A common question I usually get is, “Why do you pay rent to someone else instead of owning a property yourself?” Weird?

What if I were to share with you from a research, numbers perspective, it makes a lot of sense.

A disclaimer, everyone's situation is different so before you jump into following what we do, do clarify with us 1st before adopting this strategy. This might not be for you.

So imagine, you got yourself a new launch property and as everyone knows, there is a waiting time for the property to be ready. Just like HDB BTO as well.

So you can either choose to stay with your parents or simply rent a place while waiting right?

Which is a better option to you?

We do see an increase of the younger generation choosing to rent their own place for privacy and of course for independence.

And yes, it's increasingly more popular with the generation YOLO.

The question is,

Is it logical to rent while waiting?

And for those whose sole purpose in buying a property is to invest and resell, will there be enough profit for them after the rent?

Many have raised eyebrows at new homeowners who chose to rent as they waited to move in.

I know because whenever we share with others our

“We never stay in the property we buy”

They always give me the ODD LOOK. Like I am an alien.

Yes, I know, this is unconventional. But there are fundamentals to it from a strategy and numbers perspective.

Let's be fair, there is nothing wrong with buying a property to stay or not to stay right? Everyone’s situation and objective are different.

From a short-sighted view, it does seem illogical to rent temporarily before living in your own home compared to buying a property you can stay in right away. But, is it, though?

Let's look at two possible scenarios. We'll compare two properties: Forest Woods, a newly-launched condo back in 2016, and Bartley Residences, a resale property.

We'll do a breakdown of the two examples. Our benchmark figure for both properties is $1.3 million.

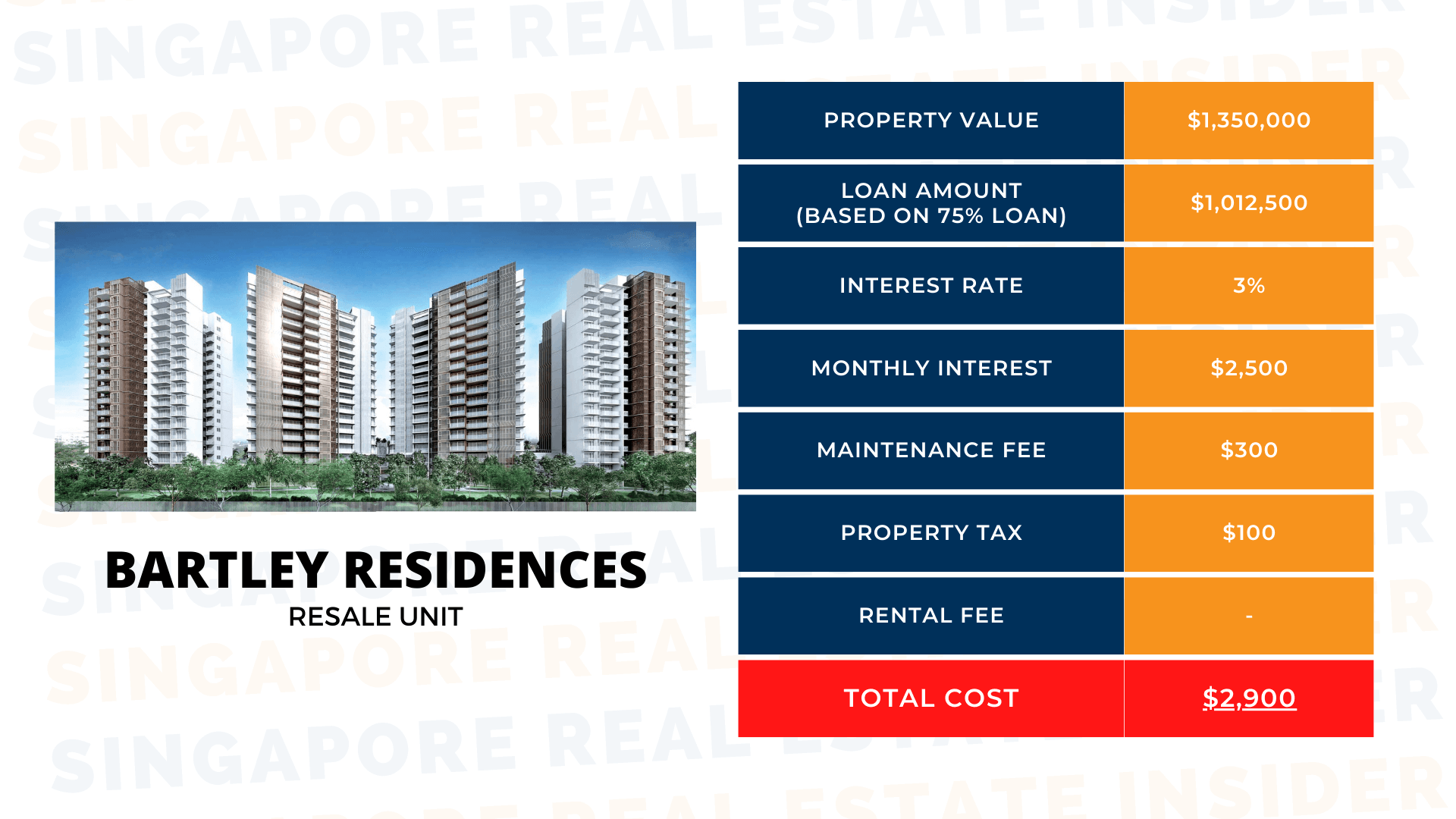

Bartley Residences' value is $1,350,000 with a loan amount of $1,012,500 and an added interest rate of 3%. So the monthly interest is $2,500, plus $300 maintenance fee and $100 property tax. In this scenario, we won't have a rental cost as you will stay there immediately. That gives us a total of $2,900 cost per month.

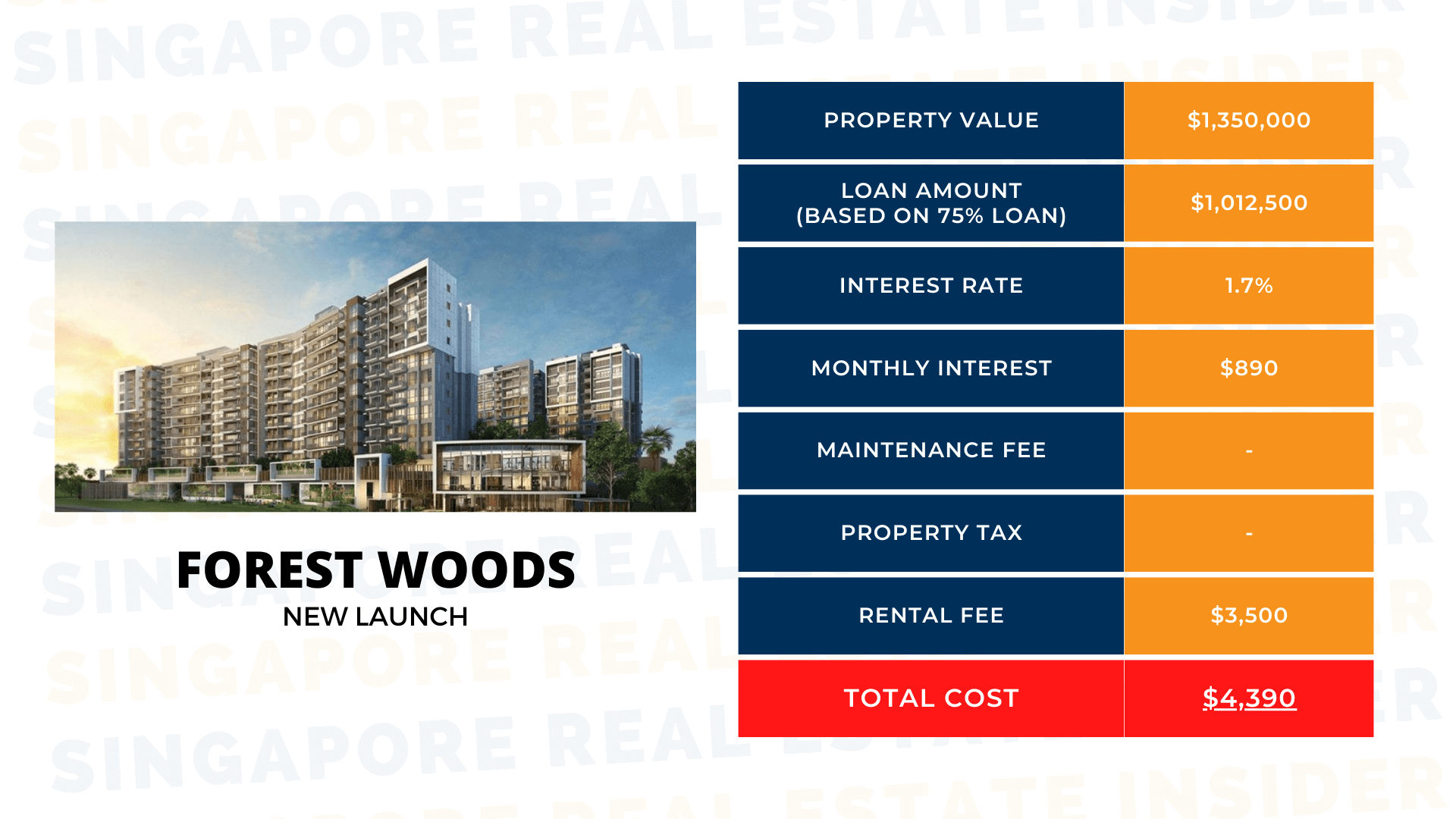

Now, let's go over Forest Woods, the new launch property. Its monthly interest rate is $890. There's no maintenance fee and no property tax yet, but you will need to shell out $3,500 a month since you will need to find a new place. The total cost of expenses per month is $4,390.

Comparing the two properties, there's a $1,490 difference in expenses. At a quick glance, it makes it look as if it's much better to get a resale property. But hold that thought--let's break it down further!

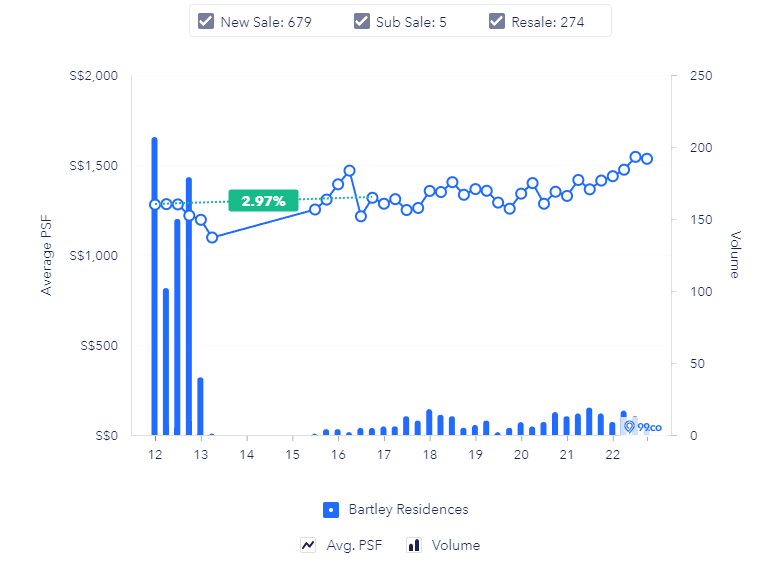

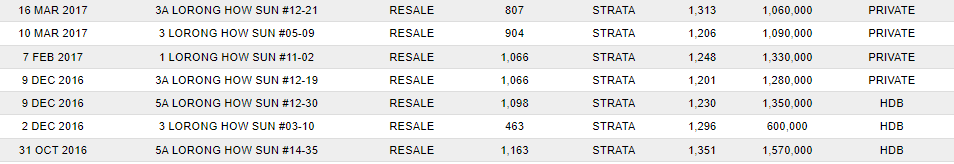

Flashback to 2016, when Bartley residences were sold for only $1,250 to $1,300 psf. A few years later, the same units are still sold within that range.

If, for instance, you sell and buy at the same price, you would have incurred that $104,400 loss! And that's not even counting the renovation costs if needed.

On the other hand, choosing Forest Woods would compel you to shell out about $158,040 for the three-year rent. That's pretty huge, I know. But remember this: the property has already earned a $300,000 increase in value, so your GAIN is $141,960!

It's easy to be swayed into making quick decisions based on needs when we don't look through a long-term perspective. That is why the Singapore Real Estate Insider is here for you!

Through my years of industry experience and careful data study, I can help you achieve your property investment goals. Click here for a complimentary 20-minute consult with us.