So you went for a property upgrade and found out your budget has become a little too tight for comfort. Is buying a newer, bigger property a good idea after all? Or is settling for an HDB the way to go rather than upgrading to private property? Let's analyze this.

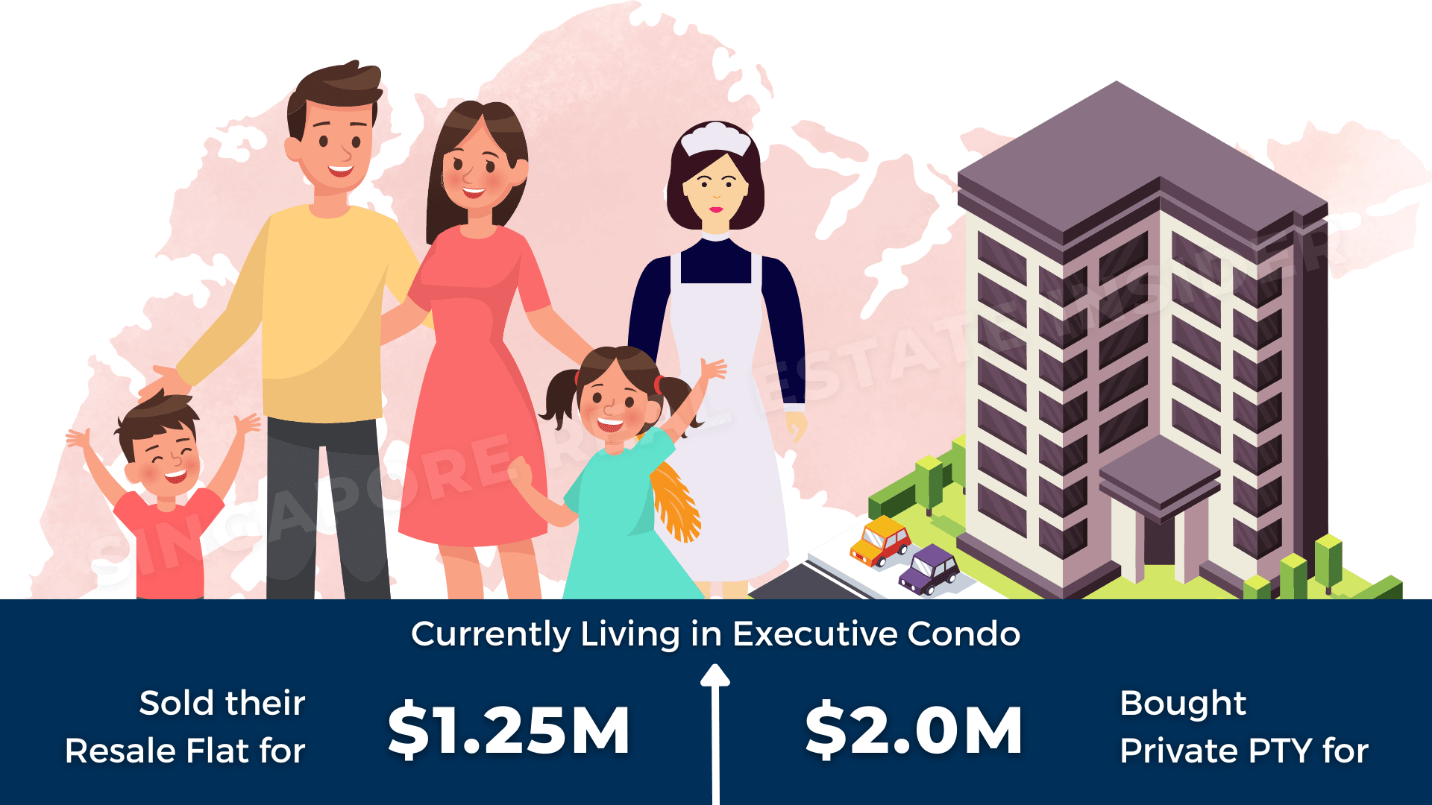

I recently talked with a couple looking to move into a larger property for some time now. Unfortunately, they're sitting on the fence about pushing for it because they're also concerned about the financial responsibilities that come with it.

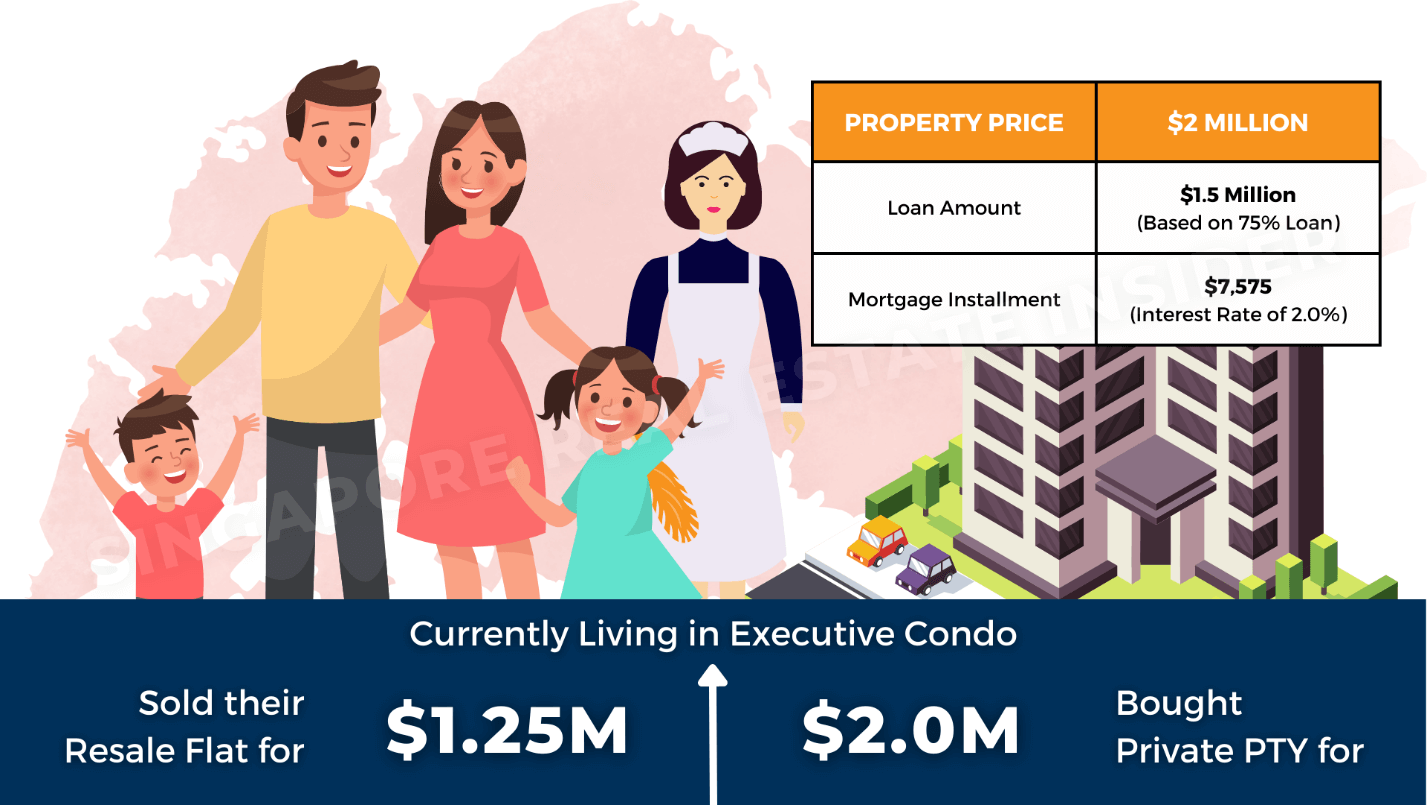

Now, Mar just turned 45. He loaned $1.5 million from his bank for 75% of the total property investment with a 2% interest rate. His installments came to $7,575 every month. He returned to me and said that this monthly fee could strain their budget and asked if they could go for an HDB instead.

MORTGAGE INSTALLMENT + DAILY EXPENSES

MIGHT BE TOO STRESSFUL

Is Downsizing to HDB a Better Choice?

What would you do in the same circumstance? I do not underestimate the amount. $7,575 is a stretch. But let's look at the possible scenarios, shall we?

There are two possible outcomes if Mar and Jess settle for the "HDB" route of downsizing:

First: Mar and Jess could live in their HDB forever. (Hold on to HDB Forever) because by the time another 5 years have passed from the MOP, you will be more worried about your age and loan will be affected. Thus you are more concerned about the limitations and might not want to do anything about your property.

Second: Mar and Jess would future downsize into a smaller HDB when their kids move out. As the kids grow up and have their own family, it's a norm they will move out and start their own home. Which means when we have the family needs now in check, the situation will still change in years to come.

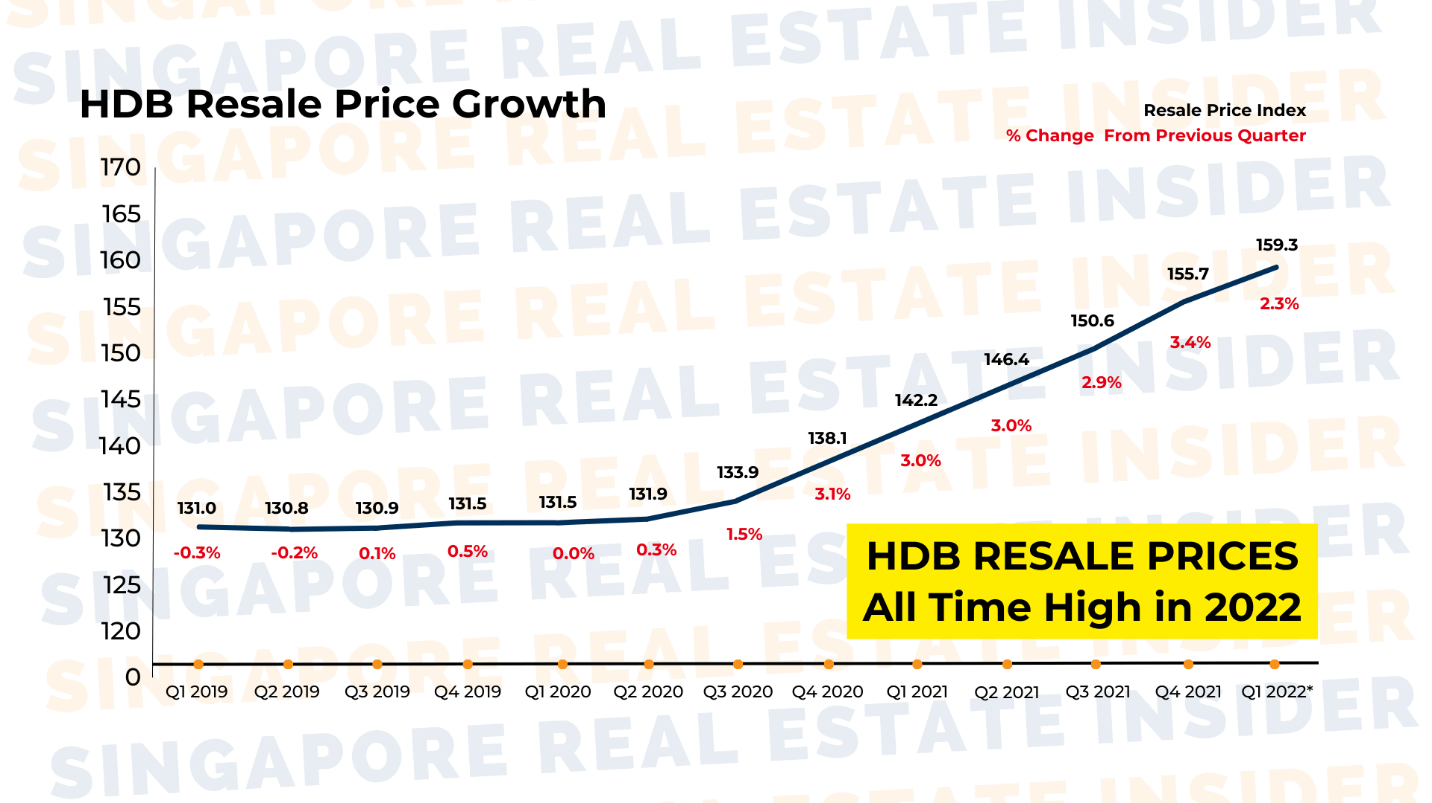

Is that OK for you? Remember, HDB resale prices today are at a record high, and the Singapore government can freely intervene in the HDB regulations and prices.

Their income from selling their EC would have been money down the drain since HDB prices erode as its property age decay.

So what is the best way to solve this? Not upgrade at all? No.

We evaluated the couple's monthly incomes, age and since they both have secure, well-paying jobs, it would be best for them to keep their new private property and change their paradigm around it: that it's a way of forced savings.

VIEW UPGRADING TO A BIGGER PROPERTY AS FORCED SAVINGS.

Ask ourselves, if we have cash in our pocket, will there be a huge possibility we will spend them on different perks or spending extra when we know we have enough. Its a scary thought but many are just not saving enough for the future. Which is why we always advocate forced saving and the way to do it is using property as an instrument.

You will never stop paying your mortgage on a monthly basis right? When structured well, this forced saving approach is you building your own BANK.

Think about it and share your thoughts in the comment below if you agree with this.

But what about the strain? There are two things they can do to manage them:

1. Refinance their bank loan using a structured leverage process. This will work out to be a much lower monthly payment of $5,700 instead of $7,575. Thats alot of savings right?

Surprise to see that there are ways to reduce the monthly commitment?

This is a very important step we take in The REI Method to help families lower their risk level so they will be able to build capital using the property.

2. Combine their CPFs. (Funds Allocation)

Combined CPF: $2,300

From Own Income: $3,000 ($1,500 x 2)

From Reserved Fund: $500

This way, all they need to shell out from each pocket is $1,500. The remaining $500 can be directed from the reserve funds of $150,000 that we have built at the start, which can be a buffer and pay for the bank loan for the next 300 months.

Doesn't that alleviate the financial burden? Can you imagine if they pursued an HDB, they would end up with it at a value of only $700,000 or even lower?

Gladly, they took my advice to upgrade to a $2 million condo. Even if the property price does not increase with no profits (which is unlikely), they would still have their home fully paid for at the age of 65 years old and still have $2m in the asset for their future..

It always pays to evaluate and study our potential when taking a leap such as this. If you don't know how to navigate them, chances are, you'll only end up losing. For all of your property investment concerns, you are welcome to contact me so we can plan this out together to reach your goals.

Click here for a complimentary 20-min consult with us.