Haven’t we waited long enough to see new property opportunities in Singapore? I know I have, what about you?

I tell you for a fact, we’re seeing some hints of the opportunities in Singapore property again.

Is it a smart move to start investing aggressively in the market in 2023? Before you usher all of your money towards the next new launch, let’s look at our possible outcomes in 2023.

Singapore's dilemma in the scarcity of available homes feels like it's dragging on for too long, am I right?

Ever since Covid happened, developments have settled at a slower pace due to the constraints and the other resulting effects of the craziness our world is facing at the moment.

- Limited supplies in the pipeline

- Pent up demand after covid

- Delay in constructions

- Higher cost of building materials & labor

Even though the need has driven the possible profits for real property investors, I'm sure some homebuyers (and future homebuyers) are in the dark trying to figure out what this will mean for them in the future.

But let's keep our heads up, my friends, as Prime Minister Lee's National Rally for 2022 has created more sparks of hope for us people who are rooting for the real estate market in Singapore.

Here’s what Prime Minister Lee mentioned about what we can expect in the coming years with major urban transformation plans and more.

Paya Lebar Airbase

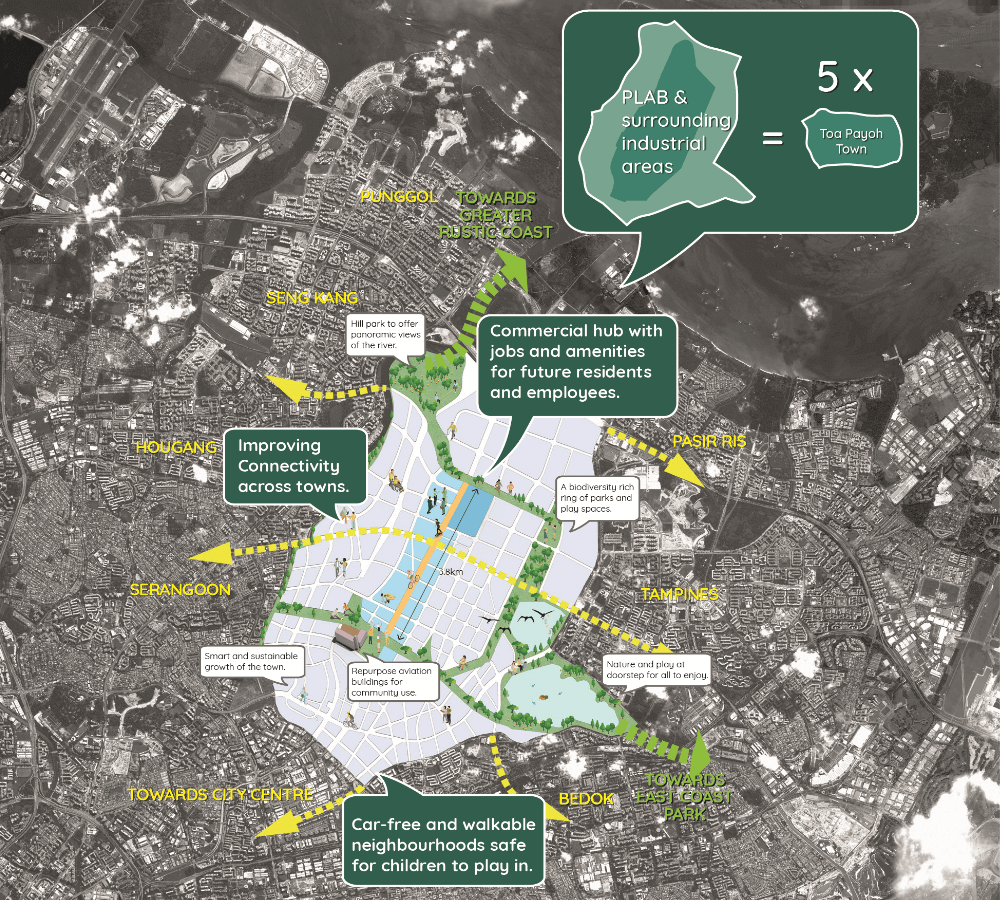

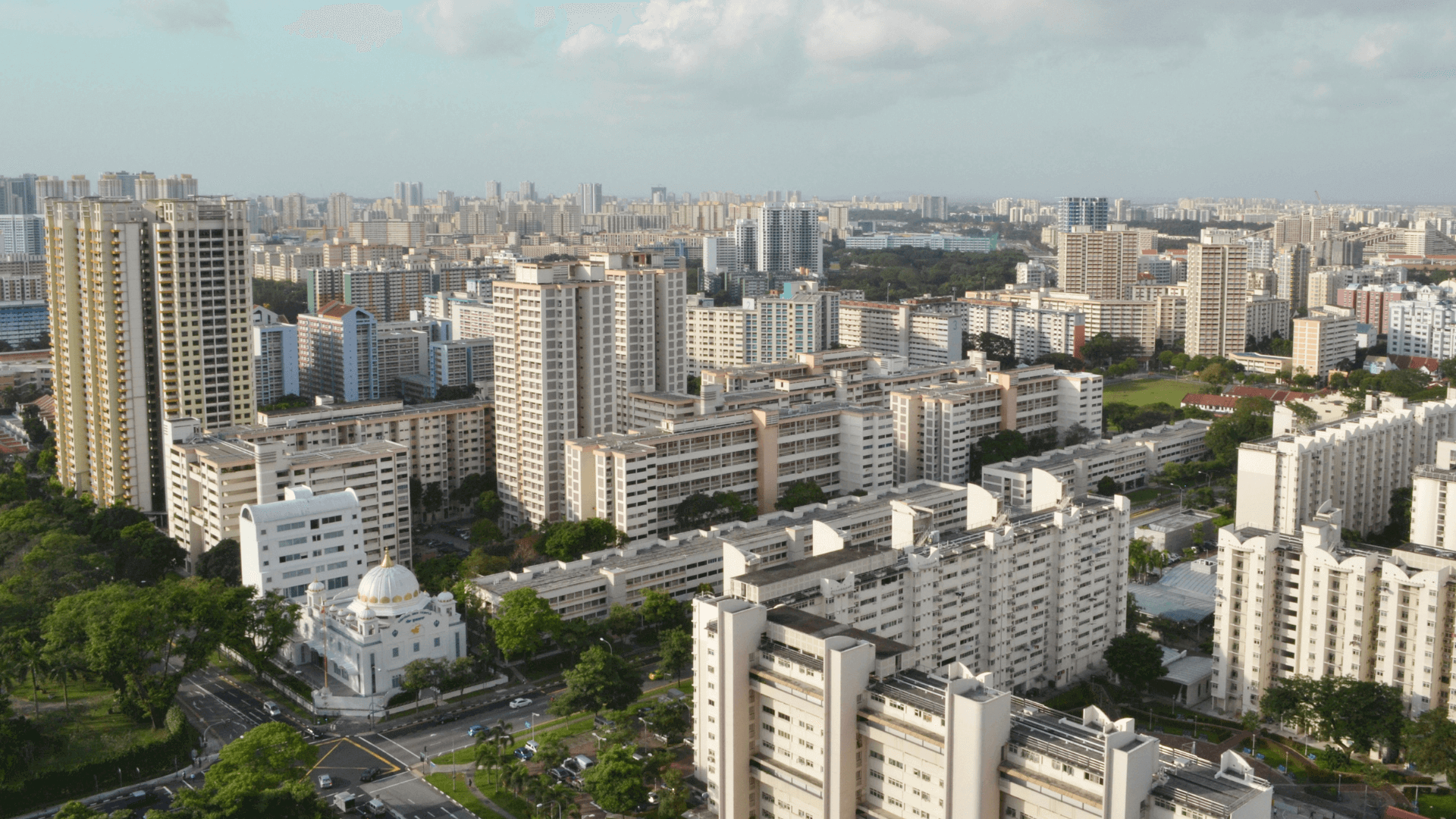

Paya Lebar - Photo from URAS

There's so much excitement in the talks about the Paya Lebar Airbase since its moving was announced during the National Rally in 2013. This time, Prime Minister Lee shared clearer, more tangible plans for the location. This sprawling area, that's five times larger than the Toa Payoh, is geared to provide up to 150,000 homes for Singaporeans. Public and private housing developments are in the works. It will surely usher in so many economic activities and jobs in the country.

Value Appreciation for Other Areas

Hougang, Marina Parade, and Punggol-area property owners rejoice! As a bonus, it was mentioned that the building height restrictions will be lifted in Paya Lebar once the airbase goes. The same will be applied for the other areas surrounding Paya Lebar to reinvent the spaces for more functionalities and amenities, and most of all, increase its property values.

For you if you are not familiar with the master plan, Singapore properties are zoned with different height restrictions at different locations.

At times you will wonder why CBD area properties can be developed more than 50 storey high and some locations can only go up to 12 storey. This has to do with height restrictions in the masterplan.

And usually when there are major changes like this, adjustments can be made. It also highlights what future developments height potentially can be built too.

More Enbloc Sales

This is usually seen when there's a major change like height restrictions or even property type changes when they go from residential site to commercial and residential site.

Developers will be eyeing major transformation like this as they have more room to work around their future property plans.

The burning question is this: Should we start investing now? There are two sides to the coin here.

Why? You get in at a much lower price point than the future. Because the urban development plans might only be rolled out by 2030 onwards. In short, you'll still only enjoy the benefits of this opportunity when they're in place later.

But always understand your objective as well if it's a wise move to hold on to the property beyond 10 years due to different reasons.

Still, careful planning and property selection should be in place here to ensure you're maximizing your potential profit and not wasting money, time, and energy on those that won't generate as much income.

Singapore Real Estate Insider of course, can help you there. Reach out to us if you need help!