Losses, we’ve all dealt with it right?

From investor to investor, the last thing you want to happen in your real property investment is for it to sell only at a break-even, let alone at a loss.

Most of us know that property guarantees growth, so how is it that others ironically bring their money down the drain? More importantly, Is there a way to prevent it?

If you're like me, I secure the things I need in life with insurance. A form of protection.

Did you ever wish you could do the same for your property's price?

Can you imagine if today all our properties are guaranteed to rise to a higher level?

How great will that be?

I am going to share with you this unknown fact many do not know.

My friend, in property, there's such a thing called built-in price protection.

In a nutshell, it protects your investment from lowering its value and ensures that it grows year-by-year by keeping a watchful eye on some important factors.

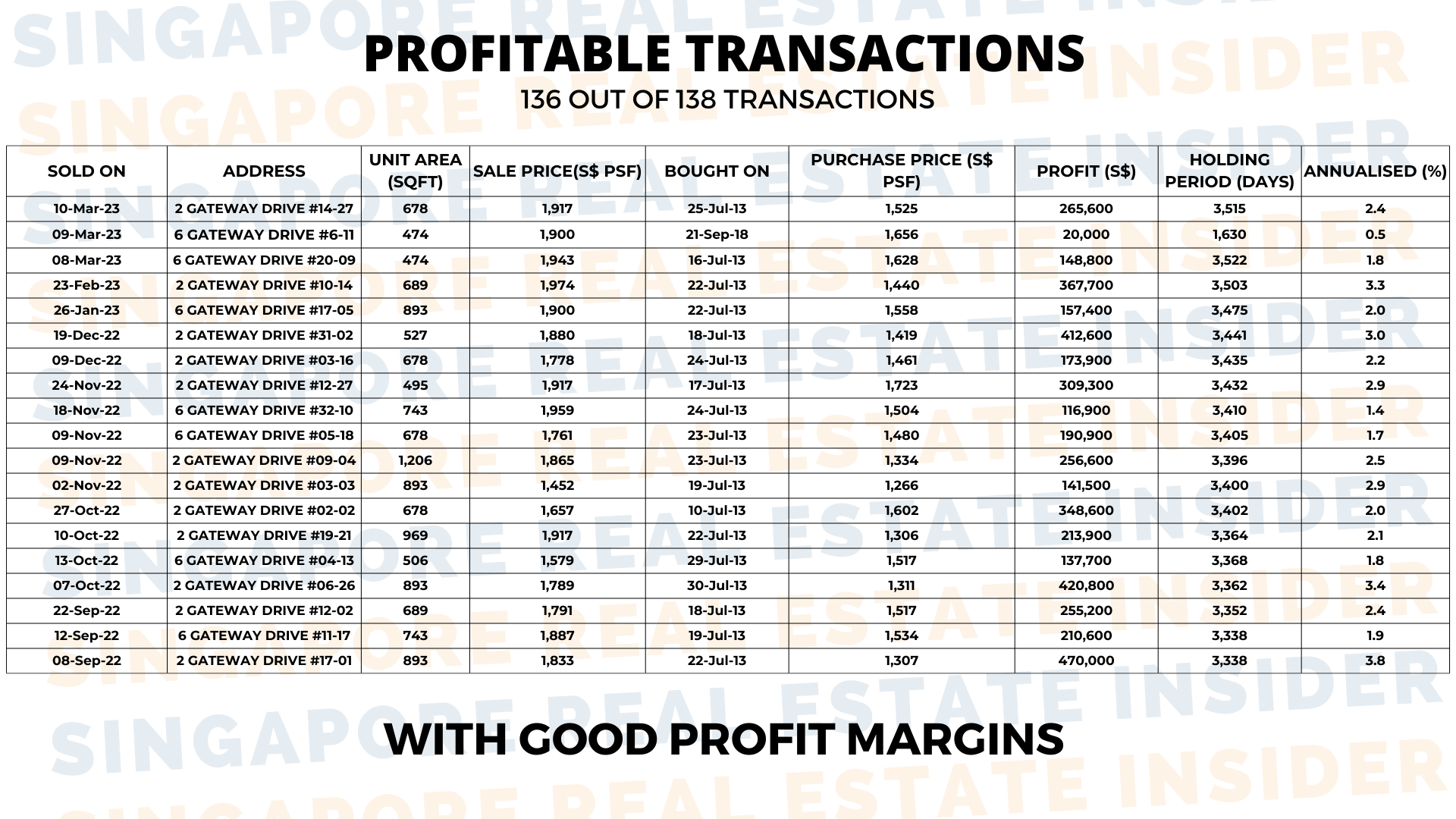

To illustrate, let's look at J Gateway Condominium.

With close proximity to Jurong East Hub Interchange MRT and how it allows every transportation that one would need to go everywhere.

It's a very convenient spot that's also close to many malls, schools, supermarkets, medical centers, and more.

Notably, this project was launched in 2013, one of the peak points in property prices, yet many still chose to buy them. And here's the most interesting thing:

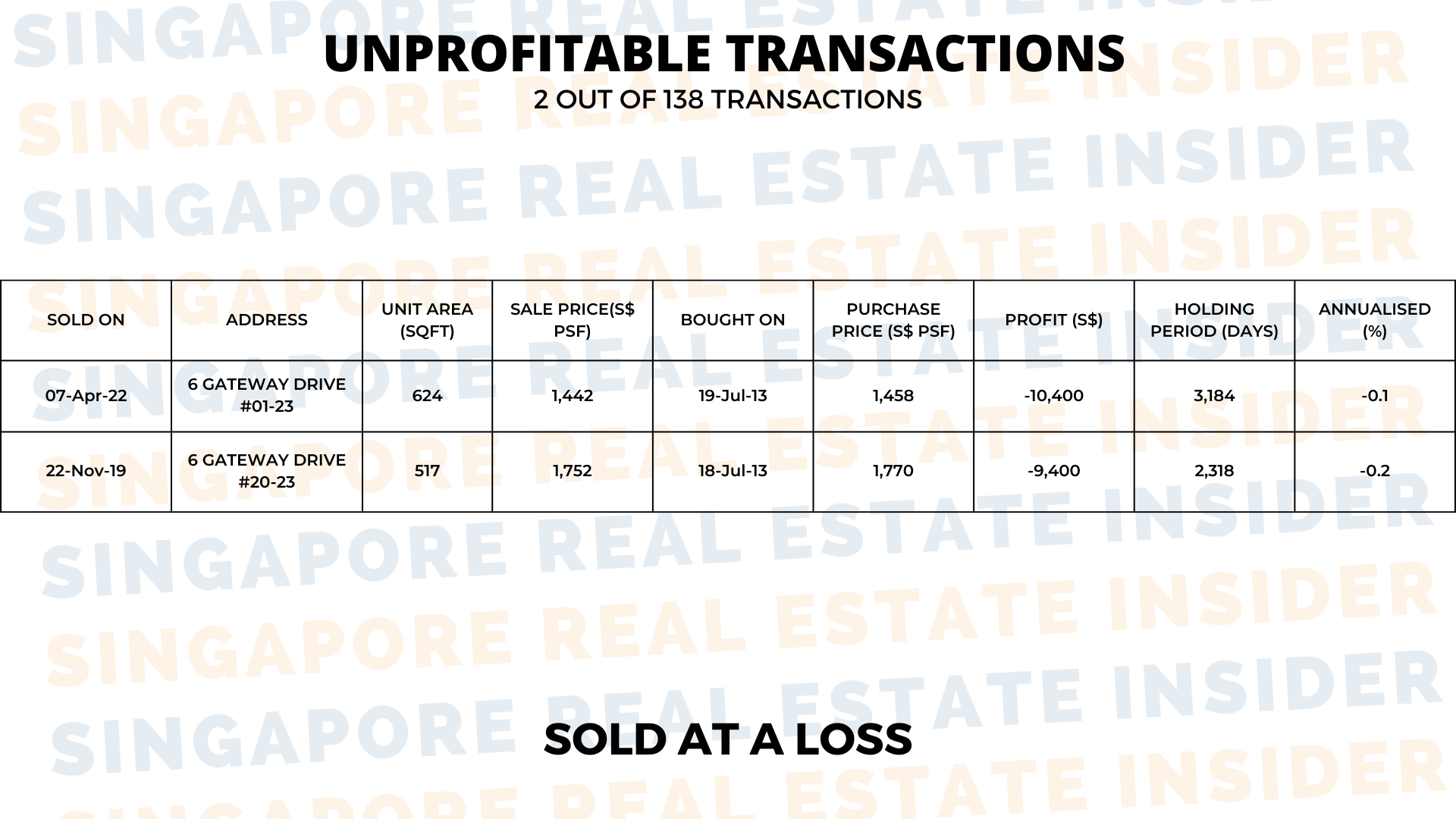

136 out of 138 transactions were sold with a good profit margin, but two units were sold at a loss.

An average joe would probably just shrug this difference and be like - “ Ah, its just 2 properties, and I got 136 more winning over”

But us insiders? We know that even though A win is A win, LOSSES .ARE. LESSONS.

SO, Let's dive deeper into this topic with a comparison of two unprofitable units.

These units were both bought during the launch date, and were sold in April 2022, another period with a record peak price. So how could it ever incur losses?

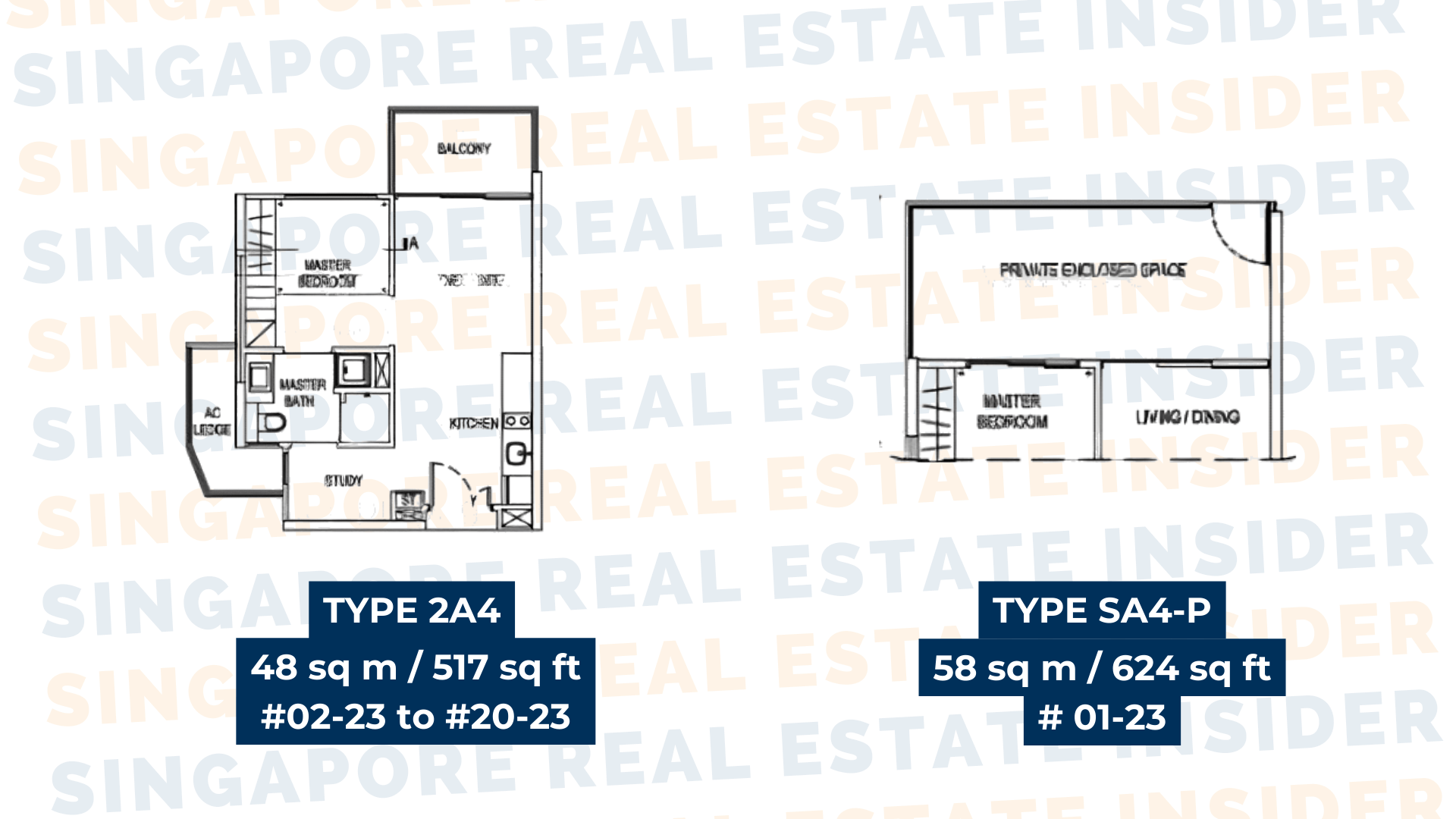

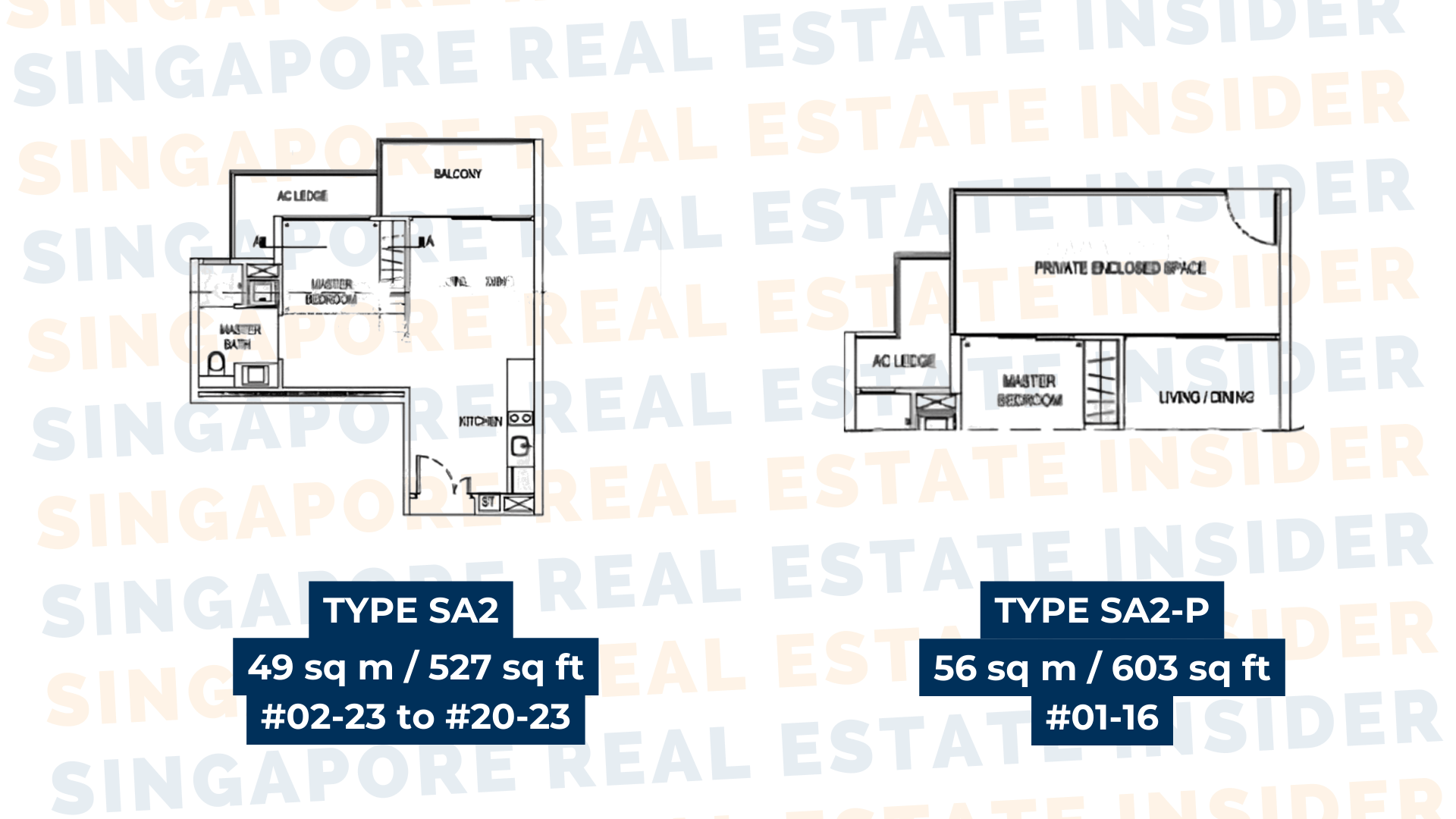

The unit at a loss was a 1-bedroom unit on the ground floor complete with a study and a patio.

The other one is also a 1-bedroom unit but without a study and patio. The former was bought in 2013 at $910,000 and was sold for only $900,000 this year. The latter, on the other hand, was bought at $764,000 in 2013, and was sold at $938,000 in 2022.

How did that happen? Do you see which unit had "built-in price protection?"

The first unit decreased in value even after 10 years of waiting,

despite most investors getting their guaranteed profit in this bullish market.

Does your property have ‘built-in price protection’? How can you determine that in your property now?

On our dockets are Location, Purpose, Property valuation, Profit, New-launch V.S. Resale, and the property market.

These are some of the most important factors that affect your price protection:

Location

"Location, location, location" is still as true today. This plays an important indicative role on your property price in the future because WHERE you live mirrors HOW you want to live.

Makes sense? Choose one that's promising.

Areas near Schools, MRT, and Upcoming transformations sweeten that deal.

Purpose

There is a reason for everything.

And Identifying WHY you want to purchase a property - is not just essential. IT'S NECESSARY.

Property investments are not cheap and integrating your life-long plans along with this change , helps you avoid regrets and losses in the future.

So bear these questions in mind:

- How long are you intending to hold on to the property?

- Is it going to last through primary school for your kids only OR

- Do you intend to stay for the next 10 years of their education?

Property Valuation

You will need to do the math: purchase price, taxes, interest rates.

Do not overlook these costs because you want to make sure you're making more than what. you paid for at the start.

With higher interest rates and higher prices for property, the need to adjust financials is very important.

How we can save in the meantime is also an essential thing to learn.

Profit

In connection with property valuation, ask yourself:

How much do you want to earn, and what does your bottom line (net income) look like over a certain period?

This factor will dictate how long you will need to hold on to your property before selling.

If the plan is to exit in a mid-term plan like 5 to 6 years, then choosing the right property in the next step is crucial to maximize the potential.

New Launch VS Resale

Choose which property yields better results, but also, which can cater to most of your needs and purposes.

There is a saying that “You Can’t have it all”. Wanting to have both high returns while also attaining your needs and wants.

Is just a recipe for you to end up with nothing.

As much as many don't like to hear this, you DO need to make a decision if the property is for your stay for good OR you are buying from an investment point of view.

Why? Because both criteria are very different. Don't you agree?

And if you start to mix both criteria together, you likely will end up with the wrong property or worse.

Property Market

As you go into property investing, you'll need to learn the ropes of the market and read between the lines of the data to ensure you're making the best decisions to maximize your profit.

There are so many data points to look at for property and 1 mistake could make you lose 6 figures easily.

Of course, we can take care of that burden for you because -

Here at Singapore Real Estate Insider,we use a 5-point framework to determine how to enter and exit the property market with our clients.

For every factor which I have mentioned before, you have to remember that it's not an overall reason.

Properties that were sold below its purchase price, to be fair can be the result of a number of isolated reasons -

- The loss might have happened because of the unit's condition, OR

- Perhaps the owner needs to sell it as soon as possible.

And take note.

These cases are very rare nowadays since 2013 because of the various cooling measures preventing any home owners from overleveraging thus unable to pay for the mortgages.

Maybe once in a blue moon, but other than that - its almost unlikely.

So Remember that - you need to do careful research before investing in a significant property in today's market.

It takes more than just guts to move swiftly in this field.

At Singapore Real Estate Insider, we want to see all of our clients succeed. That's why we go through a rigorous process with each one of them, from establishing their purposes and goals in investing, to financial planning to doing the math and backwork to sell at the right price and at the right time.

For all of your property investment concerns, you are welcome to contact me so we can plan this out together to reach your goals.

Click here for a complimentary 20-min consult with us.