How much is enough to retire in Singapore? Is Retirement Planning really necessary?

Recently, I saw an article from the straits times, reflecting on those who are in their sixties and have regretted not having a head start or any proper planning when it comes to retirement, that they have to continue working into their golden age because of the lack of savings to last them through retirement.

Would you want to live a life like this?

I don’t know about you, but I would rather leave my later age traveling and seeing the world.

Now you must be wondering, why am I sharing this with you and what has this got to do with property?

Maybe you are still young in your early thirties or even forties. What has retirement and property got to do with you?

Read on, as I share with you the importance of forward planning so that we can be set for life.

There are two situations, many busy professionals and homeowners fall into when it comes to property.

- They do not have enough to enjoy life.

- They have just enough, but not living the way you desire.

Together with my wife, Cindior, after going through so many homeowners on their property plans, I realized many are making mistakes, just like us before in not planning for our retirement.

What if you know the mistakes and you can avoid them much earlier than others, will you think this can help you?

This is also the reason why we started to plan for our retirement when we were 35 years old.

Let us first establish some basis of understanding for past HDB and private housing trends.

Based on a common concept, passed down from the baby Boomer’s parents buying an HDB flat as a matrimonial home and living there forever is kind of the norm in the past.

A reader of this article, like you would probably know that this is no longer what the younger and more educated Singaporeans have in their life plan.

However, do not be surprised that there are still many Singaporeans subconsciously doing what their parents have done.

Now let’s take a look at the property overview of a typical baby boomer. Hardworking Singaporean, age 65, who owns a property in Ang Mo Kio and has lived there for almost 29 years. And there’s only one more year to fully pay off their mortgage.

o you can see that this Singaporean has a potential profit of half, a million dollars to pocket if he sells the flat. Perfect right? Nah, it’s far from being perfect, actually, because at the age of 65, you may be able to enjoy a handsome profit of half a million in your banks if you choose to sell your only property, however, what’s the plan after that?

You will not be able to get another mortgage loan from the bank for another purchase. Therefore, there will only be two other options for you. Buy another flat with all your hard-earned profits or downsize to a smaller flat, if you want to enjoy life a little or pay off some debts.

Is that the kind of retirement you want? Perhaps you already have in mind the kind of retirement you will strive for, or even set in an earlier retirement.

Working very hard and living prudently may work for some in the past but the past is already in the rearview mirror.

Working hard can no longer make you rich.

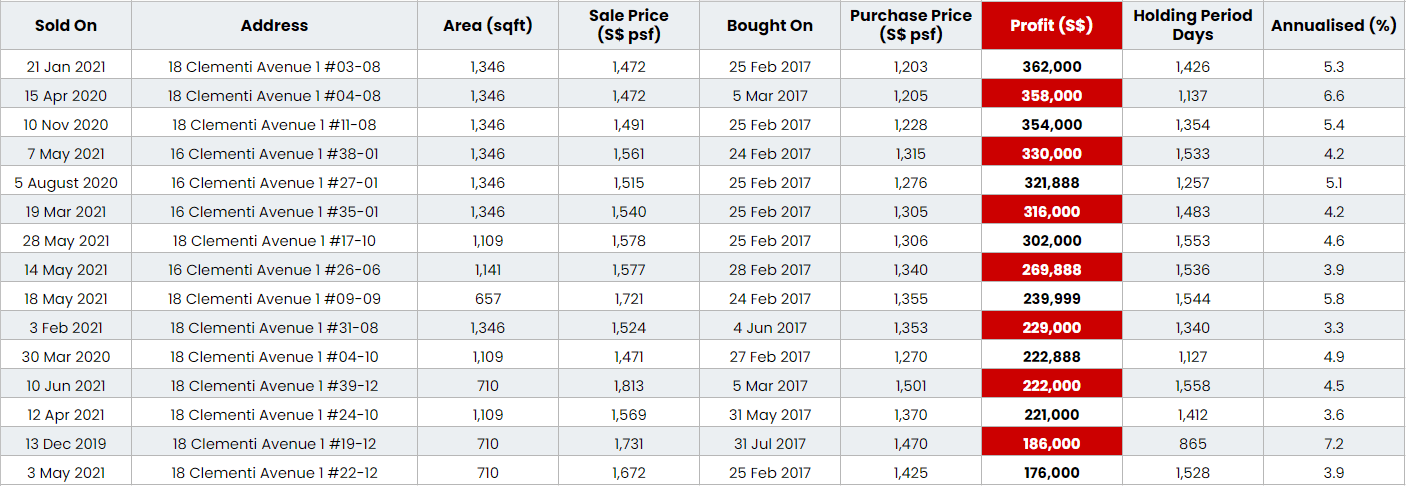

While everyone else is working hard to help Singapore grow, this example shows that who knows how to plan ahead for their financial goals. And in just three years, making a staggering profit of $200,000 with their Clement Canopy purchase.

Unreal? This is as real as it gets. Heard the phrase, “You work hard for money so that you can make those monies work harder for you in the future.”

But what this phrase does not tell you is how to have a secure way of making your hard-earned money, work for you.

Why do people call it hard-earned money?

This next example shows the average income of Singaporeans grow at a snail’s pace of 2.4% per annum.

Isn’t this hot or what?

One last case study. If you held onto a property for the last 20 years, which you bought at $750,000, and today it hits $1.4 million. As an example, let’s say you are 55 years old right now, would you consider selling it or upgrading it? If you wanted to downsize the property and purchase a resale flat off the market today, a resale flat will probably cause you $600,000.

Let’s throw in the renovation, the miscellaneous fees will likely drive the figure to about $700,000. Is the remaining $700,000 enough to allow you to enjoy comfortable and fulfilling retirement while still supporting your family?

Bear in mind, that the ever-rising cost of Singapore is growing along with the world. With so many questions involved, there are many crucial choices to make as a property upgrader.

CONCLUSION

At the end of the day, everyone who wants financial freedom and not to be burdened by monthly issues like your monthly mortgage, especially at the later stage of one’s life; must be doing retirement planning now.

Attaining financial freedom is definitely possible with meticulous planning and commitment. Some even arrive at the pinnacle of their real estate dream, a freehold landed property.

The possibilities are endless my friend, but it can only start when one has clarity of what is ahead so that you can take the first step in educating yourself.

***

Join us in our private group where we help busy professionals and homeowners make six-figure profits in their property, safely.

Property is an ongoing process and journey because they are constantly changing and different strategies must be applied at different times.

Therefore in this group, we not only do weekly live coaching on property, we also cover a wide range of property knowledge and information that we as homeowners must know and be educated on to make informed decisions.

Just click on the button below to join.

Disclaimer: All information presented is based on personal opinions. Singapore Real Estate Insider is not liable for any losses and expenses whatsoever related to investment decisions made by the audience. The ideas presented are here for reference and educational purposes only.