Am I too old to purchase a property in Singapore in my 40s?

Sure, you may not bounce back from workouts and travel as quickly as you did in your 20s, but I'm here to tell you that you don't have to limit yourself.

Is it risky to purchase a property in your 40s?

Making such a milestone decision may be scary after you past your "prime years," but buying a property in Singapore in your 40s is not inherently risky.

However, it comes with certain considerations. After all, they say, "Life starts at 40!"

You'd be surprised to learn that many Singaporeans start their homeownership journey later in life when they're ready to upgrade to a private property.

In this blog, we'll discuss the barriers you may face in purchasing a property and how to overcome them.

People in their 40s may face several barriers when buying a property in Singapore, which may arise from many factors, including financial considerations, changing life circumstances, and market conditions.

Here are some common barriers:

Affordability

Consider that property purchases in Singapore typically require a substantial down payment, depending on the property type and whether it's a first or second property purchase.

Meeting these down payment requirements can be challenging for some buyers because they may have other financial responsibilities, such as supporting children's education or saving for retirement, which can limit their ability to allocate funds for a property purchase.

However, by your 40s, you likely have a more stable financial situation than your younger years. This can make it easier to qualify for a mortgage and manage the financial responsibilities of property ownership.

Loan Eligibility

Mortgage loan eligibility can be a barrier, especially if individuals have existing debts or lower credit scores.

Before approving a home loan, lenders assess:

- Applicants' creditworthiness,

- Income stability, and

- Existing financial commitments

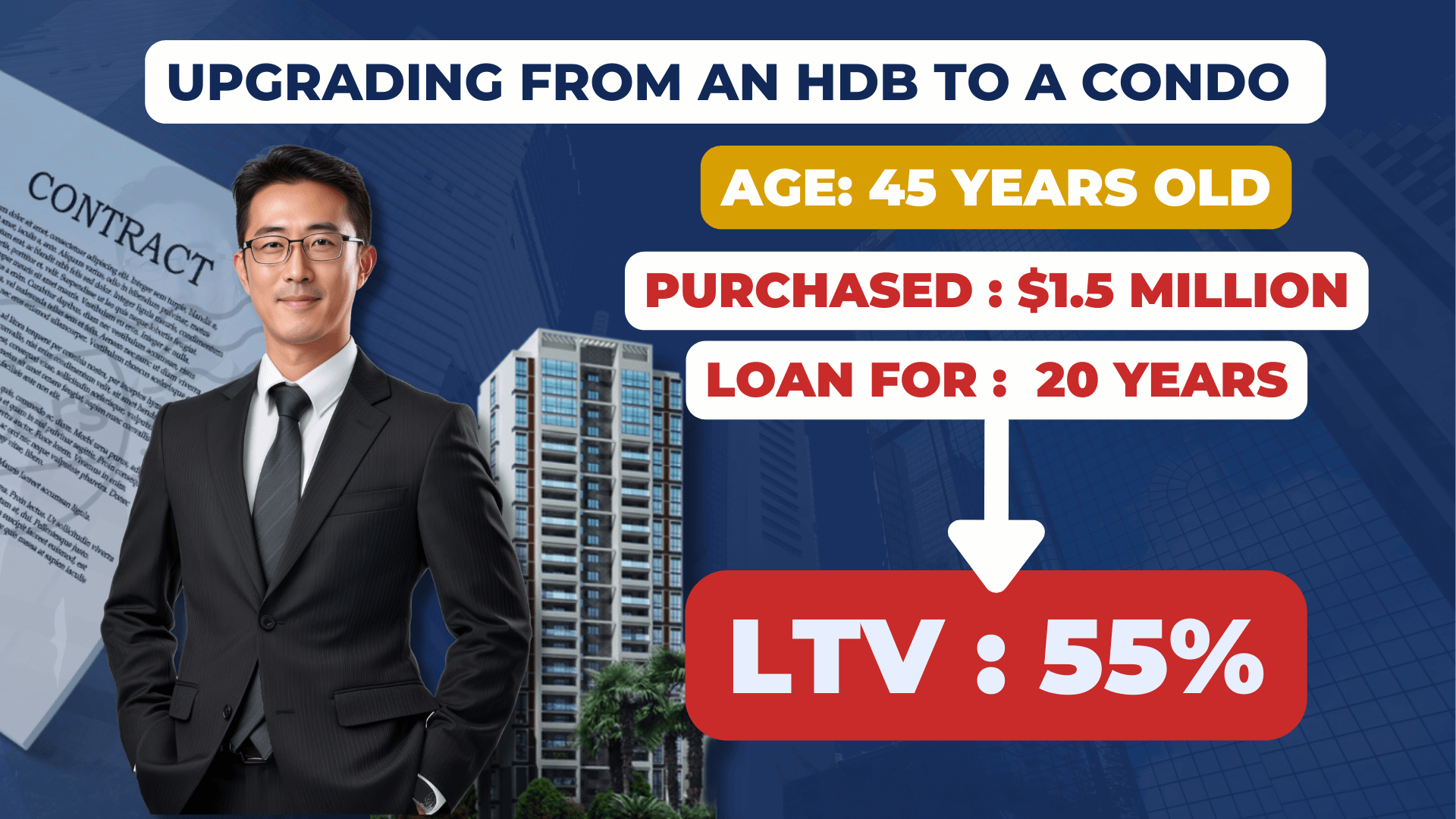

LTV

Buyers in their 40s may have limited loan tenure options due to their age.

Singapore's regulations restrict loan tenures that extend beyond retirement age, which can result in higher monthly mortgage payments.

Currently, the maximum LTV for bank loans is 75%, but it gets more complex for older buyers with loan tenures extending beyond age 65.

For example, suppose you're upgrading from an HDB to a condo at 45 years old and desire a 20-year loan. Your LTV drops to 55, affecting your down payment and monthly repayments.

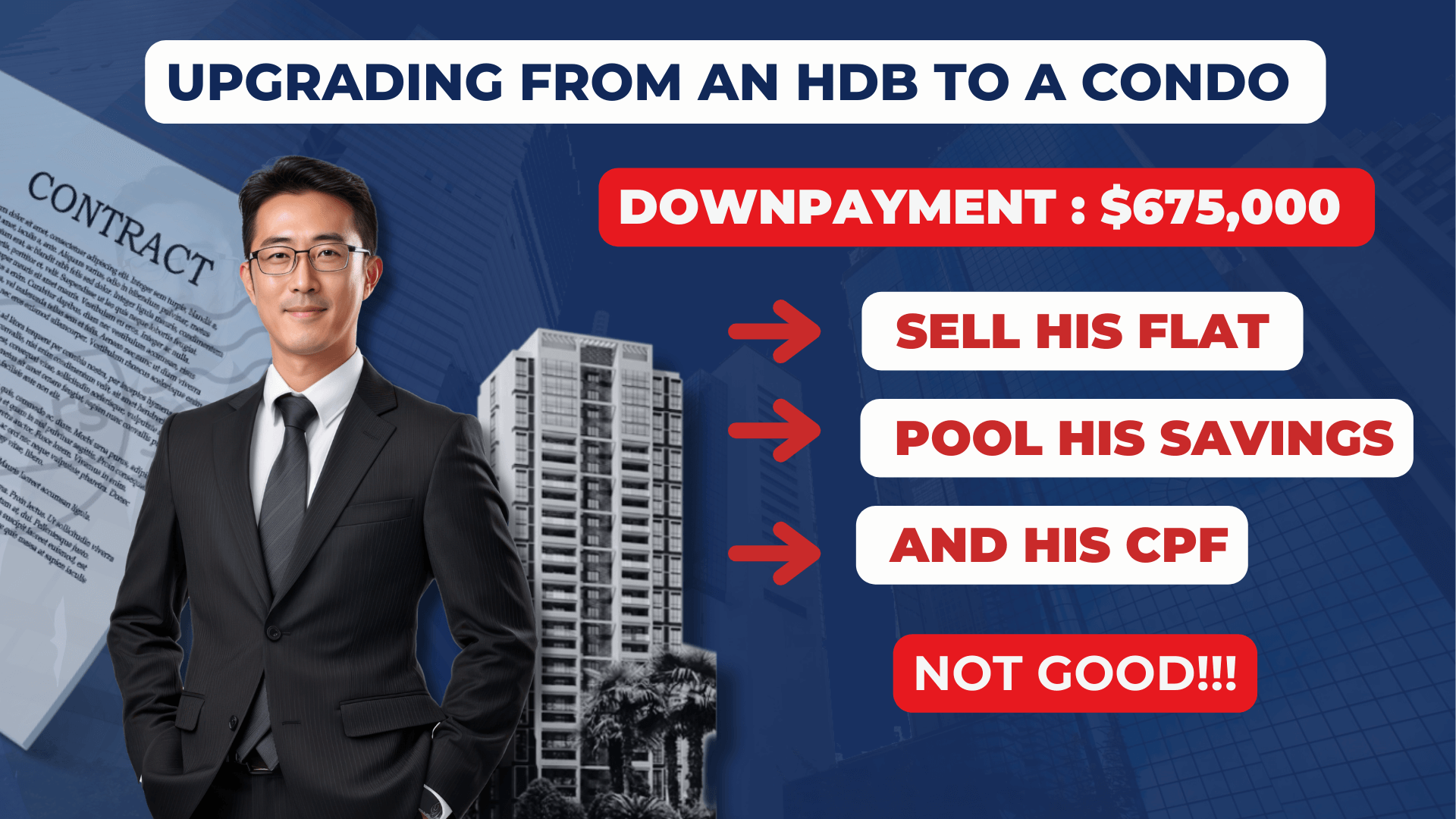

Larry is 45 years old and decided to purchase a private condo at $1.5 million. He wants to stretch out the payment to 20 years, so his LTV dropped to 55%. He needed to pay the downpayment of $675,000 by selling his flat and pooling his savings and CPF.

Regarding financial planning goals, homebuyers must be practical, weigh the pros and cons, and wisely decide if they should lower the tenure and make higher monthly repayments or reconsider their property.

Changing Family Dynamics: Choosing the Right Type of Property

Family circumstances can change as individuals age. Children may move out for education or work, impacting housing needs and preferences.

This can lead to uncertainty about the required size and type of property, which leads homebuyers to thoroughly consider their kind of property.

Would you really need a freehold property? Plan to live comfortably for the long term without having to pay excessively for things you won't be using so much in the long run.

Retirement

Balancing property ownership with retirement planning is crucial. Some individuals may hesitate to commit to a property purchase that could affect their retirement savings and financial security.

But there's another factor about retirement you should consider - the place and lifestyle.

How do you want it to look like? More seasoned people take a longer time to adapt to changes. Will the area where you're purchasing your property be the right one for you and your lifestyle?

Property Maintenance

Maintaining a property can be challenging as individuals age.

Multi-storey homes with stairs may become less practical, leading to concerns about accessibility and maintenance.

In conclusion..

There is always risk in investing at whatever age, but buying property in Singapore in your 40s can be a sound financial decision if you plan carefully, assess your financial situation, and consider your long-term goals.

As we always say in Singapore Real Estate Insider, thorough research and consultation with experts like me to make informed choices that align with your unique circumstances and aspirations will make a world of difference in your investment and portfolio.

Reach out to us today! Click here to book your complimentary consultation with us.

Invest wisely and stay tuned!