Safe assets are assets, which do not carry a high risk of loss, across all types of market cycles.

Some of the most common types of safe assets historically include real estate property, cash, Treasury bills, money market funds.

Thats our CPF Special Account. Done correctly, this also is potentially 1 of the place you can grow your wealth.

1 key factor when we consult many families is that, safely build your nest through property and not rush into getting more if there are no safety measures in place in the event any worst happens.

Be it emergency, medical or as many fear nowadays is the retrenchment of job security.

I have seen many because of the desire to use property as a form of ‘get rich quick’ did not do their fundamentals assessments.

I learn from my business mentor before. Be it any form of decision, it is ok to take RISK, but never be RISKY.

IS SINGAPORE A HIGH RISK ENVIRONMENT?

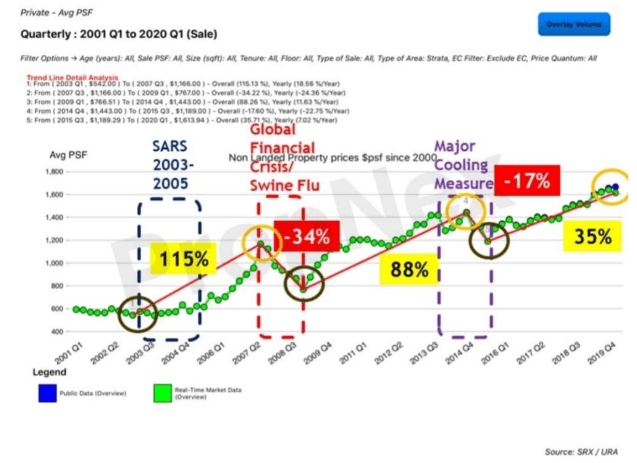

This chart shows us how historically Singapore private property prices touches new highs and corrects to higher lows in almost every cycle.

The high of today is always higher than previous highs as per the lows. Thus real estate is always a cycle and when you study it carefully the history, it does leave us clues for the future.

Do you agree Singapore property can be very predictable once we dive in to study it?

Behind the upwards trend in prices are fundamental reasons that I had shared before in my previous articles and my LIVE sessions. So if you are yet in my private telegram group, join now with this link.

And from the ground, if the multiple property stabilizers (ie: Cooling Measures) since 2009 were not put in place, chances, you and I will not even look to buy properties anymore as they will be out of reach.

Do you think so?

Edmund Tan

Your Singapore Real Estate Insider

The REI Method

Whatsapp Here