness of the situation here. My heart goes out to all those who have been affected by this global happening – one way or another. Savings in a Property (or in this case, any form of wealth building instruments) is probably the last thing on most Singaporeans’ mind right now.

However, the purpose of this, is meant to help put some perspective on the current situation.

But how come it always slip through us cycle after cycle without us able to capture the opportunities?

Question is, are you ready for it when times like this happen and you have done your homework prepared ahead?

While there are panics and concerns around, I always still go back to fundamentals that are driving Singapore economy and property market.

Ignore the noises

Where are the actual heart beats going on and where the market demand is?

If you understand a typical property cycle, you’ll know that there are 4 stages.

I will cover it in subsequent topics.

And so it is crucial that we pay attention to market fundamentals to avoid being paralyzed by fear and missing out on opportunities in a crisis.

I guess the closest reference we have is back in 2003 when SARS virus outbreak happen. So I be honest, I was not practicing Real Estate but my family went thru that cycle along with many of my clients who are more senior than I am to share their experiences with me.

But what I did during the practice of the business was to study past cases and understand about markets and economy, what trends were going on. Information and data were lacking back in 2003 as compared to now – so it became evident that as more data and information improves with technology till date, so does our research work.

Now Mark Twain said this.

‘History doesn’t repeat itself, but it often rhymes.’

Based on that, let’s see what kind of impact the SARS virus had on Singapore’s economy back in 2003.

What was your memory of the property market in 2003?

1. Low transaction rates

2. Prices drop drastically

3. No property deals done

4. Land prices reduced

Lets continue in A lesson from 2003 SARS Virus in year 2020 as we dive into the research to draw relation between SARS virus 2003 and COVID-19 virus 2020. What can we learn from our past trends that potentially you can benefit from too.

Edmund Tan

Your Singapore Real Estate Insider

The REI Method

Whatsapp Here

[…] If you cannot recall what are the relation between Covid-19 and 2003 Sars, read here as we cover Covid-19: The unexpected factor in a Property Market 2020? […]