So you made the right decision to invest in a property a few years ago, and now it has grown so much in value. Now, you're facing a dilemma: to sell or not to sell?

This is one of the most essential and common questions I encounter whenever my clients consult with me:

"Should I let go of my current property that has grown so much in value?"

It's one of those questions that can leave one torn in making the right decisions.

Maximizing Property Investments: Navigating Today's Market

Letting go of a property purchased at a bargain price can be challenging, especially considering the current real estate market conditions.

But of course, Singapore Real Estate Insider is committed to helping you succeed in the real estate game. To make informed decisions, let's address some common questions you may have regarding property investments in today's market.

- Can I Still Profit from Property Investments Today? Many investors purchased their properties a decade ago when the price per square foot (PSF) ranged from $600 to $800. However, today's market doubled in average PSF rates, hovering around $2,000. The question arises: Is earning from property investments in today's market still possible?

- Can I Sell for a Profit? We understand the uncertainties that come with investing in property.

Consider this: When you bought your previous property, it likely had a higher price tag than its value years ago. Capital appreciation plays a vital role here.

What does your property investment portfolio look like in the next 10 or 20 years?

With the REI method, we can guide you on safe, stress-free, and legal strategies to consistently generate six-digit profits from property investments.

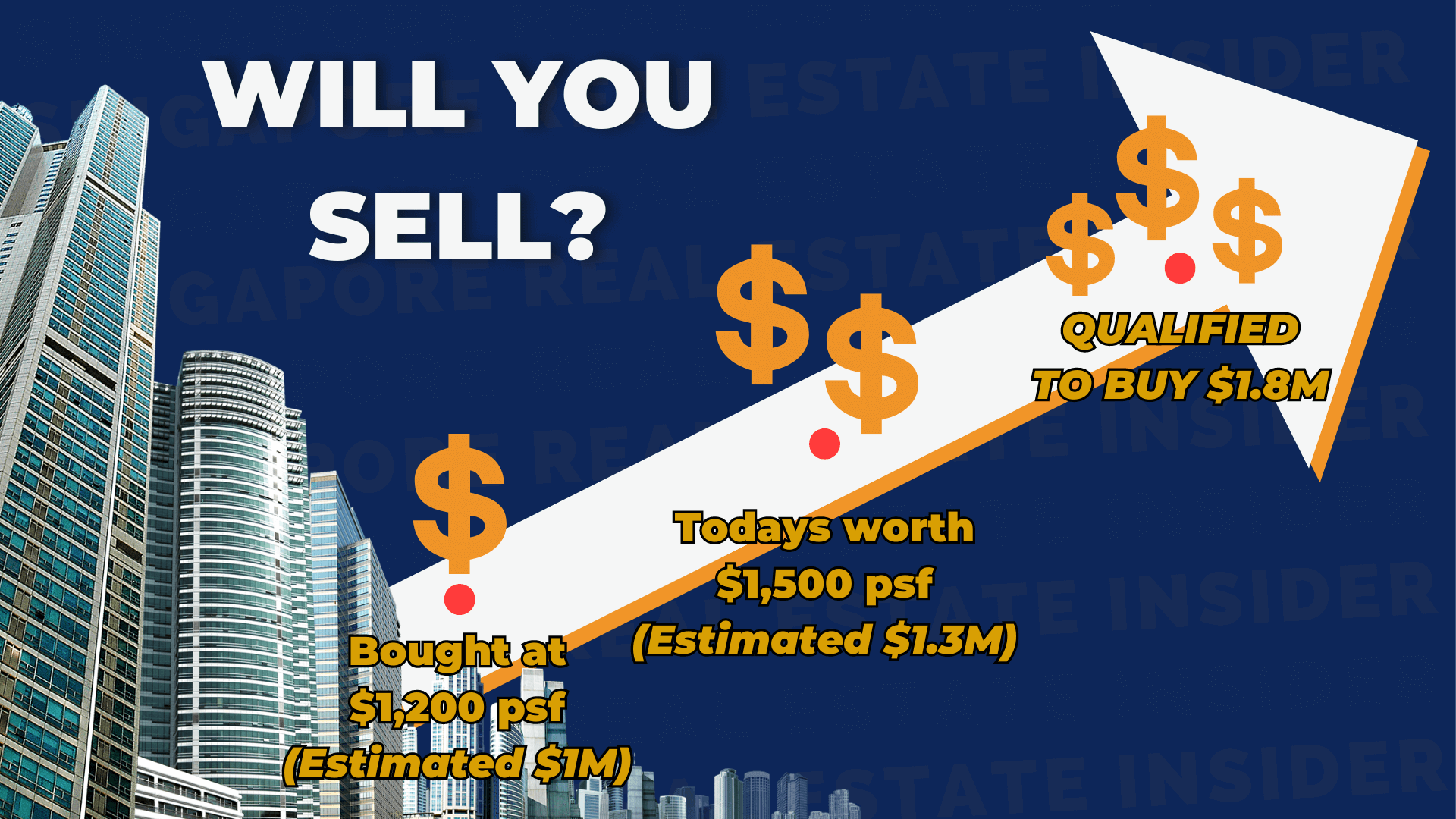

Imagine you purchased a desirable unit for $1 million, with an average PSF of $1,200. After five years, its value has increased to $1.3 million, with a PSF of $1,500. Should you sell?

Furthermore, is it wise to invest in a brand-new property with a PSF of $2,000? These are important considerations, especially since the market is currently at an all-time high and interest rates have risen.

Let's discuss potential strategies and options.

- Timing and Cooling Measures: Should you wait for new cooling measures to reduce property prices? Understanding market dynamics and government policies can help you make an informed decision. We'll provide insights on timing and potential impacts of cooling measures on property prices.

- Rental Opportunities: Renting your property can be viable, especially given the peak rental market conditions. We'll explore the potential rental income and factors to consider when opting for this strategy.

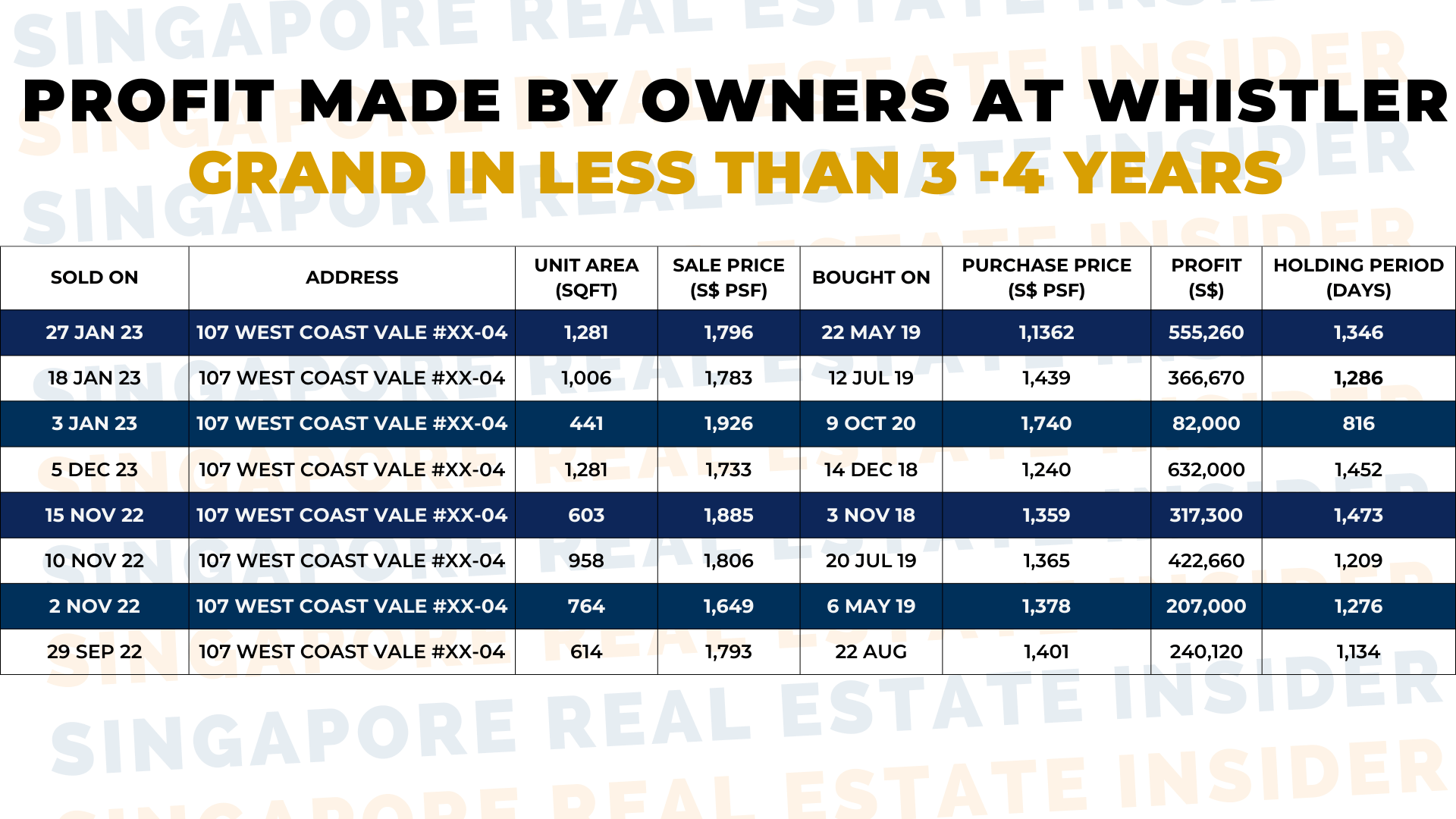

Whistler Grand

An example is Whistler Grand owners who have experienced impressive profits in a relatively short span of fewer than four years. On average, they made a profit of $300,000. We'll delve into the factors that contributed to their success and examine valuable lessons that can be applied to your property investments.

Its always better to follow what works than figure the unknown ourselves right.

A wise man once say, “Success leave clues.”

While it may be challenging to let go of a property purchased at a low price, it's crucial to adapt to the current real estate market to maximize your investments.

You can make informed decisions and achieve significant returns by exploring various strategies, understanding market dynamics, and seeking guidance from experts like me at Singapore Real Estate Insider.

At Singapore Real Estate Insider, we are dedicated to helping you navigate the complexities of today's market and secure your financial success in the world of real estate.

Although property prices and interest rates may be high at present, with proper financial planning, you can capitalize on these conditions and make advantageous property investment choices.

How can I fortify my capital?

If your goal is to transform your properties into assets rather than liabilities, there is a crucial question to address: "How can I fortify my capital?"

Let's revisit the previous scenario: You initially purchased a property for $1 million, and its value appreciated to $1.3 million. Now, with the earnings, you have the opportunity to buy a brand-new unit priced at $1.8 million. The question arises: Should you proceed with the purchase?

Hold on, Edmund. The leap from $1 million to $1.8 million is almost twice the price! Why would anyone choose to upgrade? Individuals prioritizing building a strong capital base opt to secure their profits.

If you find yourself in a similar situation, the REI method can assist you in achieving that $1.8 million through sound financial planning, leveraging your profits and additional capital.

It's important to recognize that transferring your capital and earnings from the initial property to a new investment safeguards your wealth, raises your net worth to $1.8 million, and enhances your potential for increased profits.

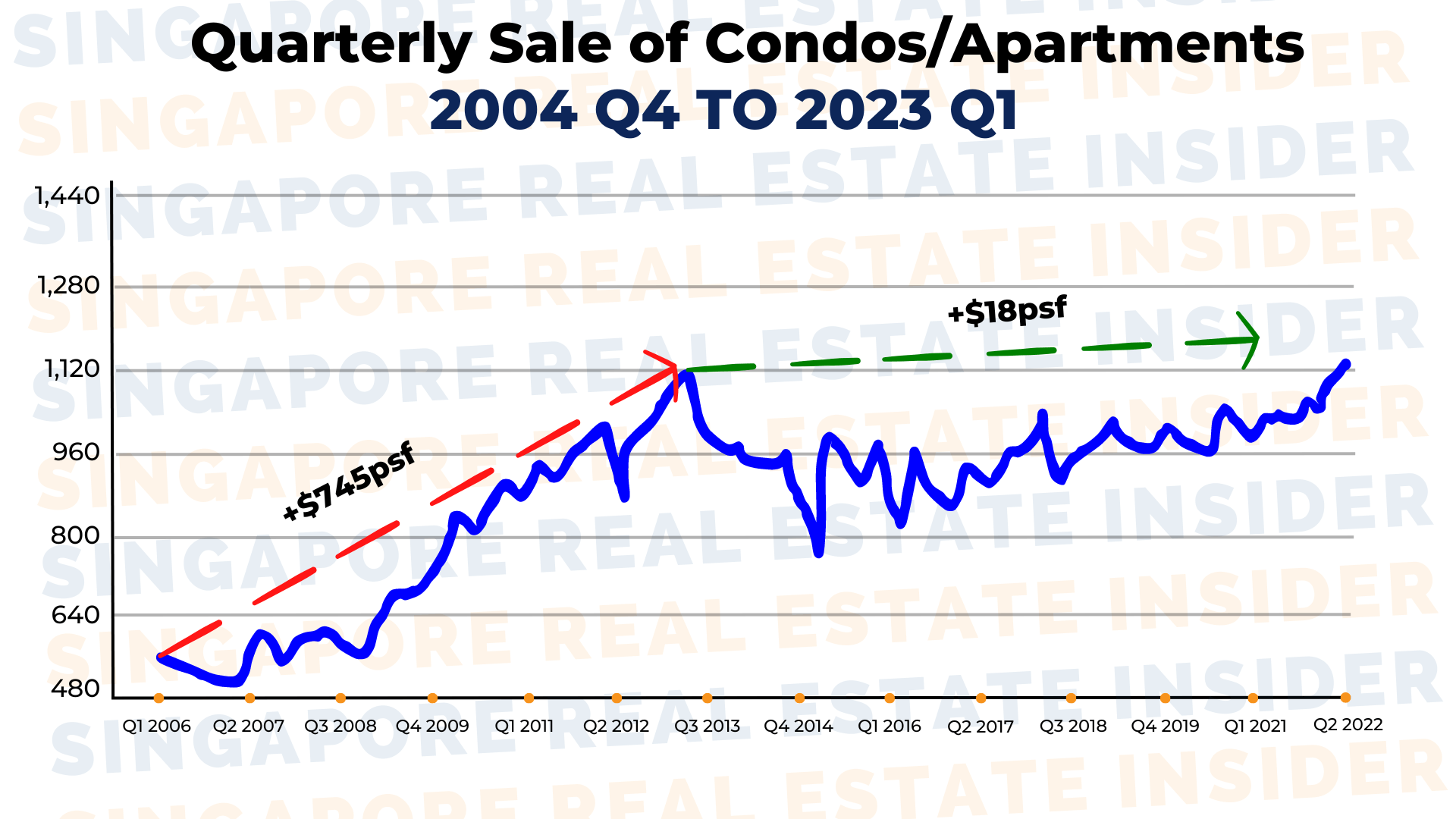

Take a look at this chart showcasing the performance of property units.

Notice how, upon reaching its Temporary Occupation Permit (TOP), the unit experiences a peak in profit.

After five years, it doubled to $745 per square foot (psf). This is a critical point where many individuals should consider avoiding holding onto their property.

Now, shift your attention to the second section of the chart, representing cases where owners choose to sell.

The growth rate slows significantly, resulting in a meager additional increment of $18 psf over ten years. Unfortunately, many people make the mistake of missing out on their opportunity for maximum profit.

Kingsford Waterbay

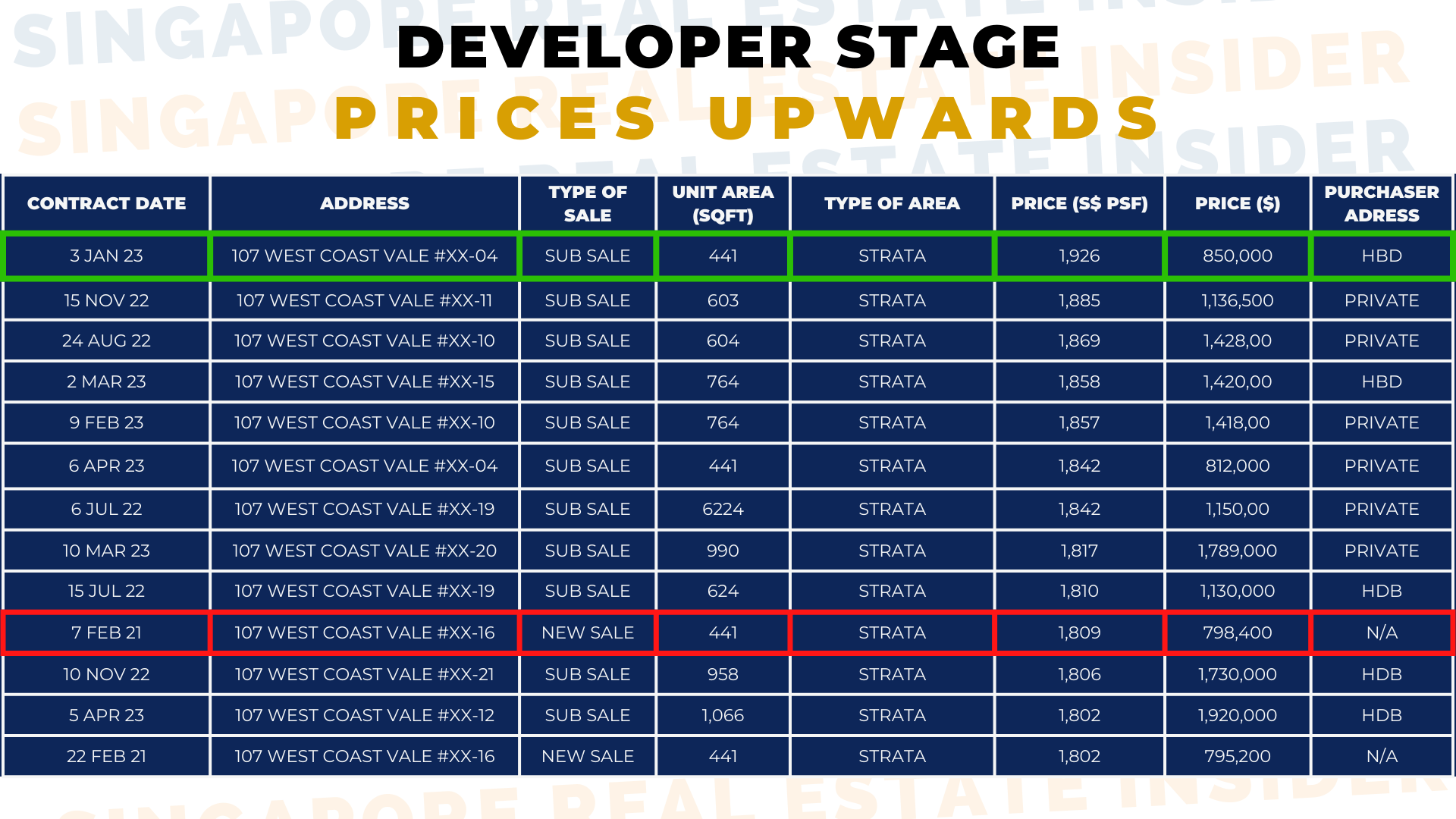

Let's consider another example featuring Kingsford Waterbay.

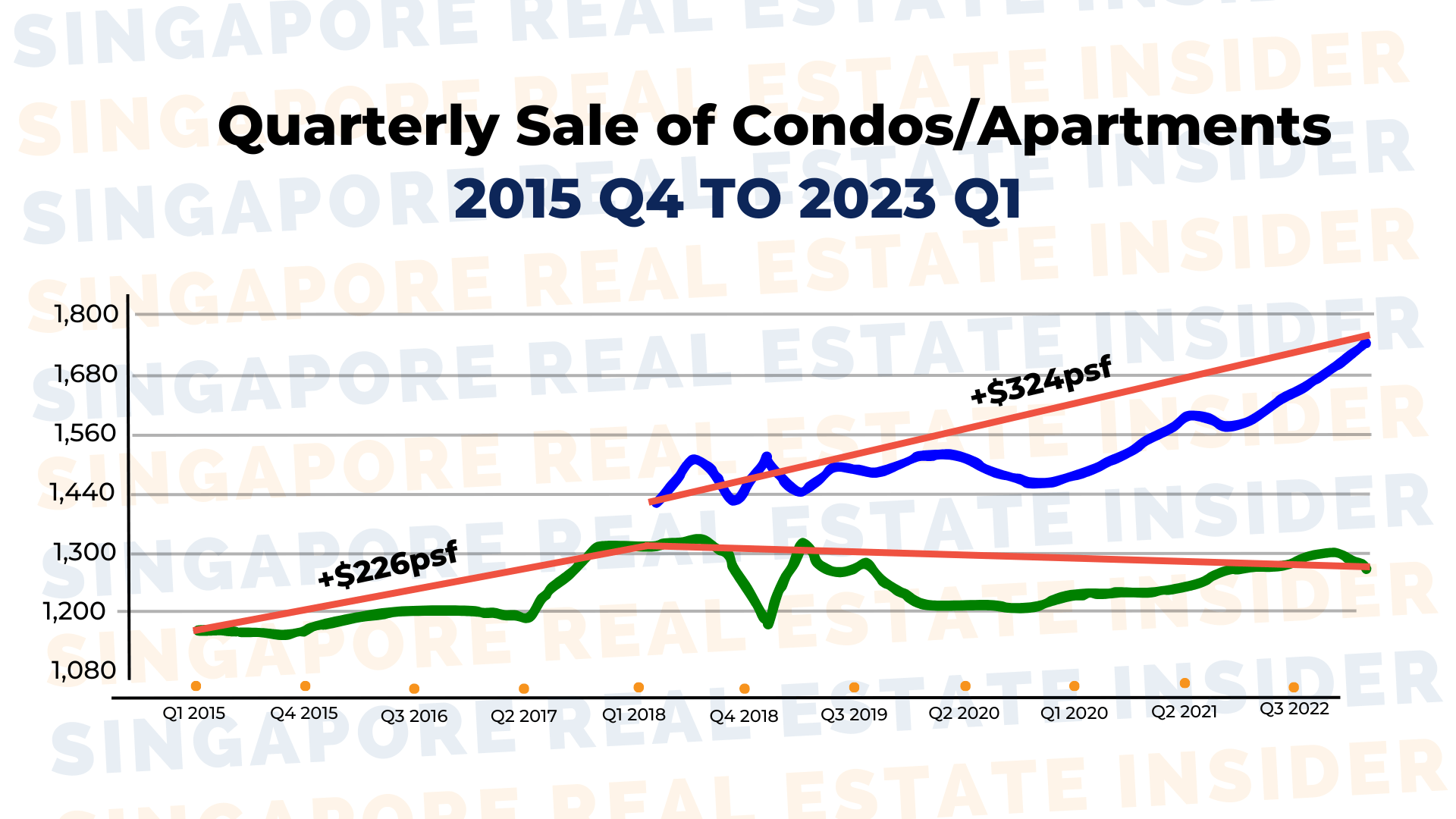

A property owner purchased a unit at and decided to sell it soon after it TOPed, gaining a total of $226 psf , subsequently even though he bought the property lower in the past, he understands the concept of building assets.

Thus, he sold at the right exit and continued to replicate the same model, acquiring another property at Twin View. This strategic move resulted in an additional increment of $324 psf over the next 4 years.

Which option would you prefer? Holding onto a property with a slow increment of $18 psf or taking a calculated risk with the REI method and potentially earning an additional $324 psf with a new property?

When building our net worth, it is crucial to keep progressing.

Risks will always exist, but with the right investment mindset and the valuable assistance of the REI method, you, too, can make profitable moves and potentially secure six-figure profits safely and securely. Reach out to me today to learn more about this process and how it can benefit you.

Ready to transform your property investment portfolio? Book a discovery call with me! Click here.