Hey! A Quick Check - Do you remember my previous blog about How To Avoid Your Property Losing Money?

If not, well what are you waiting for? Go Back and check it out first!

Remember, it’s always better to know the entire context. In that previous blog, I talked about how investing in real estate is a surefire way to secure financial growth…

BUT - of course, I have to come clean … Some properties do lose value overtime.

Some properties do lose value overtime, much like how one day your PC might stop working, or how some of your favorite crypto will eventually take a dip.

It all boils down to the ever-changing course of the economy and physical depreciation.

BUT - IF THERE IS A WILL, THEN THERE IS A WAY.

I’m here to tell you that the good news is that you can protect your investment with BUILT-IN PRICE PROTECTION.

As your Singapore Real Estate Insider, I want to empower you to make smart decisions and build a successful property portfolio using the REI method. Let's explore how this price protection works and what factors you should consider to ensure your property's long-term appreciation.

The Irony of Property Investment

While real estate is known for its growth potential, some investors end up selling at a break-even or a loss. We'll discuss how built-in price protection can shield your investment from such pitfalls.

Understanding Built-In Price Protection

You know when something sounds too good to be true and it probably isn’t ? Yeah, well - that doesn’t apply to this case. And you better believe it my friend.

In a world where everything deteriorates over time - Built-in-Price-Protection can be your knight in shining armor.

Imagine if your property's value was guaranteed to rise steadily over the years, just like having insurance against price depreciation. Built-in price protection does precisely that.

It ensures that your investment retains and increases its value by carefully considering essential factors that influence its long-term appreciation.

But of course, before committing into this aspect, you should consider what comes along with it.

The First 3 Key Factors for Price Protection

In my previous blog, I mentioned 6 key factors investors need to look out for to know if their property has built-in price protection.

Here, we’ll delve deeper into the first three, and then I’ll walk you through the last ones in the part 2 of this article.

1. Location: Remember when I said “ Where you are, reflects how you want to live” - well its still stands true for today. So, Choose a promising location that aligns with your investment goals. If you're aiming to bag the gold, some of the key areas are as follows:

- The Marina Bay area has seen a significant increase in property values in recent years, thanks to its prime location and proximity to major attractions such as the Marina Bay Sands casino and the Gardens by the Bay.

- The Orchard Road shopping belt is another popular area for property investment, with prices rising steadily thanks to its high demand and limited supply.

- The Dempsey Hill area is a trendy neighborhood with residential and commercial properties. Its popularity has led to an increase in property values in recent years.

- The Holland Village area is a popular residential area with a mix of old and new properties. Its central location and proximity to amenities have made it desirable to live in, driving up property values.

- The Katong area is a historic neighborhood with traditional and modern properties. Its charming atmosphere and proximity to the beach have made it a popular tourist destination, boosting property values.

These are just a few examples of how a good location can impact property values in Singapore. But let's look at the top gainers in private property sales.

Top Property Sales in 2023

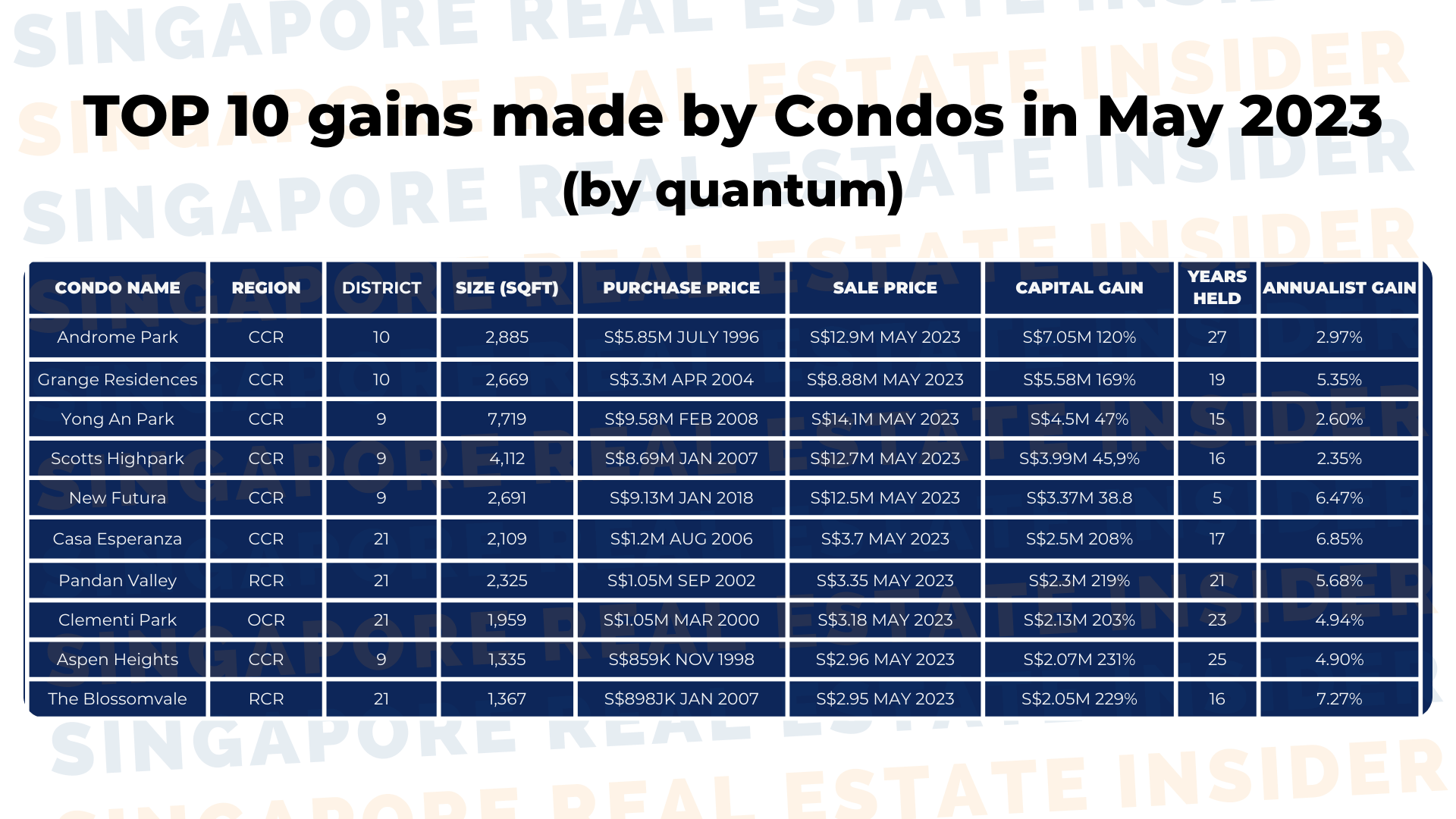

In May 2023, 820 condo units were resold, making a considerable average capital gain of approximately S$470,000, based on URA data. Interestingly, this average capital gain aligns closely with the capital gain made by ECs resold during the same period at around S$473,000.

The highest capital gain recorded was an astounding S$7,046,101 for a 2,885 sqft unit at Ardmore Park in Newton. This property was originally purchased for S$5,853,899 in July 1996 and was sold 27 years later for S$12.9 million. Such a substantial capital gain of 120% and an annualized gain of 2.97% showcases the potential value a prime location like Ardmore Park can add to a property.

Why such growth? District 11, covering Newton and Novena, boasts exclusive private housing, renowned educational institutions, and diverse places of worship. It has also seen significant commercial development with notable buildings such as Copthorne Orchid Hotel and Raffles Town Club.

The area's prosperity and business appeal have attracted many property buyers, increasing the population. Various residential options, including HDB areas, condominiums, and landed properties like L'VIV and Andrew Road Bungalows, have been developed to accommodate the growing demand.

Novena, a key part of District 11, is a well-planned urban zone centered around the Novena Church (Church of St. Alphonsus). Residences here are more expensive due to the prime location and amenities, with condominiums like Birmingham Mansions and Lion Towers being prevalent.

Newton, another main component of District 11, is famous for its food centers, notably the Newton Food Centre, offering a wide variety of delicious local dishes such as oyster omelet, popiah, barbequed chicken wings, and seafood.

Prices are high, but gains are high too.

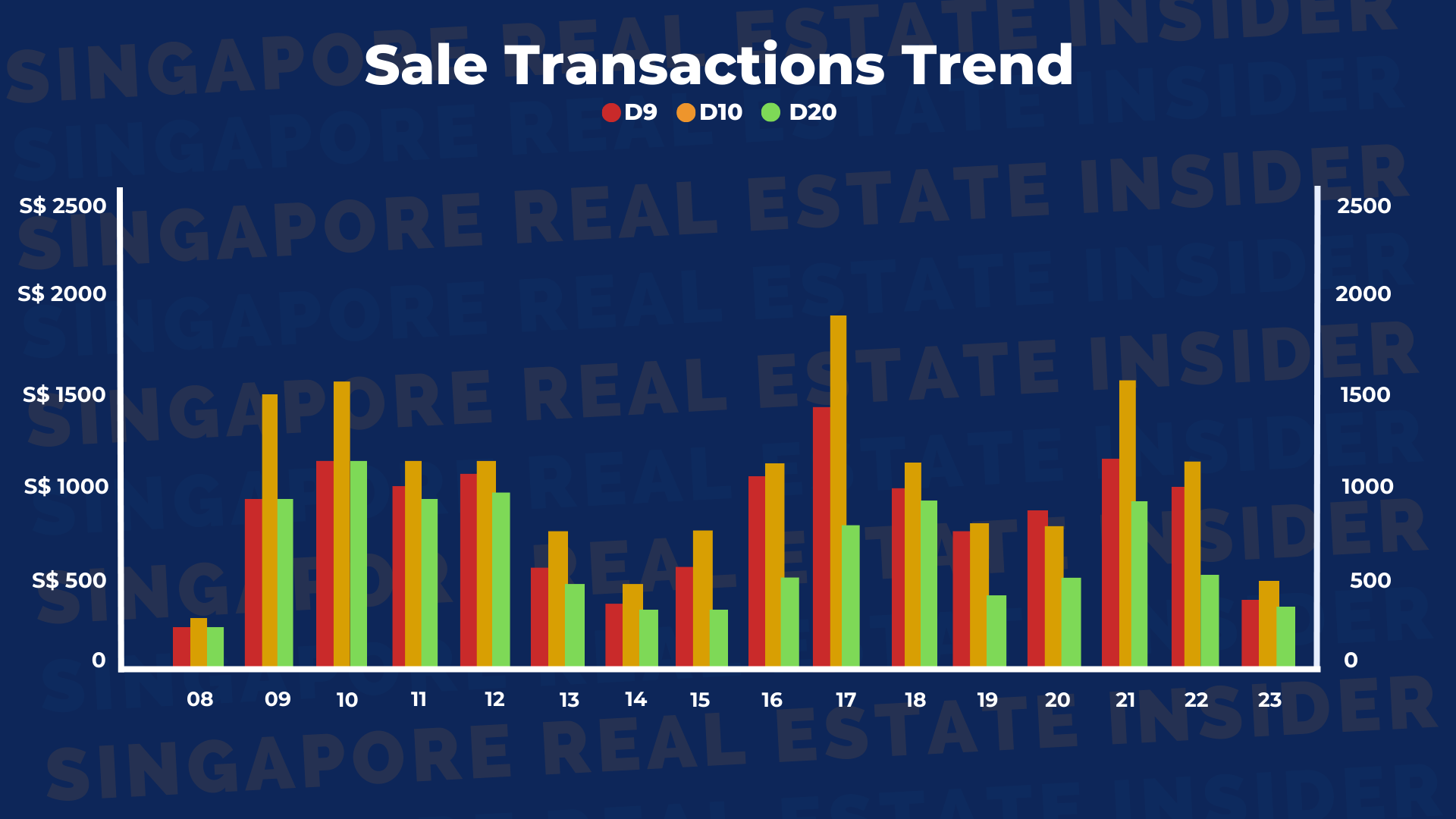

District 21 is noteworthy, as 40% of the top 10 condo gainers hail from this region. However, the majority of the top 10 condo gainers, 60%, are situated in the Core Central Region (CCR). Notably, all the top five condo gainers are in the CCR, specifically in Districts 9 and 10—known as Singapore's prime areas. The proximity to the city center in these districts contributes to the significant price growth they experience.

Comparing the price trends in the last 15 years for resale condos in these three districts, District 21 exhibits the highest appreciation at 109.67%, followed by District 10 at 84.05% and District 9 at 65.09%. These figures demonstrate how location plays a pivotal role in adding value to a property, with specific areas experiencing more substantial growth over time.

2. Purpose: As a property investor, you must determine your purpose behind buying real estate, as it will directly impact the value of your asset and influence the type of property that suits you best. For instance, if you're purchasing a property to live in, you'll want to ensure it's located well and meets your personal needs. On the other hand, if you're buying to rent out, you'll focus on finding a property in a solid rental market that can fetch a reasonable price.

Additionally, your investment purpose will guide your budget considerations. If it's for your residence, you can invest more in a well-located property that meets all your requirements. Conversely, for rental purposes, you may opt for a property that aligns with an excellent rental market and fits a budget that ensures a profitable return.

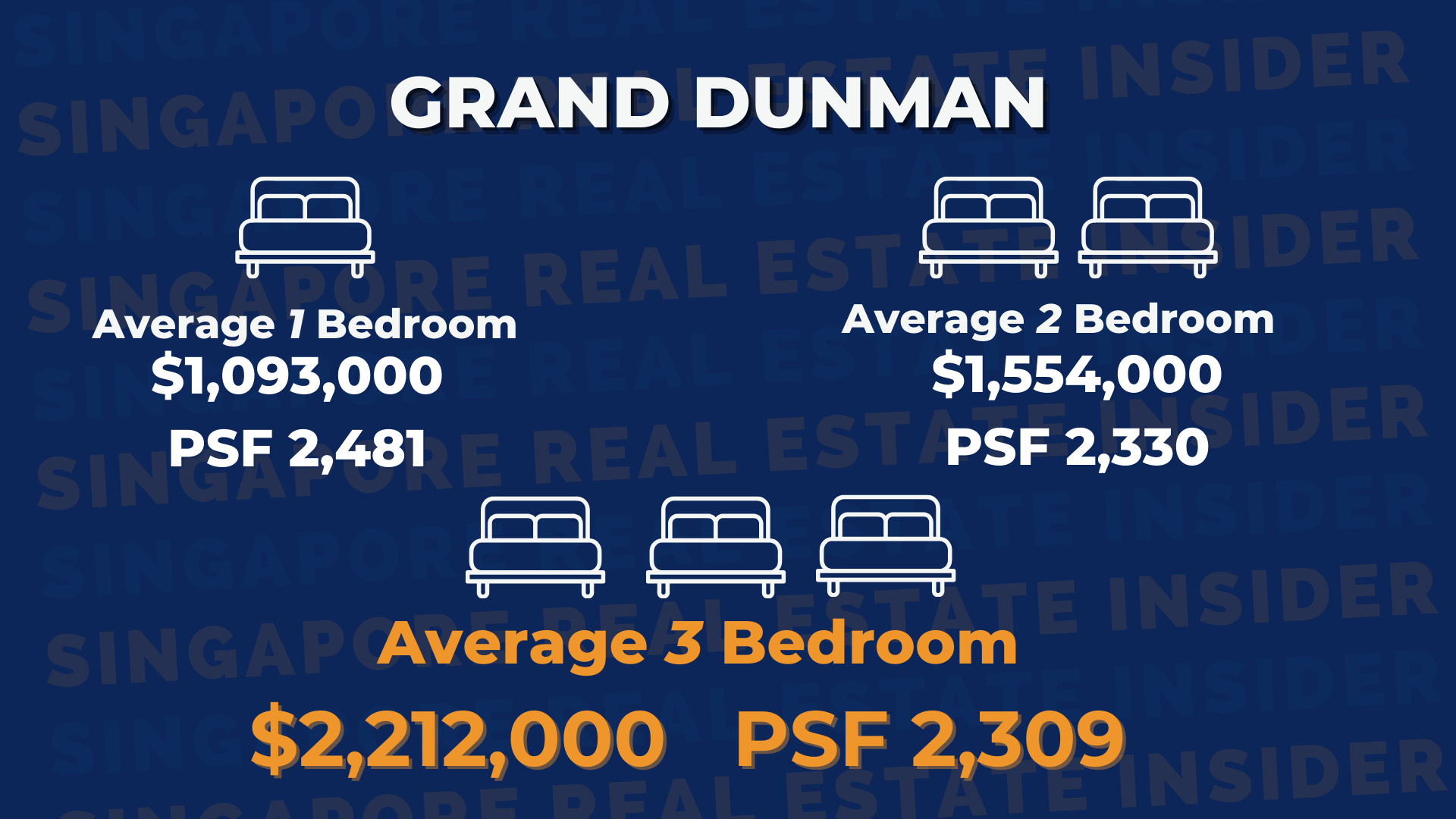

According to 99.co, Grand Dunman was such a hit and sold 50% off on its launch weekend last July 1, 2023. It's a promising development set to TOP in 2025/2026. ERA Singapore's CEO, Marcus Chu, explains why: "Majority of the unit types that found buyers are priced within S$2.5 million. This is the current sweet spot pricing amongst the majority of homebuyers and investors."

PropNex's CEO, Ismail Gafoor, agrees, saying, "The pricing is also seen as acceptable by buyers, given the project's city fringe location, proximity to the MRT station, and easy access to the Paya Lebar commercial hub, Suntec City and Beach Road, as well as the central business district."

Other than its proximity to Dakota MRT Station, educational institutions, and other amenities, Grand Dunman promises value growth for investors looking to flip their units upon TOP.

The property offers a great potential in resale and rental investments, being surrounded by multiple HDBs, so Grand Dunman serves as a catch-all for those needing to upgrade. Other than its on-point features, its unit sizes are more inviting compared to nearby projects with smaller spaces.

Regarding rental prospects, the condos in the area offer an above-average rental yield. Grand Dunman consists of a significant proportion of 1 and 2-bedroom units, comprising almost half of its total units. Additionally, the availability of dual-key units allows residents to live in one unit and rent out the other. This setup presents excellent rental opportunities, particularly appealing to individuals employed in the city and the Paya Lebar business district.

As a bonus, determining your purpose helps you make better financial decisions and set realistic expectations on your possible returns, and perhaps the unspoken setback of all, it helps you avoid making emotional decisions that could incur negative financial consequences in the long run.

3. Property Valuation: Consider all costs, such as purchase price, taxes, and interest rates. Ensure your investment generates positive returns.

A foreigner purchased Seascape in Sentosa Cove, a non-landed, private property at $9,600,000 as a vacation home. Sadly, this dream vacation home was sold at a loss in April 2023 at $5,500,000. That's negative $4,100,000!

We can all but deduce that they bought it at such a jacked-up price because of high stamp duty rates, as it was imposed on foreigners to pay 60% ABSD in the latest cooling measures.

There's much research and discernment that goes into property investments, and this is where Singapore Real Estate Insider steps in: guiding you to secure up to 6-figure profits safely through our proven REI Method. If you need guidance and clarity, book here for a FREE 20-min property consult with me.

Watch out for part 2 of this article!

Invest wisely, and stay tuned!