We're diving into the age-old question: should you buy or rent a property?

But we're adding a twist to it. We'll be tackling this dilemma through the lens of a young couple, the Lees, who are facing a crucial decision about their daughter's education. So, let's jump right in!

Imagine this – you have a child on the way, and you know that sooner or later, you'll have to consider their education. For the Lees, enrolling their daughter in their school of choice, MGS, is a top priority. But here's the catch: they need to be within a 1km radius of the school. Quite a challenge, right?

Jen and Joseph Lee, a couple with their own investments, are currently living with Joseph's mom in a 3-bedroom unit at Viz at Holland. With a comfortable combined income of $400k per year and $500k in CPF, they have some decisions to make. So, let's explore their options together!

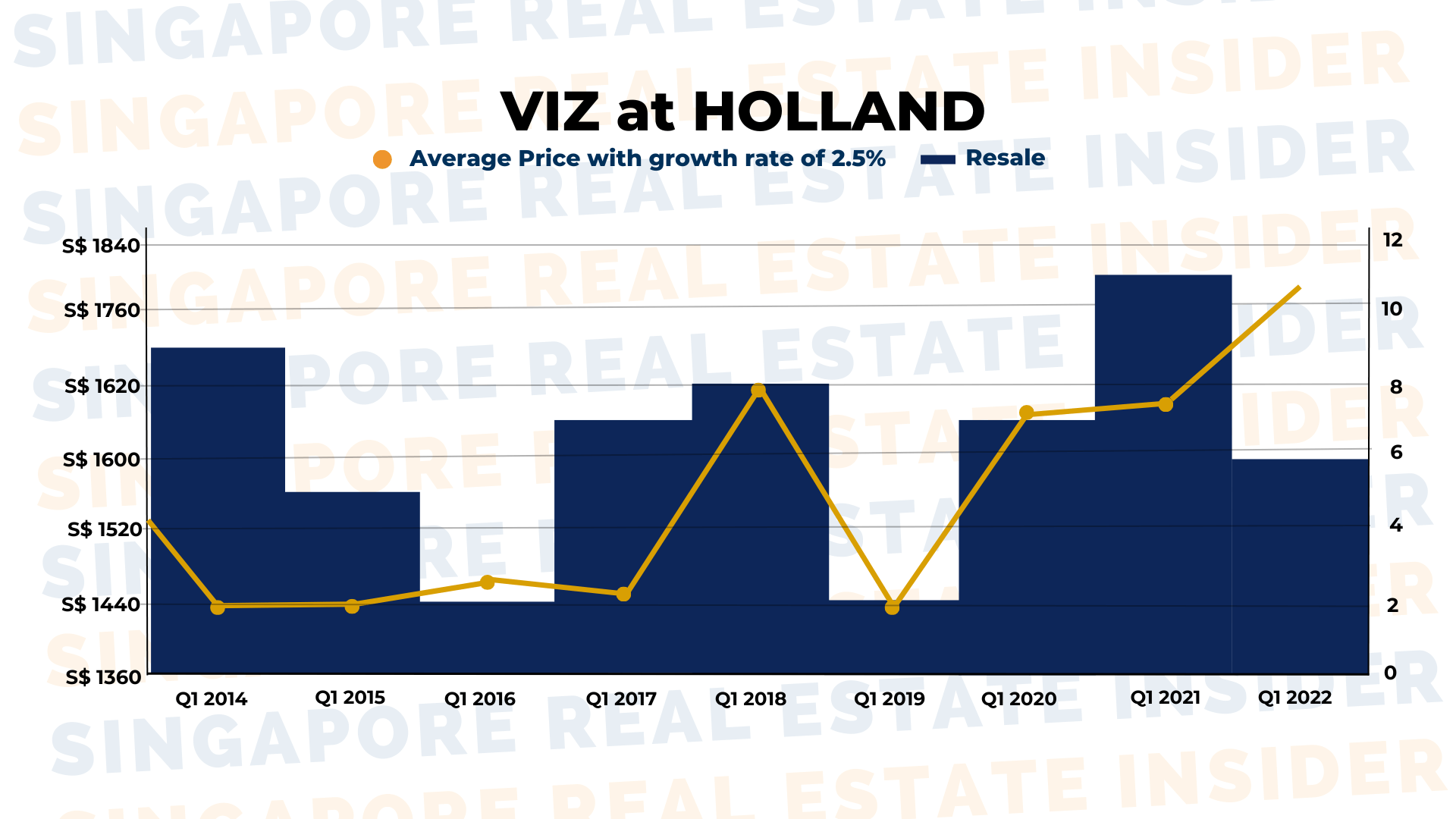

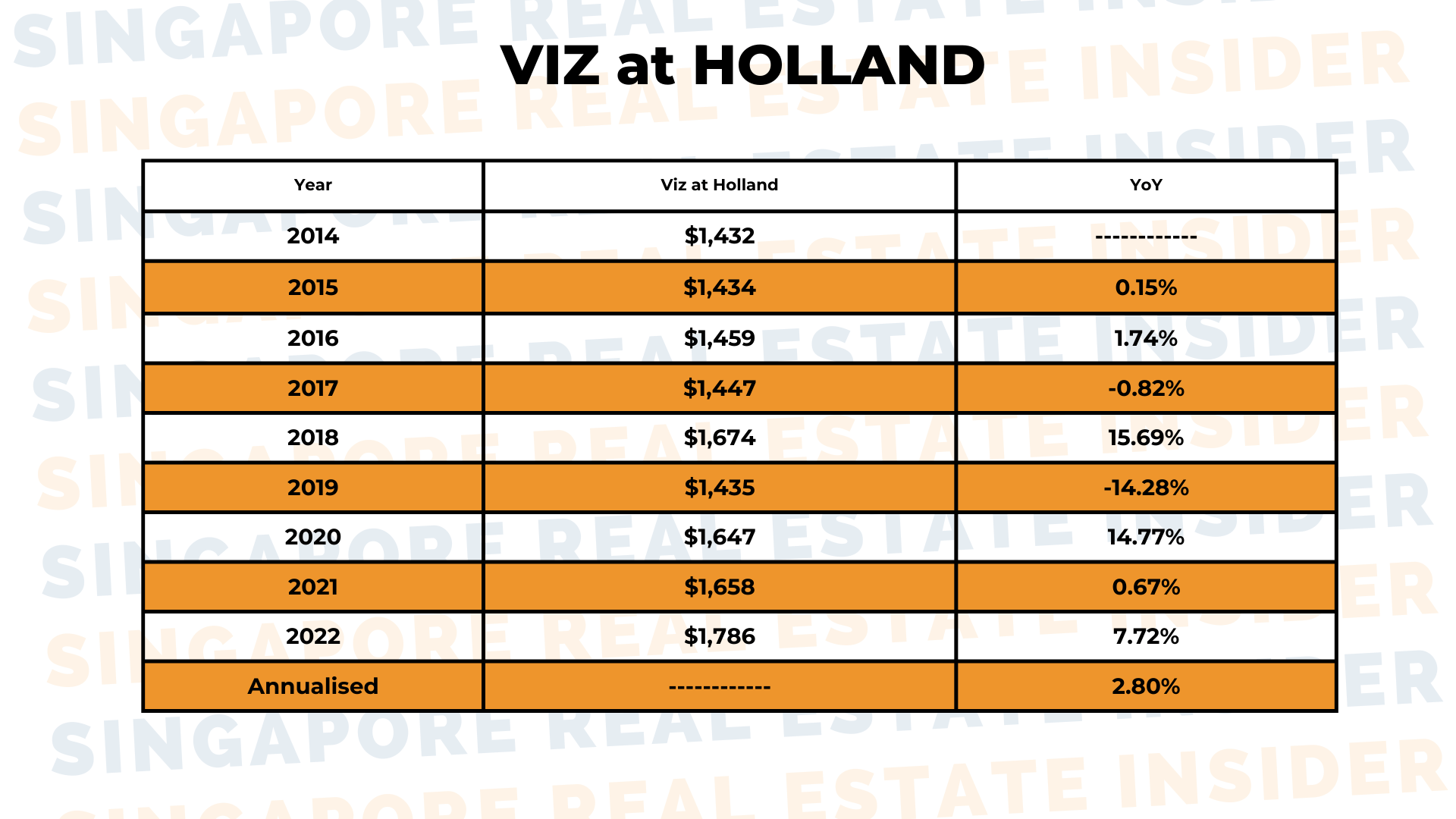

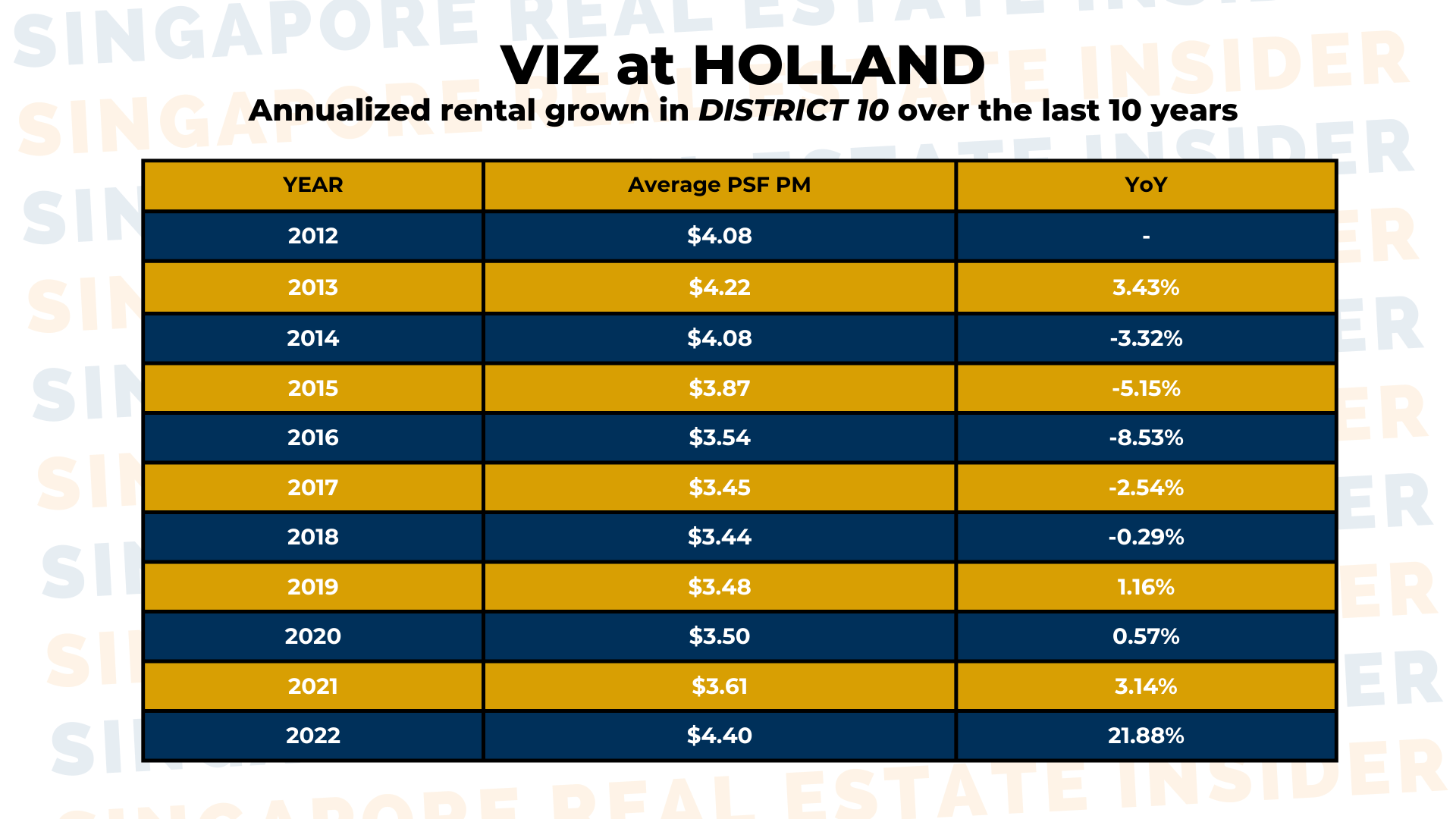

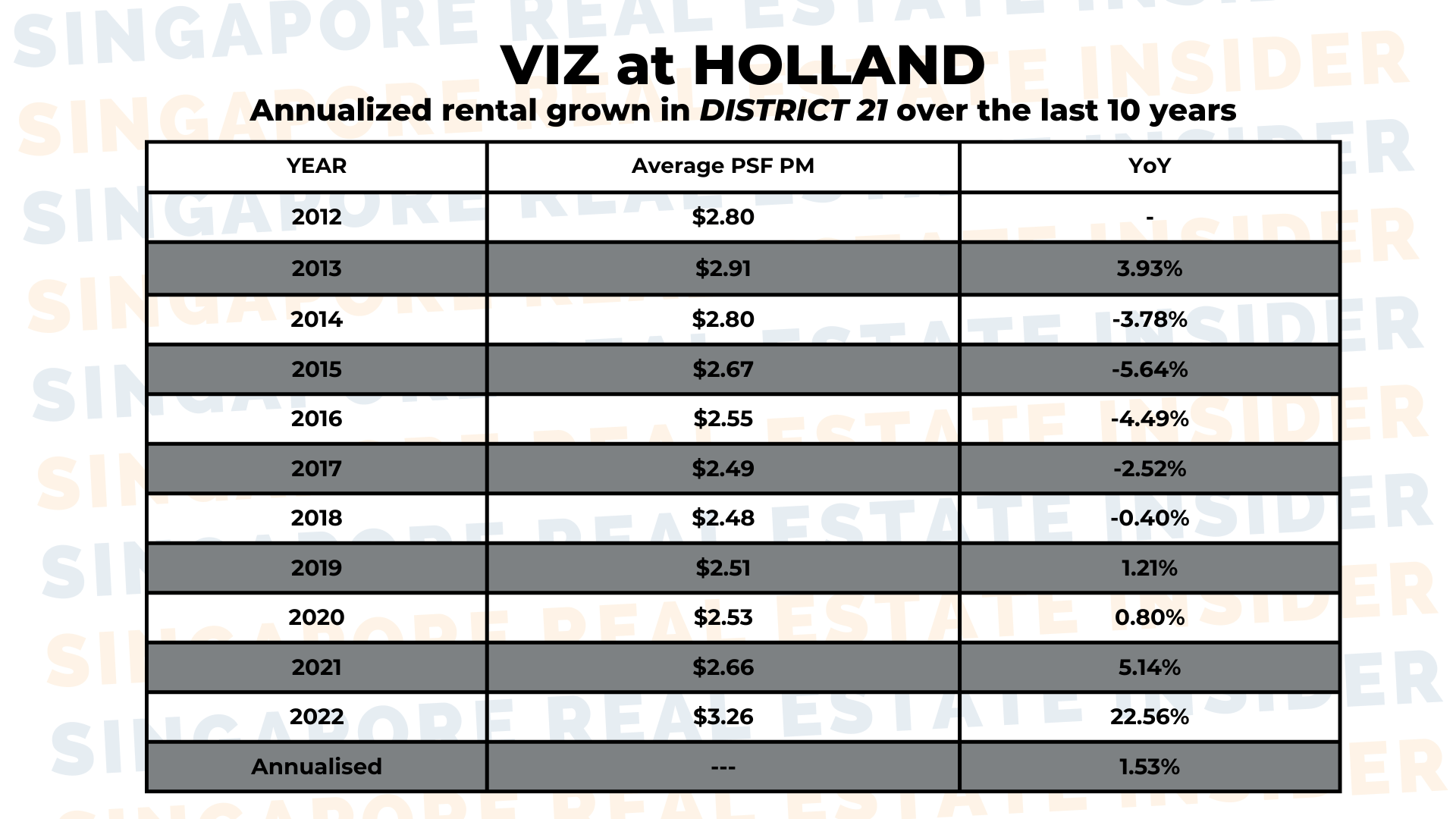

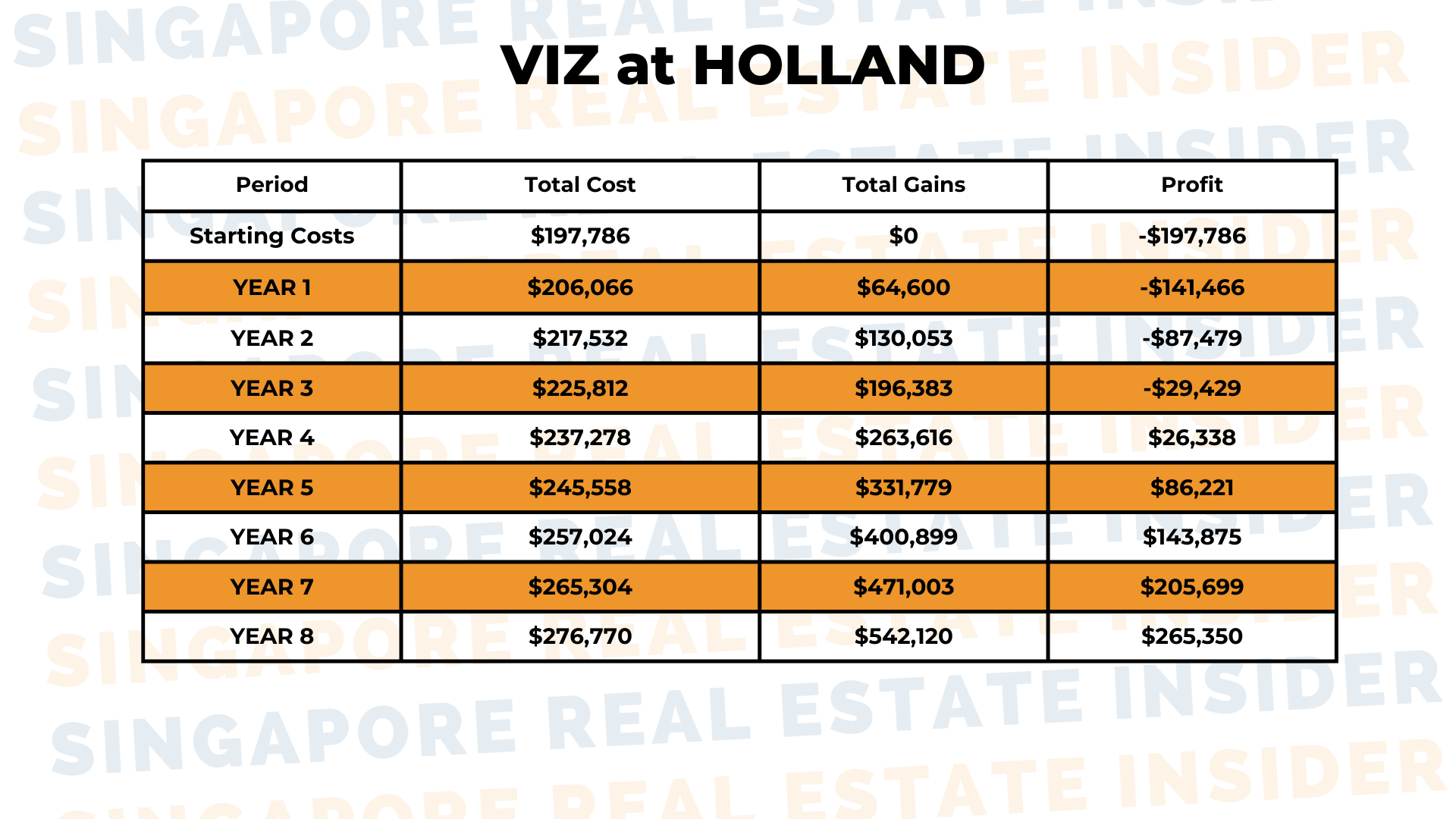

First, let's take a look at how their current property at Viz at Holland is performing. Prices have steadily grown over the years, with a 25% increase since 2014. However, the annual growth rate has been relatively modest at 2.8%.

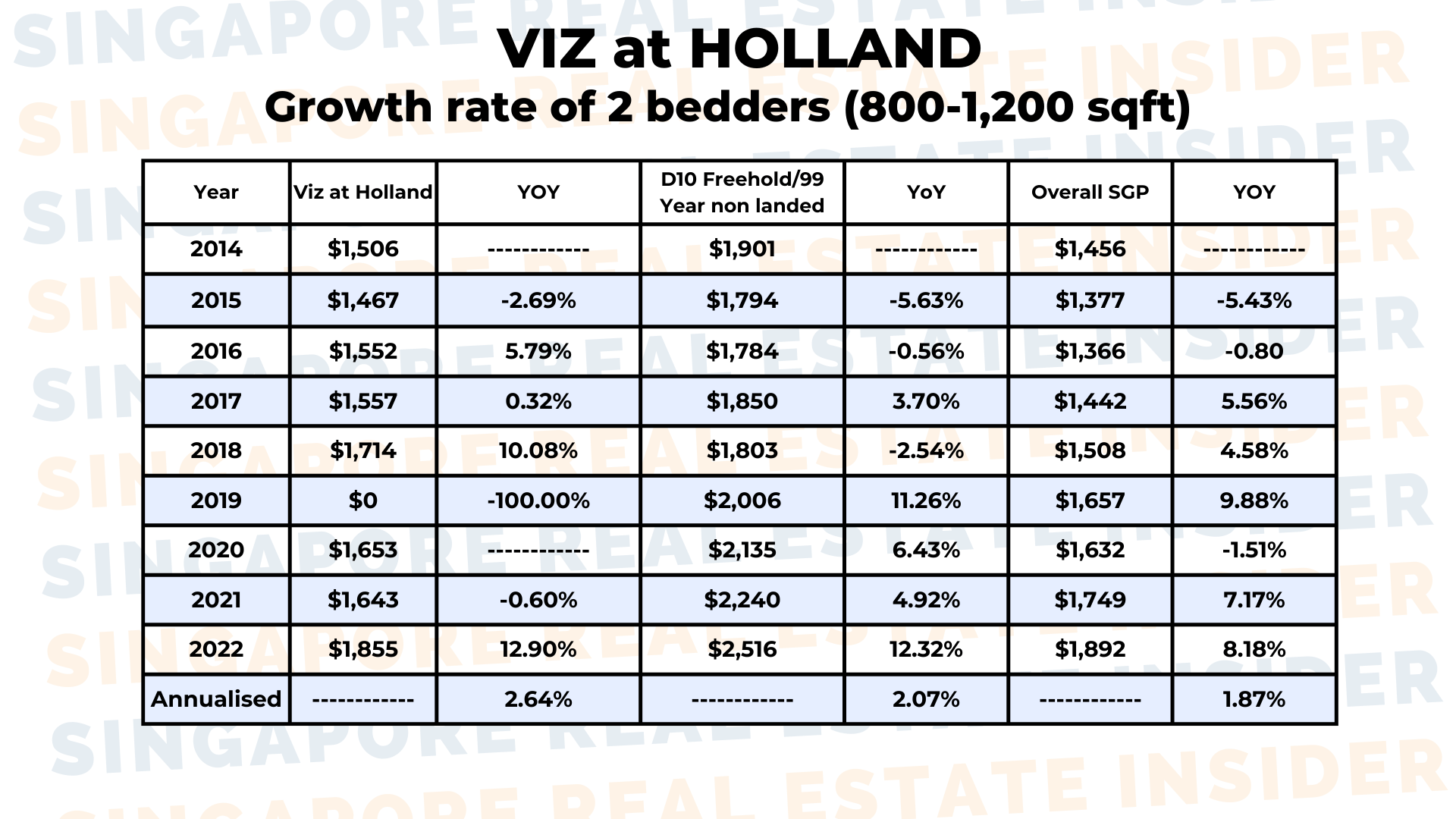

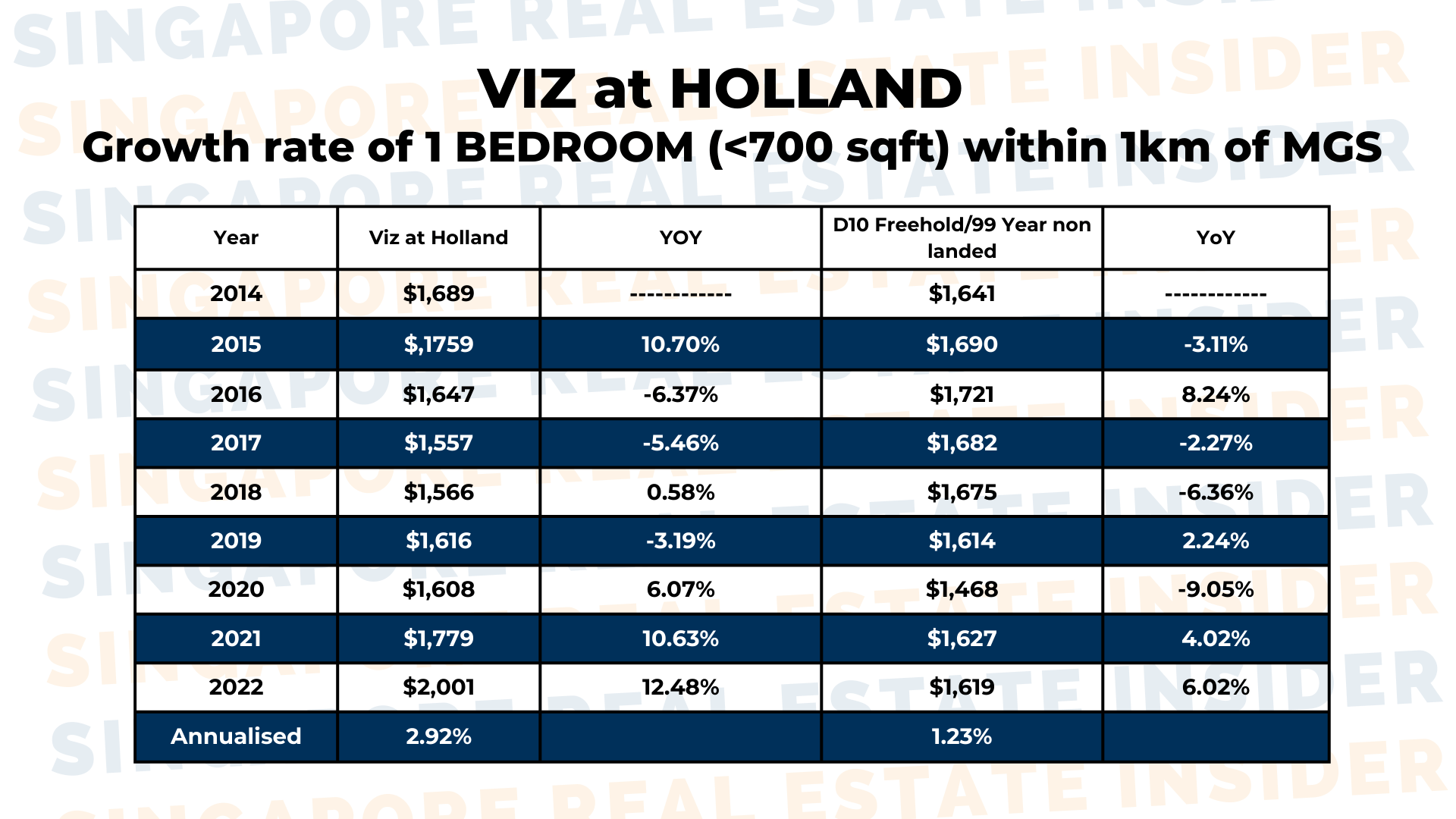

Now, let's shift our focus to properties within a 1km radius of MGS.

The Lees have their hearts set on being close to the school, but the available options are limited. The most prevalent units are one-bedroom apartments, which have experienced remarkable growth over the years.

Surprisingly, these below 700 sq ft properties have seen a significant 2.92% annual growth rate – the highest across Singapore! From an average price of $1589 psf in 2014, they've now reached $2001 psf in 2023.

With these insights in mind, let's explore the Lees' three possible approaches:

Approach one: Sell their current property and purchase a one-bedroom unit near MGS. This option allows them to be closer to the school, but it might not be practical for the entire family, including Joseph's mom.

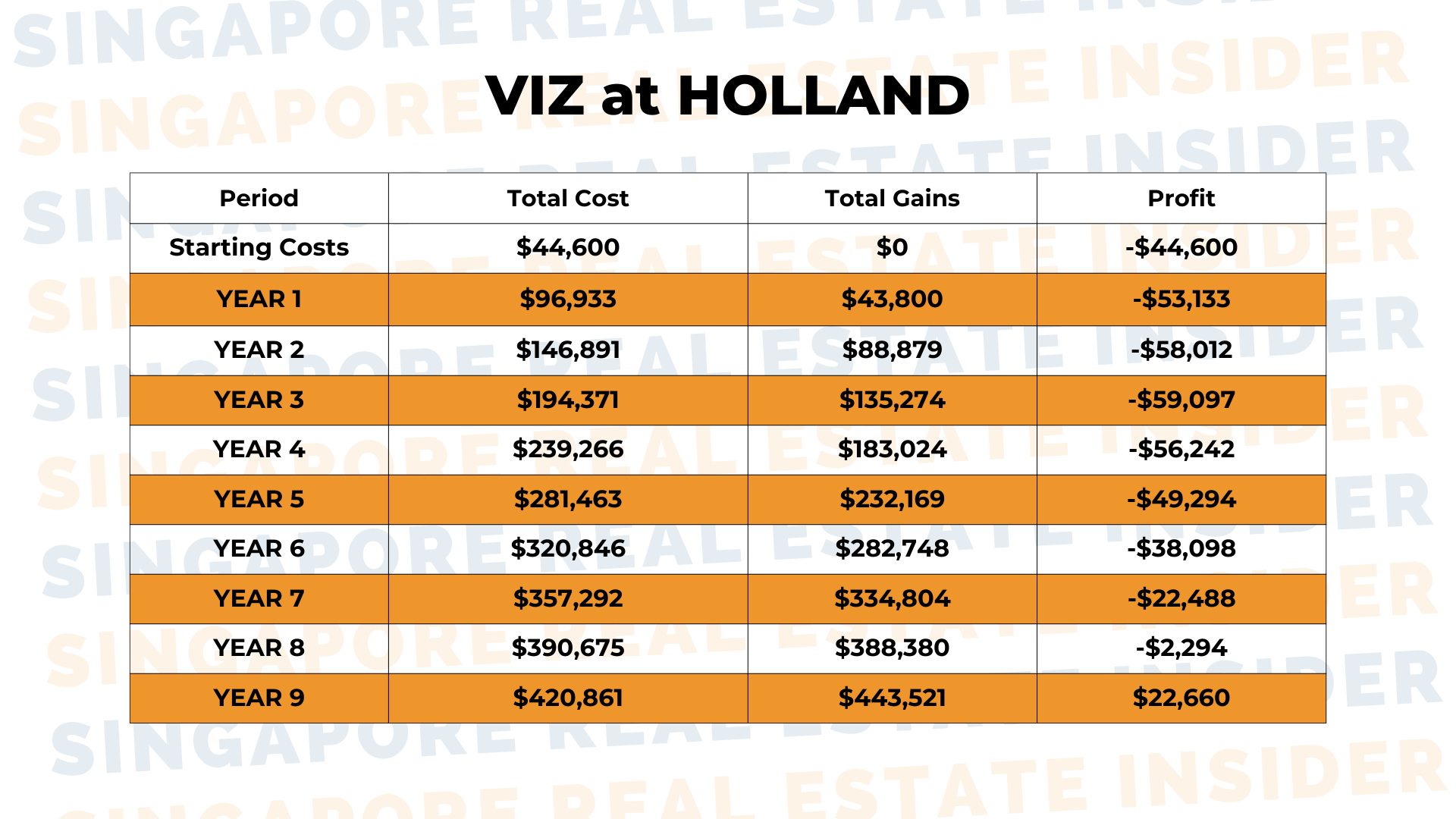

If they choose this path and buy a $1.5M one-bedroom in D21, they would need to take out a loan for $1,125,000. By holding the property for nine years until their daughter's P1 registration, they could potentially gain $22,660.

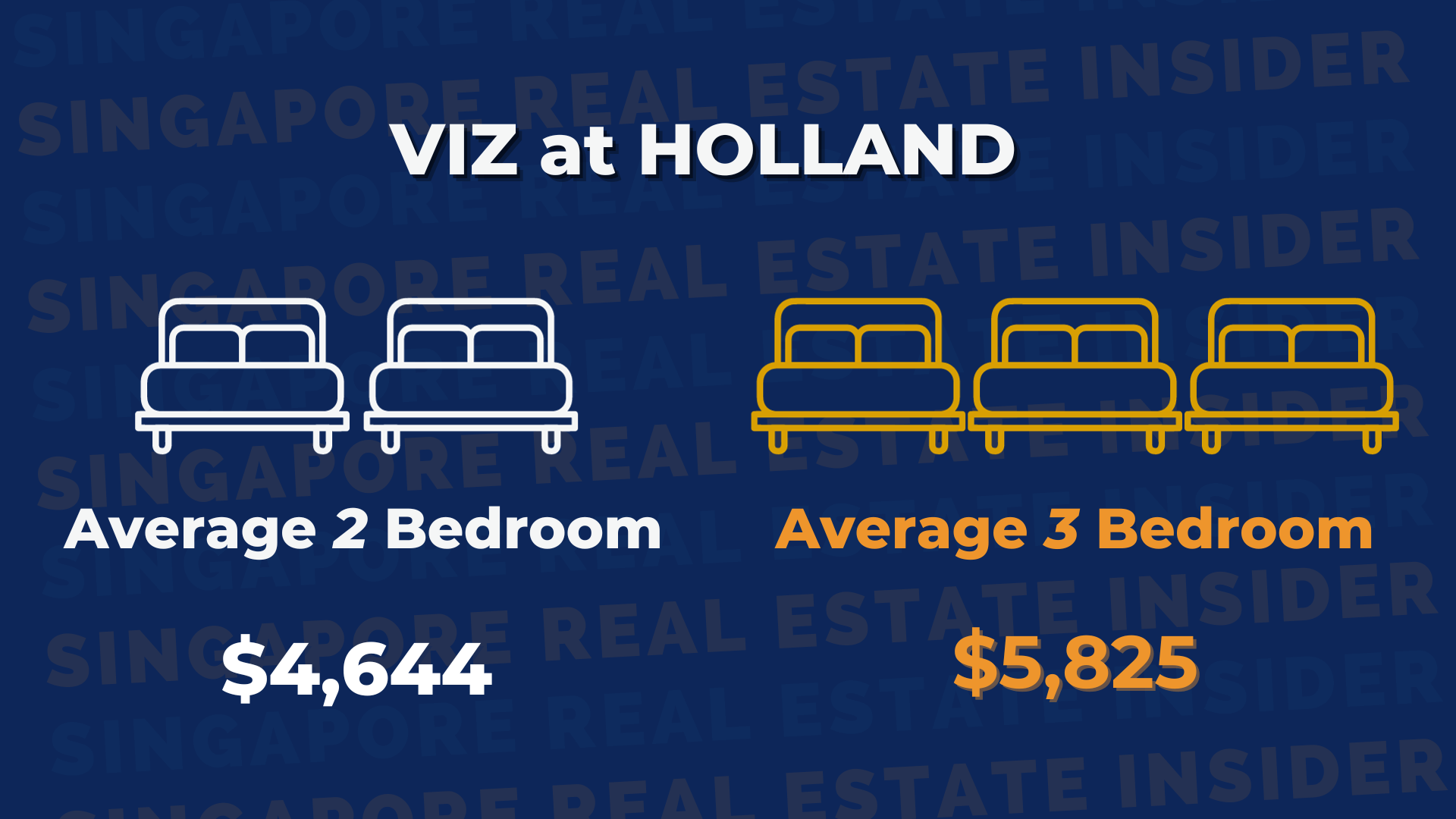

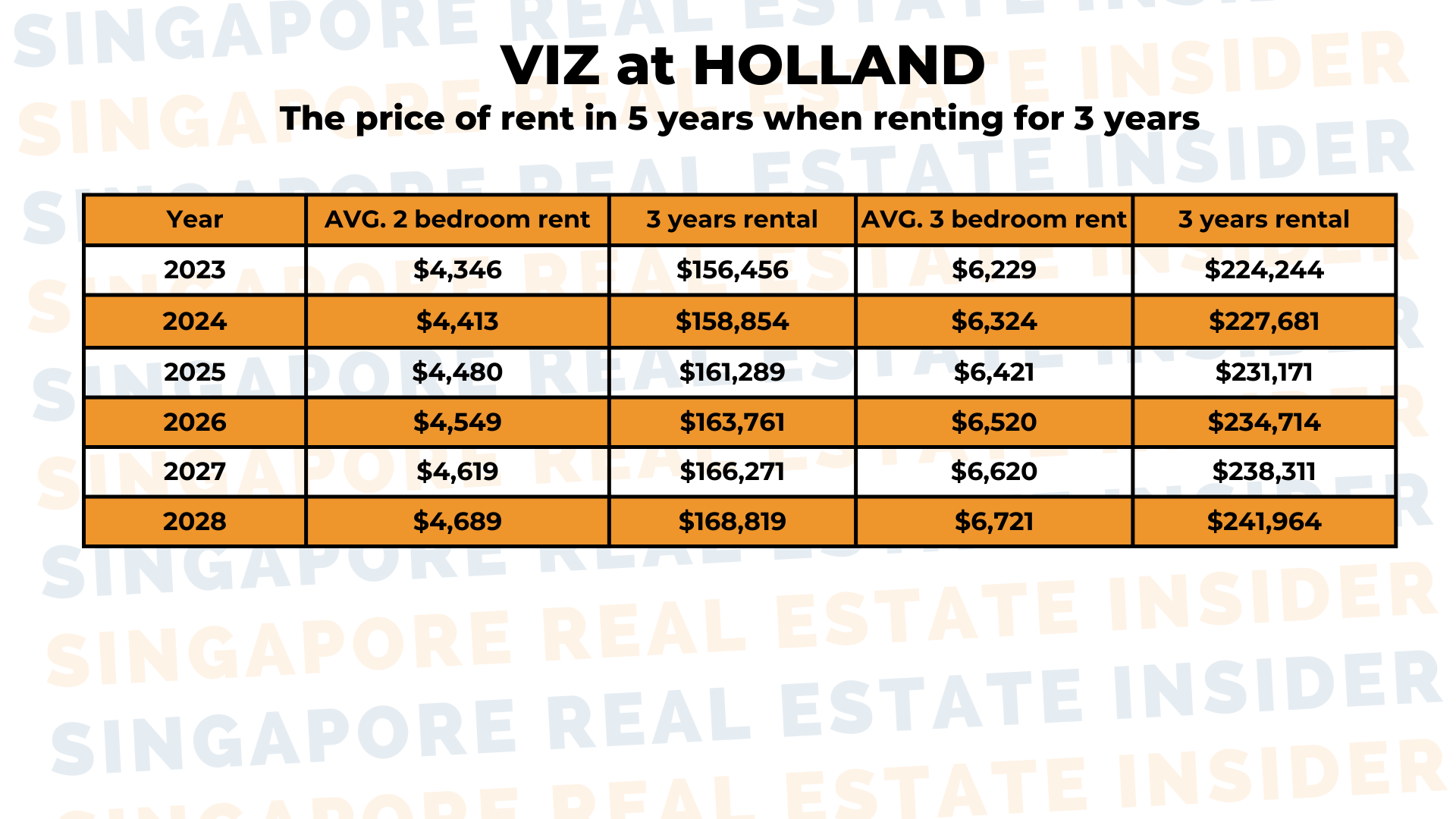

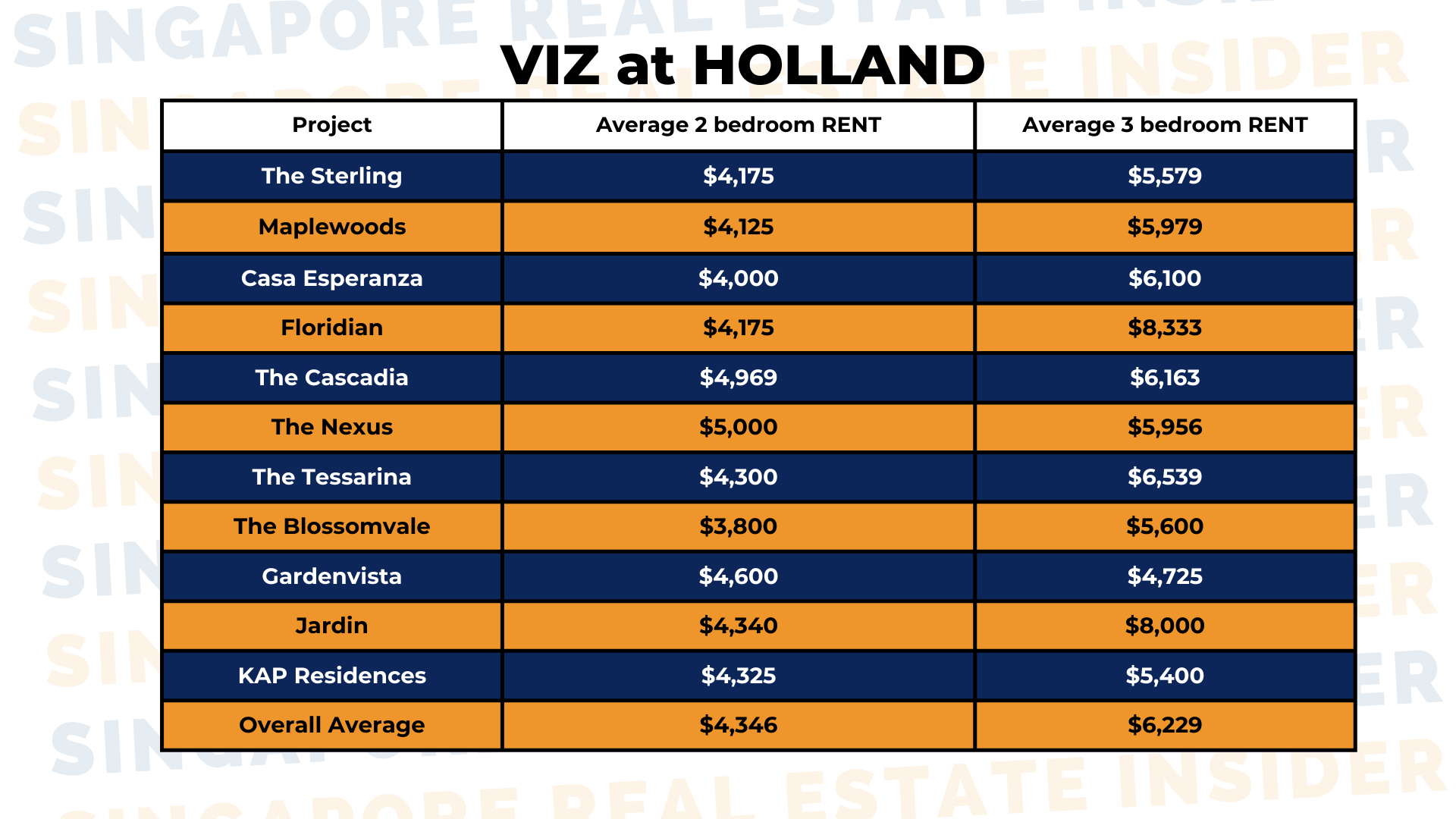

Approach two: Rent a two or three-bedroom place within 1km of MGS. This option provides more flexibility for the Lees and allows them to keep their existing properties at Viz at Holland. However, they would incur rental expenses.

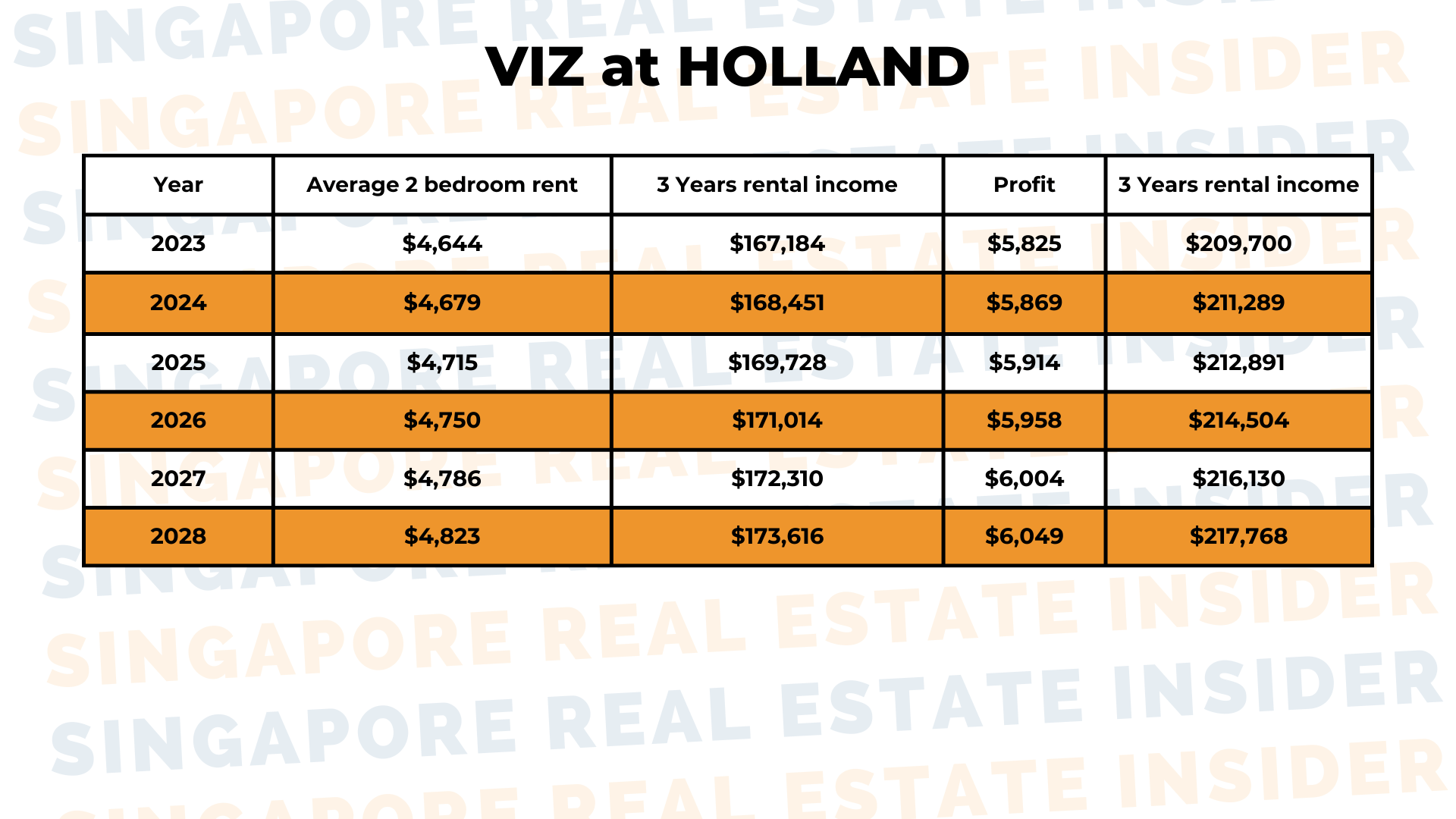

Considering their daughter's school enrollment in 2028, the Lees would face a three-year rental expense of $241,964 if they choose this approach. However, by renting out both their units at Viz at Holland, they could potentially gain $222,566 if they rent a two-bedroom condo, or $149,421 if they opt for a three-bedroom condo.

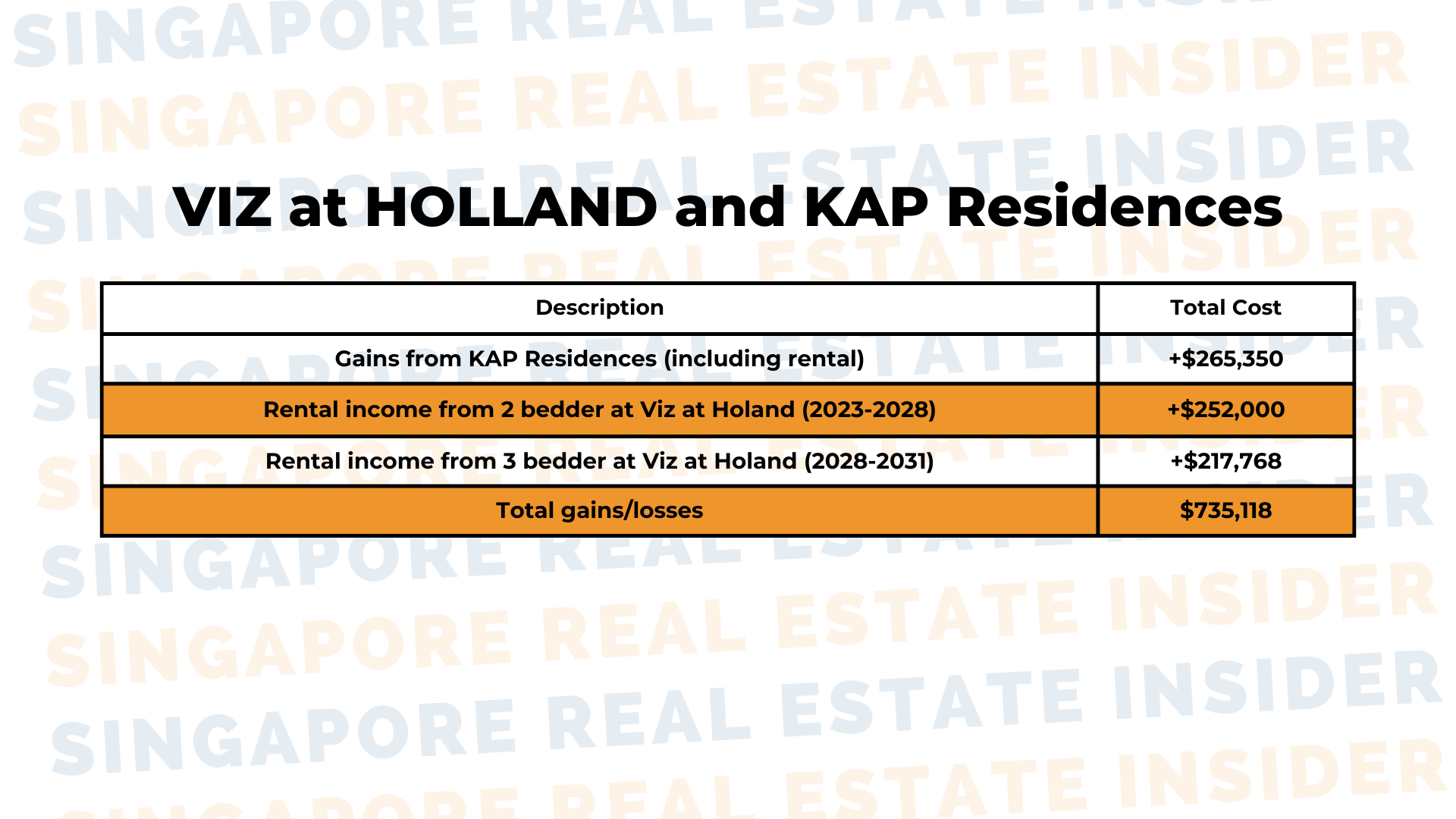

Approach three: Purchase a third property within 1km of MGS, considering the new Additional Buyer's Stamp Duty (ABSD) regulations. The Lees' only feasible option in this scenario is a studio apartment at KAP Residences under $1M. However, this would require them to exhaust all their savings.

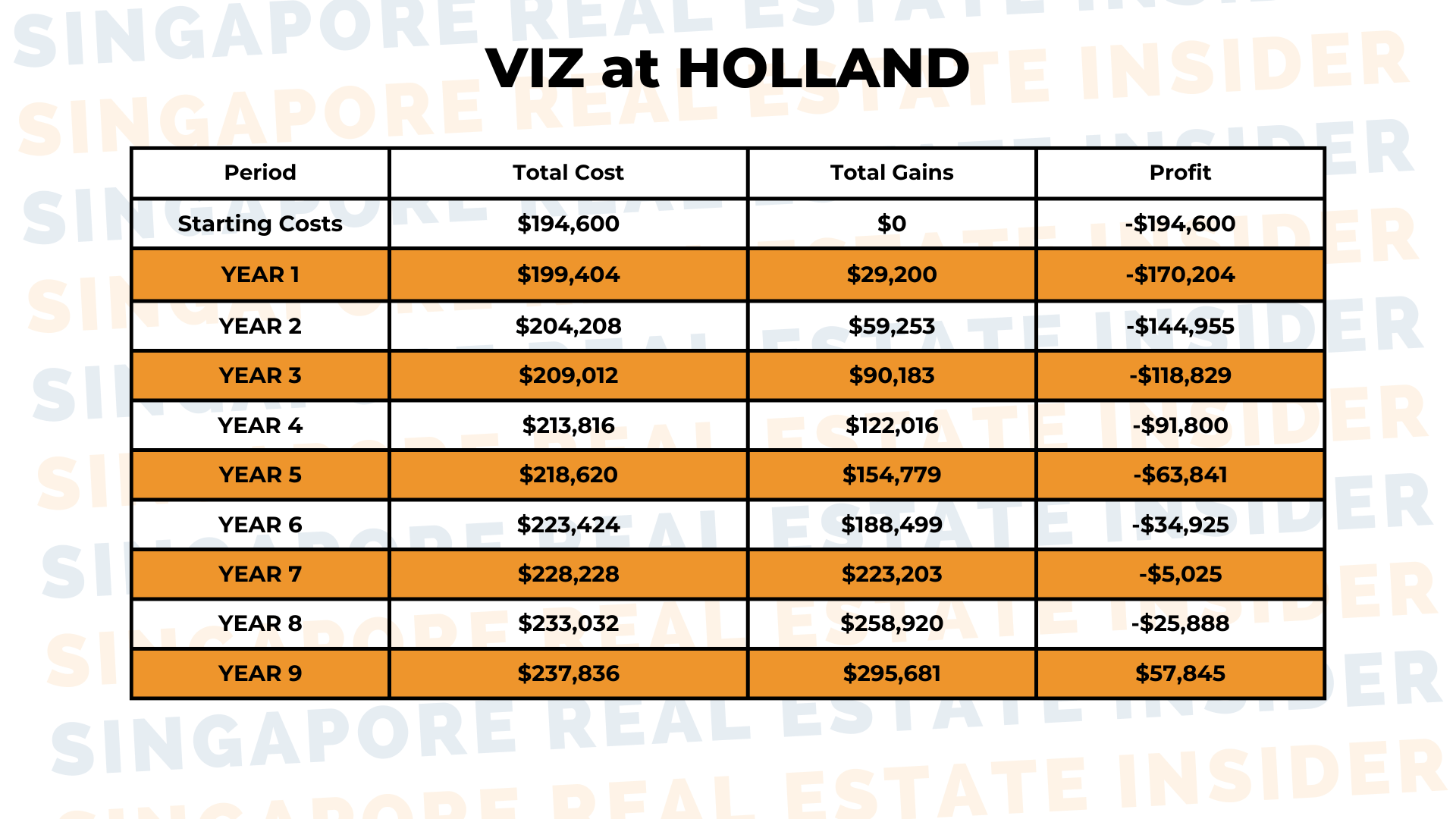

By holding onto this property for at least seven years, the Lees could break even, given the higher ABSD. Alternatively, if they choose to rent out the unit until 2028, they might see a profit of $57,845.

However, it's important to note the associated costs, including property tax, maintenance fees, and a stamp duty of $194,600.

So, which option should the Lees consider? Let's recap and weigh the pros and cons.

Option one - offers the advantage of being closest to MGS, with a potential annual return of 2.92%. It also performs better than other properties in District 10 and the overall Singapore market. However, the Lees need to consider the financing and address the practicality of downsizing for the whole family.

Option two - allows the Lees to leverage their existing properties and rental income. By renting a property near MGS while keeping their units at Viz at Holland, they can offset the rent expenses. This option provides stability and income potential.

Option three - purchasing a third property, comes with the risk of higher ABSD payments and exhausting their savings. However, if the property market continues to grow as it has over the last decade, the Lees could potentially reap substantial gains by renting it out until 2028.

Ultimately, the choice depends on the Lees' risk tolerance, financial goals, and preference for proximity to MGS. It's crucial for them to carefully consider each option and seek expert advice to make an informed decision.

Remember, winning the property game requires thorough study and deliberation.

Luckily, experts like us at Singapore Real Estate Insider are here to guide you and help you make the right decisions for maximum income.

Are you faced with the same dilemma? Reach out to us for an expert advice if you need clarity about your own property journey. Click here.