BANKS in Singapore have started a mortgage war, spurred by the lower interest rate for a longer duration, to the delight of the legions of home buyers who are pouring back to a buoyant residential market.

DBS no longer sole provider in three-year fixed-rate space; BOC’s package has varying yearly rates; OCBC conspicuous by its absence.

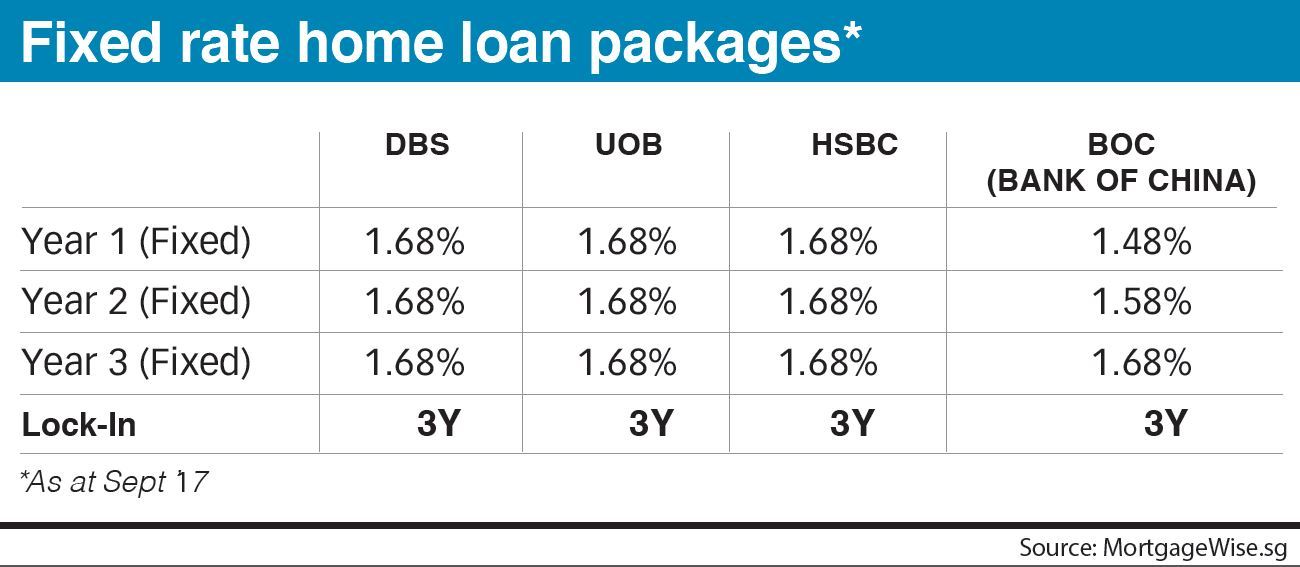

Last week, both United Overseas Bank (UOB) and HSBC launched three-year fixed-rate home-loan packages which until now had been mainly the preserve of DBS Bank, the nation’s largest housing-loan provider. Bank of China (BOC) also has a three-year fixed-rate package but with varying yearly interest rates.

UOB and HSBC have joined DBS in selling three-year fixed-rate packages of 1.68 per cent for each of the three years, capitalising on the recent drop in interest rates amid doubts of further rate hikes by the US Federal Reserve.

The key three-month Sibor (Singapore interbank offered rate), which is used to price home loans, has fallen and been range-bound at 1.12283 per cent from a year high of 1.13717 per cent reached in July.

The total number of private homes sold in both the primary and secondary markets reached 6,905 in the second quarter of this year. This was the highest quarterly sales figure since the second quarter of 2013, when 6,945 units were transacted before the total debt servicing ratio framework was introduced in late-June that year.

The 6,905 private homes sold in Q2 2017 reflected increases of 32.7 per cent quarter on quarter and 51.8 per cent year on year.

In the first half of 2017, the transaction volume in both the primary and secondary markets was 12,107 units, up 63.7 per cent from the first half of 2016.

“When it comes to fixed rates, most lenders will have a two-year fixed-rate package to offer, but in recent years, only less than a handful would dangle a low fixed-rate term of three years due to the higher costs involved in hedging interest rates for a longer period with an improving global outlook,” said Darren Goh, executive director of mortgage broker MortgageWise.sg.

As a result, only DBS and BOC are in the market offering a three-year fixed-rate package, he said.

HSBC came back into the mortgage business in Singapore with a roar last month with an aggressive two-year fixed-rate home loan at 1.52 per cent per annum, and further introduced a three-year fixed-rate this month at 1.68 per cent per annum, noted Mr Goh.

Said Matthias Dekan, HSBC Bank (Singapore) head of customer value management: “HSBC has introduced fixed-rate mortgage packages on the back of home buyers’ demand and their expectations of further interest-rate hikes. Given this environment, customers prefer fixed-rate mortgage packages as they allow home owners to lock in the interest rate for the first two to three years of their loan tenure.”

Mr Goh of MortgageWise, said: “For homeowners, with more lenders joining the fray to offer competitive fixed rates, it keeps the incumbents in check which leads to more choices and lower interest for everyone.”

As for DBS: “We review our home loans on a regular basis to ensure that our rates are aligned with market conditions,” said a spokesman on whether it would change its rates now that rivals have gatecrashed its party.

In May, DBS chief executive Piyush Gupta had said no one else in the home-loan market was able to match DBS’s three-year fixed-rate package at 1.68 per cent.

The largest bank in South-east Asia, DBS has a arsenal of cheaper deposits than its competitors, which would come in handy in a home-mortgage market-share fight.

A UOB spokesman said: “Our range of home-loan packages is designed to suit the needs of our customers. For example, fixed-rate packages offer customers certainty and assurance that their monthly repayment amount will not be affected by market movements.”

OCBC Bank, the second-largest bank in Singapore, remains conspicuous by its absence in the three-year fixed-rate space. It has a two-year fixed-rate package at 2.38 per cent.

Mr Goh noted that banks have recently raised rates for their floating-rate packages, narrowing the gap with fixed-rate loans to within 20 basis points.

“However, there may still be those who would go for floating; for example those thinking of selling their property soon, or those with loans above S$2 million and who believe rates will not rise so quickly or at all,” he said.

At S$2 million, on a straight-line basis, each 10-basis-point saving on a floating rate, over the higher fixed rate, translates into S$2,000 savings in a year.

“Generally, fixed rate is the way forward, until such time this latest fixed-rate war ends, which is when we expect US Fed to announce in its meeting this month to start trimming down its massive US$4.5 trillion bonds,” Mr Goh said. “We think that is when the market will start to see some real upward pressure on the dollar and 10-year yields, with interest rates going north within three to six months of such bond sale actions.

“Homeowners should make use of this window of opportunity now to lock down fixed rates especially for the longer fixed term.”

#unlockrealestatewealthnow #clientsforlife #futureofrealestate #singaporerealestateinsider

This article is taken off www.businesstimes.com.sg

Submit your details below and we’ll get Back to you within 24 hours