Property needs will continue to exist, be it for housing or investment. Singapore property market trends are becoming interesting every year, especially in 2023, when almost all sectors of life have bounced back after being hit by Covid-19.

Here in Singapore Real Estate Insider, we will discuss four things in property trends 2023 that you should read in full to stay informed.

The public certainly hopes that there will be adjustments in several matters related to the property market this year.

Increasing home supplies and stabler prices

The high demand for houses in the community makes the Government take appropriate and fast steps. After seven years, new homes and ECs are TOP-ing this year. We're looking at 20,000 more units that may go to long-term occupation, rental, or resale.

Home prices could rise by 5% in 2023 after gaining 3.2% in the first quarter, thanks to higher rents and favorable supply-demand dynamics.

"Yet in the near term, some buyers might wait for greater clarity in the global macro and interest-rate environment, along with more choices from upcoming launches," said BI analysts led by Bloomberg by Ken Foong

As you know, the dwindled housing supply in the country brought sale prices and rentals to an all-time high. But as massive projects such as Treasure at Tampines, Parc Clematis, The Florence Residences, Piermont Grand, Sengkang Grand Residences, and OLA are hailing from the Outside Central Region (OCR), demand in the suburbs will ease quite a bit.

The Rest of Central Region (RCR) will see about 6,600 units coming from developments such as Avenue South Residences, Riviere, and Daintree Residences.

The luxury market will have a top-up of 2,500 units expected to be completed this year by Leedon Green, Kopar at Newton, Haus on Handy, Boulevard 88, and Van Holland.

New home launches will finally serve pent-up housing demand since 2019

With a whole generation that graduated into a real need for homes, coupled with the demand from families due to work-from-home arrangements and hybrid learning, the demand for housing prices increased. Finally, this will be served by more than 11,000 new units from 45 developments, and this does not include executive condos.

Based on Channel News Asia, analysts expect property prices to stabilize, growing more slowly but not falling.

"New launches in 2023 are expected to perform well, but their performance is largely linked to the limited options in the immediate term," said Dr. Lee Nai Jia, head of real estate intelligence – data and software solutions at PropertyGuru.

However, developers may release their launches in batches throughout the year so buyers can prioritize unsold units from launches since 2020. Do watch out for significant developments like The Continuum in Thiam Siew Avenue, The Reserve Residences in Jalan Anak Bukit, Lenor Hill Residences, and sites in Dunman Road, Marina View, Jalan Tembusu, and Pine Grove Parcel.

If you want to upgrade from your HDBs, check out the ECs in Bukit Batok West. Look at The Botany at Dairy Farm, Kassia at Flora Drive, the former Park View Mansions, and Lakeside Apartments on Yuan Ching Road, as well as the development in the works at 798 800 Upper Bukit Timah Road.

Lentor is becoming the following residential site and is spruced up by a major shopping mall, among other amenities. So if you're considering setting up your place in the area, you can look forward to Lentor Hills Residences and Lentor Hills Road Parcel B.

As for the luxury market, grandiose developments are in the pipeline for reimagining the AXA Tower, the former Maxwell House, the former Peace Center and Peace Mansion, Newport Residences, and the Marina View white site.

Districts one and two will get even more exciting with these developments, and the Government has yet to announce more from the more significant southern waterfront precinct this year.

More prudent buyers due to uncertainties and high interest rates

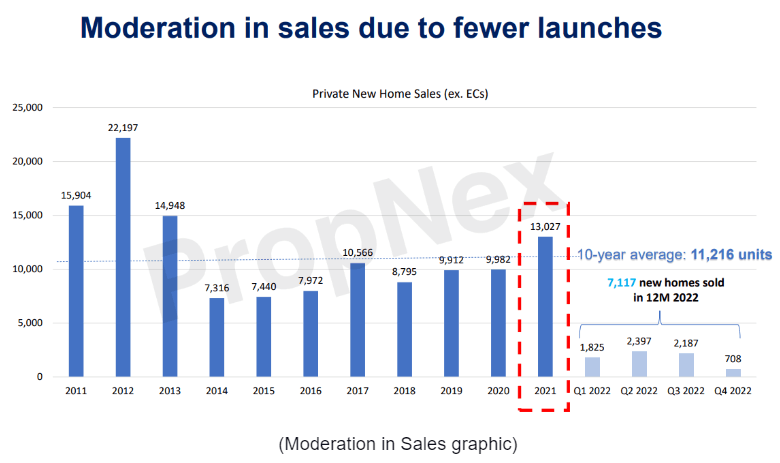

Image Courtesy of Propnex

We may see property price adjustments in the future, but not this year. Buyers are more cautious in spending their money or committing to long-term, high-ticket purchases thanks to higher interest rates. While property prices will continue to grow, they will be at a much slower pace this 2023.

This prudence might bring down the number of sales this year and stretch the time from buyers inquiring about a property to closing the deal.

According to The Strait Times, although the Government has ramped up the supply of Build-To-Order (BTO) flats and private housing, uncertainties could weigh on Singapore's economy in 2023.

National Development Minister Desmond Lee said Singapore's property market stayed buoyant despite the pandemic as owner-occupier demand remained firm, supported by resident wage growth.

But if left unchecked, prices could run ahead of economic fundamentals, raising the risk of a destabilizing correction later. At the same time, borrowers would be vulnerable to the sharp rise in interest rates.

House rental prices might stabilize

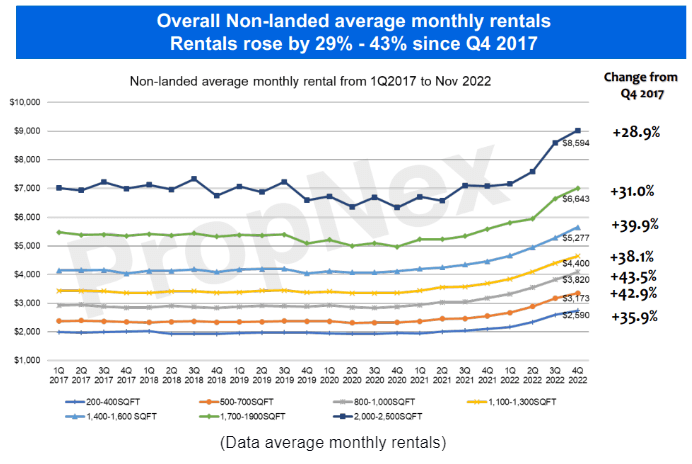

If a landlord rents your property, you might face some stretches this year. Higher rental rates are defied by more resistance, with renters looking away from private properties and considering affordable HDB flats. Singaporeans who struggle with rent choose to move back in with their families or look for co-living spaces. Other than this, home buyers waiting to move into their properties will be exiting the rental market.

But keep hope because the steady influx of expats might fill those vacancies sooner than you think. Landlords may be signed into an agreement for longer rental durations but not at a lower rate since they will absorb more expensive maintenance costs, property tax, inflation, and mortgage rates.

With these going on, rents will peak and stabilize by the second half of the year. Fast-climbing rental rates will not rattle tenants for at least this year.

Image Courtesy of Propnex

Undoubtedly, we will not be able to predict what will happen. But studying the data and numbers does allow us a glimpse based on facts instead of 2nd guessing ourselves.

We always want to exercise stability and safety in purchasing a property. Take your time with it due to the Fear of Missing Out too.

Yes, the word is still "uncertain" for 2023. Our macroeconomic environment has compelled the need for higher investment security.

If you want to inquire further about buying a house or real estate investment or just looking for insight, Singapore Real Estate Insider will accompany you until you reach your goal.

Click here to book your complimentary 20-minute call with us.