The value of a leasehold property is like a ticking time bomb.

The longer the lease, the more valuable the property.

But as the lease gets shorter, the value of the property plummets. This is because the property becomes less and less desirable as it gets closer to the end of the lease.

So if you're considering buying a leasehold property, maximize your investment by working against its decreasing value. BUT HOW?

First, let's determine the value of the property.

Determining the worth of a leasehold property might be challenging, especially if you are unfamiliar with real estate in Singapore. Several elements, including the remaining lease term, the property's location, and the property's condition, determine the value of a leasehold property.

Bala's Curve

But thankfully, we're not left to second-guess because we have Bala's Curve.

Bala's Curve is a guideline used by the Singapore Land Authority (SLA) to assess the value of leasehold land. It's a time-tested computation developed by a Land Office employee named Bala when Singapore was still a British colony--it's THAT old!

It can help buyers to determine how much they should pay for a leasehold property, and it can help sellers to determine how much they should ask for their property.

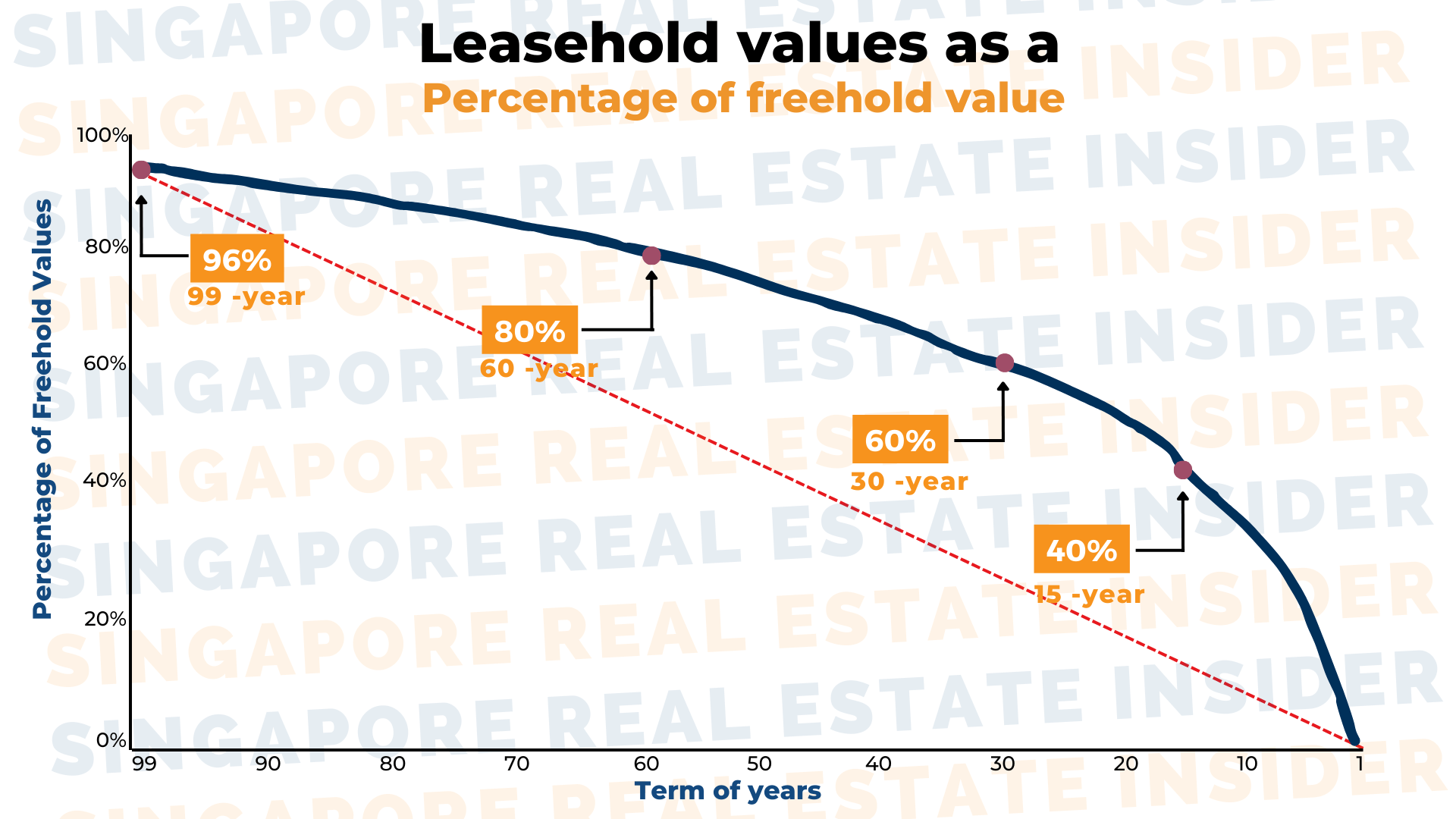

The curve, also known as Bala's Table or Bala's Curve in graph form, calculates the value of leasehold land based on the remaining lease term.

The value of the leasehold land is expressed as a percentage of the land value if it were freehold. Before I give a sample, here are a few important things to note about Bala's Curve:

- The curve is non-linear, meaning the decrease in value over time is not constant. As the lease nears its end, the depreciation of the property tends to accelerate.

- The curve considers rental income, inflation, and discount rates. The rental income is assumed to rise at a constant speed but at about 3.5% below the discount rate, which erodes the value of rental income over time.

- The value of leasehold land decreases gradually at first but declines more rapidly after the 30-year mark due to the effect of the discount rate.

- Eventually, and inevitably, the value of the property reaches zero at the end of the lease.

For example, a property with a 99-year lease would be worth 96% of its freehold value. A property with a 60-year lease would be worth 80% of its freehold value. And a property with a 30-year lease would be worth 60% of its freehold value.

Disclaimer: It's important to note that real-world property prices, especially for newer homes, tend to keep pace with inflation and may not follow the exact devaluing effects of the discount rate.

However, as the lease term decreases, the property's value may start to decline, and this can affect factors such as loan approvals and the use of CPF funds for purchasing older properties.

So How Do You Stop a Ticking Bomb?

Rather than being passive and watching the value decline, you can take proactive steps to make the most of your leasehold property. The key is to secure the property first and then leverage the remaining time to achieve a return on investment by renting it out.

Since it's inevitable for a leasehold property to decrease in value, what investors ought to do is to make the most of it before it only has 30 years left. It would be best to secure that first so you have enough time to ROI by renting it out. The rental rate grows steadily, and we all manage well despite inflation and high-interest rate.

Suppose you purchase a leasehold property for $2 million and manage to rent it out for $4,000 per month ($48,000 per year). We can calculate the rental yield: ($48,000 / $2 million) x 100 = 2.4%.

2.4%? Are you kidding me?! Sure, that sounds like a disappointing return especially when compared to potential growth rates of up to 3.5% per annum by leaving their money in their CPF Ordinary Account.

Rental Yield with an Older Property

Let's say you got an older leasehold property with just 30 years remaining. You could bargain with the owners to sell the unit to you for $600,000 (that's fair enough to purchase a decent resale flat.)

Here's the thing: the number of years left on the lease doesn't matter to your tenants; they will still pay the entire rental cost each month.

Therefore, you decide to rent it out for $4,000 monthly. In this case, the rental yield stands at ($48,000 / $600,000), resulting in a remarkable 8 percent per annum.

Can I Still Earn at a Lower Rental Rate?

It is fair to peg the price lower for an older property.

Suppose you get a $2,500 monthly rental income for your old unit. Despite this, the yield remains impressive at ($30,000 / $600,000) x 100 = 5%, significantly higher than that of that sparkling new $2 million condo.

It's worth noting that this isn't a coincidence; among the 191 units with expiring leases in Geylang Lorong 3, only 33 are owner-occupied. Most of these terrace houses are rented out by astute landlords who recognized the allure of attractive rental yields long ago.

By strategically leveraging Bala's Curve and adopting a proactive approach, you can make the most of your leasehold property investment.

Rather than fearing the depleting value, view your property as an opportunity to secure a steady flow of income and achieve substantial returns.

Don't hesitate to contact me today to explore your options and secure a safe and profitable 6-figure profit with your leasehold property investment. Together, we'll unlock the true potential of your investment and pave the way to financial success.

Click here for your complimentary 20-min consultation with me.