To sell or not to sell? That is the question. Have you second-guessed the “best time” to resell your property? I know how some property owners feel when they consider selling their investments, asking themselves: “When is the most ideal time to sell?”

“Should I really give this property up?”

“I won’t be able to score a property as good as this again!”

“Maybe I should just use the house.”

These questions are valid. After all, earning from property investments is a game of strategy. You need to play your cards well. Still, you will need to make an informed decision because, in this game, indecision will risk losses for you as well.

As our friend Percy Bysshe Shelley has stated,

“The rich get richer and the poor get poorer.”

It is true: the rich would have a different insight when it comes to assets and value. People with the “rich mindset” know how to save and, more importantly, how to invest. Because at the end of the day, nobody wants to be part of Shelley’s last line.

Property investors understand how the market works and take advantage of striking at the right time. When is the right time to sell property, you may ask? Others will most likely think that it’s better to hold on to their units for an x number of years. Well, I am here to let you in on the secret: the ideal time to resell your property is when you’re obtaining the Temporary Occupation Permit (TOP).

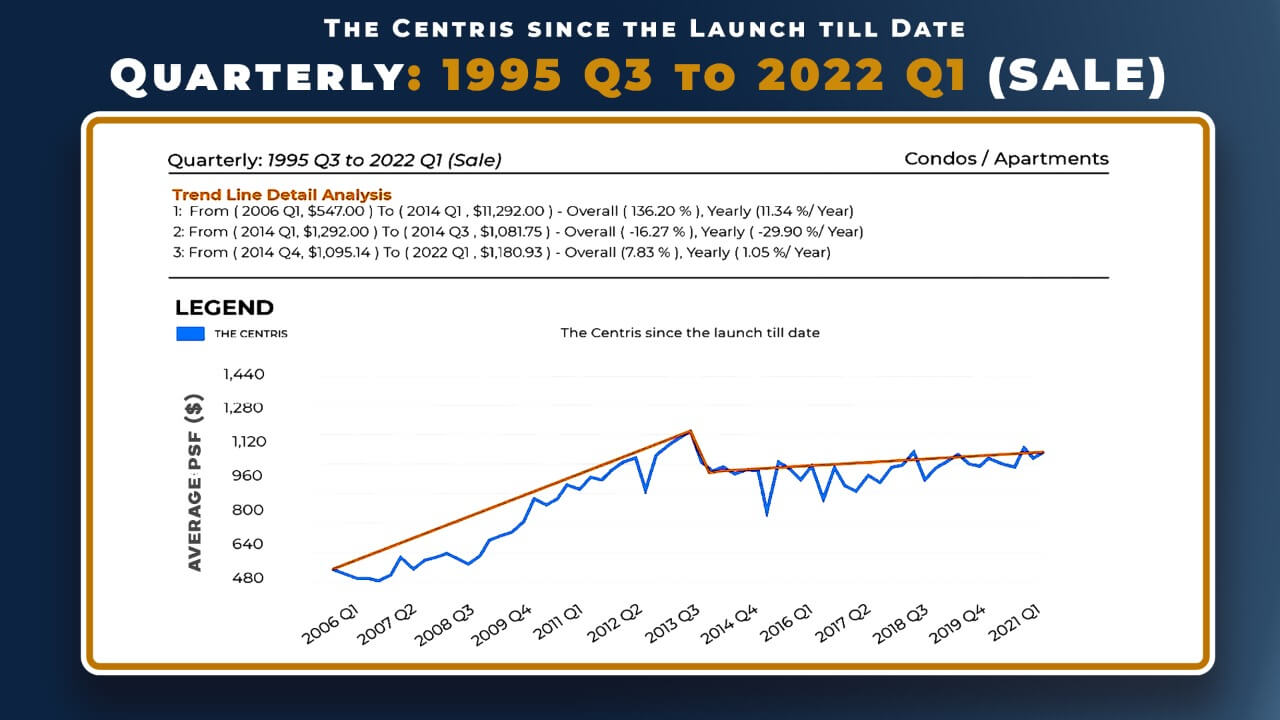

Let’s look at the trend at a property in Jurong West Central. We see that its value grew from its launch date in 2006, starting at $480 psf for a 1,066 square foot unit. It rose as high as $1,120 psf by 2013, and then took a sharp, downward trend. If you sell long after the TOP, you would have let go of a maximum $500,000 profit.

It climbed up a bit after that fall, but it took another nine years to gain growth just below (and still below) the peak rate at 2021. Considering the inflation and other factors in between, you’re pretty much selling at the same price in 2011 at about $960 psf.

Do you see the importance of striking while the iron is hot? While those who sold at TOP earned a handsome profit, others who chose to wait had to watch years go by before getting an “ok” income.

Selling High and Buying High

It’s common in any trade to “buy low, sell high.” When you’re a retailer, you would probably source your materials at a wholesale rate and then sell them at double the price to cover costs and earn. Well, here’s an example of selling high and buying high.

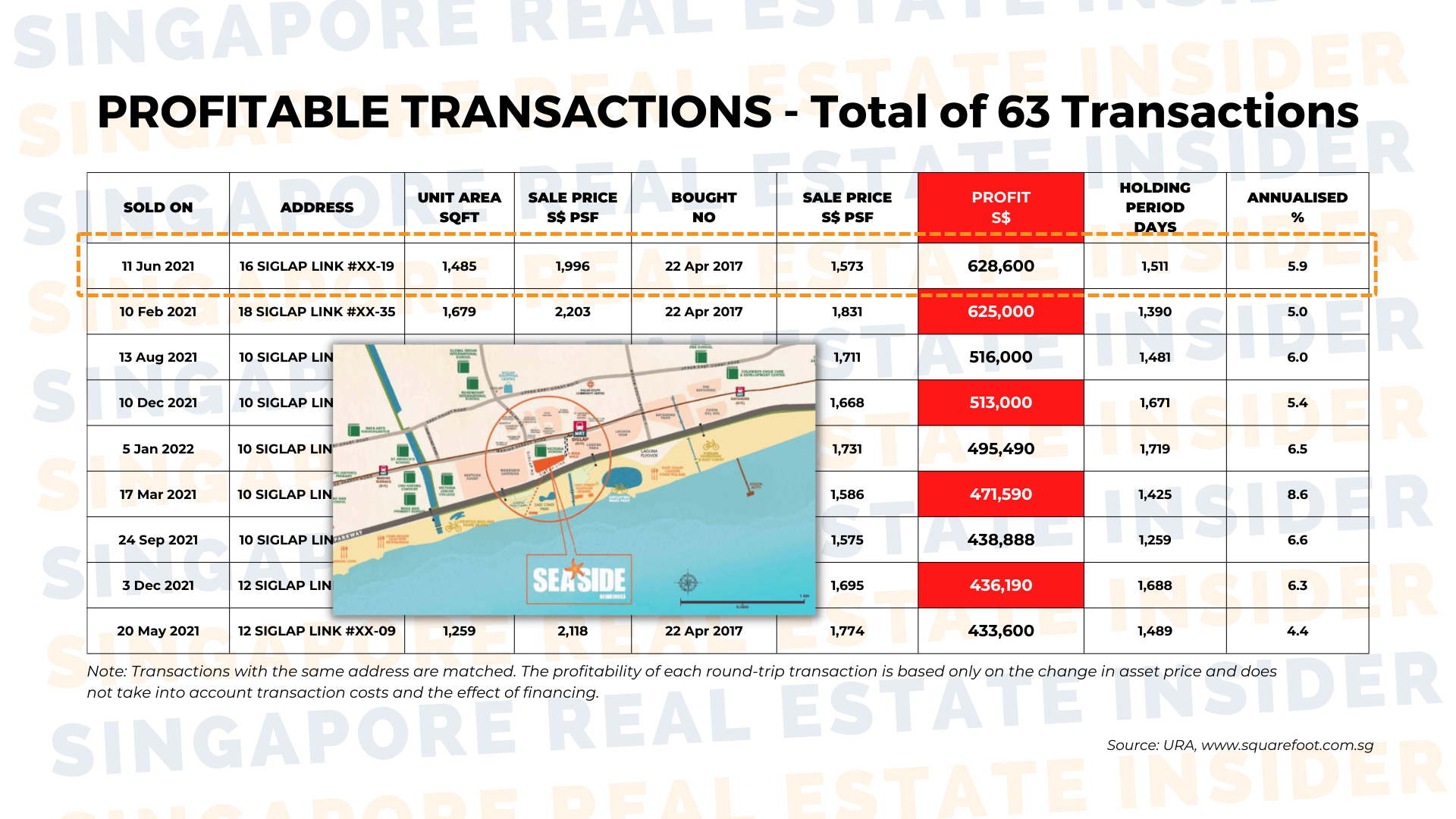

Let’s walk through another example with a 99-year leasehold at Siglap Link. This apartment complex was launched in 2017 at $1,573 psf. Buyers were criticized for “falling for” this “overpriced” property compared to a decent freehold at $1,000 psf.

Yet those who “stuck it out” won the game when it went up to a record-breaking $2,000 psf. People who chose to resell earned around $600,000! Not too shabby, right?

This goes to show that you can also earn high even when you buy high. All it takes is making the right decisions and the right moves at the right time.

At this day and age, we all need to learn how to work smart, and that includes letting our money and investments work for us. Having a good asset portfolio allows us to build the future we want for ourselves and our family without having to break our backs in the process. If you’re interested in starting to earn 6-digits from property investments, contact us. We are more than thrilled to walk with you through the process.

***

Join us in our private group where we help busy professionals and homeowners make six-figure profits in their property, safely.

Property is an ongoing process and journey because they are constantly changing and different strategies must be applied at different times.

Therefore in this group, we not only do weekly live coaching on property, we also cover a wide range of property knowledge and information that we as homeowners must know and be educated on to make informed decisions.

Just click on the button below to join.

Disclaimer: All information presented is based on personal opinions. Singapore Real Estate Insider is not liable for any losses and expenses whatsoever related to investment decisions made by the audience. The ideas presented are here for reference and educational purposes only.