Have you ever experienced that moment when you're super excited about buying a condo, but you're not quite sure where to begin?

Did you find yourself lost in a sea of information during your research? It can be overwhelming but don't worry, you're not alone!

Read on as I break down the 5 important factors you should consider when evaluating a condo's potential for future profitability.

Are you curious to know the secrets to buying the best property?

The allure of real estate is undeniable, whether you're an aspiring investor seeking financial growth or a family on the hunt for a place to call home.

In this fast-paced world, time is a luxury, and diving into extensive research isn't always feasible, especially for busy professionals like us.

Real Estate is an ever-evolving landscape shaped by economic shifts, social dynamics, and human psychology.

That's why understanding a property's journey through time can provide invaluable insights to help investors like you make wise decisions.

Luckily for you, I've distilled the crucial factors that make or break a property investment into 5 easy-to-follow steps. And yes, we have the tools to simplify the process!

With the help of property data tools like Investment Suite, we can analyze how a property can perform.

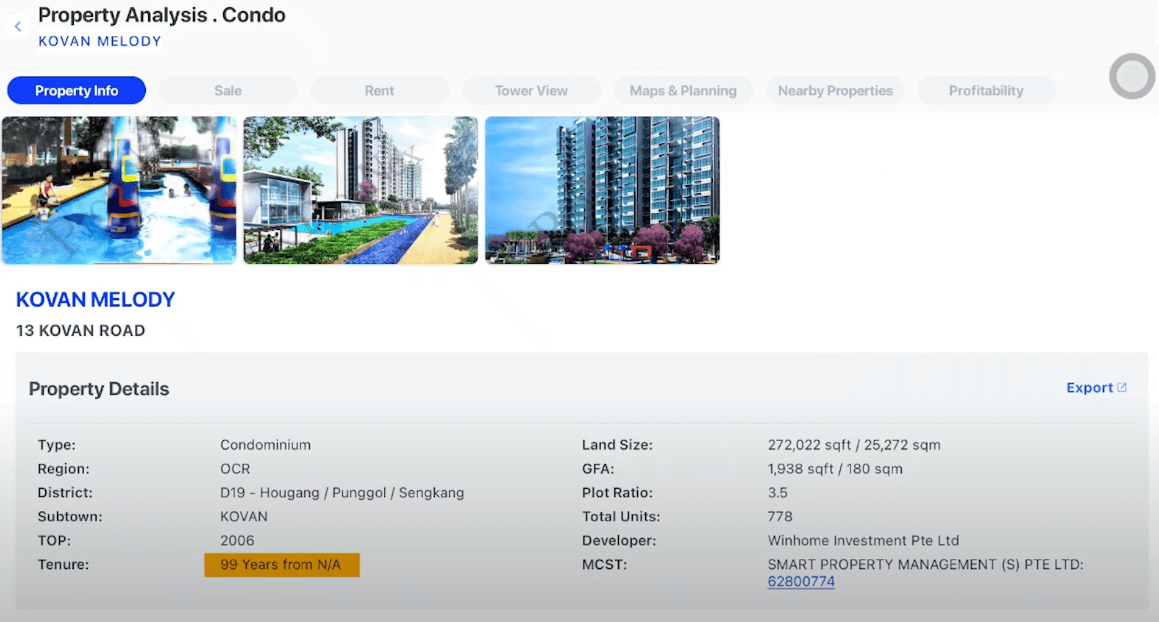

Let’s analyze Kovan Melody and uncover how various factors have molded its trajectory.

1. Tenure: Your Investment Foundation

Tenure is a critical cornerstone if you are stepping into real estate investment. (Keep in mind that tenure is distinct from project completion.)

Kovan Melody is a 99-year leasehold that started its countdown, so to speak, in 2004 and was fully realized by 2006.

This means owners receiving their keys in 2006 only have 97 years of tenure left.

2. Development Size

Why does the number of units matter? The quantity of units within a development significantly influences not only its popularity but also the sales volume, which primarily impacts the potential value of your unit. This count also unveils the demand pulse of the area—a critical insight for future sellers.

Although property triumphs or pitfalls can't be solely attributed to this aspect, a general thumb rule revered by property experts is to favor developments with a minimum of 300 units.

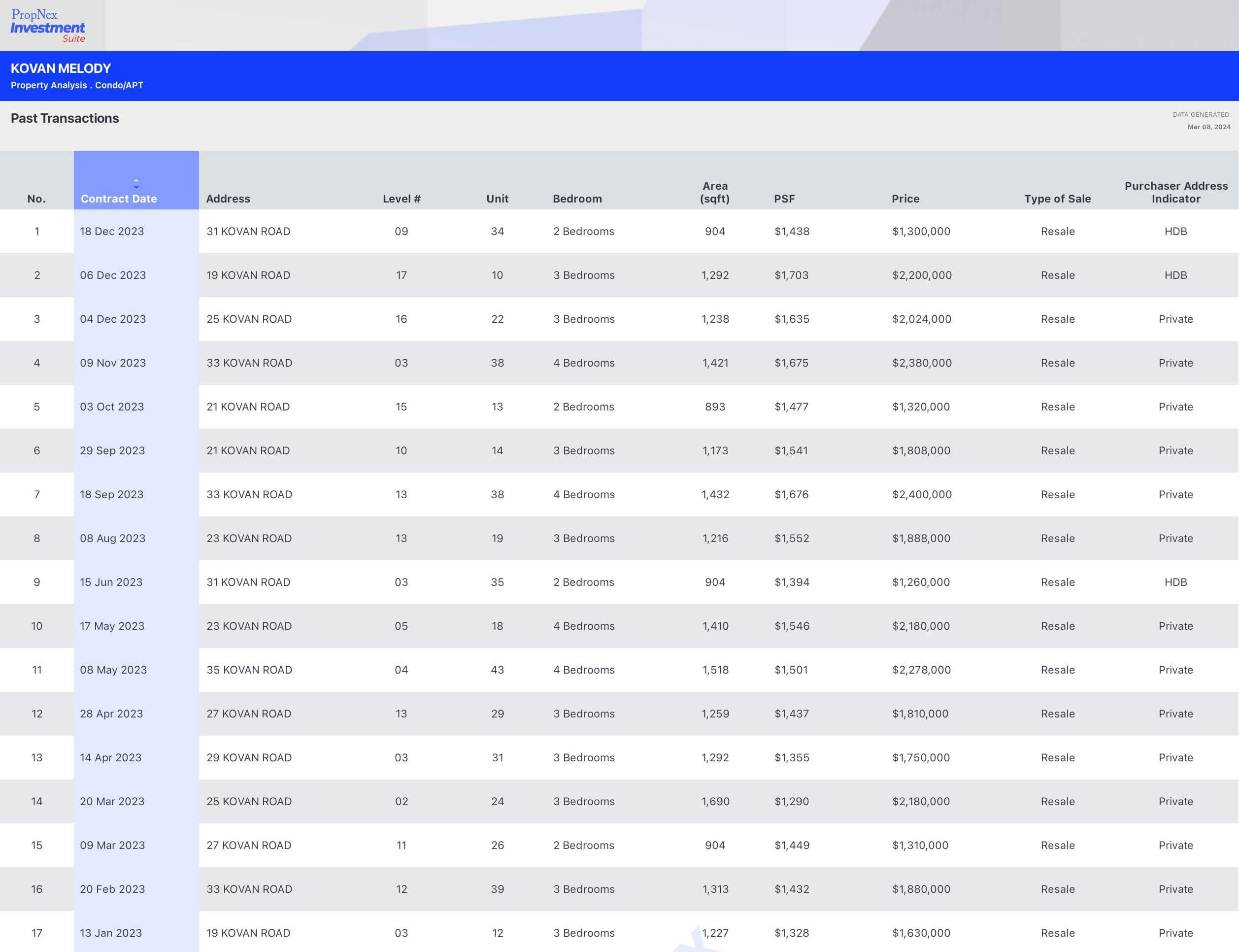

3. Transaction Insights

Numbers speak volumes, especially when it comes to transactions. Looking at Kovan Melody's transaction history, the data reveals a thriving pace of 2 monthly sales. This is an encouraging sign, as this signifies the project's enduring allure even after 17 years since its TOP.

As real estate consultants, we watch for potential red flags:

- Absence of transactions within the last 6 to 12 months

- Unprofitable transactions

- Insufficient transaction volume

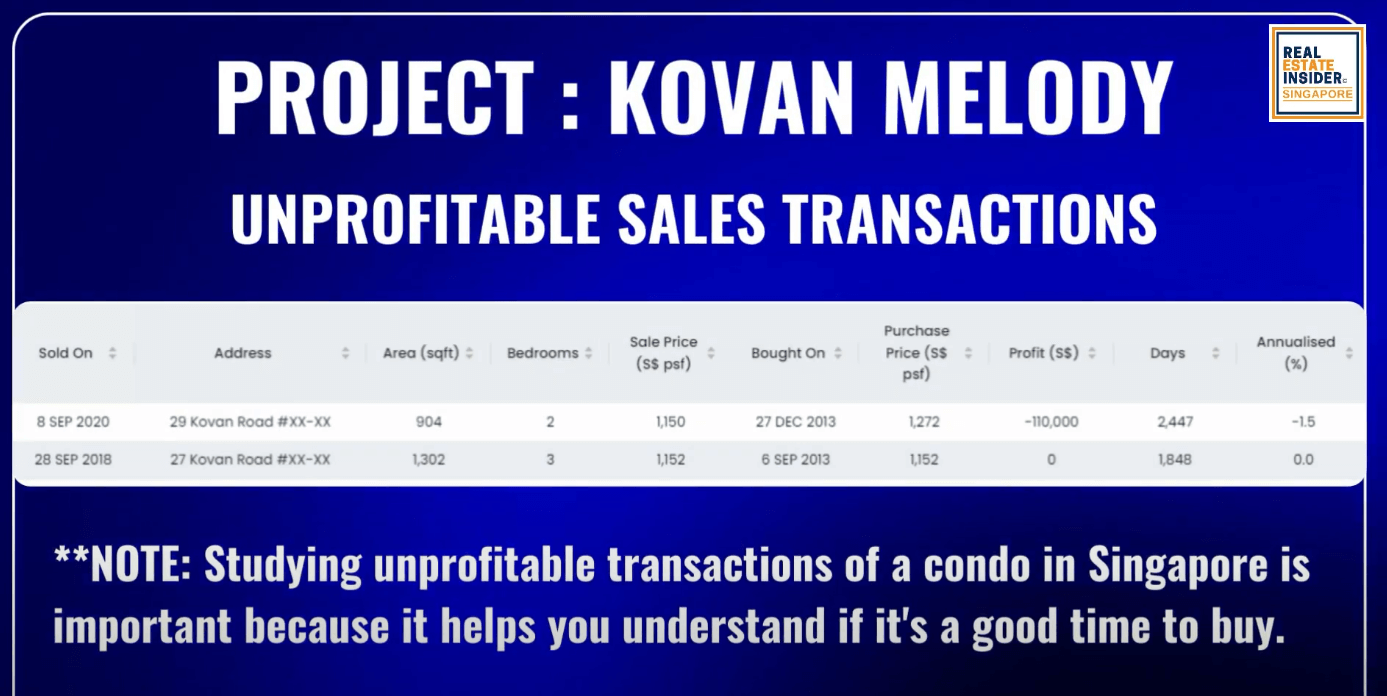

4. Unprofitable Transactions

Kovan Melody has had a total of 614 transactions, 2 transactions of which stand as unprofitable ventures.

Remember, these cases hold multifaceted explanations. These unprofitable sales affirm the property's continuous performance.

If many recent sales didn't make money, it could mean the property market isn't doing well.

You can also learn about potential problems, like bad locations or high costs, and use this information to negotiate a better price.

Plus, it helps you plan your finances better, figure out how to invest wisely, and know when and how to sell the condo if you need to.

In simple terms, it's like checking the weather before a trip – it helps you decide if now is the right time to buy and what you might need to prepare for.

5. Unit Sizes

Defining your property purpose—as a future resale or for your own stay—determines the relevance of unit sizes.

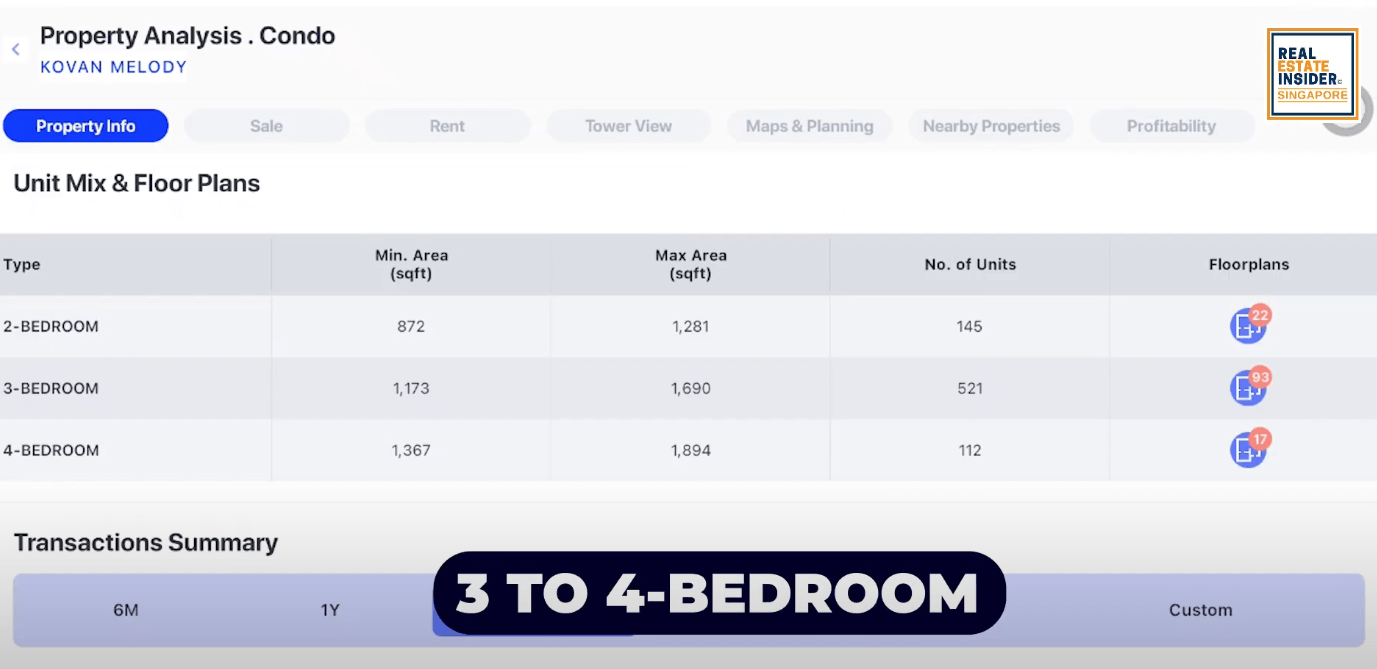

Most units at Kovan Melody are 3 to 4-bedroom units with sizes ranging from 1,201 to 1,300 sqft.

This means that it targeted families looking to stay for an extended period.

And here's your insider scoop: if the property has smaller, compact units, it might signify that the properties are geared towards rental occupancy, potentially impacting growth compared to larger units.

In Summary

Let’s recap - the 5 THINGS TO LOOK OUT FOR to choose a profitable condo are :

- Tenure

- Development Sizes

- Transaction Insights

- Unprofitable Transactions

- Unit Sizes

Remember to keep these in mind, next time you go on another property hunt.

Let Singapore Real Estate Insider help you reach your goals!

Navigating the complex property market requires a deep understanding of economics, buyer behavior, and market trends.

Fortunately, Singapore Real Estate Insider is here for you to offer personalized insights and guidance based on in-depth research and analysis.

Consulting with experts can help investors identify opportunities, evaluate risks, and make well-informed decisions. Invest Wisely and Stay Tuned! Book your complimentary 20-min consultation here.