I can still remember when I made such a costly mistake as a homebuyer and lost potentially $600,000 and ten years of my time on the property.

With my experience, I would like to educate every property buyer so they will not make the same mistake as I did.

Let me share with you the five common and costly mistakes homebuyers make when buying private property and how you can avoid them.

Disclaimer: In this blog, I will not be talking about budget and location.

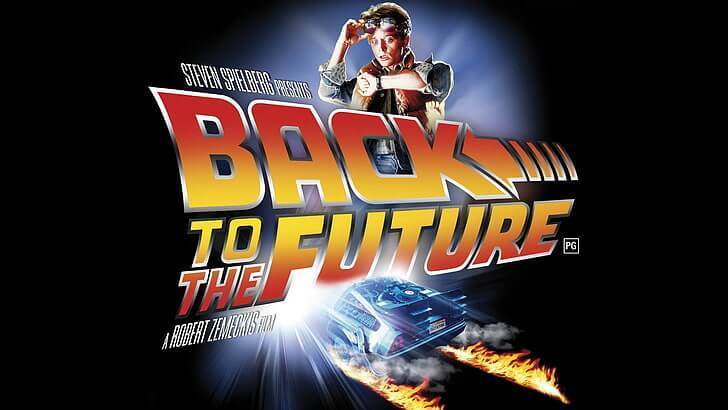

Have you watched the classic and iconic movie, Back to the Future?

It is one of my favorite movies, and I am a huge fan. If you have not seen it before, the story revolves around Marty McFly, a 17-year-old high school student who was accidentally sent back thirty years into the past using a DeLorean time machine. He arrived in 1950 and needs to undo past mistakes to return to the present time.

Which year would you like to go back to if time travel was possible?

You probably wonder why I am sharing this and what Back to the Future got to do with property buying. Well, the short answer is “everything,” my friend.

After going through hundreds of busy professionals and helping them to buy private property using The REI Method, I discovered that when buyers make mistakes regarding property purchases, it’s not because they wanted it to happen. Yet, the main culprit is that they have no clue about what was going on, let alone how to do things.

Sadly, we can’t use a time machine and go back in time. Instead, we will do this right this time for a better, profitable future.

Watch it HERE.

The 5 Costly Mistakes When Buying Private Property

1. Not Having a Clear Objective in Buying a Property

Throughout the many consultations I have done, I noticed that homebuyers start with how much their budgets are and where they would want to buy. Now, I am not saying that this is unimportant. But let’s consider other equally important or perhaps more important factors.

I want you to remember that everything revolves around this question when it comes to property purchases: Why are you buying a property?

What is your objective? Is it for your own use, or is it for investment? Do you want to make 6-figures from it in the next five to six years? Or is this your first stepping stone to a bigger property in the future?

What is your end in mind? Imagine you are going from point A to point B. You know where point A is but don’t know where point B is. How will you be able to navigate in the quickest time, the best route, and with lesser traffic?

Let’s look at an example.

You want to buy a private property that is big enough because your family is growing, and you want to provide a better lifestyle for them. Or maybe you need a home near your kid’s school for the next ten years as they enter primary or even secondary school.

Yet perhaps you may be looking to own a property purely for investment and to grow profits from it?

You must make sure that you’re buying the right one that fits your intentions, not just one you can afford.

Let me ask you again, what is your primary objective for purchasing a real estate property? Not having a clear objective for your property plan is like driving without knowing your destination.

2. Being swayed by emotions or feelings.

You won’t believe this, but some people make such significant decisions based on feelings.

I myself, to be honest, have made this mistake before.

I chose properties based on my gut feeling and didn’t study the property first and just bought it because I liked it!

Property decisions are largely determined by what we want because we all feel good when buying things: be it a property or a car. But how would you be if you were only to realize after ten years that your property did not grow in value or (worse) make losses? Basing your decisions on instinct is dangerous, especially for major purchases like properties, since it involves a lot of money.

I truly regretted trusting my gut when I made a mistake. I potentially lost $600,000 and ten years of my time on the property.

The problem with this scenario is that many won’t know it’s a mistake until they sell it, realizing that the property never grows in profit.

Ask these questions:

- Are there other things that the owner hasn’t told you?

- Are there any other surrounding projects that can be considered as well?

Looking at a property through the lens of numbers and data is crucial, for it will affect your decisions and future plans. What you want to do is to balance your emotions with logical aspects to make an informed decision.

Stay tuned for the part 2 of 5 Costly Mistakes Homebuyers Make when Buying Private Property

***

If you want to know more about how busy professionals and homeowners like you can make 6-figure profits from property safely, we have a private group where we share traits and strategies behind it.

Just click on the button below to join.

Disclaimer: All information presented is based on personal opinions. Singapore Real Estate Insider is not liable for any losses and expenses whatsoever related to investment decisions made by the audience. The ideas presented are here for reference and educational purposes only.