Let me ask the question you have only kept to yourself up to now: “Is it a good time to buy property right now? Even at its highest price to date?”

I invite you to look back at the property prices in the last decade. My last point is very important because I have a case study explained using The REI Method with data and numbers. So read all the way to the end.

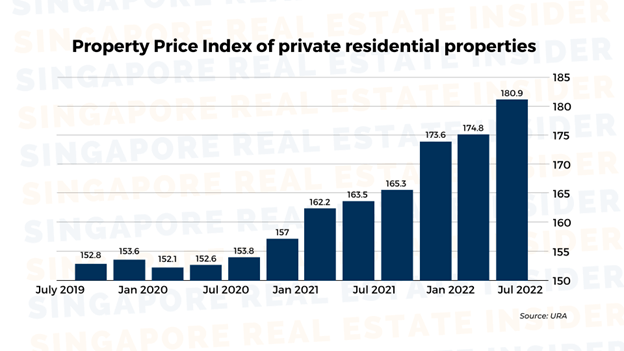

According to Urban Redevelopment Authority, Prices of private residential properties increased by 3.5% in 2nd Quarter 2022, compared with the 0.7% increase in the previous quarter. You can also see the decline in prices from 2014 to early 2018, but a quick, sustained recovery afterward. Last year, private home prices rose by 10.6 percent, sharply picking up from a 2.2 percent growth in 2020. source: Urban Redevelopment Authority

Am I Too Late to Purchase a Property Right Now?

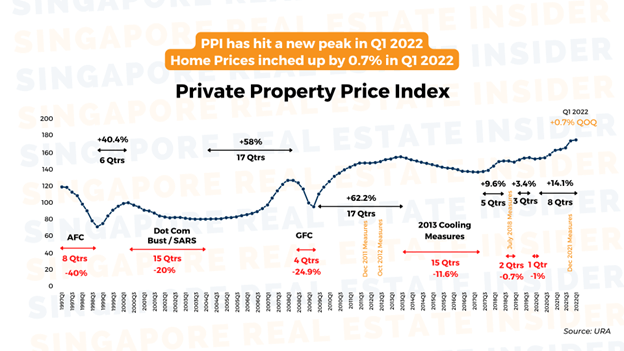

In 2009, many Singaporeans grabbed the opportunity to purchase a home at low rates, thanks to the global financial crisis. Back then, the economy made strategic moves to recover by keeping interest rates and buyer’s stamp duty low.

Next thing you know, citizens were met by a 62% increase in just 17 quarters. That is where in 2013, the infamous self inflicted Cooling Measures was introduced that disrupted how we look at property forever.

Can you remember what were you doing than?

That was where it all happens overnight. TDSR, LTV, ABSD, SSD.

This resulted in a 11.6% decline over 15 quarters.

As we know, whatever comes down will eventually go back up.

2017 graced a growth that is equivalent to the drop in 2013 and had a quick step in just 5 quarters on the increase as the economy strengthened by 2018 and private properties rose again by 9%. Ever the proactive government, Singapore rolled out another round of cooling measures to keep the property market under control.

Yet here is a curious thing: people continued to buy in 2020 after Covid-19 happened despite the craziness that was going around. I mentioned in my previous video that the primary driver of this growth in property sales is the fundamentals of low supply inventory as well as a change in consumer behavior needing bigger spaces, as most Singaporeans experienced work-from-home arrangements and online classes.

Those who bought properties in 2020 benefited from the 7.6% increase in property value in 2021.

If you observe the property price trends in the market, every dip in prices is higher than the previous dip, and every increase is even more higher than the last price hike.

That tells us to take a step back whenever we think about the right time to invest in real estate to see the long-term trend.

Let me give you an example here.

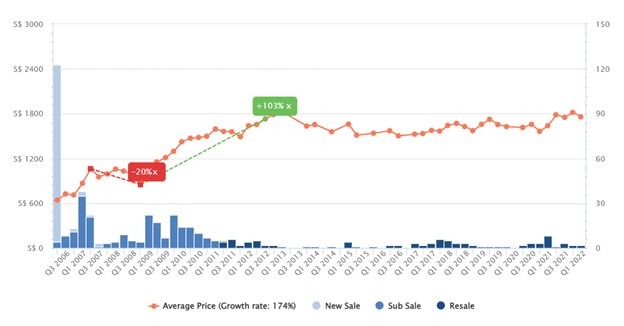

In 2006, South Bank was launched and almost doubled their property values in 2007. However, the global financial crisis dragged this down by 20% at a neck-breaking speed. While some had to let go of their properties, never mind their losses. Yet those who held on for four years witnessed the growth from 2008 to 2012, enjoying a 103% increase in value. That’s more than $500,000 of profit despite the decline in 2007.

Since the country is scarce in land, you can expect that the majority of property investors will not resell their assets at a low rate. The demand will always be high.

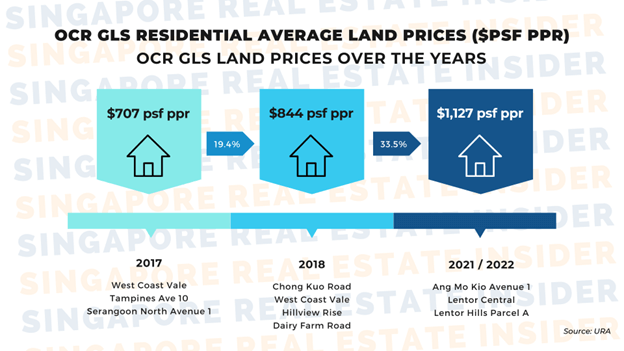

Look at the growth in land cost from 2017. It rose to $844 psf in 2018, and then it’s at an all-time high at $1127 psf in 2021/2022. That’s 33.5% growth!

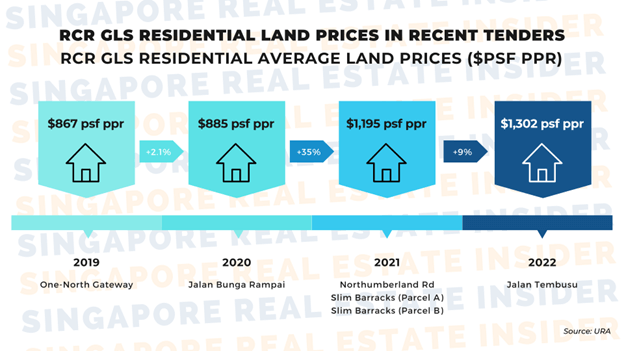

Similarly, in the RCR GLS, it went from $867psf back in 2019, increasing over the years to $1,195psf in 2021 in areas like Slim Barracks parcel A & B.

At the moment, we are experiencing even $1,302 psf in 2022.

What am I driving at? The answer to whether it’s too late to purchase a property is the wrong question to ask.

Why?

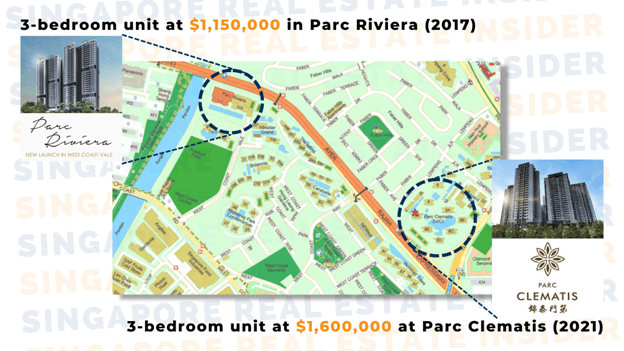

In 2017, you could buy a 3-bedroom unit at $1,150,000 in Parc Riviera. Fast forward to 2021, if you were to buy a similar 3-bedroom type of property, it will at least cost you $1,600,000 at Parc Clematis, just across the former.

Can you imagine the difference in just 5 short years?

What if you are on the receiving end and you are making that kind of profit instead?

How will that make a difference in your family and also your next stage of life?

Because what we should be asking is not ‘if it’s too late to buy property?’ but more of

‘If I buy now?’

- How will property prices continue to rise in future?

- What type of property should I look at to achieve similar growth?

- How to protect the value and price of the property overtime?

When you invest in properties, the best time to buy, cliché as it sounds, is ALWAYS 5 YEARS AGO. The next BEST TIME is NOW. You want to lock in that present rate, rather than the surely higher future rate.

Does this clear your doubts about property? Let’s talk about your best opportunities.

Contact us, and we’ll be glad to take you through a proven process. The REI Method.

***

Join us in our private group where we help busy professionals and homeowners make six-figure profits in their property, safely.

Property is an ongoing process and journey because they are constantly changing and different strategies must be applied at different times.

Therefore in this group, we not only do weekly live coaching on property, we also cover a wide range of property knowledge and information that we as homeowners must know and be educated on to make informed decisions.

Just click on the button below to join.

Disclaimer: All information presented is based on personal opinions. Singapore Real Estate Insider is not liable for any losses and expenses whatsoever related to investment decisions made by the audience. The ideas presented are here for reference and educational purposes only.