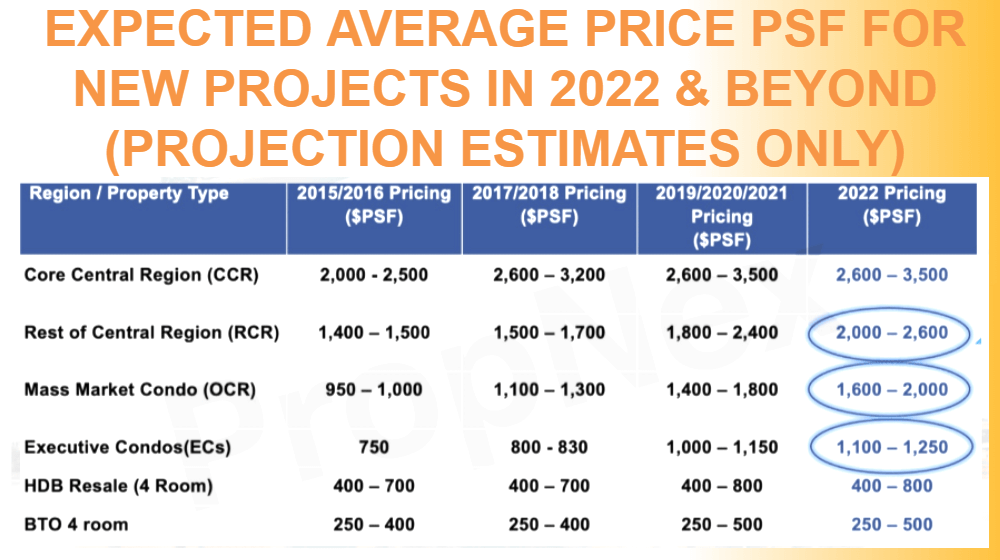

If you have been looking around the real estate market lately, you’ll notice that most new launches start around $2,000 PSF. And I know what’s going on in your mind: will this be the new average rate for properties from this year forward?

One of the most recent launches was the much-Lentor Modern by listed property group GuocoLand. Today, its average sale prices transacted from $2,000 PSF to even $2,500psf, which was a hefty price tag if you were considering it two years ago.

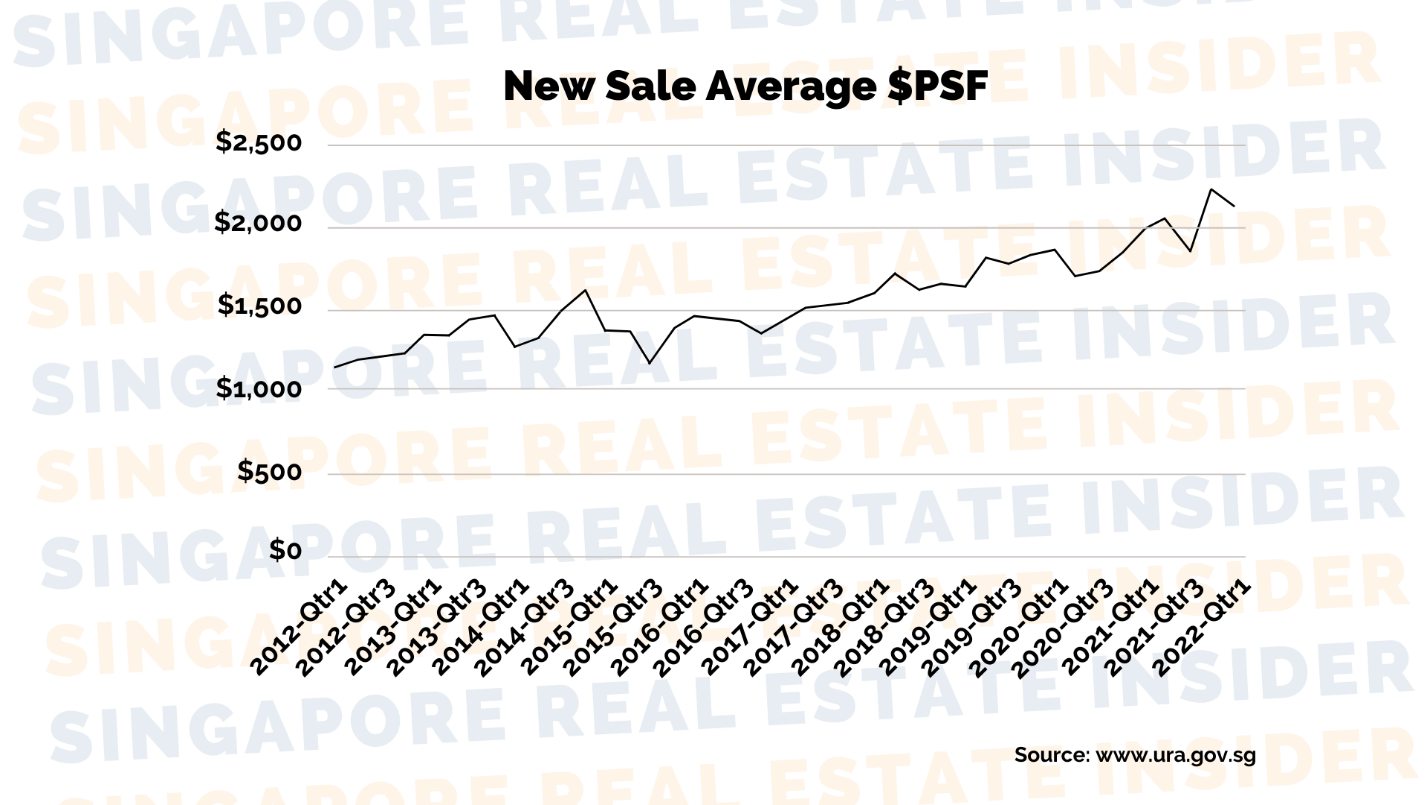

As you know, our current predicament increased the prices of most goods in the third quarter of 2019 and quickly increased by 2021. While some might have been outraged by properties above $1,500 PSF a few years back, our awareness about what’s going on globally might lead us to accept this seemingly new average rate.

According to (URA), properties averaged $2,013.92 PSF at the pandemic’s peak sometime around the first quarter of 2021–this was the highest rate in history, considering that the government has implemented so many cooling measures already to slow down the market growth.

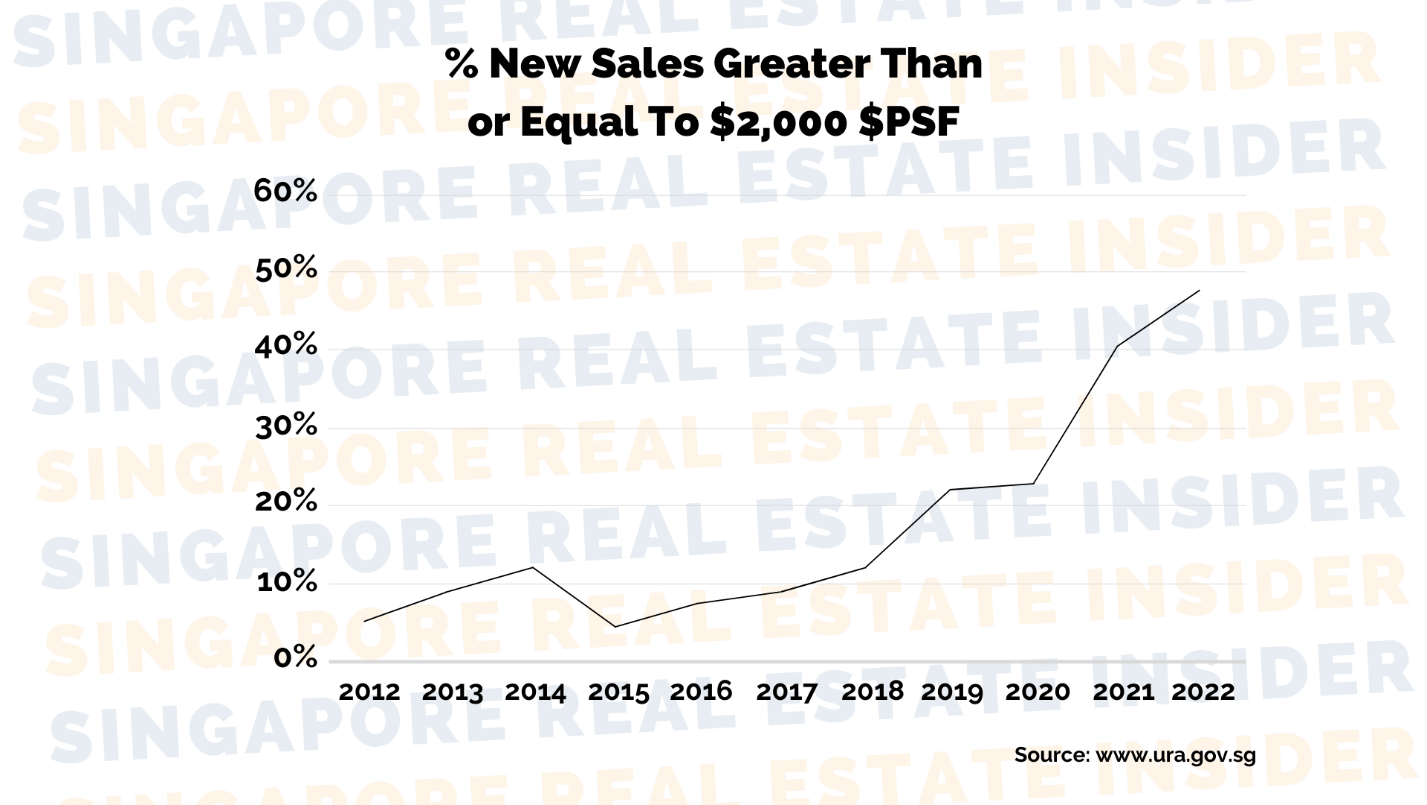

In retrospect, a very minimal number (only 10%) of new launches four years ago would price their properties at $2,000. Back then, these price tags were associated with premium properties and in the Core Central Region (CCR) mostly. And now, almost half of the newly launched properties are picking up the momentum as land cost increases to mark a norm for Outside Central Region (OCR) projects going forward.

I don’t want to rain on your parade if you’re hoping the prices will go down as soon as the proverbial dust settles. Unfortunately, it looks like the trend will only continue to increase in price. Why? Here are a few factors that influence it:

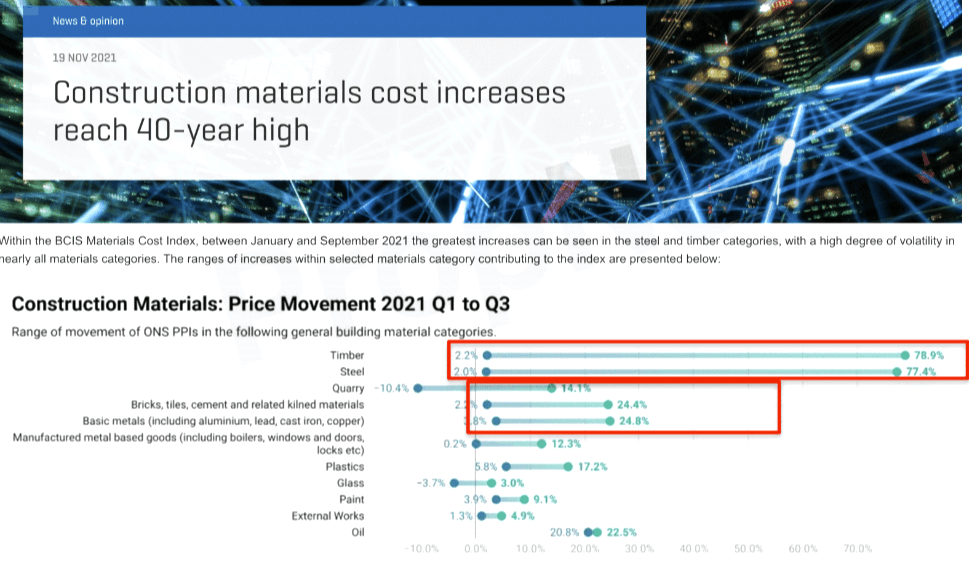

- Our current crisis (Covid-19, Ukraine-Russia War, Sanctions). This has put a dent in the movement of goods, raised the cost of fuel, and increased the prices of other products in a domino effect.

- Higher cost of development. Due to the safety protocols, and long processes, it is even pricier to bring a property to completion. Not to mention, the cooling measures implemented by the government also adds to the expenses such as the ABSD.

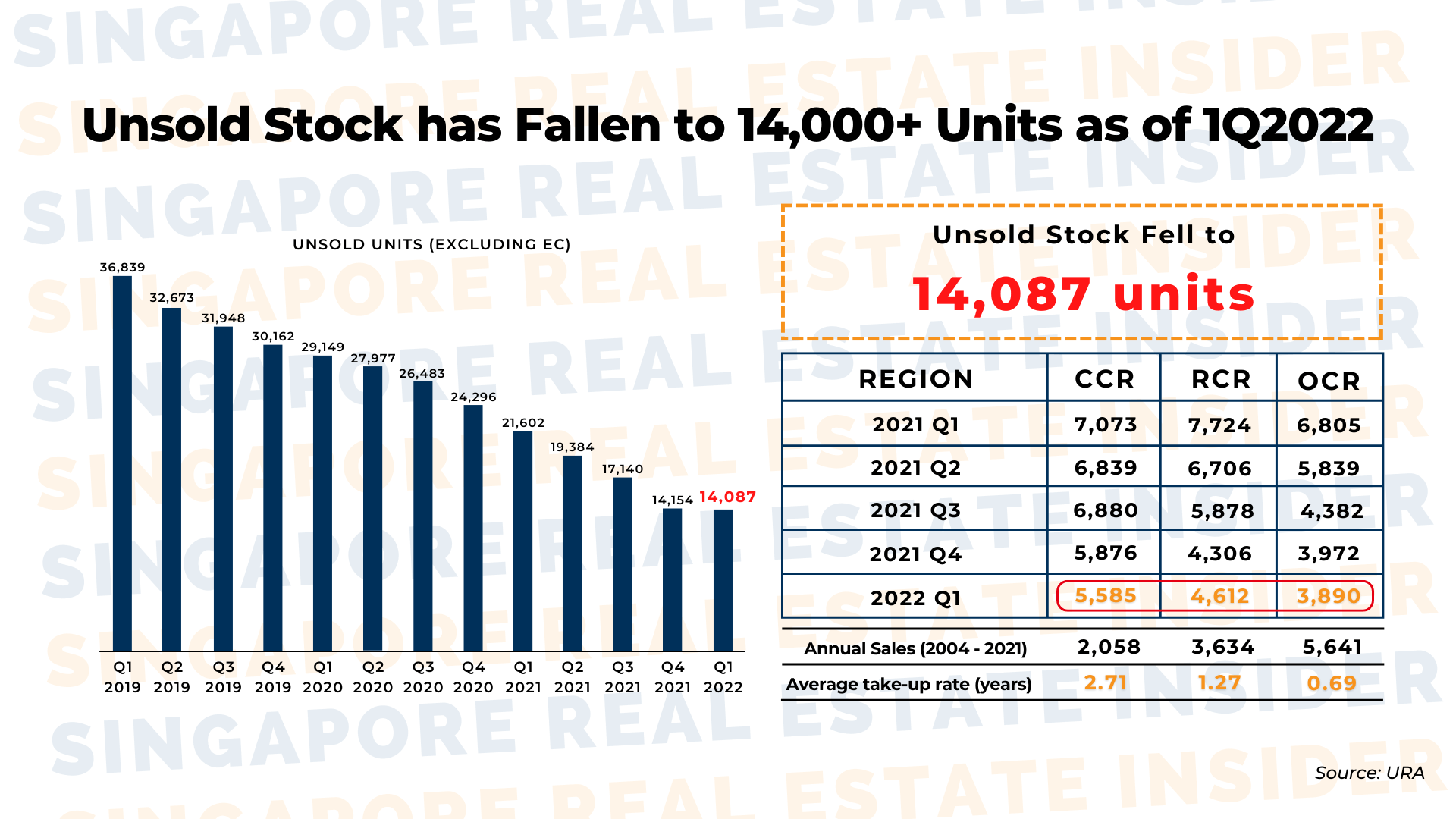

- Shortage of private properties. The government has been holding back land supply (since Singapore has minimal land). Therefore, it creates a deficit in private properties. It sounds wise to conserve. However, our growing population’s demand continues to increase year after year.

Remember that the next crisis will be worse than price peaks like the one we are going through now. At Singapore Real Estate Insider, we want the information we give you to compel you to invest in property in a smart way.

***

Join us in our private group where we help busy professionals and homeowners make six-figure profits in their property, safely.

Property is an ongoing process and journey because they are constantly changing and different strategies must be applied at different times.

Therefore in this group, we not only do weekly live coaching on property, we also cover a wide range of property knowledge and information that we as homeowners must know and be educated on to make informed decisions.

Just click on the button below to join.

Disclaimer: All information presented is based on personal opinions. Singapore Real Estate Insider is not liable for any losses and expenses whatsoever related to investment decisions made by the audience. The ideas presented are here for reference and educational purposes only.