Thinking about owning a condo?

Whether you are already residing in an HDB or currently looking for your first home to live independently or you’re starting your own family, living in a HDB is not a question of why. It is the most affordable way to have a home of your own in Singapore. So most of us start owning our first property through HDB.

Living in a HDB might be comfortable for most, but maybe some of you are thinking of owning another property for investment purposes or to have another source of income. You can buy another flat to rent it out or you can buy a condo that appreciates in value faster than HDB resale flats.

If you want to own a condo while still paying for your current HDB flat, there are some points that you need to consider before signing any contract.

Where do you start?

LOOK INTO YOUR CURRENT PROPERTY

How long have you been staying in your HDB?

As a HDB owner, this should come to mind if you want to purchase a condo. You need to comply with the 5-year MOP (Minimum Occupancy Period) before you could buy another property. This is a period, starting from when you received the keys to your flat, where you are required to physically occupy your flat (not rent it out) before you can sell it on the open market or before you can purchase another property inside or outside Singapore. As per the Housing & Development Board website, the MOP period depends on the purchase mode, flat type, and the date of application.

To know your HDB flat’s MOP status, you can check it here.

CITIZENSHIP STATUS

Here are the criteria of your eligibility to own another property based on your citizenship status:

- Singaporean Citizen – can own both HDB flat and Condo at the same time. But take note that you can only purchase a Condo after you complied with the MOP of your HDB. You also cannot reverse the process, like owning a private property first then a HDB.

- PR (Permanent Resident) – can own a HDB and a Condo but not simultaneously. If you wish to own a private property, you must sell off your current HDB flat within six months of buying a private property.

- Foreigners – cannot own an HDB flat but can purchase private properties. There are also other restrictions as to what kind of properties foreigners can purchase, and in what vicinity they can acquire a property.

FEES AND LOAN ELIGIBILITIES

There are fees that you need to consider when you want to buy a condo while at the same time owning an HDB. We’ve talked about how the become factors that affected the rise of private homes sales in our previous article but we’re going to discuss them here with regards to buying a new condo or property.

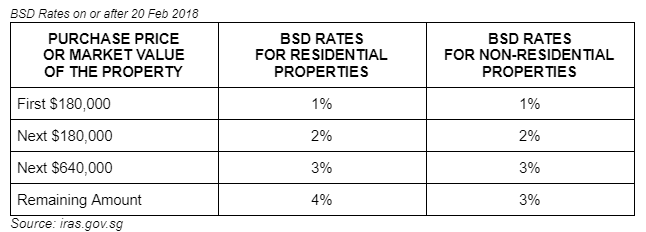

BSD (Buyer stamp duty) – Buyer stamp duty is an IRAS (Inland Revenue Authority of Singapore) requirement to pay for documents executed for the transfer or sale and purchase of property located in Singapore. BSD will be computed on the purchase price stated in the document to be stamped or the market value of the property (whichever is the higher amount). If there’s a discount for the selling price, it will be considered on the computation of BSD given that the net price is still reflective of the market value.

If you are buying a property worth $1M, your BSD will be:

First $180,000 x 1% = $1,800

Next $180,000 x 2% = $3,600

Next $640,000 x 3% = $19,200

TOTAL BSD = $24,600

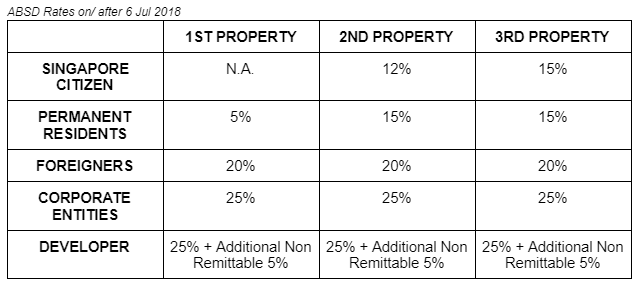

ABSD Additional Buyer Stamp Duty – When you purchased your HDB you paid a BSD (Buyer Stamp Duty) for the property you purchased. Buying another property other than your current property comes with additional fees. Aside from paying the BSD for your next property, you will be paying ABSD for your next property should you decide to keep them both. As a reference, here’s a guide as to how much ABSD you will pay for your 2nd to your next property.

Considering the above ABSD rate, as a Singaporean citizen, if you will purchase a Condo say amounting to $1 million, you need to come up with $120,000 as payment for the ABSD of your 2nd property.

$1,000,000 x 12% (ABSD) = $120,000

If you’re a permanent resident, then you’re ABSD rate will be 15%. Given the same example, you will need to pay $150,000 ABSD.

$1,000,000 x 15% (ABSD) = $150,000

Loan to Value (LTV) – Determines the maximum amount an individual can borrow from a financial institution (FI) for a housing loan. This defines the maximum home loan amount a bank or financial institution can grant you as a percentage of the property’s market value.

For instance, with the property priced at $1M, you are required to pay the 25% down payment in cash or through your CPF then the remaining 75% will be your LTV if it is your first loan. If you are going to loan for another property, then the bank can only grant you 45% LTV given that your age during the application of the loan does not pass 65 years old.

So simple computation will be: $1,000,000 x 75% (LTV) = $750,000 (1st Loan)

$1,000,000 x 45% (LTV) = $450,000 (2nd Loan)

Given the mentioned LTV and ABSD fee, owning another property aside from your current HDB does require you to have a generous amount of savings for you to afford a condo.

Total Debt Servicing Ratio (TDSR) – refers to the portion of a borrower’s gross monthly income that goes towards repaying the monthly debt obligations, including the loan being applied for. A borrower’s TDSR should be less than or equal to 60%.

TDSR is a good reality check to see if you can still afford to purchase another property. Here, all monthly debts like car loans, credit card balances, monthly mortgages, or any other financial responsibilities like monthly subscriptions are being considered to protect the borrower from loaning more than they can really pay.

Sample computation: Salary a month = $12,000 | Monthly Debt to pay = $0

TDSR = $7,200

Salary a month = $12,000| Monthly Debt to pay = $3,000

TDSR(less debts) = up to $4,200

All numbers stated above are for illustration purposes only. If you want a detailed explanation based on your current situation, you can reach out to us.

What’s next?

Given the above examples and computation, owning another property seems like that it’s for the well-off only. Yes, it’s true that you’ll be needing a lot of savings if you want to buy a condo given that you are still paying for your existing HDB. If you don’t have that much savings, you should bear in mind that getting another loan will make it even harder to pay both loans especially if you experience financial emergencies like loss of job or sickness in the family.

Buying a condo or another property is an added financial responsibility, but can also help you in acquiring wealth for the future. The decision to go on buying is completely up to you. No one should force you or convince you to purchase another property without you taking into consideration all the factors that are related to it.

You as a homeowner and investor should do your research well.

Look into your current property’s market value, update your property portfolio. Research on the latest property market trend and don’t be swayed by the news that you hear. Don’t believe everything you hear or see, whether on the news or mere hearsay and opinions. Thorough research and study about your property and about your future plans will give you the numbers and data that will aid your decision-making process to purchase another property or not. Don’t make a decision that will make you regret it later just because you didn’t take up the time to study your property and you decided to buy based on your emotions.

If you think you really need someone to guide you, step by step in your real estate journey, and that you need to have the right mindset regarding the property market, we, at Singapore Real Estate Insider have guided a lot of homeowners like you and will be glad to assist you all the way. We are updated on the latest property market trend and we can give you the numbers and data you need to make a logical decision for your property, should you wish to have our service. Send us a message and we will surely get back to you and help you with your property needs.