I recently posted on the previous article about the winners in Singapore’s new property cooling measures as per MAS December 2021. With its publishing came an onslaught of questions about who the losers are and how to avoid them.

You might think it’s funny to play Abba’s “The Winner Takes it All” on Spotify to set the mood while reading this. There’s a line there that ties the winning and losing feelings together: “The winner takes it all, the loser standing small” because if you have ever experienced failing at times, you know how that sucks.

Can you imagine how much worse it would be when you lose at something as huge as property investments?

Watch it HERE.

Let’s walk through the “losers” of the new cooling measures:

1. Second and Subsequent Residential Property Buyers

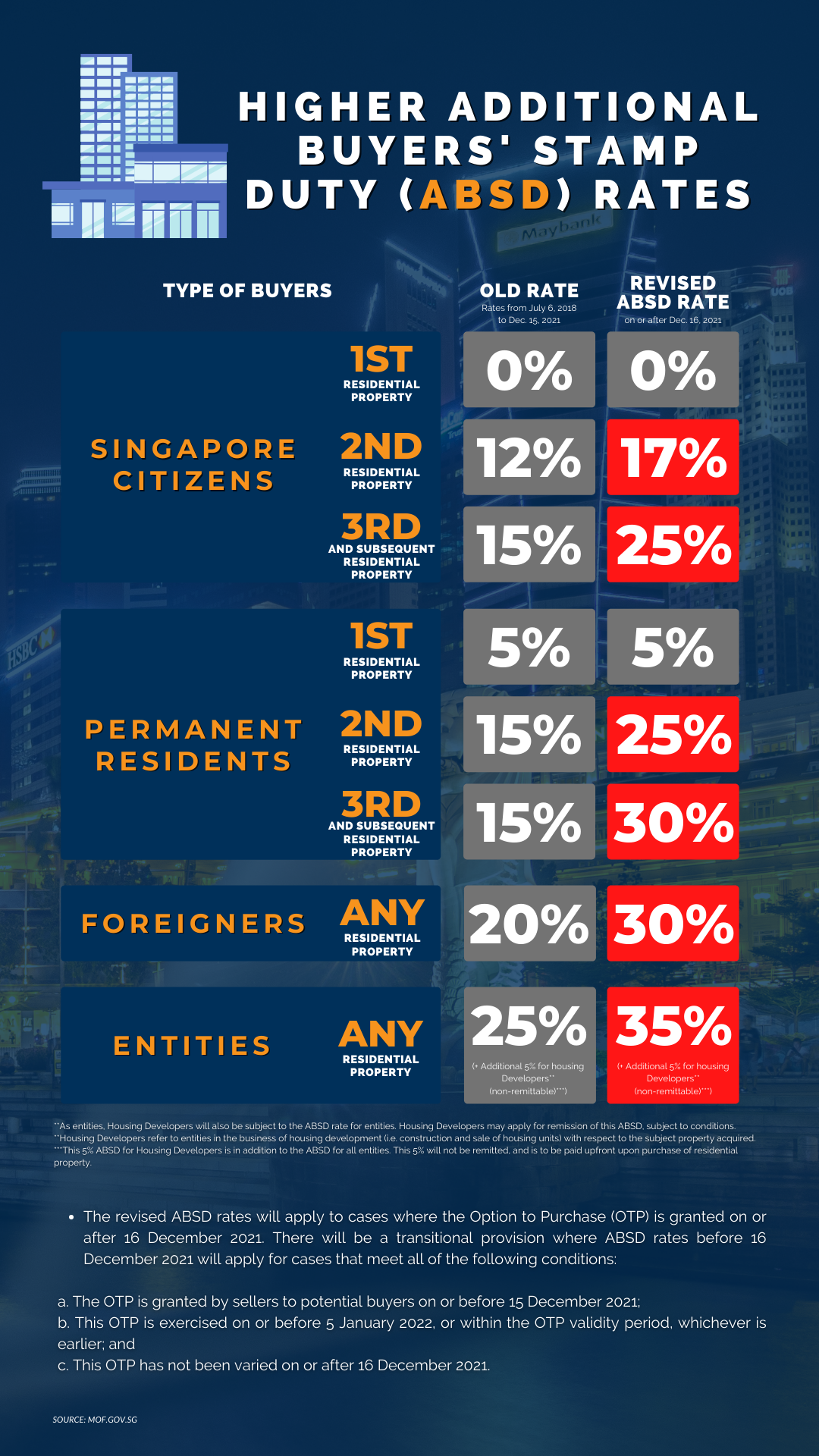

The Additional Buyer’s Stamp Duty (ABSD) rate hike will soften the investment demand.

As a quick overview, buyers are subjected to ABSD on top of the Buyer’s Stamp Duty (BSD).

These stamp duties are computed against their purchase price as declared in the dutiable document or the property’s market value (whichever is higher).

Investment hopefuls will have to think twice if they want to purchase another property for investment purposes.

They will have to pay a higher ABSD of 17% for 2nd residential properties and 25% for the third and subsequent properties.

2. Foreigners Interested in Purchasing a Residential Property in Singapore

As you have seen in the previous ABSD chart, there’s a 5% increase in foreigners’ rate. It can be a hefty sum when applied to a property worth millions of dollars.

The 30% ABSD on properties will concern many foreign buyers, especially the big tickets in the Core Central Region (CCR). Before foreigners make a decision, they may need to think twice.

3. Developers with Core Central Region (CCR) Projects

Developers are most likely to experience the losses brought about by the new cooling measures, but more so for the high-end home developers with Core Central Region Projects.

The demand will likely slow down as investment demand moderates and a lack of foreigners enter the market. In this scenario, people are more likely to opt for a sensible and affordable home that fits their immediate requirement, which is having a bigger space for most families.

As for high-end developers, perhaps adjusting their prices can be an option to attract local Singaporeans and PR buyers.

4. En Bloc Hopefuls

The impact on the collective sale market may be uneven, with mega-sites and CCR sites facing more challenges. Developers are likely to withdraw from larger land plots.

Homeowners looking to sell through En Bloc might only get a small amount compared to their property’s value if a sale will push through at all.

Collective sales sites in the OCR could still be profitable for the developers in the long run.

We spent a lot of time understanding how the measures will affect the busy professionals and homeowners like you moving forward. Most importantly, how can we take these measures and emerge as winners in the end.

If you want to know more about how busy professionals and homeowners like you can make 6-figure profits from property safely, we have a private group where we share traits and strategies behind it.

Just click on the button below to join.

Disclaimer: All information presented is based on personal opinions. Singapore Real Estate Insider is not liable for any losses and expenses whatsoever related to investment decisions made by the audience. The ideas presented are here for reference and educational purposes only.