Looking at the Singapore cooling measures this year helps us understand how the government uses rules to keep different areas, like the economy and real estate, stable. It's like adjusting things to maintain a balance, similar to managing the temperature in your house. This analysis not only shows how economic principles are applied in real life but also gives us insights into how the government adapts to challenges.

Singapore's real estate market has attracted foreign investors due to its promising prospects, safe political climate, and stable economy. Despite the introduction of Additional Buyer's Stamp Duty (ABSD) in 2013 to deter investments, foreign buyers have continued to see Singapore real estate as a valuable investment.

However, the April 2023 cooling measures have brought new implications for foreigners, Singapore citizens, and first-time home buyers. These measures were introduced just six months after the previous set of cooling measures in September 2022. The September 2022 measures included changes to stress test interest rates and HDB Loan-to-Value ratios, as well as a 15-month wait-out period for property owners downgrading from private to non-subsidized HDB resale flats.

Additionally, Marginal Buyer's Stamp Duty (BSD) rates were raised for higher-value properties in the Budget 2023 announcement.

Let's delve into the details of the April 2023 cooling measures and how they may impact you. These are the OLD NEWS and you likely already memorized all this. But its always good to do a recap.

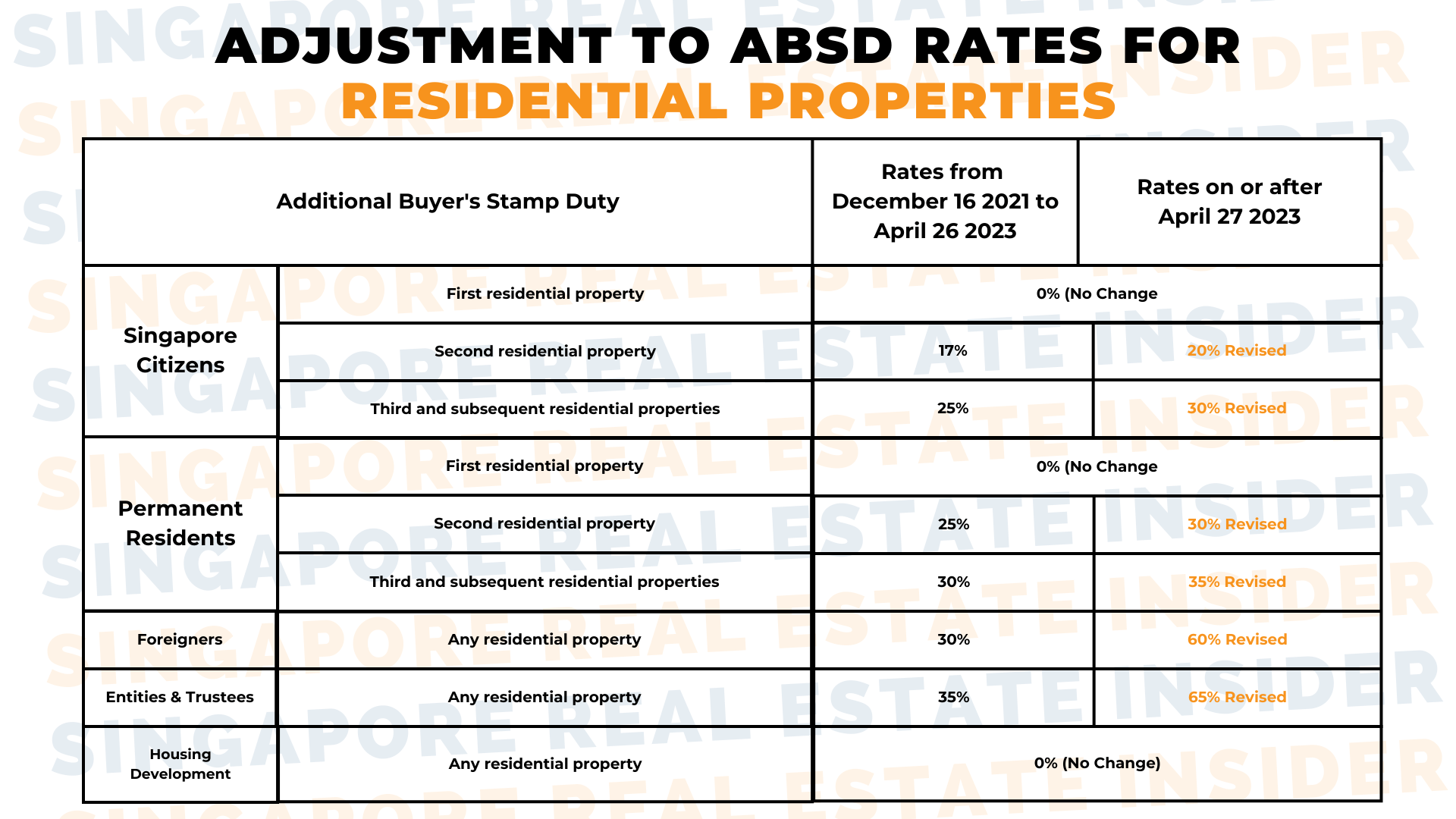

ABSD rates were increased across the board, except for first-time residential property buyers who are Singaporean citizens or Permanent Residents.

Singapore citizens purchasing their second residential property now face an ABSD rate of 20%, while the rate for their third and subsequent residential properties increased to 30%.

For Permanent Residents buying their second property, the ABSD rate is now 30%, and for their third and subsequent properties, it increased to 35%.

Foreign buyers purchasing any residential property now face an ABSD rate of 60%, while entities and trusts will encounter a rate of 65%. This significant increase of 30-35% on top of the existing 30% ABSD rate is expected to have a substantial impact on foreign transactions.

Joint acquisitions involving parties with different profiles will be subject to the highest applicable ABSD rate.

However, married couples with at least one Singaporean spouse may still be eligible for an ABSD refund if they purchase a second residential property together and sell their first property within six months.

These measures have made it more challenging for aspiring and current multiple property owners to manage their portfolios effectively. The continuous rise in ABSD rates has limited flexibility in transitioning between properties and discouraged property owners from expanding their portfolios.

Property investors, especially those with smaller units, have been significantly affected by these changes. Limited capital appreciation and modest rental returns from small properties make it difficult for investors to realize their gains. The current market trend favors new property launches, while resale properties, particularly smaller units, attract fewer buyers. Owners of small units with existing tenancy agreements are facing challenges in finding buyers.

Families holding onto their HDB flats while investing in multiple private properties also face difficulties. Previously attractive as an investment option due to lower ABSD rates, these smaller properties now offer limited returns and pose challenges when selling. As a result, many families are considering pooling their resources to purchase larger landed properties or 4-5 bedroom condominiums. However, this transition presents its own set of challenges.

For instance, Singapore Citizens who want to buy their second property will need to shell out 20% more, while those who are trying to accrue their third and subsequent condo will have to pay an extra 30%.

To give you a clearer picture, let's consider an example:

Raegan, a Singaporean citizen looking to purchase a second property. With the new cooling measures, Raegan will have to pay an additional 20% on top of the original selling price. So, if he wants to buy a property at $1.1 million, he'll need to shell out an extra $220,000. This decrease in profit margin can significantly impact buyers like Raegan.

Would you still continue doing this and come out the 20%? Would you?

The higher ABSD rates, coupled with the Total Debt Servicing Ratio (TDSR) restrictions, have diminished the purchasing power of property investors. This has led many to explore the option of combining names to own a larger property or considering alternative investment options outside Singaporean real estate.

WARNING! Do not take what I am going to share with you lightly. Because if you just go ahead and do it, chances are you would have gotten it wrongly in terms of structuring or you would have adopted the wrong method in your purchase.

So which profile has been increasing in buying property?

Parents supporting their children in getting their 1st property.

It makes sense right?

Would you as parents worry that future property prices are continuing to increase that it could be beyond reach for our future generation?

And I cannot blame them for thinking that seeing that even with the various cooling measures, higher interest rates or the lukewarm economy, the market doesn't seem to slow down and we are still having loads of properties being sold.

Whether you are supporting your children to buy their 1st property with the initial down payment or paying off the property with your hard-earned savings, there are pros and cons to doing so as well.

This complex situation has left property investors feeling stuck, as the cost of building a property portfolio has escalated due to the rising ABSD rates. Upgraders looking to transition to landed homes also face concerns related to loan tenure and trade-offs in quality of life between condos and landed properties.

Considering these challenges, it's essential for buyers to employ effective strategies when navigating the changing real estate landscape.

Finding a resolution to these challenges requires a deep understanding of individual needs and objectives, as well as guidance from experienced real estate professionals like us at Singapore Real Estate Insider.

That wraps up our topic on Understanding the Impact of Singapore's 2023 Cooling Measures on Property Buyers.

We hope this information has been insightful and helped you make informed decisions in the Singaporean real estate market.

If you need assistance with your current property situation, feel free to reach out to us by clicking here.