Do you know that when you use CPF to pay for your HDB, you are incurring INTEREST LOSS! If you use 200k of CPF, you will lose 128k in 20 years’ time! You will have negative sale (ie will not get back any cash) the longer you hold on to your HDB.

For example, Sale Profit = 100k, CPF Interest = 128k

Negative Sale of 100k – 128k = – 28k

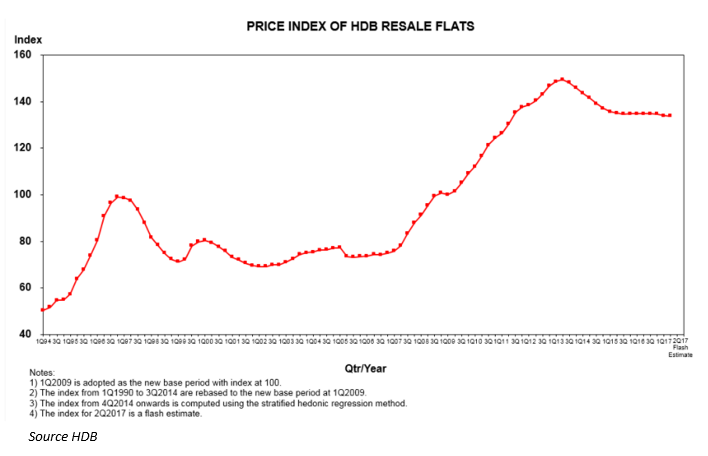

Looking at the chart below (latest Q2 2017), will HDB price double in 10-20 years’ time?

For example, assume current 4-room HDB=400k. If it doubles to 800k, you will need a household income of 12k in order to support the loan !

And you might want to also refer to this article on what will happen to your HDB once it reaches its 99 lease tenure or if your asset is of any value as its tenure finishes.

#unlockrealestatewealthnow #clientsforlife #futureofrealestate #singaporerealestateinsider