The ultimate dream has always been to own multiple properties (private assets) for many Singaporeans. But here is the burning question many busy professionals and homeowners are asking right now: is it still safe to own multiple private properties in Singapore? And why do many people chase this dream in their lifetimes?

Should You Take the Risk?

Read until the end to understand why many homeowners strive to own multiple private properties in Singapore (and do it safely!) for their loved ones.

Five Key Points Homeowners Adopt to Own Multiple Private Properties in Singapore Safely

After consulting hundreds of busy professionals and homeowners in their property plans using the REI method, I noticed that five key points are essential to achieving your dream of owning multiple properties.

By following these points, I hope to show you that owning more than one property does not mean over-committing yourself financially. It’s not about second-guessing what to buy next, just to rent it out. What’s more important is understanding the critical fundamentals of why having several properties can help us in the future and that you can do it too!

Growing up, we repeatedly hear that properties are the best form of investment for Singaporeans. Owning multiple properties, renting them out, and collecting passive income can give you financial freedom, which is the Singaporean dream.

Is this your dream too? Whether your purpose is for diversification or to have another stress-free, passive income channel, owning multiple properties in Singapore entails benefits that you can enjoy.

Here’s Why:

1. Rental Income

Having multiple properties lets you lease it out and gain passive income through rent paid by your tenants. Numerous properties are equivalent to multiple income sources.

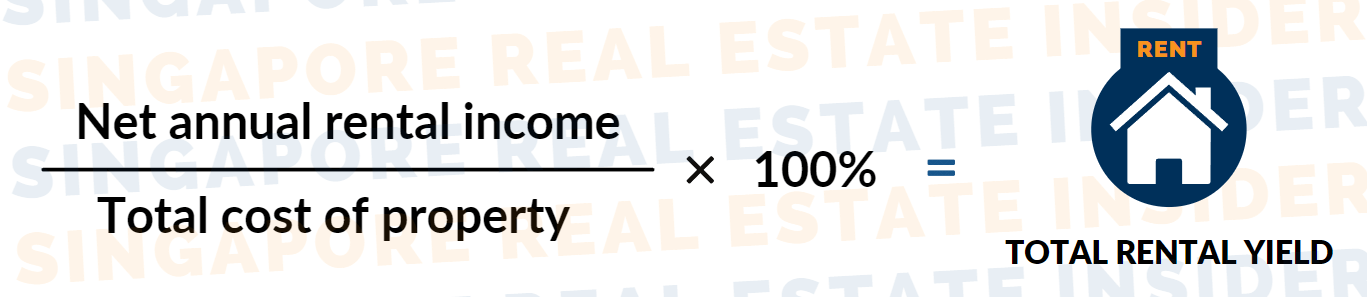

To calculate whether the rental fee could cover the capital used to purchase the property, we need to figure out the Net Annual Rent income first.

Here’s the formula:

To get the Total Rental Yield, divide the Net Annual Rental Income by the total cost of the property. Once you’ve got the figure, multiply it to 100%.

The net annual rental income is the entire rent received in a year after deducting or paying the property tax, MCST fees, property agent commissions, and other expenses.

Stamp duties, conveyancing fees, and remodeling charges, among other things, are all included in the Total Cost of Property.

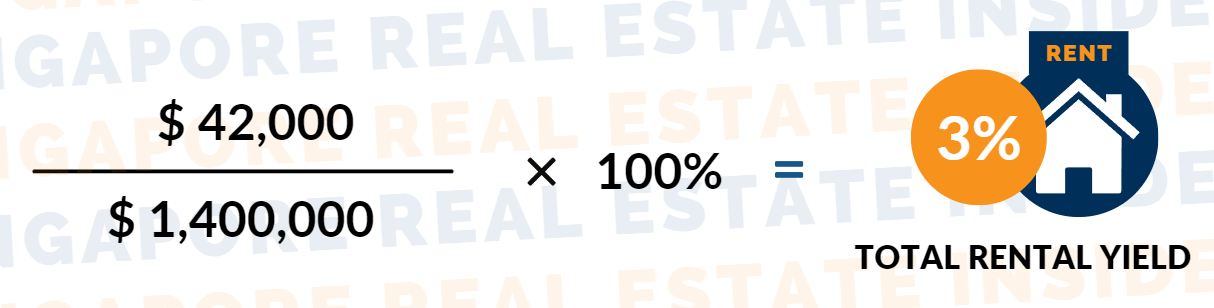

Let’s take a look at an example with the basic parameters as follows:

- Eligible for a 30-year tenure loan

- Purchased a new launch condo, with the total cost of property at $1.4 million

- Property is rented out immediately after TOP.

- Monthly rental of $3,500 (RCR Region, proximity to MRT)

Let’s compute!

$3,500 x 12 months = $42,000 (Net Annual Income).

The total cost of the property is $1.4 million.

So that’s $42,000 divided by $1.4 million times 100%. That gives the homeowner a 3% total rental yield.

The government’s recent cooling measures are adding to the growing rental market. There is a continuous demand from the younger generations for rental properties as it provides them a sense of freedom and a place to call their own.

Due to the pandemic limitations, many Malaysians working in Singapore can no longer easily commute between the two countries. This dilemma has contributed to the rise in demand for the rental market.

According to reports, continuous rental growth is expected to rise from 5% to 7% this year, and you, as a homeowner, can take advantage of it.

When done right, you will have your tenant paying down your mortgage interest instead of you topping up cash for it.

2. Funding Future Properties.

The second benefit of owning multiple properties is funding future properties.

Your first property purchase is probably the most challenging stage in investing. In terms of finance, acquiring any future rental properties gets easier.

The rationale behind the previous statement is that you may save at least some of your first property’s rental revenue for the downpayment of your second property.

After you’ve purchased your new property, you may utilize both rental revenues to cover your new monthly mortgage payments.

With the right mindset, you can maximize the potential of these properties and grow your property portfolio.

Remember, you are saving as you acquire the property. Do not look at it as an expense.

3. leveraging Power.

Yes, a real estate property is a significant investment and costs a lot of money. But the beauty of owning a property in Singapore is that you don’t need to have a ton of cash on hand just to buy one property. CPF and house mortgage loans are offered to reduce the initial financial burden of owning a home.

Bank home mortgage loans vary from 1.95% to 2.8% interest, making them one of the cheapest loans accessible.

You can get more value from the initial money you took out of your own pocket. A saying goes, “Leverage on OPM: Other People’s Money.”

4. Risk Diversification.

What’s great about investing in properties is their resilience in crisis.

Property investment is one of the least risky investment techniques available and is a physical asset that will always recover from a crisis. Purchasing several properties is an excellent way to lower the risk of real estate investing even more. If you have diversified investments, you will be less affected by any unforeseen situations that may impact any form of assets.

5. Capital Appreciation.

What is capital appreciation?

Capital appreciation occurs when the value of a property rises above its acquisition price over time. As we all know, land is a premium asset in Singapore and will continue to increase in value over time. That is why the property costs right now will definitely change in the future. As a homeowner, it is up to you to take this information and put it to use right away.

In Summary

- The rental income. Having a second property allows your funds to be built not only on the rental income but also through its capital growth in the future.

- Funding future properties. Many will take property mortgages as a form of expense. If done correctly, you are saving into the property, and someone is paying down your mortgages instead.

- Leveraging power. Our ability to loan is already a huge advantage vs. other financial instruments. This is why property has always been deemed to be stable and a favorite among many.

- Risk diversification. Where will you be able to get an asset that, no matter how bad things go, the value will not plummet to zero? Having a diversified investment portfolio helps.

- Capital Appreciation. Past trends, especially in Singapore, have been growing over time and this is also the key reason why many buy properties. It is stable and has a strong currency exchange.

Conclusion

In conclusion, if you are looking for something to build your passive income on, property is a great mechanism to use where you may not only leverage, and make rental income, but also appreciate the cash invested in the right market circumstances!

If you wish to own more than one property, keep in mind to never do it in a rush. There are still many components to look into besides just the idea of owning one more property.

This is also the reason why we have a private group where we help busy professionals and homeowners make 6-figure profits in their property safely.

Investing in a property is a very dynamic process and is not as simple as going from point A to B only. Therefore, in this group, we also do Weekly Live Sessions on various property segments so that we can be educated and be informed of all the different types of property decisions. Join us by clicking here to learn the traits and strategies on property.

***

If you want to know more about how busy professionals and homeowners like you can make 6-figure profits from property safely, we have a private group where we share traits and strategies behind it.

Just click on the button below to join.

Disclaimer: All information presented is based on personal opinions. Singapore Real Estate Insider is not liable for any losses and expenses whatsoever related to investment decisions made by the audience. The ideas presented are here for reference and educational purposes only.