Would you pay a 10% to 20% premium just for a Freehold Property and still don’t make 6-figure profits from it after five years?

In this blog post, I will be debunking common misconceptions about freehold vs. leasehold properties and their role when choosing the right property for you.

You may have encountered these terms while browsing listings as you were searching for the best property for you. But for the benefit of those going into the property market for the first time, let me first walk you through each of these above-mentioned terms.

Watch it HERE.

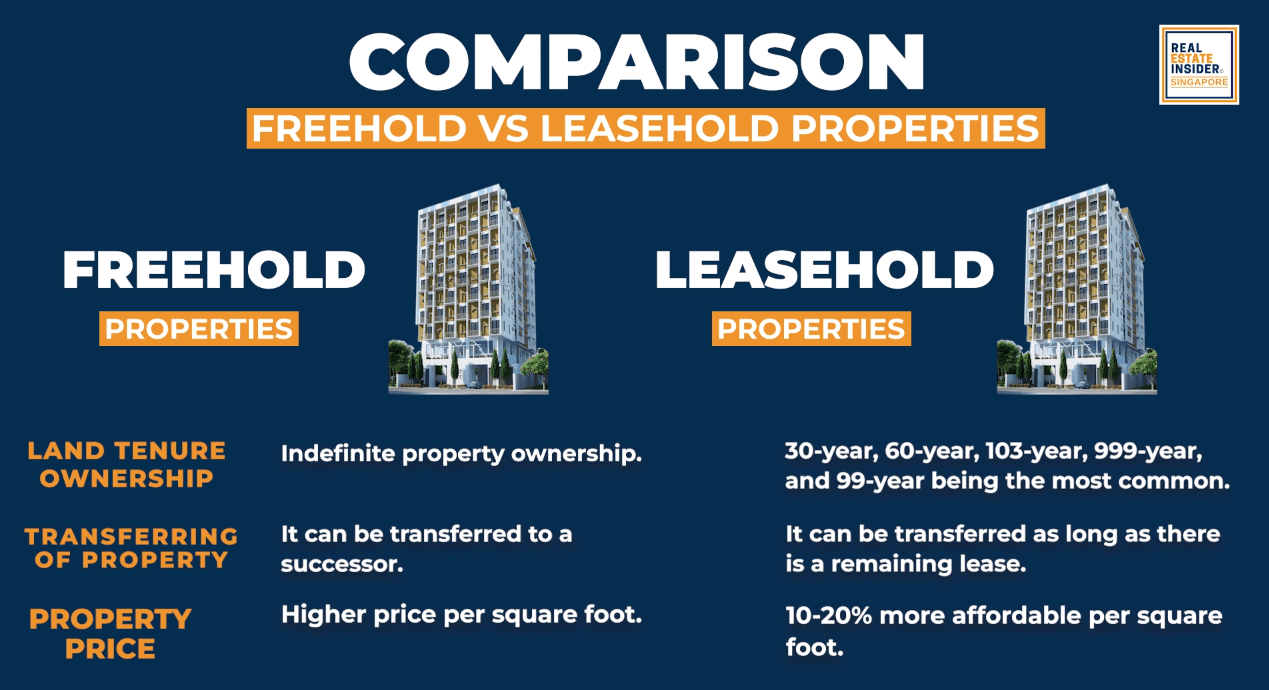

Freehold Property means you have full ownership of the land and own it indefinitely. You can pass this property to future generations without restrictions.

Freehold property is classified as such because:

- The property is immobile. Your property is affixed to a land.

- The property has no fixed duration. It should have no definite ownership duration or no stated end.

Leasehold Properties are properties with a defined lease period. Buyers of such properties lose ownership once the lease is over.

999-leasehold can sometimes be viewed as freehold. However, it’s still technically a leasehold type of property ownership since it has a set duration.

If you are someone who, for whatever reason, can only accept freehold property, check out this video where I share the 3 important factors to look out for a freehold property.

Based on the above date, let’s tackle the misconceptions about freehold and leasehold property.

Common Misconceptions

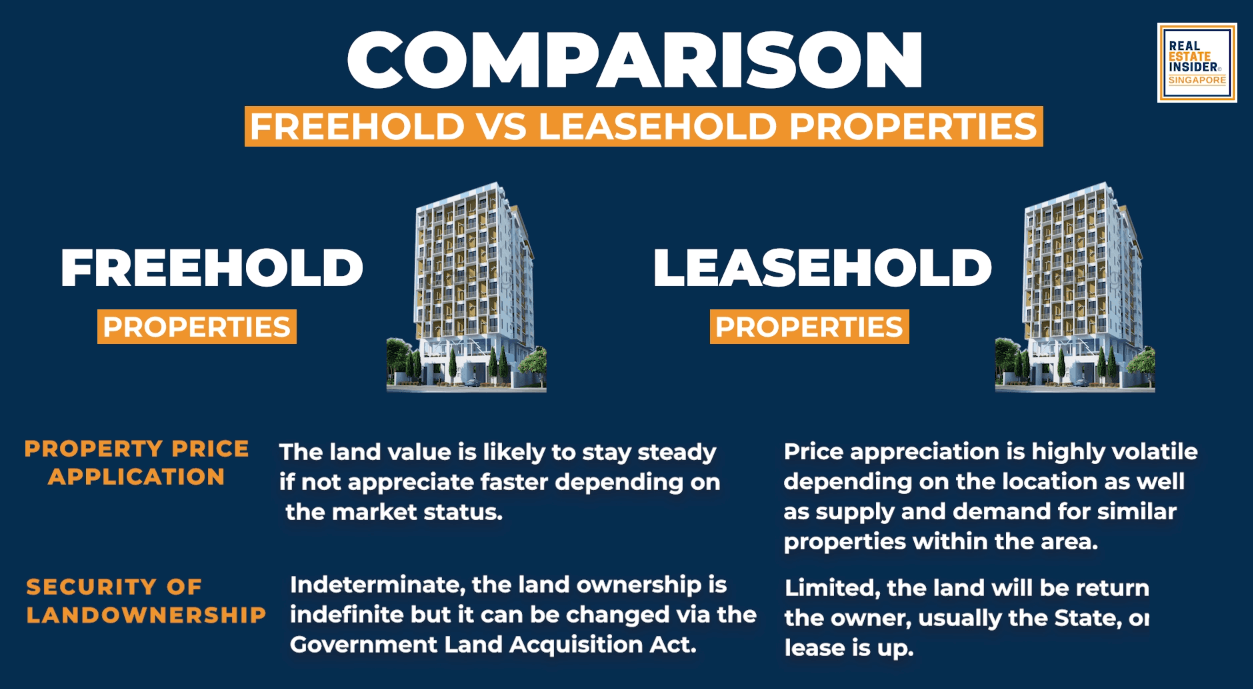

1. In freehold, the government cannot take back the land, and in leasehold, the government can take back the property anytime.

While it’s true that you own the property indefinitely when it is a freehold, the government can still take back the property if it is sitting on a site embarked for future development.

For example, if your property is in the way of a new MRT underground network, the government will move you out of the MRT path and compensate you accordingly to the current market value. The same goes for leasehold properties.

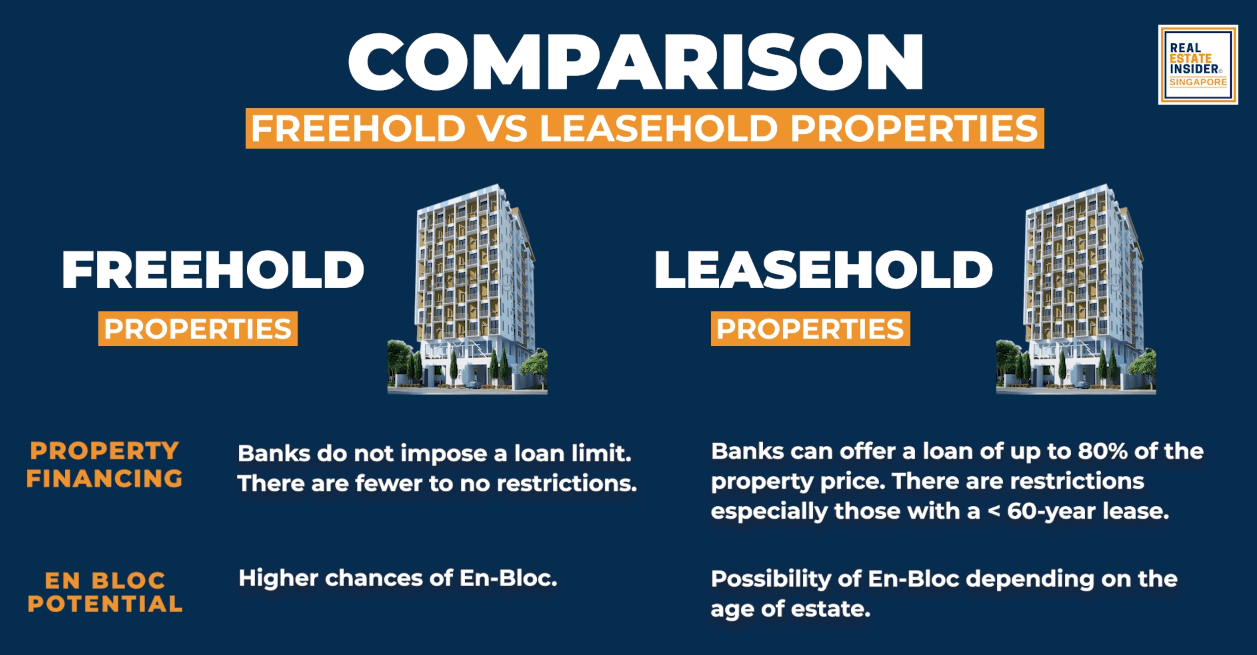

2. Freehold properties are exempted from enbloc sales.

Some believe that freehold developments cannot be included in the enbloc sales. This is a myth. The truth is if a developer attempts to buy your condo, and the majority of residents within that development agree to it, you will have no choice but to push through with the sale of your home.

That concludes Part 1 of debunking myths about freehold vs. leasehold properties. In my upcoming article, I will address the remaining myths that we shall dispel.

Stay tuned for the part 2 of Freehold vs Leasehold Property: Misconceptions debunked.

***

If you want to know more about how busy professionals and homeowners like you can make 6-figure profits from property safely, we have a private group where we share traits and strategies behind it.

Just click on the button below to join.

Disclaimer: All information presented is based on personal opinions. Singapore Real Estate Insider is not liable for any losses and expenses whatsoever related to investment decisions made by the audience. The ideas presented are here for reference and educational purposes only.