2022 is at risk of having 6 interest rate hikes this year, and this does sound crazy!

Due to the pandemic, we spent two years in lockdown and remote work, and just when we thought we saw the light at the end of the tunnel, the war between Russia and Ukraine broke out. What exactly is going on?

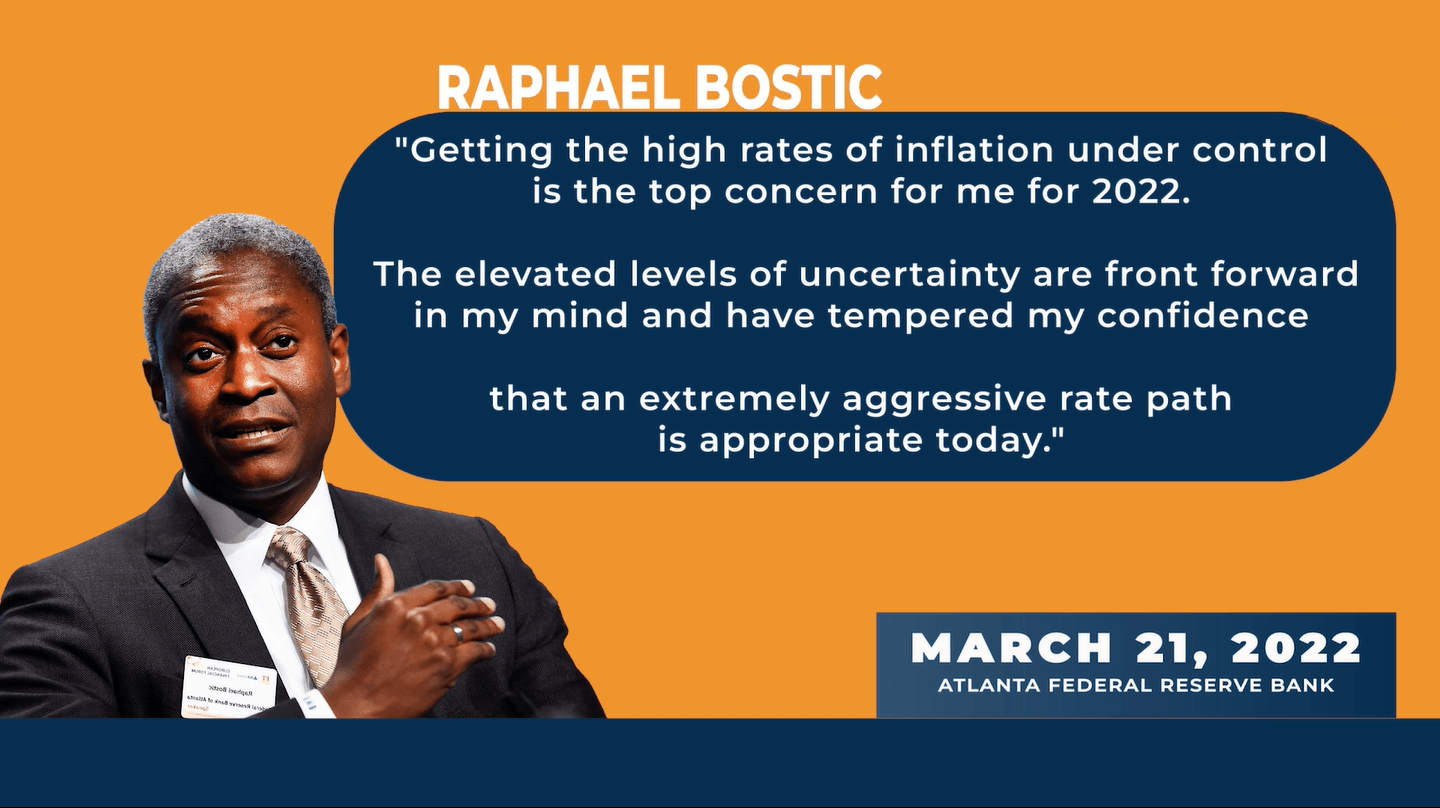

These global issues make a dent in worldwide economies. Last March 21, Atlanta Federal Reserve Bank President Raphael Bostic foresees six interest rate hikes in 2022 and two more in 2023.

What does the US have to do with you as a Singaporean or a PR (Permanent Resident)?

It causes an indirect but substantial effect on interest rates in Singapore.

As the rates in the US rise to a predicted 2.5%, so will the rates in Singapore be at 3% for home loan rates alone. It’s how banks would possibly respond to this global crisis. This will eventually compel private banks to increase their HDB loan rate from 0.1% to 2.6%.

Previously, mortgage brokers quelled the uncertainties by declaring that the predicted interest rates will be rolled out in small increments of 0.25% over a prolonged period. Yet, surprise, surprise, the Fed has penciled in six rate hikes in a year. Yikes!

Do Singapore Homeowners Need to be Concerned?

It depends on your property and your loan. If you’re paying off an HDB loan, it might remain at 2.6%. However, if you choose a private bank loan for yours, you can expect real effects soon. But if you’re a landlord and you’re renting out your units, the impact on the rental market comes with the rising cost of, well, pretty much everything from fuel to food due to the economic sanctions against Russia.

What and Who Needs to Look Out for the Impending Interest Rate Hikes?

1. High Earners

If your income is included in the high-scale range, you might be advised to get a private bank loan, which leaves you to go with the growing interest rates. Consult a broker and see if you can appeal for this, but if HDB declines, the next best thing is to secure a good, manageable rate.

2. Individuals who want to refinance their HDB Loan

For a while, many Singaporeans have switched to a bank loan that offered 1.3% compared to HDB’s flat 2.6%. But as mentioned, the private bank loans might roll out a higher than 2.6% interest rate this year. It would be wise to hang on to your HDB loan.

3. Executive Condominiums

EC or Executive Condominiums are excluded from HDB loans. So, if you’re eyeing an EC unit, beware that you don’t have a choice other than private bank loans.

4. Tougher Loan Process

It is already tough to secure a loan due to the tighter TDSR limits. As it is, you can only loan a maximum of 55% of your monthly income. That means if you need to get a loan, you will need to pay a heftier down payment. You might extend your loan tenure, but there’s no assurance you can get them.

Watch out for the internal board rates private banks might push to you in the coming day.

Board Rates are interest rates that have been a constant for years. While there’s an inkling of a possibility that it could keep your rates from increasing suddenly, remember that loan caveats will always mention something that goes along with:

“Rates may increase without prior notice.”

5. Short Outstanding Loans

If you’re lucky enough to start investing early on and are at the last trench of payments, consider paying off the remaining balance rather than continually paying monthly to spare yourself from the increasing interest rate. But before you write that check, double confirm your loan’s terms and conditions, and it would be beneficial to consult with a financial coach because there might be some clauses where you will be charged extra for paying early

6. Landlords

If you’re renting out a property, you will probably need to increase your rate to match the rising costs of everything. But don’t fret so much, especially if you’re done paying for it because, for one, you can claim tax deductions to offset your mortgage interest rate, and since you’re done with your dues, there’s not much more to worry about other than maintenance costs, etc.

Amidst these crazy times, the best thing to do is remain calm.

A clear head will help you digest this information thoroughly and lead you to wise decisions. Never hesitate to contact a consultant before making a move and be mindful of the long-term effects. We’re all hoping that this clears out soon. Until then, let’s maximize our investments.

***

If you want to know more about how busy professionals and homeowners like you can make 6-figure profits from property safely, we have a private group where we share traits and strategies behind it.

Just click on the button below to join.

Disclaimer: All information presented is based on personal opinions. Singapore Real Estate Insider is not liable for any losses and expenses whatsoever related to investment decisions made by the audience. The ideas presented are here for reference and educational purposes only.