When is the best time to exit a property? But, before we get there, this is the Part 2 of our series on making the right decisions to maximize your property journey. This is a continuation of our short and sweet videos on the 5 Key Considerations in Purchasing a Property. If you haven’t read the part 1, you can read it here.

In this article will continue on that topic, and I’m going to answer the next burning question homebuyers want to understand: when should I exit the property?

Let’s start and jump in.

Layout

Let’s play another round of “which unit would you choose?” When it comes to this factor, we need to understand that the availability of a certain unit layout will largely influence the money you’ll be making.

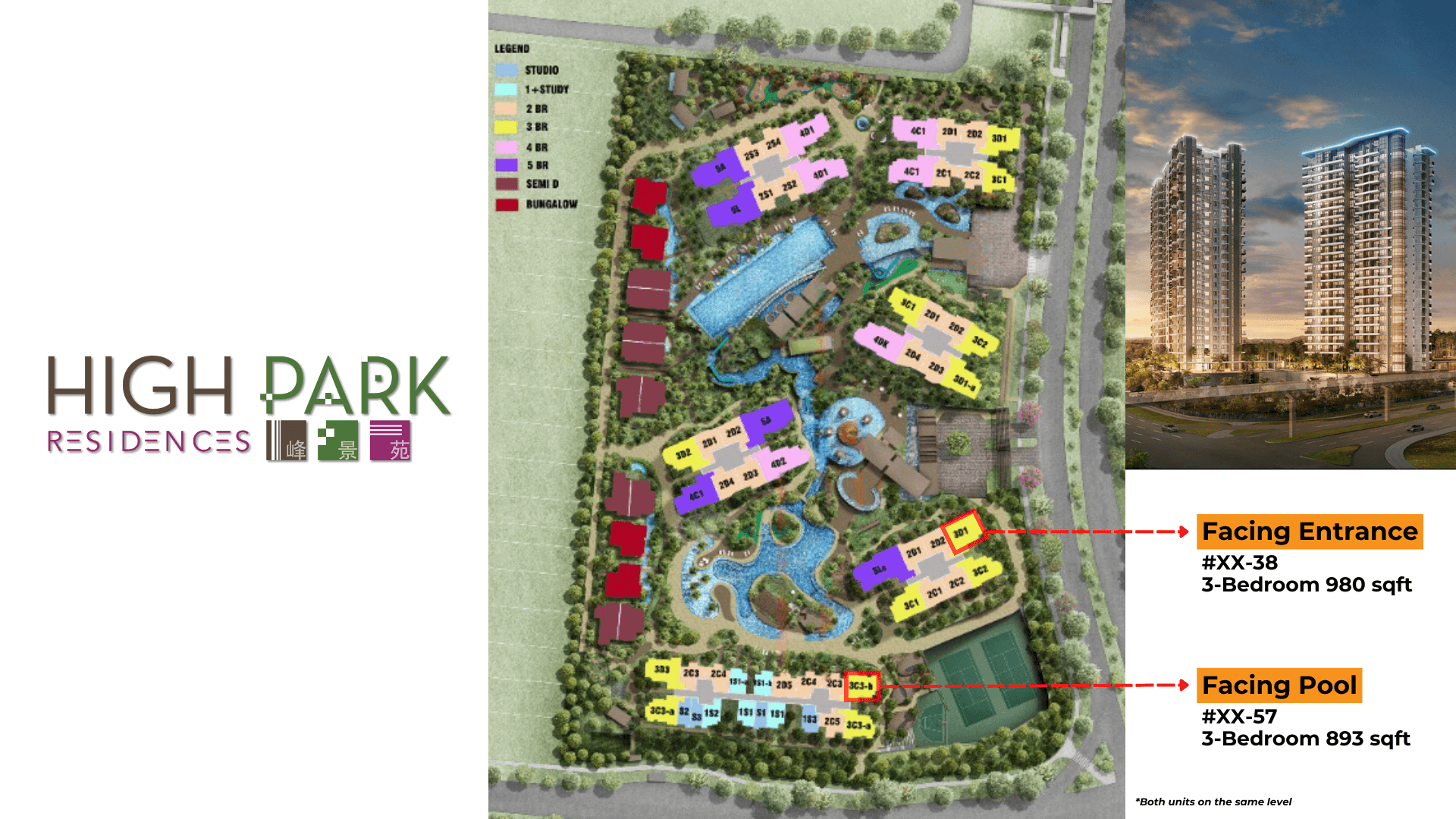

To illustrate my point, let’s look at two stacks in High Park Residences. Both stacks are on a similar level, except the first one is an 893 SQF 3-bedroom unit that faces the entrance, and the next one, also a 3-bedroom unit at 980 SQFT, facing the pool. Most would go for the pool-facing one, because that sure is a lot of fun, right?

Both units were purchased on the same day for $854,000. When it was time to sell, the entrance-facing unit made a $346,000 profit while the pool-facing one made $181,000.

The entrance-facing unit made more money because of its location. For those of you who don’t know it yet, Fernvale area is surrounded by HDBs, which means many upgrades will be looking for a private property within the same location. And do you know what they’re looking for? A good, functional layout that can accommodate their needs.

Using the same example, the entrance-facing unit is bigger in square foot at 980. While the pool-facing one is only 893 sqft. In the floor plan, we can see that the entrance-facing unit comes with a utility room, three decent-sized bedroom, and a larger kitchen and dining area.

The pool-facing unit, on the other hand, while it offers a good view, doesn’t have a utility room, has more cramped bedrooms, and a longer foyer perfect for chilling.

Remember, most upgraders would be having their own families and will probably prioritize having a proper utility room, and look for bedrooms that can fit queen to king-sized beds.

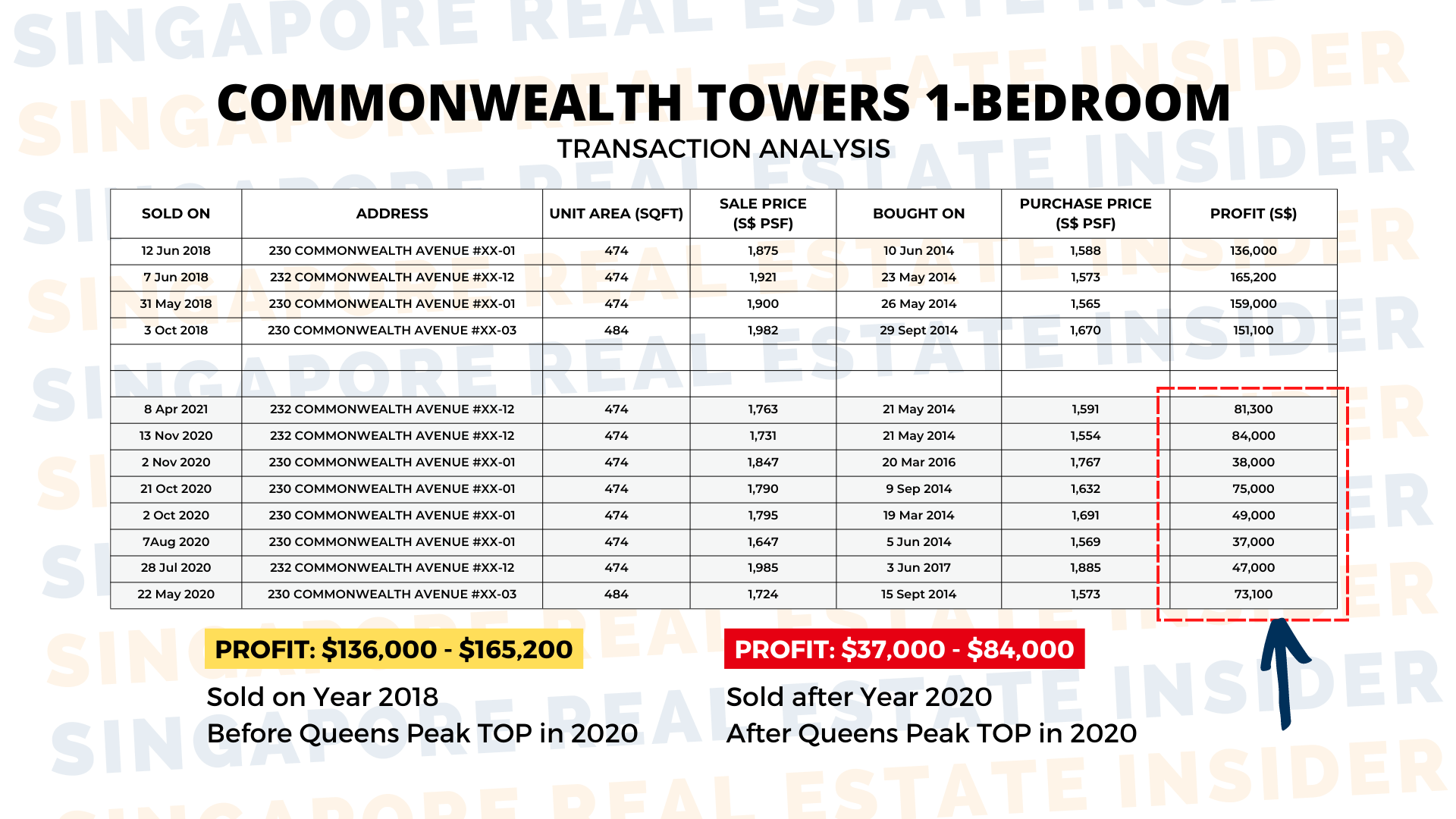

Let’s compare another pair of private properties. This time, in the Commonwealth area, namely Queens Peak, and Commonwealth Towers. Queens Peak has 736 1-bedroom units TOP in 2020, while Commonwealth has 845 units that TOPd last 2017.

Commonwealth Towers unit owners profited at least $130,000 when they sold in 2018, just a year after the TOP. However, units sold after 2020 (before Queens Peak TOPd) had only $35,000 to $80,000 in profit.

If you guessed that the down turn of profit of Commonwealth units is because of Queens Peak TOP-ing in 2020, you are right.

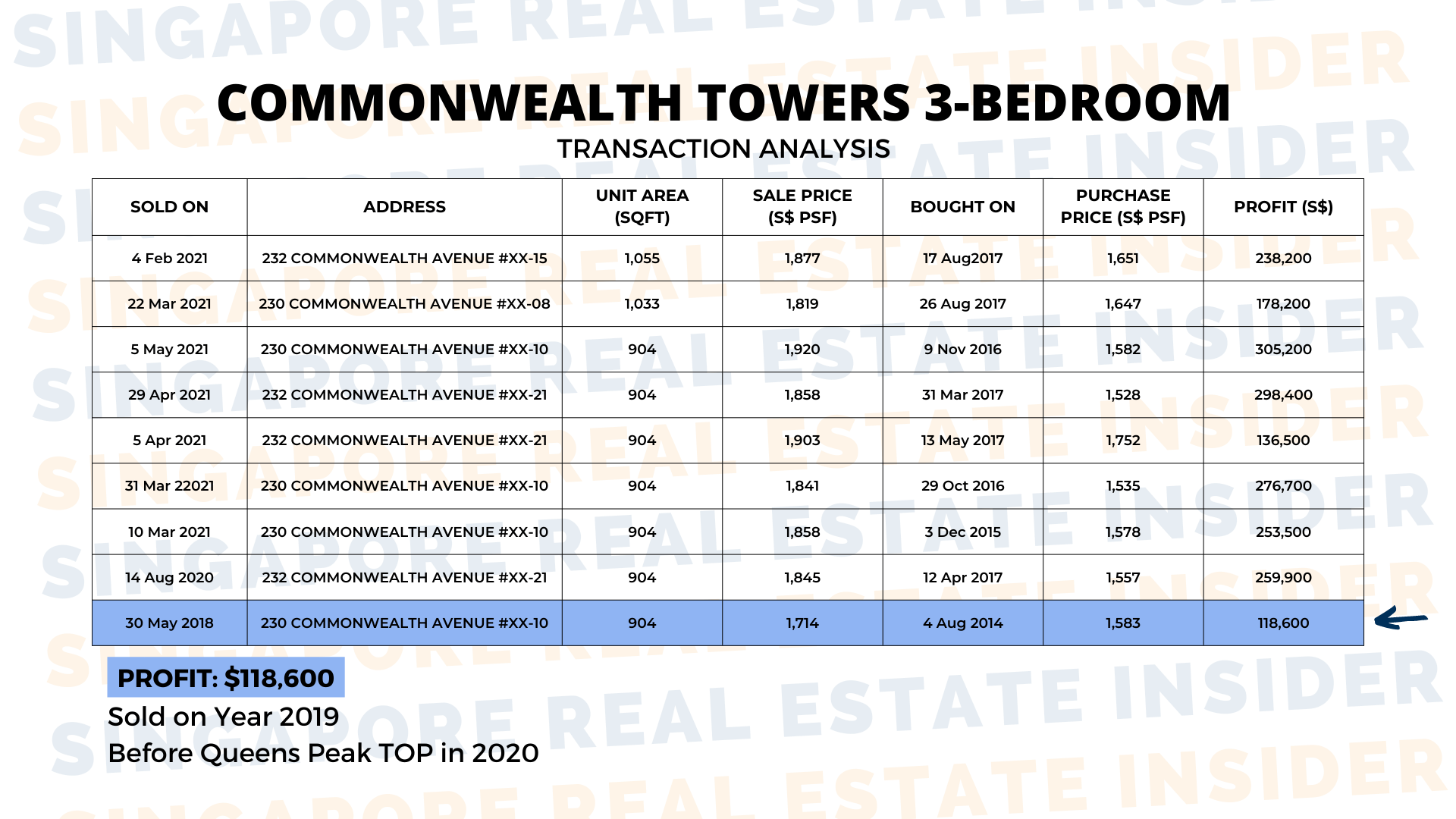

Now that the Queens Peak is in the picture, let’s observe how it also impacted Commonwealth Tower’s 3-bedroom units. You’ll notice that while the 1-bedroom units took a dip, its 3-bedroom units performed better, with profits starting at $119,000 and even up to a whopping $300,000 after 2020!

And it’s still because of the layout. Let’s browse through the floor plans.

Commonwealth Towers’s 3-bedroom is the smallest among the options, their units had a better kitchen space, and plus, the bedrooms can accommodate larger beds. While the 3-bedroom unit from Queen’s Peak had an open kitchen, the bedroom is smaller, only fitting a single bed.

When people look into a three-bedroom unit, it’s almost always safe to assume that they intend to stay for good, and so having a more spacious house that can accommodate a growing family is more appealing to buyers.

Exit

There are two important things you need to know before selling your private property investment or exiting your property..

- The supply of private properties around your area.

- Your property’s layout compared to the ones surrounding your condo.

Exiting well is all about knowing the location’s transformation. An area’s transformation largely impacts the growth and demand of private properties within a location. So when you get a better idea about what’s in the works, and what are the possible opportunities, you will understand the probable property demands coming forth, and this information will ultimately lead you into exiting your property at the best time and with the best profit.

A. The supply of private properties around your area.

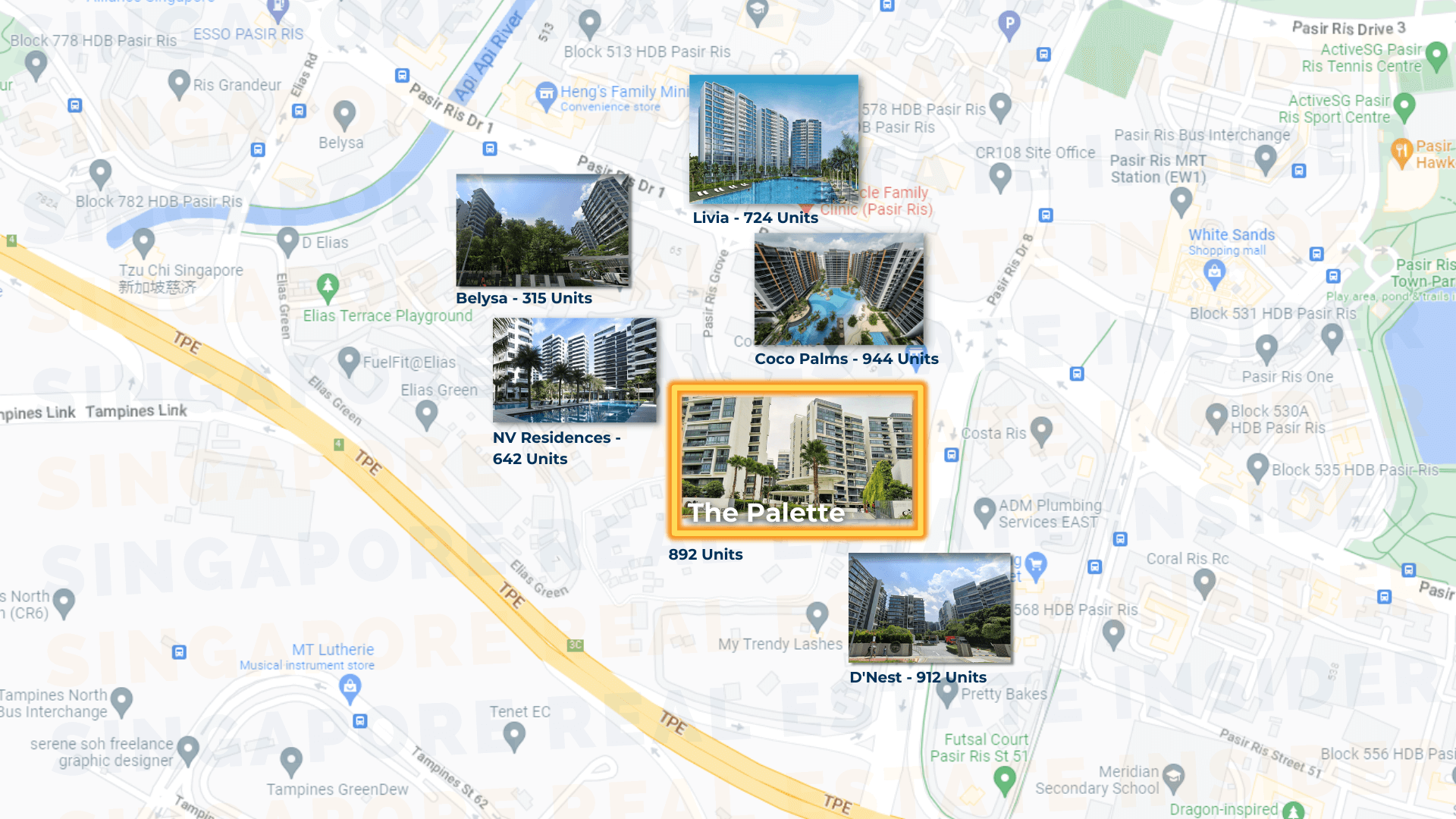

BELYSA 315 UNITS (55 – 59 PASIR RIS DRIVE)

LIVIA 724 UNITS (61 – 81 PASIR RIS GROVE)

COCO PALMS (11 – 33 PASIR RIS GROVE)

NV RESIDENCES 642 UNITS (88 – 99 PASIR RIS GROVE)

D’NEST 912 UNITS (127 – 149 PASIR RIS GROVE)

THE PALETTE 892 UNITS (101 – 123 PASIR RIS GROVE)

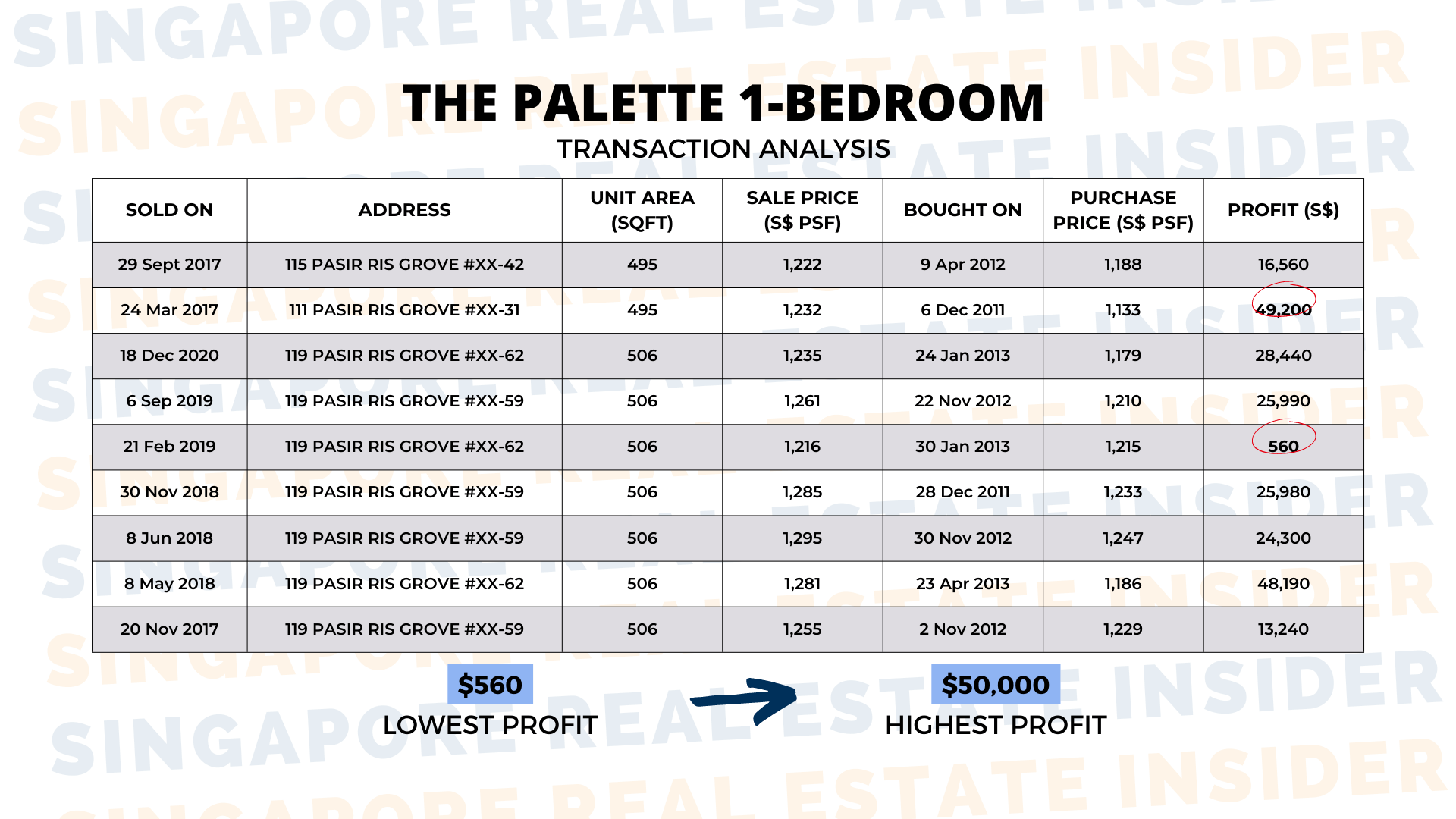

So why is it that The Palette’s 1-bedroom units sell so low? They’re bought at $1,222m, and could only sell at $1,188m.

Compared to The Palette, the surrounding developments are much newer. So if the buyers do gravitate towards The Palette, they won’t be too willing to pay a higher price.

Does that make sense?

See yourself in this example, will you also make decision this way? Share in the comment below.

B. Your property’s layout compared to the ones surrounding your condo.

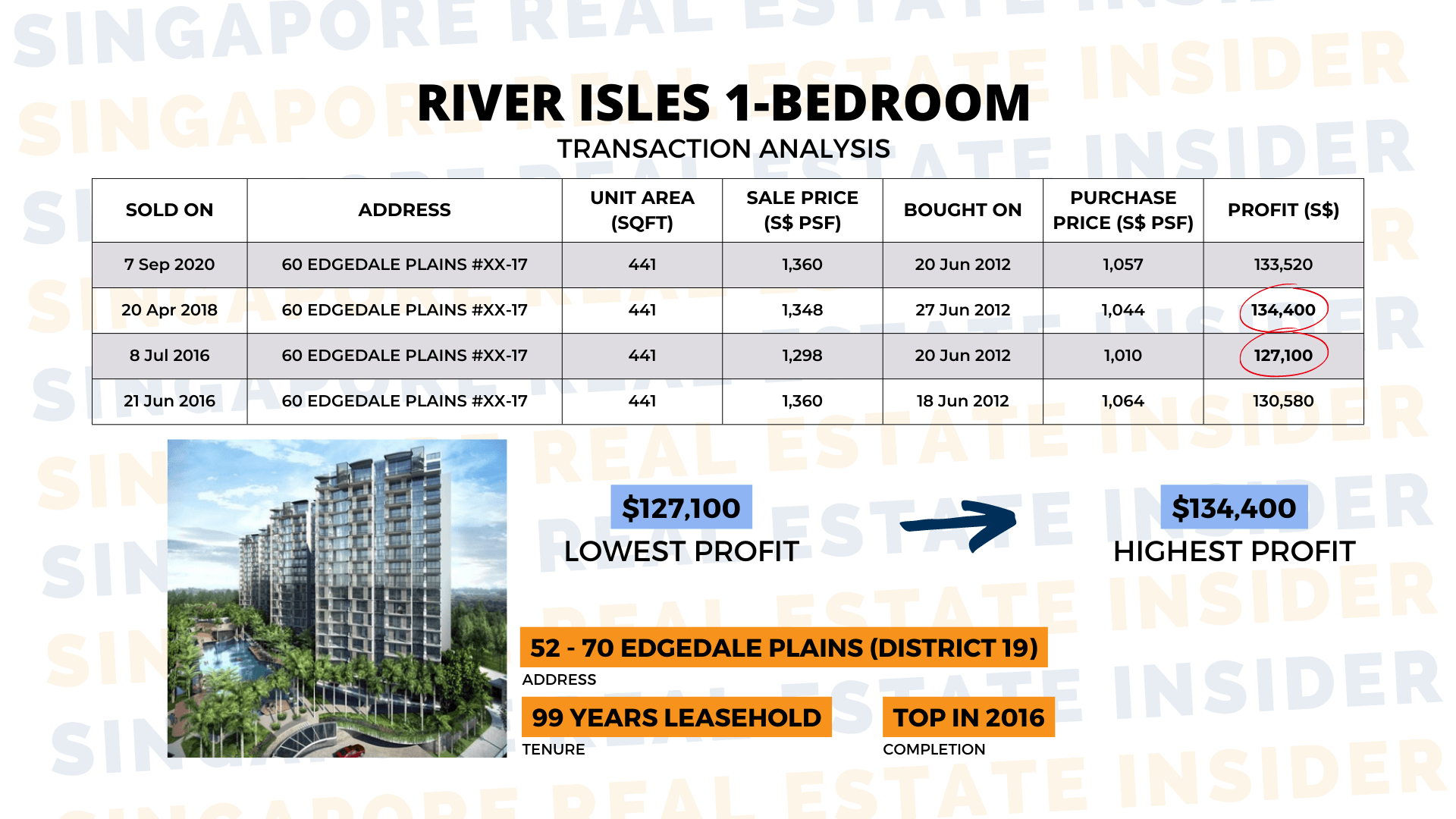

Now, let’s look at River Isles in Punggol. Their 1-bedroom units sell with a profit between $127,000 to $130,000!

What’s the difference you ask? River Isle is the only development in Punggol that offers 1-bedroom units. The rest of the private properties are executive condos. Other than that, River Isle only has 1-bedroom units, which means, they’re selling like pancakes. Higher demand, lower supply, higher price.

In conclusion, the property’s TOP can in some way indicate the ideal time to exit your unit; nonetheless, it is recommended practice to do thorough research to determine when actually is the best time to exit. You will have a better idea of what to do next if you first analyze the upcoming supply of the properties that are in the surrounding area, as well as the layout of your unit.

In order to make a successful exit, you need to be aware of the possibilities within the area around your home. However, I am aware that the property market may be, at best, difficult, and that is why I am here to assist you in making educated choices regarding your real estate investment so that you can achieve that six-figure profit in a safe and secure manner. Make sure to get in touch with us for a consultation!

Need guidance in knowing when you can exit your property specifically? Book a complimentary call with us here.

***

Join us in our private group where we help busy professionals and homeowners make six-figure profits in their property, safely.

Property is an ongoing process and journey because they are constantly changing and different strategies must be applied at different times.

Therefore in this group, we not only do weekly live coaching on property, we also cover a wide range of property knowledge and information that we as homeowners must know and be educated on to make informed decisions.

Just click on the button below to join.

Disclaimer: All information presented is based on personal opinions. Singapore Real Estate Insider is not liable for any losses and expenses whatsoever related to investment decisions made by the audience. The ideas presented are here for reference and educational purposes only.