Which buyer profiles will emerge as the winners and losers?

How are we as busy professionals & homeowners going to use the new cooling measures to our advantage & continue to make 6-figure profits in property safely?

We see these new cooling measures as a way for the government to keep property prices in check and that Singapore will continue to have stable and affordable property prices even for the next generation of buyers.

Despite this, many of us are still doubtful whether this new property cooling measure is for the best. If you want to have an overview of what the new cooling measures are about, you can read our article HERE.

Many of us are concerned and worried about the latest cooling measure and how it will affect us as homeowners. Let us help you as we break down in detail how the cooling measure is going to affect each specific profile of buyers. Will you win or will you lose?

We will breakdown how the cooling measures affect:

-

- 1st time buyers for HDB or private property and how TDSR and LTV will affect your finances

- If you are a HDB upgrader to private property, what are the known 2 strategies to save money if you want to own more than 1 property

- Limitations for foreigners & developers in future

Watch and listen to Edmund explain each in detail.

As a homebuyer, you should be informed of how the new cooling measures affect you so you’ll have an idea on what to do next.

NEW COOLING MEASURES WINNERS AND LOSERS

FIRST-TIME BUYERS

As a first-time homebuyer, the new ABSD rates will not affect you since it’s only applicable to 2nd purchase & the subsequent ones. That make you a winner in this new rounds of cooling measure!

The only thing that could affect first-time buyers are the LTV or loan to value which means higher down payment for them and the tighter TDSR total debt servicing ratio.

Here’s a sample computation:

Under the old rule (60% TDSR), the required combined monthly income would be about $8,343. With the new rules, (55% TDSR), it would require a combined monthly income of about $9,102.

From a total quantum perspective, here’s how it adds up:

If a person has a $10k per month income, his max loan will be $1,336,000. His maximum purchase price is $1,781,000.

Under new rules, the person with the same monthly income of $10K per month, will have a max loan of $1,244,000 and a maximum purchase of $1,632,000.

TDSR (Total Debt Servicing Ratio)

In terms of TDSR, as first-time homebuyers, the new tightened TDSR rate affects you by lowering your purchasing power.

It’s still up to you to adjust your finances accordingly, make bigger down payments and borrow less until the TDSR limit fits your purchasing ability.

If the reduced TDSR is really an issue for you to buy property, maybe you should check if you are overleveraging yourself and look for a property that’s within your means instead.

Are there ways to increase this limitation?

There are ways to properly structure your finances so you can increase the limitation and buy the property that you want. To know more about how this works. Reach out to us so we can assist you.

FIRST-TIME HDB BUYERS

For first-time HDB buyers, the new LTV affects them in terms of financing a higher down payment, which will not be felt much since they can use their CPF to cover for it.

When you buy an HDB flat, you can only set aside up to $20,000 in your CPF ordinary account (OA). Then the remaining balance can be used for the down payment of the property.

For Singaporean couples, your combined OAs means you can make a way bigger down payment than the minimum 15% required. So the new cooling measures may not affect you that much.

HDB UPGRADERS

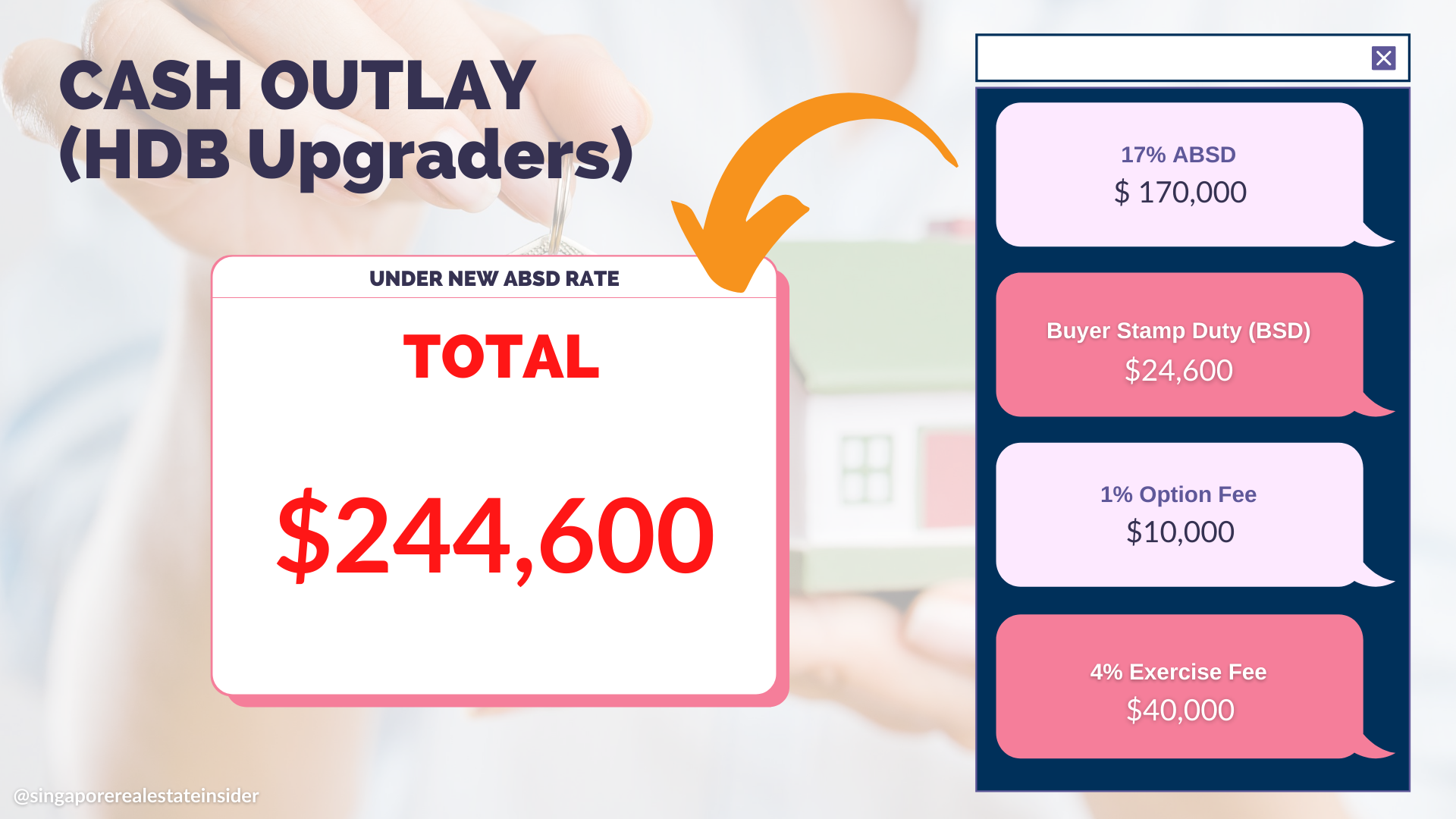

Here’s an example of how the new cooling measures affect HDB upgraders.

A Singapore buyer purchasing a property worth $1,000,000 before selling their existing HDB flat (or any other property) will need to pay an ABSD of $170,000 in cash (17% of $1,000,000), up from $120,000 previously.

Take note, that this is in addition to the:

Buyer Stamp Duty (BSD) = $24,600

1% Option Fee = $10,000

4% Exercise Fee = $40,000

Total Cash Outlay = $244,600

They will need a cash outlay of at least $244,600 to purchase a $1,000,000 private property.

While the ABSD can be refunded upon the sale of their existing HDB flat, buyers still need to have cash first to complete the transaction.

If you really want to avoid paying the hefty 17% ABSD, your alternative will be to sell your existing property before purchasing your private property. Sell first, purchase later.

However, there are also some challenges with that particularly. During this pandemic, it could be very inconvenient for families if they need to move out of their existing home, without their new place being ready yet.

2 Strategies to Save Money

There are 2 other option that can help you with ABSD. Join our private group where we share about it exclusively. Click HERE to join.

One of the common methods to avoid paying ABSD is to buy property under trust. With the TRUST method, you will buy the property under trust for your child below 21 years old.

You as a trustee will not pay the ABSD since you are not considered as the legal owner of the property.

Though this way is possible, it’s not accessible for all since buying property under trust requires FULL CASH payment without a loan or CPF usage. A way that only well off and wealthier buyers can take advantage of.

FOREIGNERS & DEVELOPERS

For foreigners, the new 30% ABSD could discourage them from purchasing property in Singapore, especially for big ticket purchases in the Core Central Region (CCR).

This pre-emptive measure that the government has placed is in preparation for the foreigners who will be coming to Singapore to put up their businesses and looking forward to purchasing luxury homes as the borders are now slowly opening up.

On the developers’ side, with the high 35% ABSD, and additional non-remittable 5%, they need to be more selective in buying their land acquisitions that will in turn affect En Bloc transactions.

Though developers can remit the ABSD if they sell ALL units within the 5-year period, this will still be very challenging for them.

CONCLUSION

With the new rounds of cooling measures, we can clearly see that these will have more impact on foreigners and developers than for regular, genuine home buyers.

For us not to be troubled with the current change, we have to see these new cooling measures as a way for the government to keep property prices in check, and that Singapore will continue to have stable and affordable property prices even for the next generation of buyers.

If you are a busy professional and home buyer and want to earn 6-figure profits through property safety, we have a private group where we share traits and strategies behind it. Just click on the button below.