Is there really a good side to inflation? Isn’t it supposed to decrease the value of money? Every person on this planet is bound to suffer from price inflation as the day goes by. Add to that the impact of the pandemic, Russia’s war on Ukraine, and we won’t be surprised to see a significant increase in the prices of goods.

What if I tell you that there’s a good side of inflation you can benefit from?

First, let me walk you through inflation.

Suppose you need a refresher on your economics class. In that case, inflation is defined by Wikipedia as “a general progressive increase in prices of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money.”

I’m sure everyone has heard of its illustration: think of the value of a plate of chicken rice 20 years back compared to its prevailing price today. How much is the difference? Will your $5 buy as much chicken rice today compared to 20 years ago? $5 is $5, except what you can buy with it two decades ago is far different from what you can get from it in 2022.

A conventional way to measure inflation is through the Consumer Price Index (CPI), which looks at the average prices of a “basket” of goods that people consume. This includes food, clothing, transportation, health care, and other essentials. This is done by calculating the average change in prices in a period and determining the average cost of living as an add-on.

Now, if we look at this from an investment angle, it tells us that it’s not a good idea to hang on to our cash alone. Simply put, money loses its value. Of course, having a liquid emergency fund and enough bills in our pocket will sustain our daily lives, but if you want to grow your money, the best way to do it is by investing.

You want to put your money in assets that could potentially bring in more income for you as their prices inflate. In a study by Yahoo! Singapore Finance, a 1,345 square feet 5-room HDB flat in 1990 was sold at an average of $230,000. Today, a 1,184 square feet 5-room HDB is at $448,700.

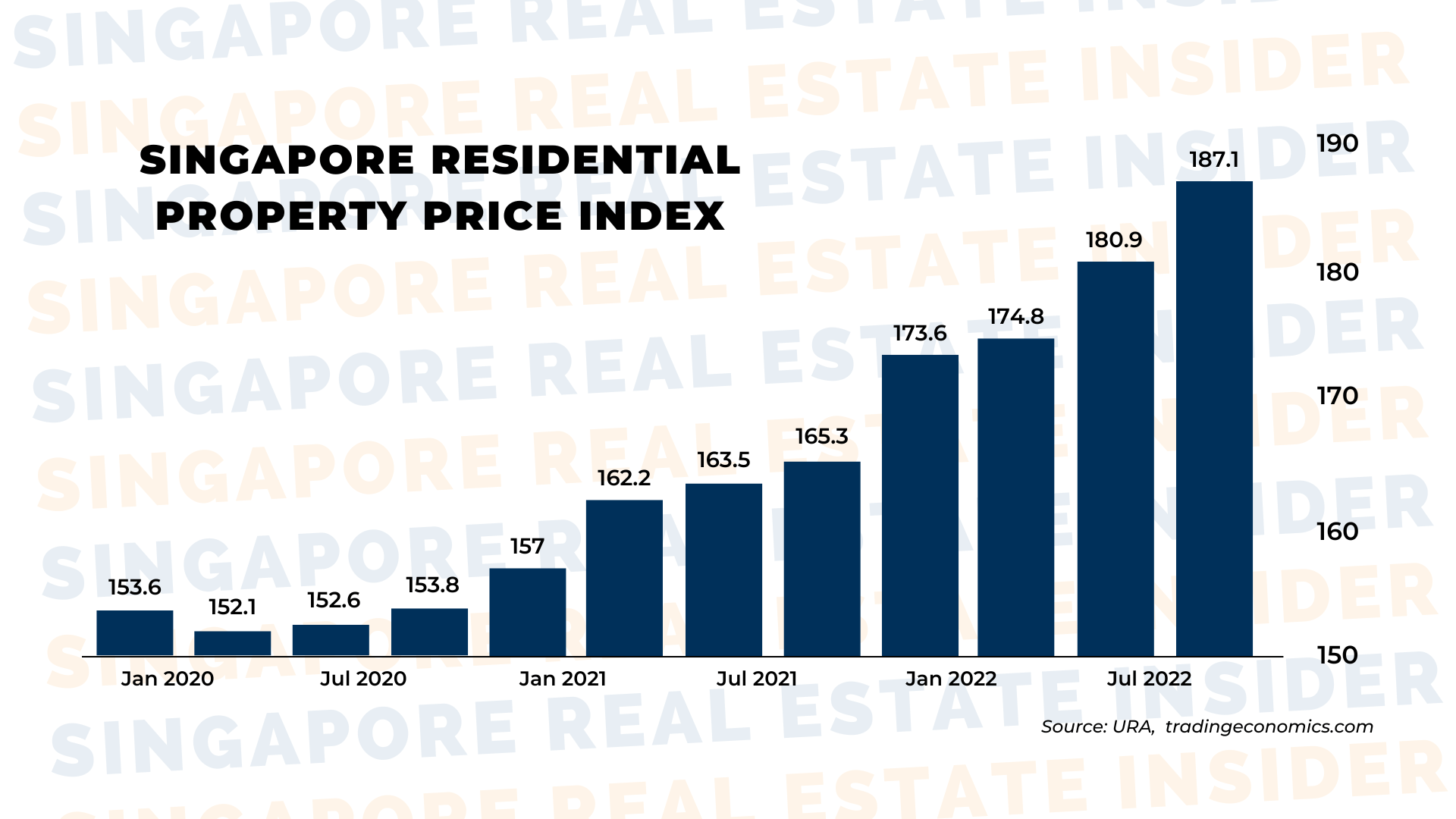

But this is not all the doing of CPI inflation. Inflation is not the same for all goods and services. In fact, real estate prices rose the most compared to the other goods in Singapore.

Another type of inflation drove the rise in real estate prices. It’s called Asset Inflation. It is generally pushed by investors who want to put their money on valuable assets. So, it increases the demand for real estate investments as a domino effect.

Here’s the bad news, according to fortune.com, the U.S. officials announced that “inflation is no longer transitory.” This means it will continue to increase above a moderate rate.

Since the pandemic, real estate prices drastically rose around the world, especially in countries where land is scarce such as our homeland, and Hong Kong.

So, how do we get into the good side of inflation? The elephant in the room is:

“Invest in real estate right now because you can most likely benefit from asset inflation.”

Real estate properties are your best bet in securing your money and potential income. It’s the one asset that’s bound to bring in returns and never lose value. The proof has always been in the data, and it’s all telling us the same thing: put your money into real estate.

If you’re ready to take this leap and secure a good financial future for yourself, send us a message, and we’ll partner with you in achieving your investment goals.

***

Join us in our private group where we help busy professionals and homeowners make six-figure profits in their property, safely.

Property is an ongoing process and journey because they are constantly changing and different strategies must be applied at different times.

Therefore in this group, we not only do weekly live coaching on property, we also cover a wide range of property knowledge and information that we as homeowners must know and be educated on to make informed decisions.

Just click on the button below to join.

Disclaimer: All information presented is based on personal opinions. Singapore Real Estate Insider is not liable for any losses and expenses whatsoever related to investment decisions made by the audience. The ideas presented are here for reference and educational purposes only.