Is the Singapore property market, notorious for its relentless rise, finally shifting gears? Brace yourselves, because experts are predicting a price decrease in 2024! This surprising turn of events presents a unique landscape for property investors and homeowners alike.

Hold on to your hats, because we're diving deep!

The property market is in for a seismic shift, and understanding the "why" behind the price drops is crucial. National Development Minister Desmond Lee himself acknowledges rising interest rates, economic headwinds, and supply-demand dynamics as potential roadblocks to the ever-climbing property prices.

So, what's causing this price correction? Let's break it down:

1. Rising Interest Rates: A Pinch on Affordability

Savills, a leading property consultancy, predicts a dip in high-end property prices due to rising interest rates. Mortgage rates are expected to stay high, making it tougher for buyers, especially those on tight budgets. Think smaller loan amounts and a more limited pool of properties to choose from. This can lead to a slowdown in transactions, putting downward pressure on prices. Sellers might struggle to find buyers willing to pay top dollar, creating a more buyer-friendly market.

2. Economic Headwinds: Uncertainty Breeds Caution

Geopolitical tensions and tech industry jitters are casting a shadow on the global economy. When job security and financial futures are unclear, people tend to prioritize affordability and delay big purchases like houses. This reduced consumer confidence can put a damper on the housing market.

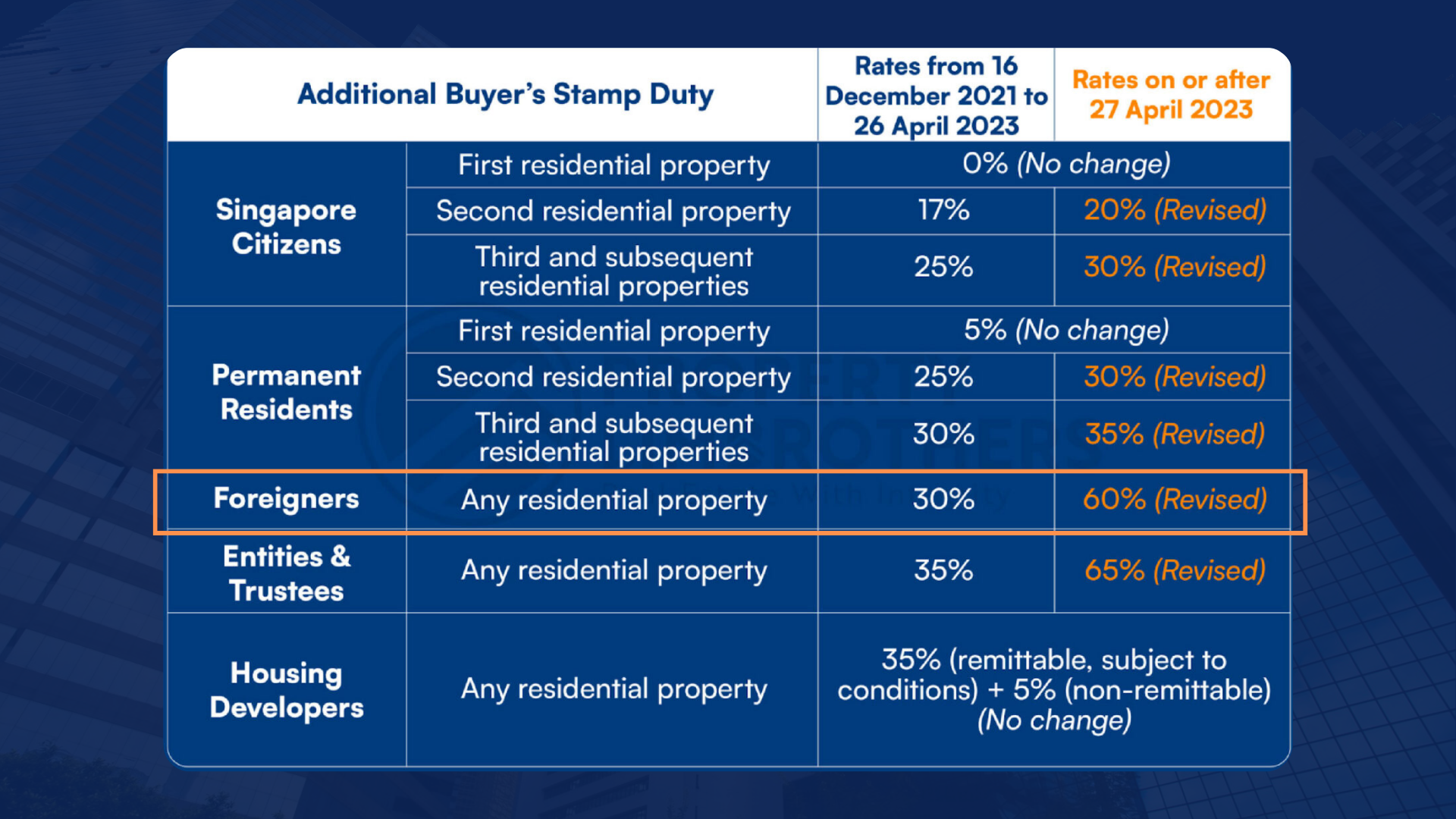

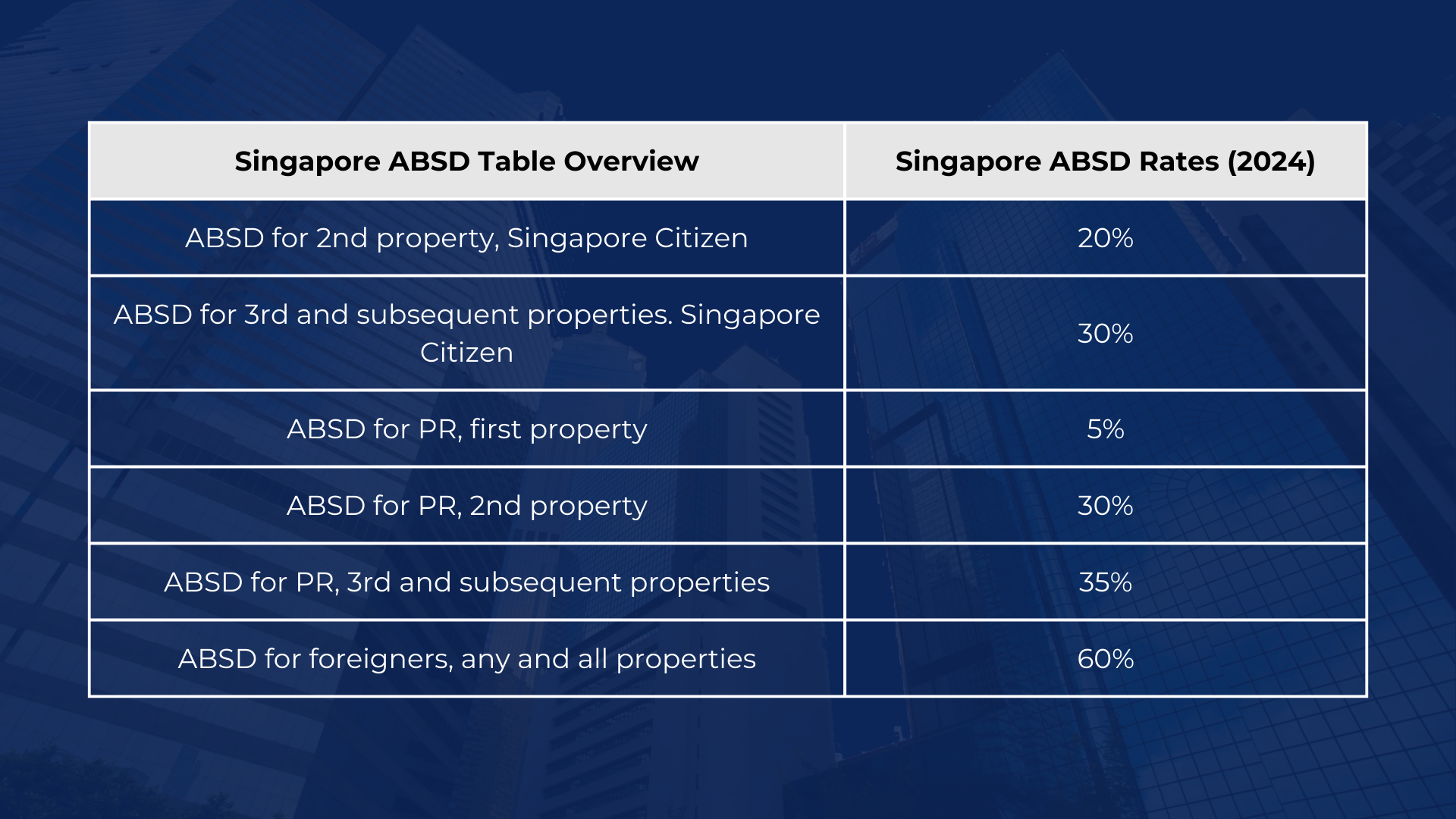

3. Foreign Buyer Restrictions: Cooling Down the Prime Market

The hefty Additional Buyer's Stamp Duty (ABSD) for foreigners (currently 60%) directly impacts their purchase decisions. Prime locations, a magnet for foreign investors, could see a decline in demand due to these additional costs. Reduced foreign investment can contribute to lower property prices in these areas.

4. Shifting Buyer Behavior: Affordability Over Opulence

A noticeable shift in buyer behavior is emerging:

Move to City Fringe: Economic realities are pushing buyers, especially in the high-end market, to explore more affordable options outside prime regions. City fringe and fringe areas are gaining traction due to their budget-friendliness.

Affordability Over Luxury: Buyers are prioritizing value for money over luxury features. They're opting for more practical properties that fit their budgets.

Rent vs. Buy: Some are choosing to rent instead of buy. Renting offers more flexibility and avoids the long-term commitment of homeownership, which can be appealing during uncertain times.

5. Supply and Demand Dynamics: Finding the Right Balance

The government's commitment to managing supply and demand plays a vital role. While stabilized application rates for BTO flats, increased land supply for private housing, and other measures can lead to a balanced market, an oversupply or shift in demand patterns could still influence prices.

The ABSD Revision: A Double-Edged Sword

On February 16th, the government revised the ABSD, offering some flexibility for developers and a helping hand for downsizing seniors. Let's explore this two-pronged approach:

- ABSD Concession for Single Singapore Citizens: To encourage downsizing, Singaporean seniors aged 55 and above can claim a refund of the ABSD when they sell their current home and purchase a less expensive one. This could increase the number of available units, potentially pushing prices down.

- ABSD Remission Clawback for Developers: Developers who successfully sell at least 90% of their units within five years can enjoy a lower ABSD rate. This can provide some relief for the industry.

The Good, the Bad, and the Golden Opportunity

These factors are likely to lead to slower property purchases, ultimately affecting prices. Here's how this translates for property investors:

The Good News:

- Increased Affordability: Lower prices make it easier for more people to enter the market.

- First-Time Buyer Opportunities: A golden chance for first-timers to realize their dream of homeownership.

- Diverse Investment Landscape: Investors can explore a wider range of property options, diversifying their portfolios.

- Government Measures for Stability: The government's commitment to a stable market offers peace of mind.

The Challenges:

- Foreign Investors Face Hurdles: Foreign investors may find it more challenging and expensive to enter the Singapore property market due to the ABSD.

- Lower Demand in Prime Regions: A shift in buyer preference towards city fringe areas could lead to lower demand and potentially less profit for investors selling in prime locations.

- Impact on Sellers and Developers: Sellers might face difficulties selling properties at previously high prices, and developers could experience reduced demand, requiring adjustments in their strategies.

The Golden Opportunity: Navigating the New Landscape

While the price correction presents both positive and negative aspects, the key lies in adaptation. Here's how you can turn this situation to your advantage:

- Embrace Affordability: The lower entry point opens doors for a wider range of buyers. Consider properties that cater to this growing segment.

- Explore Diverse Options: Look beyond prime locations and delve into city fringe or up-and-coming areas that offer good value.

- Be Strategic: Conduct thorough research, understand market trends, and make data-driven decisions to maximize your returns.

Don't Miss Out: Take Action Now!

The current market presents a unique opportunity, but it won't last forever. Act swiftly and strategically to secure your place in the Singapore property market.

We are here to help you navigate this dynamic landscape. Our team of experts possesses the knowledge and experience to guide you towards informed investment decisions.

Contact us today and book your complimentary consult here and let's discuss your property goals!

Together, we can unlock the potential of the 2024 Singapore property market.

Remember, investing in real estate is a significant decision. Make sure you have the right guidance by your side!