Cooling measures – they are back with a vengeance. And if you’re like me and the busy homeowners investing in real estate, well, we kind of knew it was coming right, It was only a matter of time. Or did you hope it would NEVER come?

In this article we’re not just going to summarize the measures for you, but more importantly I am going to share 6 Super Hot Questions you are thinking and asking yourself but you have no answers to them yet.

So remember to read ‘till the end.

To be fair, the Singapore government only intervened with these new measures to ensure that its citizens are protected from the increasing interest rates, and record-breaking private home prices.

You see, the HDB Resale price index got hotter by the tail end of the second quarter of this year, with a 5% increase in sales. To moderate the market, the Singapore government imposed measures to keep it from getting too hot so houses and HDBs remain affordable for those first-time buyers who probably need it most.( The HDB Resale Price Index increased by 5% in sails during the second quarter of 2022. Cooling measures were put in order to make houses affordable)

Here’s my short and sweet digest of the new Singapore Cooling measures:

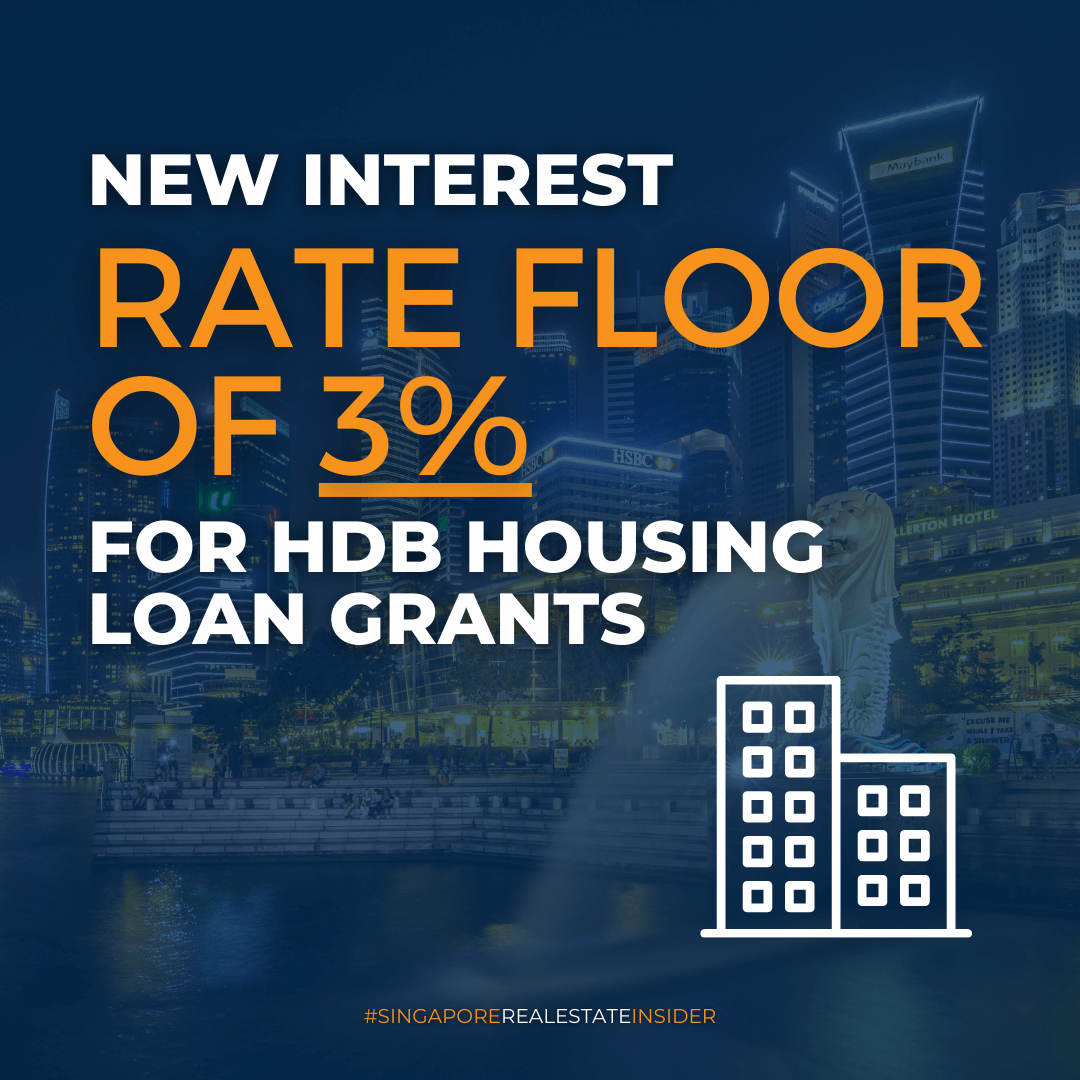

- Increased floor rate for MSR, TDSR, and HDB loans. This means that loans will be increased by 0.5% in computing the Total Debt Servicing Ratio (or TDSR) for private properties, and the same rate for Mortgage Servicing Ratio (or MSR) for HDBs. The previous will only allow homebuyers up to 55% of their income.

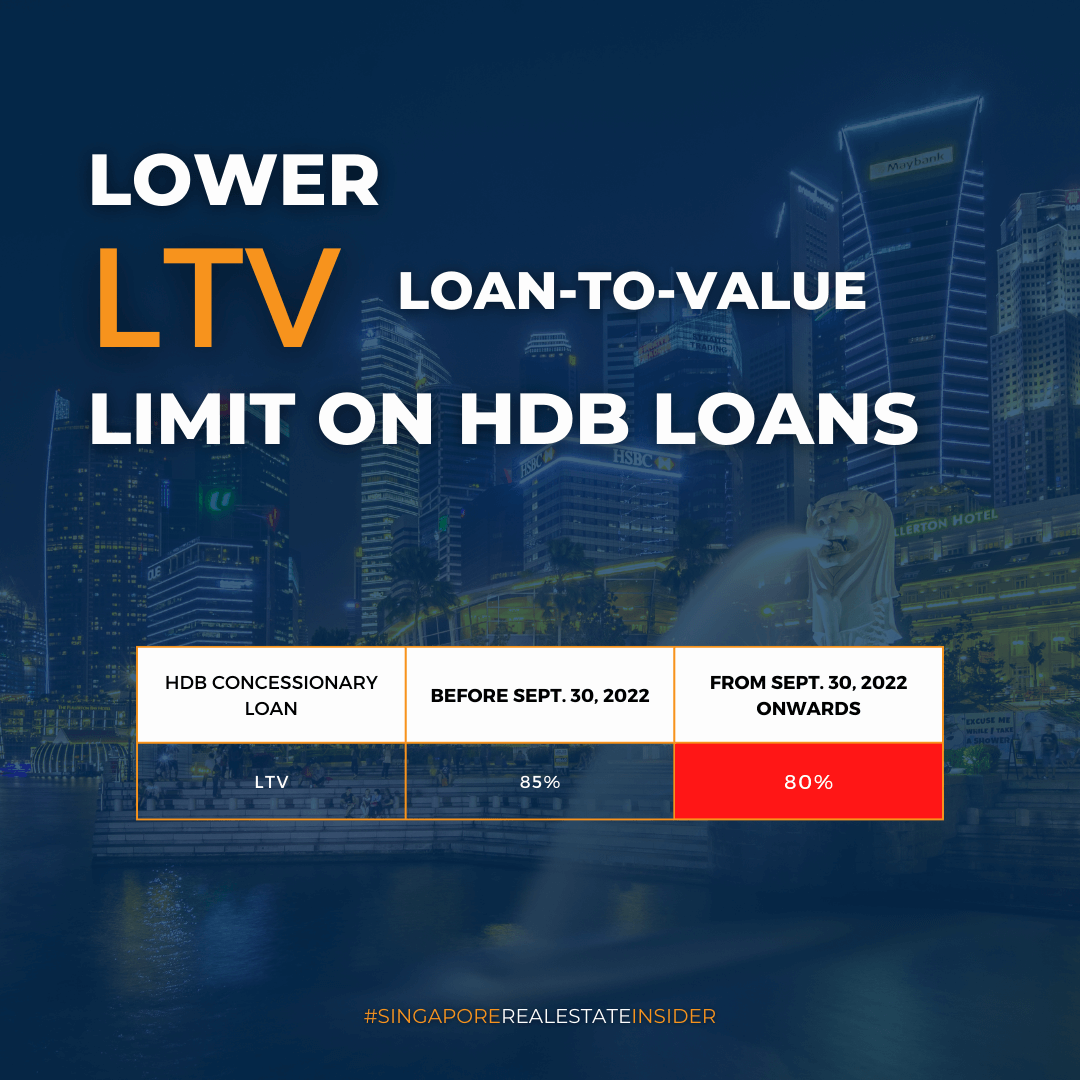

- Decreased LTV limits on HDB loans. As for the HDB loans, the previous limit of 85% will be brought down to 80%.

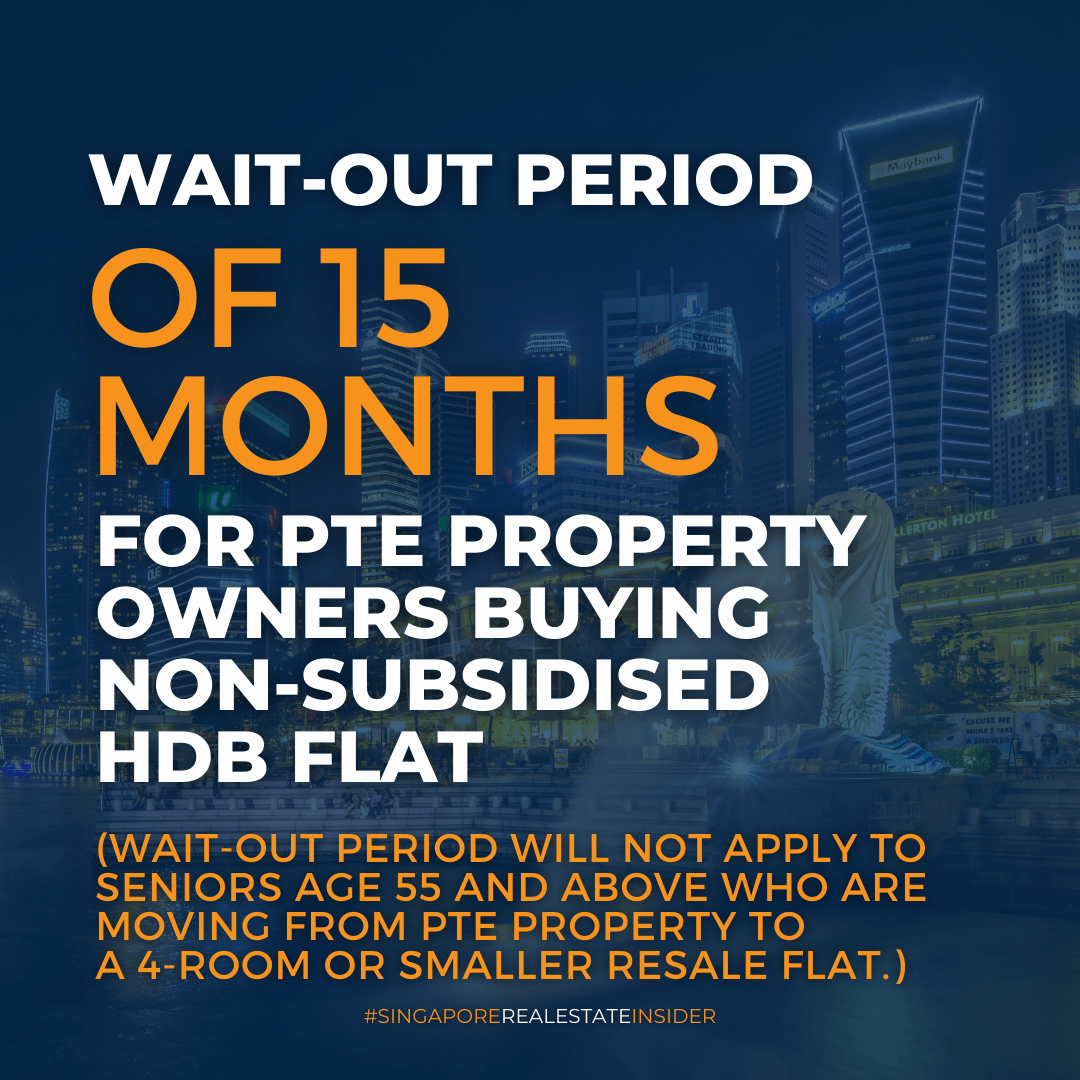

- Here’s what caught most of us off guard: Homebuyers will need to wait for 15 months if they decide to sell their private properties and choose to downsize.

The government rolled out a round of cooling measures last December 2021, and as though that wasn’t enough–and it hasn’t been a year since! We’re bracing ourselves for another impact.

Here are 6 questions homeowners like you should know about this new cooling measure that might affect you.

Who is affected by this measure?

Singapore has just introduced new cooling measures with regards to TDSR, HDB, LTV and interest rate floor.

A 15-months wait out period for Private property owners and ex-Private property owners will be added for non-subsidized HDB resale flats with the exception of new homebuyers and seniors aged 55 and above who want to downgrade to a 4-room or smaller flat for retirement.

So if you already have the intention to sell your private and buy a HDB to stay, you might need to plan this ahead. And you have options:

One option is of course to buy a condo instead of the HDB.

Or else, you could capitalize on the upswing market to rip in a handsome profit from your property now first. Than you can choose to wait & rent or, if your situation permits, stay with someone else for the next 15 months–that saves you so much on rent, before deciding how to re-enter the market later.

You may have some qualms about renting for at least 15 months, but let me assure you, renting for a year or so comes by so fast, and the cost vs. the profit you can get now still offers a big gap in your favor.

As for the HDBs, the 30-month waiting period for subsidized HDB flats will remain unchanged.

Hers’s a BIG TIP for HDB Buyers: Regardless of age, circumstances, you may approach HDB for assistance on an appeal, and they will assess your situation on a case-to-case basis.

For Private Residential Property Purchase

As for you guys who have taken out a bank loan for a private residential property,

Let me give you an example to help you gauge the impact:

Household income : $10,000.

Borrower’s Age : 35, Max 30 years tenure.

Under the current 55% TDSR rule, assuming you have no other loans, your total mortgage can only go up to the maximum of $5,500 a month.

Previously under the 3.5% interest rate used for TDSR calculation, the Loan quantum was $1,224,822.

Now after the 0.5% raise to 4%, the Loan quantum is $1,152,037.

This is around a 5.94% reduction in loan quantum. (Note: This % reduction varies with loan tenure, etc)

Is this going to affect you greatly? Personally, if you are already looking at private property, I do not encourage you to max up everything from your loan and leverage.

Thus with the increase of 0.5%, this won’t deter buyers from entering the market. On the contrast, those who have been waiting on the side line, might take this chance when there’s lesser competition to do their property plan.

For HDB Residential Property Purchase

For those taking a HDB loan when buying a HDB, the MSR remains at 30%.

However, the stress test interest rate for HDB Loans will be at 3%, 4 points up from the 2.6% previous interest rate. On top of this, LTV for HDB housing loans will be reduced from 85% to 80%.

This example is for those buying a HDB taking HDB loan,

Under the current 30% MSR rule,

Household income : $10,000.

Borrower’s Age : 35, Max 25 years tenure.

Previously under 2.6% interest rate used for MSR Calculation would mean a HDB LOAN quantum of ~$661K.

Now, after an increase to 3% interest rate used for MSR Calculation, this means HDB LOAN quantum of ~$632K.

This is around a 4.33% reduction in loan quantum. (Note: This % reduction varies with loan tenure, etc.)

The impact is minimum here as well for any HDB buyers.

>> To be continued on part 2.

***

Join us in our private group where we help busy professionals and homeowners make six-figure profits in their property, safely.

Property is an ongoing process and journey because they are constantly changing and different strategies must be applied at different times.

Therefore in this group, we not only do weekly live coaching on property, we also cover a wide range of property knowledge and information that we as homeowners must know and be educated on to make informed decisions.

Just click on the button below to join.

Disclaimer: All information presented is based on personal opinions. Singapore Real Estate Insider is not liable for any losses and expenses whatsoever related to investment decisions made by the audience. The ideas presented are here for reference and educational purposes only.