The allure of owning a condo is ingrained in the Singaporean dream.

Having that dream flat near an MRT Line, so you can go from work - to the hawker center - to the malls, all under one-go.

The advertising market is also pulling out - all it’s aces to tell you that:

“ HEY, I’M LAUNCHING SOON - I GOT THE OCEAN VIEW - I’M THE BEST”

“NO, MY INDOOR SWIMMING POOL AND MRT LINES ARE WHAT MAKES ME STELLAR”

AND YES, while these ads may be annoying in your social media feed sometimes,

I know there is an INKLING in there that says - Wow, I wish I have that too.

Today, let’s tackle one of the most infamous questions -

How much do you need to earn to afford a condo in Singapore?

Whether you need a 6-figure income to make this dream a reality can be intimidating. With soaring HDB resale flat and private property prices, it's natural to wonder if owning a condo is within reach.

However, I have good news for you!

In this blog, we'll explore the affordability of condos in Singapore and demonstrate that the salary requirement may be closer to your current income than you think.

More than earning a certain figure to buy a condo or any property in Singapore, your eligibility is essential.

Distinguishing eligibility from affordability is crucial when considering property purchases. While eligibility refers to meeting the criteria for obtaining a home loan, it should not be equated with the ability to afford the property.

In Singapore, affording a condo requires careful financial planning.

According to some financial experts, ensuring that your total monthly mortgage repayment, comprising both principal and interest, does not surpass 30% of your gross monthly income is advisable.

To plan that out, you need to determine your budget vs. the current property's cost.

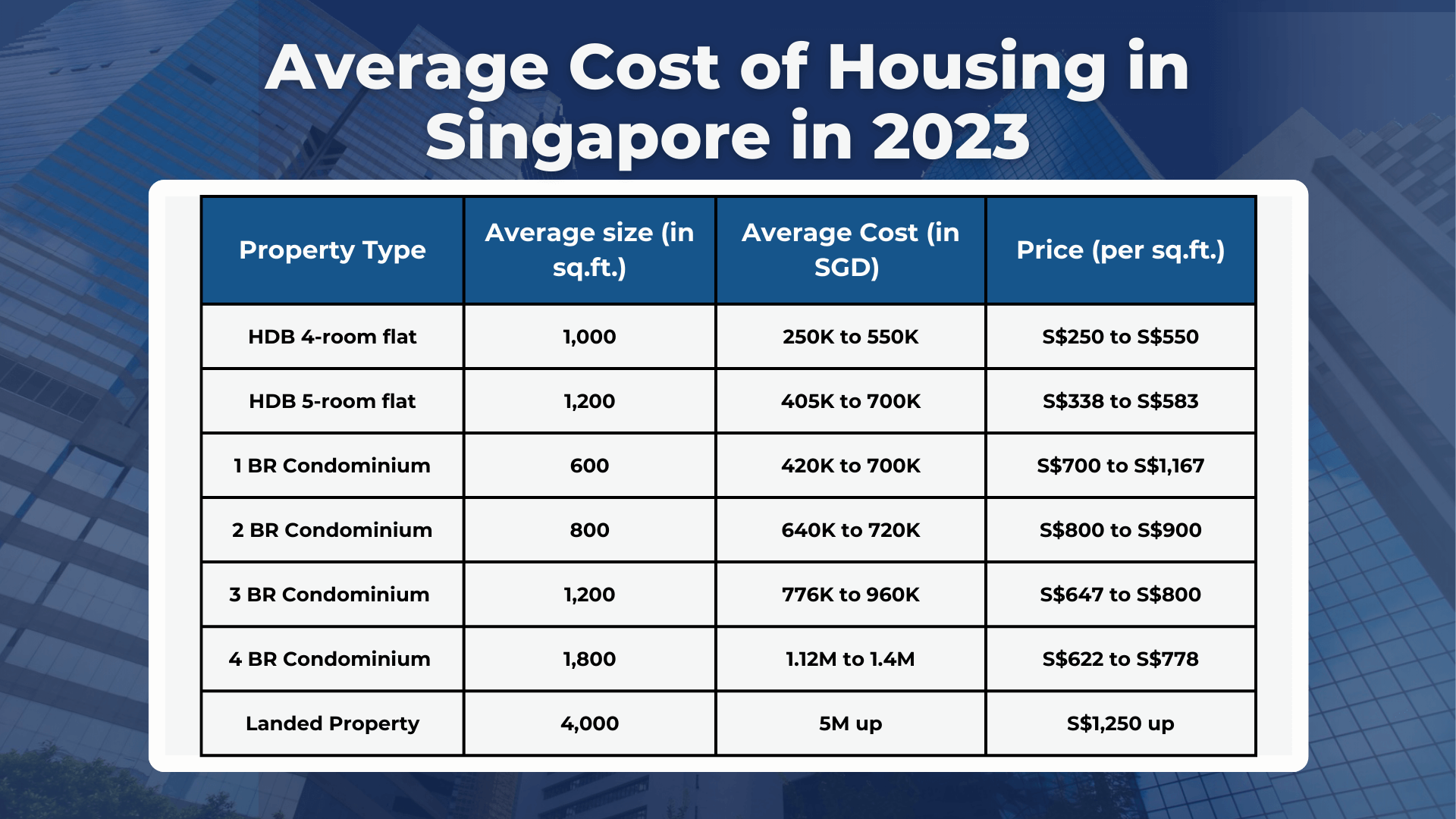

The first thing you need to acknowledge is - The Varied Cost of Condos

Condo prices in Singapore vary widely, depending on location and unit size.

Take 3-bedroom condos as an example. They are popular among young couples, families, and HDB upgraders.

In the OCR, you can expect to find reasonably priced 3-bedroom condo units ranging from approximately $900,000 to $1.5 million.

The more affordable options usually include older and leasehold condo units.

For instance, on 26th July 2023, a 3-bedroom condo at The Woodgrove was available for $1 million.

If you prefer newer or recently-launched units, alternatives like The Commodore offer 4-bedroom condos at prices starting around $1.6 million.

Moving to the RCR, 3-bedroom condo units are priced between approximately $1.5 million to $3 million.

Aljunied, Paya Lebar and Geylang districts often have more affordable condo units.

However, closer to the Central Business District (CBD), city fringe condo units can start from upwards of $2 million, catering to those seeking higher luxury and accessibility.

The CCR is home to Singapore's luxurious condos, where 3-bedroom units can be found just below $3 million.

However, many luxury condos exceed this price range, demonstrating that premium living in this area knows no bounds.

So, if you were given the chance to live in these districts, which one would you prefer?

FINANCES: Financing Your Condo Purchase

When comparing the eligibility criteria for purchasing condos and HDB flats in Singapore, one may conclude that buying a condo is relatively "easier."

Why?

Firstly, unlike HDB properties, condos are open to anyone, including foreigners.

Secondly, condo buyers do not face an income ceiling assessment, which is required for prospective HDB flat and new executive condominium (EC) buyers.

Thirdly, condo buyers are open to owning other properties, meaning you can own an HDB flat and still purchase a condo.

However, you will be subject to the Additional Buyer's Stamp Duty (ABSD) in such cases.

Now that you understand the condo eligibility criteria and what to expect, let's delve into the analysis of condo prices and calculate the income needed to afford a condo in Singapore.

First up we need to, - Compare Affordability Across Income Brackets

Through case studies, we'll illustrate how prospective condo buyers from various income brackets can realistically afford a condo in Singapore using current mortgage rates.

Second, we have to consider the - Condo Eligibility vs. HDB Eligibility:

Unlike HDB properties, anyone, including foreigners, can buy condos in Singapore.

Condo buyers also face fewer income and property ownership restrictions, making it easier to purchase a condo.

Third, we do some math wherein we -Calculate Your Affordability:

Under this step, We'll guide you through calculating how much salary you need to buy a condo in Singapore. Considering the upfront down payment and long-term mortgage repayments, you can work backward to determine your desired income level.

And No. 4 is acknowledging -Affordability for Many Singaporeans

The median gross monthly income for full-time employed residents in 2022 was $5,070. Based on this figure, many entry-level condos in the RCR and OCR may be affordable, especially when considering joint-borrowing for couples.

In this guide, we approach affordability from a reverse perspective, relying on condo eligibility criteria as a starting point for assessment.

However, you cannot base your decision on this alone -

When determining the necessary salary to afford a condo in Singapore, it's essential to consider not only debt servicing limits but also your overall cash flow situation, including earnings and expenditures.

Meeting eligibility criteria may not guarantee affordability if your daily living expenses are substantial.

Even if you think you’ve got what it takes, you better make sure your finances can too.

If you’re buying a condo, you have to remember this:

Financing a condo in Singapore can only be achieved through a bank loan, allowing you to allocate 55% of your monthly gross income to mortgage repayments, following the Total Debt Servicing Ratio (TDSR) rule.

To calculate the required income, you must consider two primary elements: the upfront minimum down payment of 25%, with at least 5% payable in cash, and the ongoing monthly mortgage repayments.

Working backward from these figures will lead you to the desired income to afford your dream condo.

CASE STUDIES: Buying a Condo with an average salary

So, do you need a 5-figure income to buy a condo in Singapore?

Let’s figure it out in this case study:

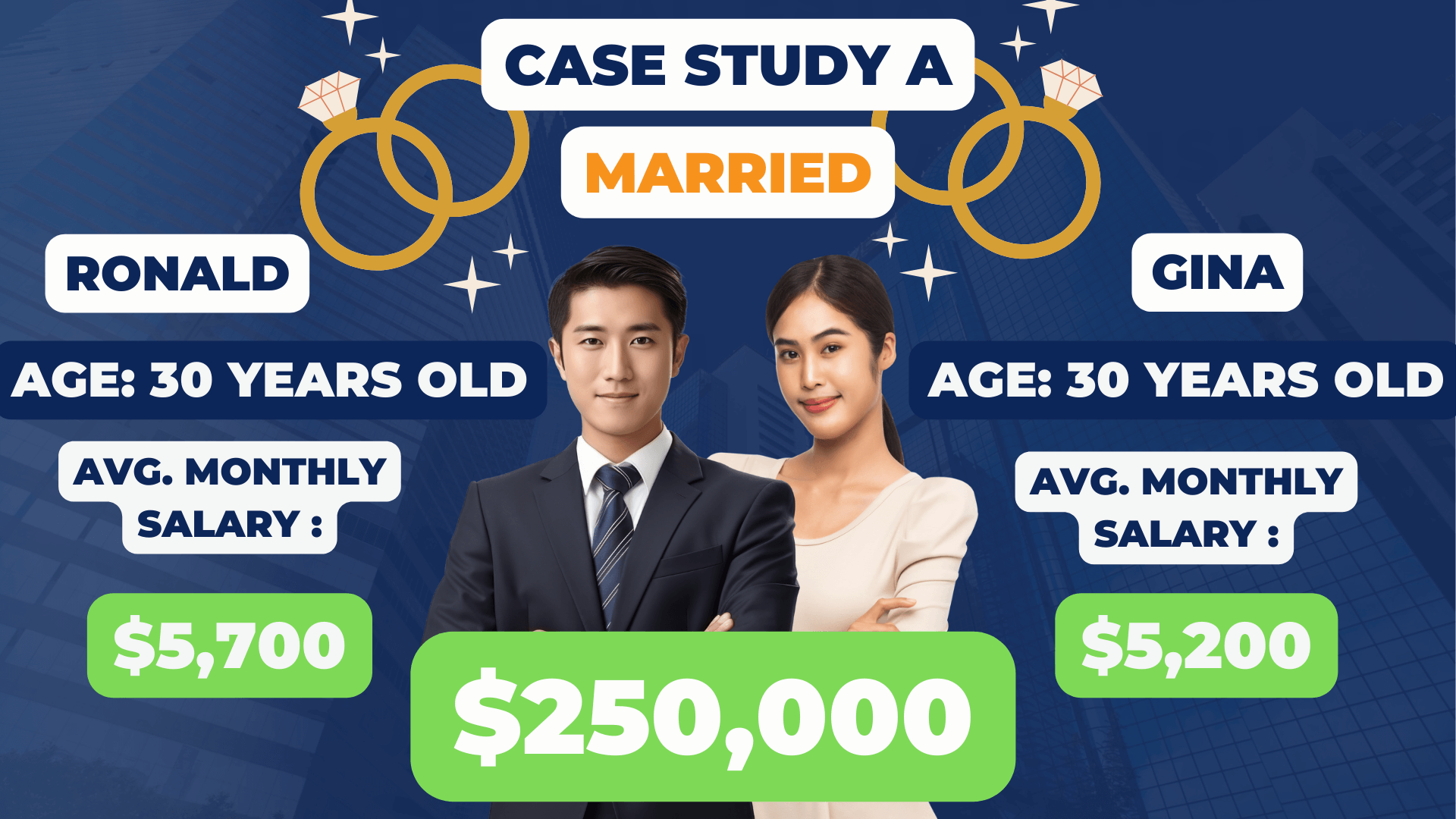

Our man is Ronald, age - 30, married, with an average monthly salary of $5,700.

His wife, Gina, earns $5,200, and they have a $250,000 start-up savings for their home.

They are looking to purchase their first condo, a 2-bedroom unit in OCR at $1 million.

They will use up their $250,000 savings to settle the down payment

Take out a loan of $750,000 with a 3.7% p.a. interest for 25 years.

If they pursue the unit, they will need to pay off monthly mortgage repayments at $3,856, leaving them with a comfortable $7,044 to spend on other expenses.

So, when you rack-up the numbers,

Is it possible to afford a condo in Singapore without a 5-figure income?

ABSOLUTELY!

It all boils down to choosing the right unit that works for you and thorough financial planning.

Don't let the thought of a 5-figure income deter you from your condo dreams.

Start building your future today by consulting Singapore Real Estate Insider, and let us help you make your condo dreams come true!

Invest wisely and stay tuned! Click here to book your complimentary consult with me.