The big question many busy professionals and homeowners like me are asking now is: What will happen to the Singapore Property Outlook in 2022?

With critical issues that affect us, such as the pandemic, the Russian-Ukraine conflicts, and the sanctions imposed, there is high uncertainty over the economy and our future. In a more local context, these issues include the rising interest rates and recent cooling measures in the property market.

What does this have to do with you, as a busy professional and homeowner? EVERYTHING!

Note: Read to the end because I will walk you through why the Singapore property market continues to flourish because of its previous policies that we can take advantage of today.

Singapore Property Outlook in 2022: What Will Happen to Singapore Properties in 2022?

In this post, I want to show you the current HDB and Private Property Trends and how we interpret them.

After consulting hundreds of busy professionals and homeowners, here’s what I discovered: many love to buy property, but in studying data and numbers, they are very handicapped in making wise decisions due to a lack of knowledge and understanding.

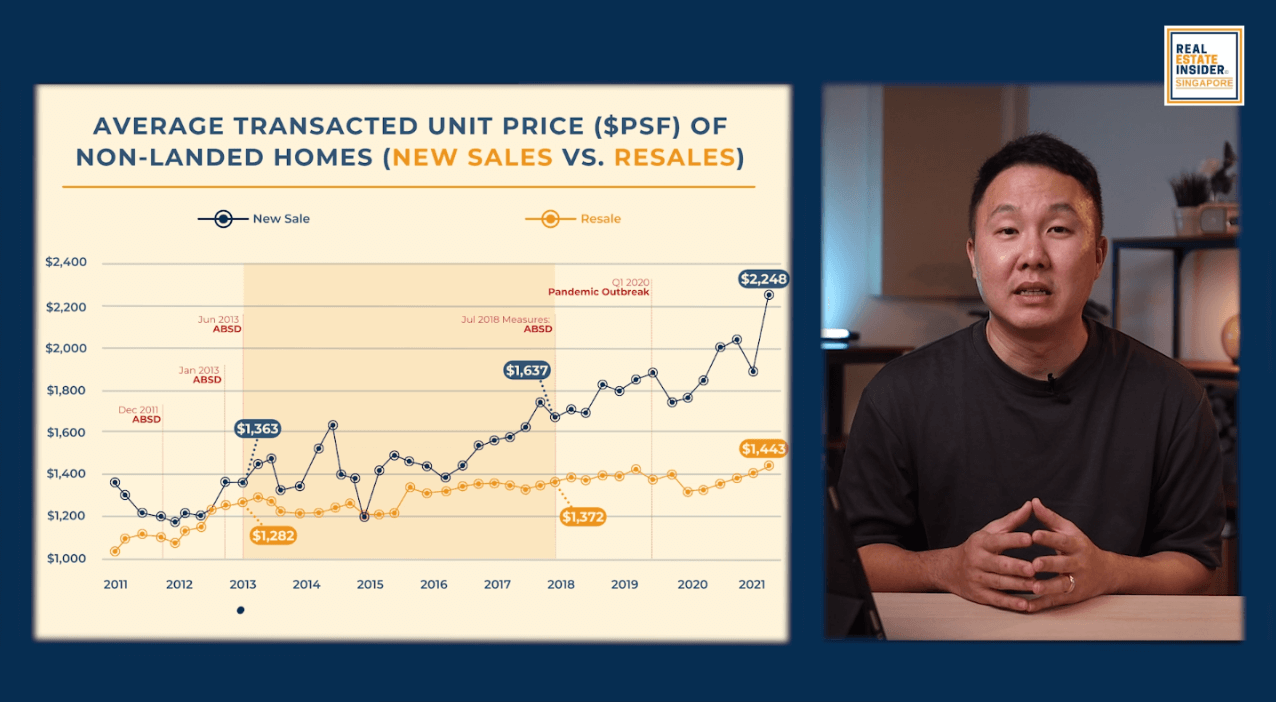

From the data, you can easily observe that despite several rounds of cooling measures implemented, the average prices of new and resale homes in the private sector continue to flourish.

From 2013 after the double round of cooling measures in January 2013 up to July 2018, the new sales average per square foot grew by 20% overall.

The per square foot rate grew by about 7% on the resale front.

Assuming you entered the market after the second round of ABSD in 2013 and bought a property of 1,000 sqft at $1,363 psf and kept it under the recent highs of 2021 when it’s $2,248 psf, you could have the option to walk away with a staggering $900,000 profit!

The objective here is to help you take the right action if you had the choice to buy a property of your own-stay and, at the same time, reap big profit margins. Would that be a dream come true? Don’t you think it is nearly impossible to save $900,000 in just eight years by working hard in your day job while thrifting?

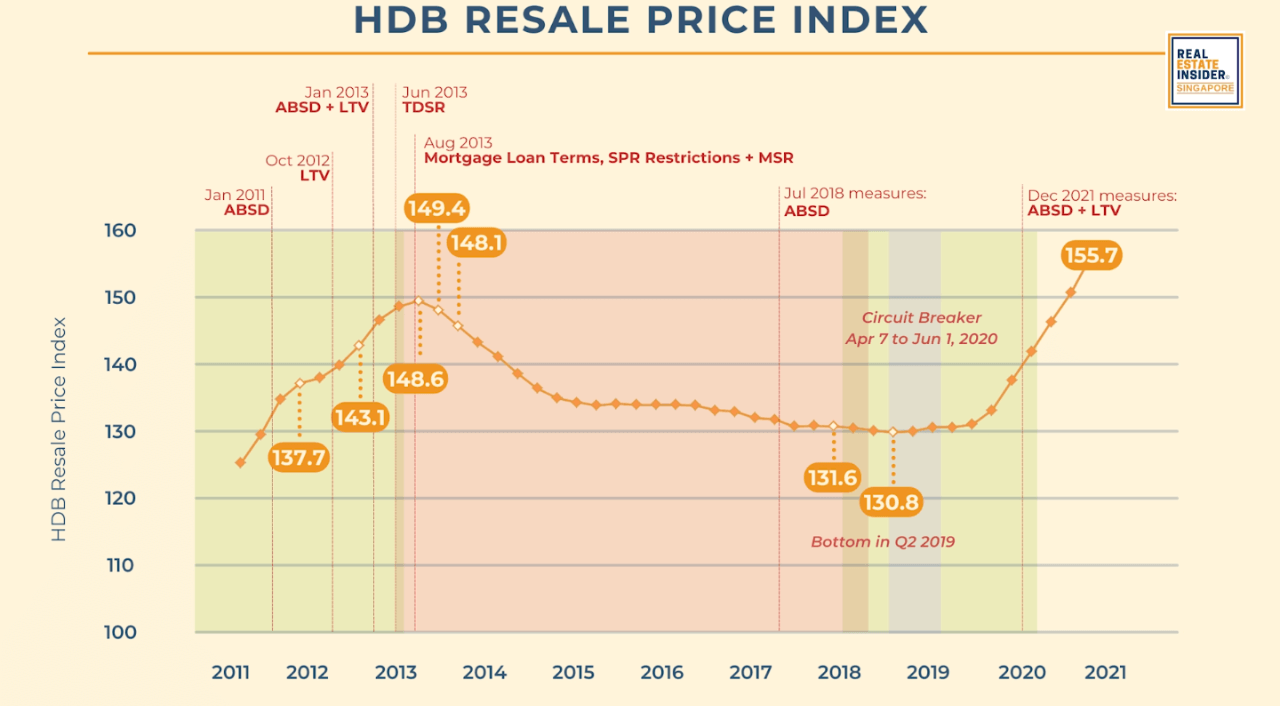

Even on the property outlooks of HDB during the same period as seen in the next data from its peak prices in 2013, resale prices have dipped for 24 consecutive quarters. That’s six years by about 12.4%.

After bottoming in Q2 2019, prices rebounded and did remarkably well in 2021 as prices grew by 12.7% exceeding peak prices in 2013.

Looking at the data might trigger one to consider if you sell their HDB flat in 2012 or 2013 before the price slump or simply wait another eight years to enjoy higher returns?

Could you have foreseen how long it would have taken the HDB prices to exceed their previous high? Or could you have profited even more by reinvesting those possible profits?

Many homeowners continue to battle with such questions and ultimately causing their inaction.

Let’s take a look at this example for private property:

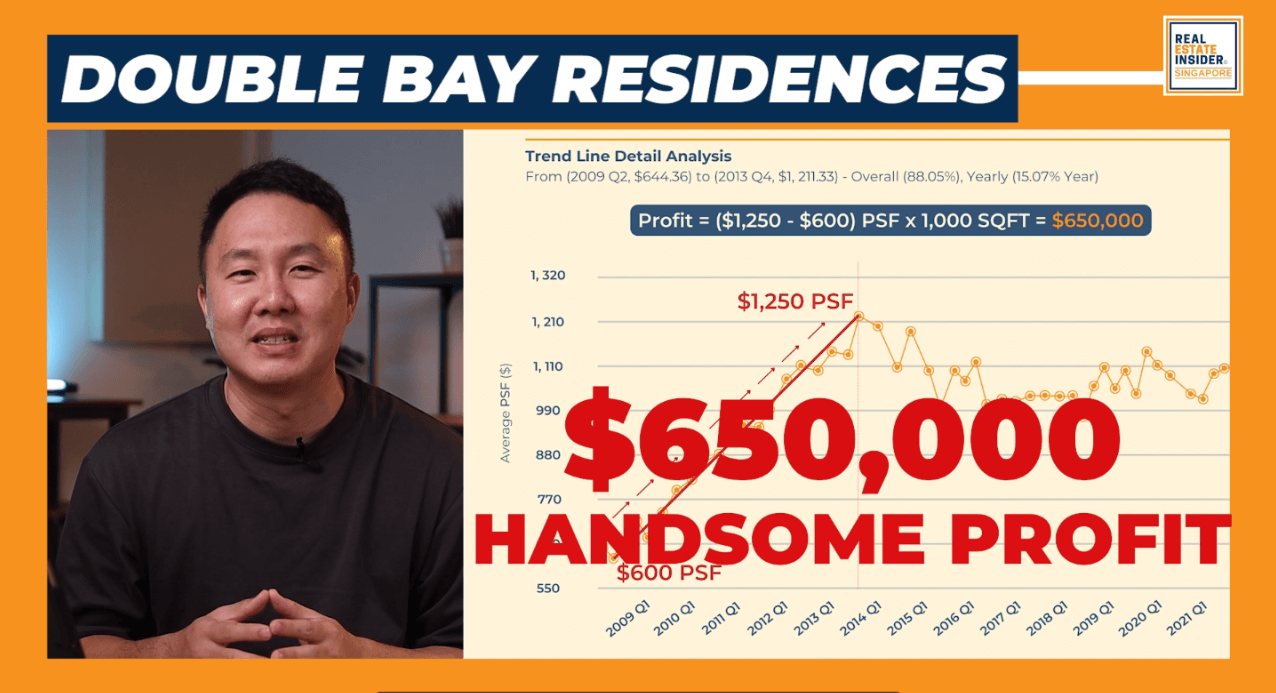

Double Bay Residences is a 99-year leasehold property with an average entry price of $600 psf when it was first launched.

Double Bay residences main pool photo from www.dbr.com.sg.

Double Bay residences main pool photo from www.dbr.com.sg.

It peaked in 2014 when prices soared to an average of $1,250 psf. If you had sold it then, you would have reaped a handsome reward of $650,000!

Noting that prices have continued to move sideways since the peak in 2014, the question is,

“Will the price continue to move sideways or would there be more upside for this development?”

But the most important question is, “Why did this property not ride the recent upswing like the newer developments?” Could there possibly be key indicators out there that you could read into to enjoy the maximum gain like those highly savvy investors?

With so many burning questions from homeowners and property buyers from all walks of life, we decided to take it upon ourselves to design a method where you can get your questions answered and at the same time, (depending on where you are in your property journey) understand and address concerns that you will be facing (or are already facing right now).

We aim to take you through four stages of your real estate journey and provide clarity to property owners and aspiring ones to make wiser decisions moving forward.

“Timing may be critical, but precision is everything.“

If times are good, you can make good profits on your property but even at times when it may seem unfavorable, some opportunities lie within. Especially during a crisis.

Timing your entry and planning your exit with precision is crucial as it often dictates the kind of profits you can generate.

These goals are also the reason why we have a private group where we help busy professionals and homeowners make a 6-figure profit from their properties safely.

Property is a very dynamic process. It is not as simple as going from point A to point B only.

So in the group, we hold weekly live sessions on various property segments so that we can be educated and be informed about all the different types of property decisions. You can join us by clicking here.

Many families worked with us about their property plans using The REI Method.

We invite you to apply for a personalized consultation to help you further in your property plans. Click HERE to book your 20-min Complimentary Discovery Call with us.

Through our consultations, we will take a deep dive into your current property situation and what you want to achieve in the future for you and your family through safe and sound solutions in making 6-figure profits.

***

If you want to know more about how busy professionals and homeowners like you can make 6-figure profits from property safely, we have a private group where we share traits and strategies behind it.

Just click on the button below to join.

Disclaimer: All information presented is based on personal opinions. Singapore Real Estate Insider is not liable for any losses and expenses whatsoever related to investment decisions made by the audience. The ideas presented are here for reference and educational purposes only.