For real estate investments, it’s a common misconception that in order to get the maximum profit from your investment, you simply must know when to enter and exit at the right time. While there’s some truth to it, there’s more to consider than just that to make sure that you’re choosing a profitable property.

Tell me if this is too good to be true: I had a client who purchased a premium sea-facing property in 2017. I talked to him about the property cycle (which I talked about in my previous video, check it out somewhere).

Because of that, he had a clear vision of what he wanted and what his possible profit could be. Today, his investment of $2m dollars gained a healthy profit of an additional $700,000 in only five years! That’s amazing!

What is the moral of the story here? While timing your entry and exit in the property market is essential in gaining a good profit, you also have to ensure that you are choosing the right unit.

Read on as I will share 3 out of 5 key criteria you must know as a homeowner in order to make the right decision in your property journey. I leave the other 2 criteria in the next blog.

Here’s how you can select the best unit:

Entry Price

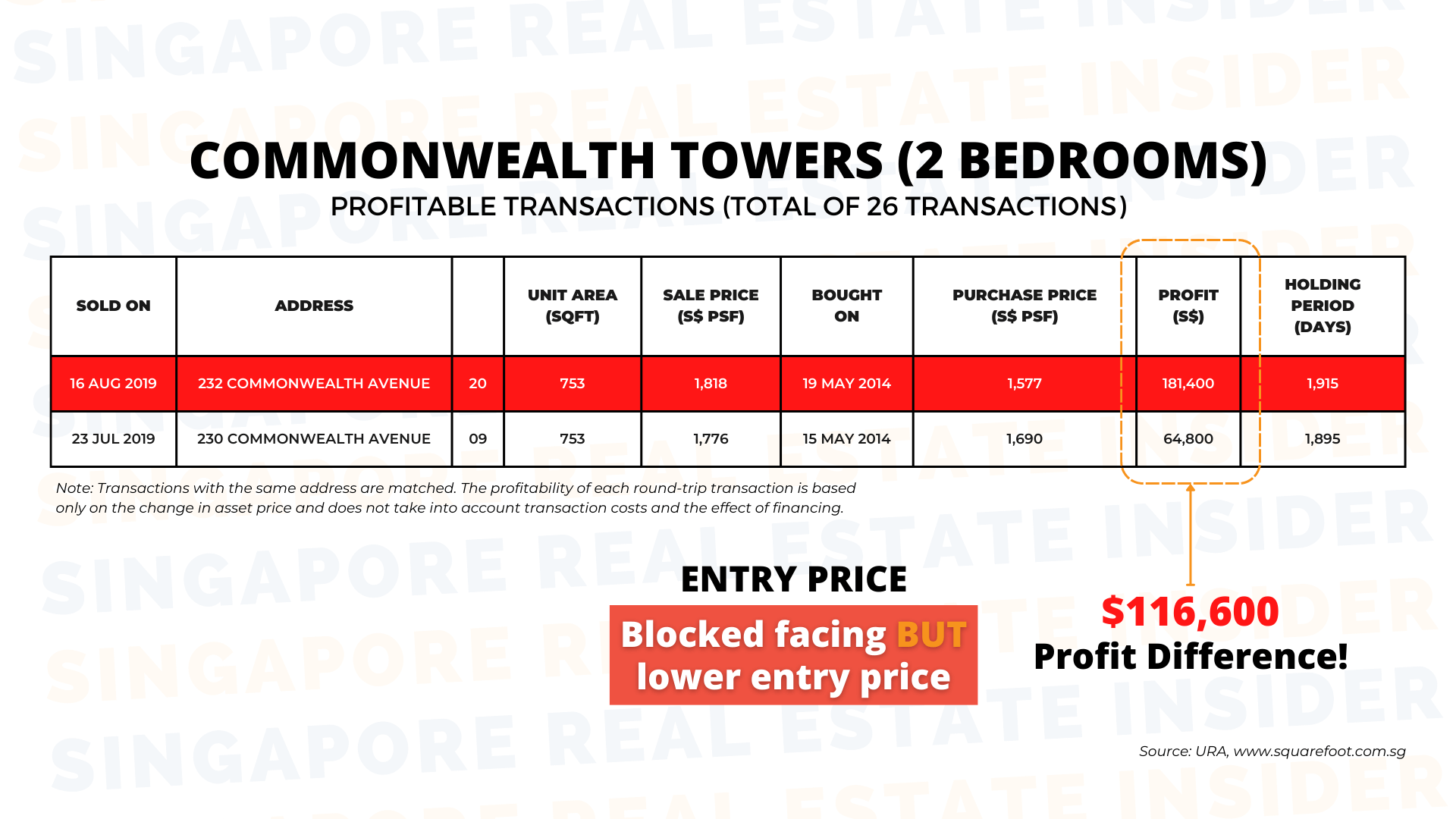

What’s the right entry price for you? If you were to choose a 2-bedroom unit at 775 sqft, which one would you buy?

- unit at stack 9 with a view of the pool

- a unit at stack 20 that faces another development, blocking your view?

Most people would think, that’s a no-brainer, Edmund! We’ll take the unit in stack 9! But let’s look at this comparison in Commonwealth Towers.

The unit in stack 9 was more expensive in 2014 at $1,690 psf, while the unit in stack 20 was only sold for $1,577 psf. However, five years later, the unit at stack 20 gained a $181,400 profit compared to the unit in stack 9, which only gained $64,000.

What caused this? The lower entry price was leverage for the unit to increase in value.

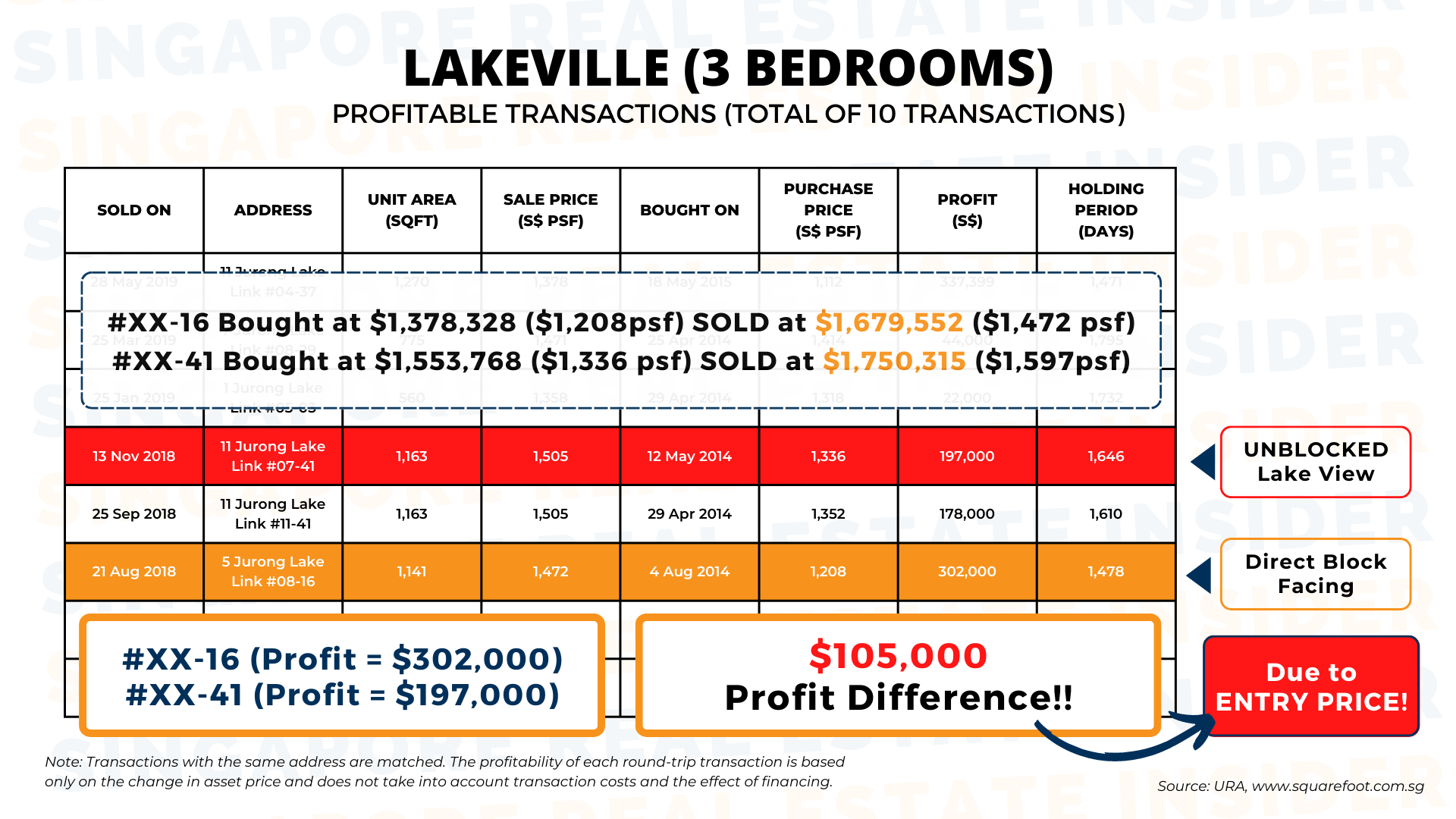

Property Facing

Does the layout make sense? I’ll make you choose again. Which unit would you buy?

a. Unit 16, a 3-bedroom unit with 1,141sqft priced at $1,378,328 that is directly facing an HDB block, or

b. Unit 41, with the same credentials except it faces an unblocked view of the lake at $1,553,768?

If you choose option 2 (b), you would have lost a possible profit of $105,000 compared to option 1 which was facing an HDB block.

It goes back to the importance of factor number 1, the entry price. option 1 was cheaper by $200,000 at the entry point, but do consider as well that the layout should accommodate the people living in the unit, who are most probably, sticking to a budget.

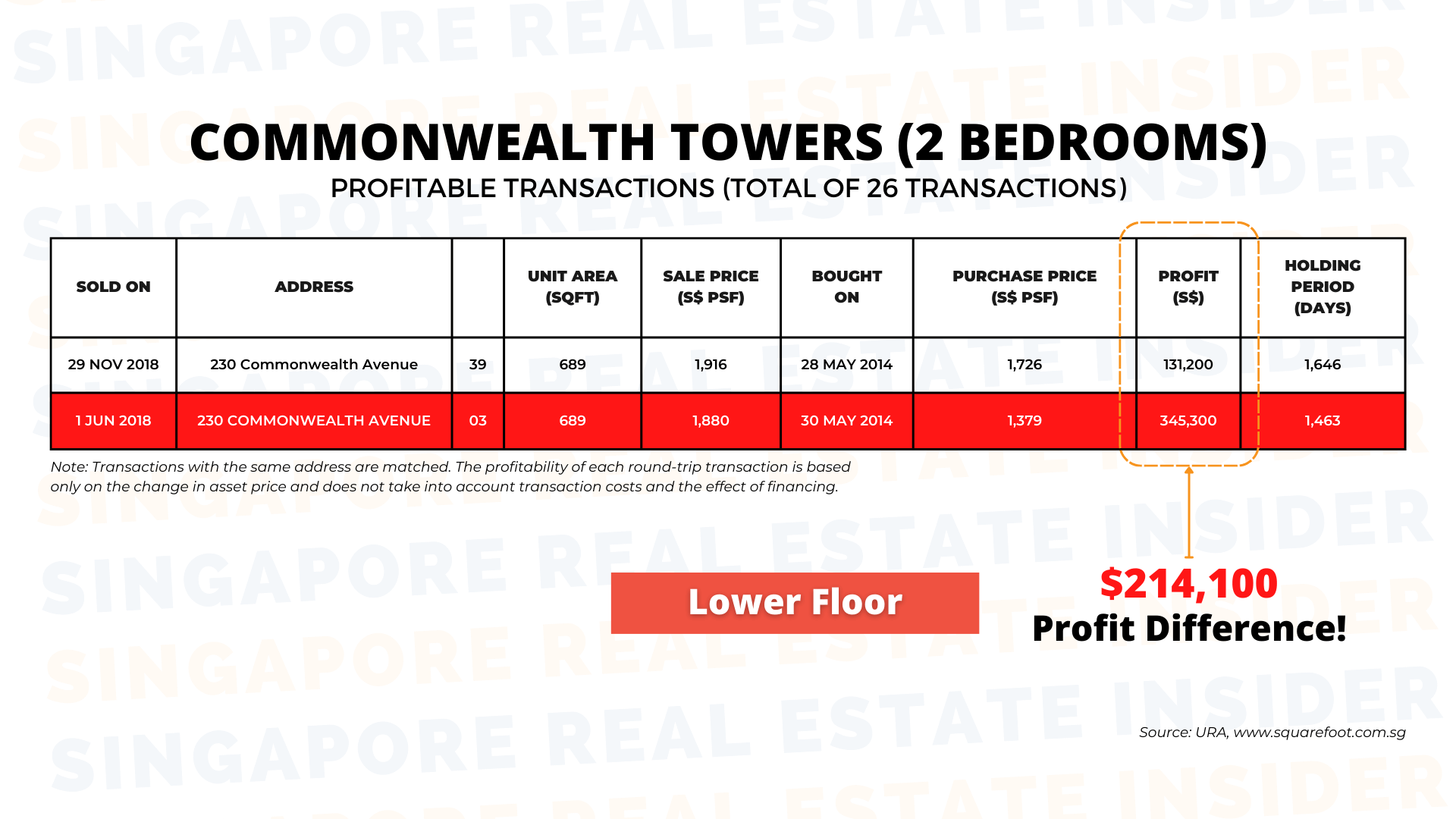

Height

Does height matter in choosing a profitable property? Pick a unit! Same size and same facing units with floor difference.

a. Unit 39 is situated on a higher floor, or

b. Unit 3 is on a lower floor.

Now, it makes sense for people to choose the higher one for less noise and better view.

Yet, the lower unit incurred a $200,000 higher income than the higher floor.

Not knowing these factors could possibly make you lose a 6-figure in your property. But you can rest assured that with Singapore Real Estate Insider, I will walk with you from selecting the best unit to exit at the right time in order to earn 6-figure profit.

Remember, this is just 3 out of 5 key criterias you must know as a homeowner in order to make a right decision in your property journey. Carry on the next video as I reveal the other 2 very important points as well.

Find them in the next article.

To learn more about what we’ve talked about here in this article, click here for a complimentary call with us.

***

Join us in our private group where we help busy professionals and homeowners make six-figure profits in their property, safely.

Property is an ongoing process and journey because they are constantly changing and different strategies must be applied at different times.

Therefore in this group, we not only do weekly live coaching on property, we also cover a wide range of property knowledge and information that we as homeowners must know and be educated on to make informed decisions.

Just click on the button below to join.

Disclaimer: All information presented is based on personal opinions. Singapore Real Estate Insider is not liable for any losses and expenses whatsoever related to investment decisions made by the audience. The ideas presented are here for reference and educational purposes only.