Tell me if this sounds familiar:

Mr. hard-worker - around 30s / 40s - has just decided to take the plunge and go for that investment.

You’ve built your standards - And might’ve gone to different jobs, different places, met different people, just to find “THE ONE”

AND When - it seems like everything is falling into place, you get that sinking feeling that you might have forgotten something?

So, how do you avoid that?

HOW do you know when you’ve actually found "the one" for your property investment? And not get scared?

Keep up with me, and I’ll give you THE CHECKLIST to maximize your capital.

Now that you have decided to maximize your earning potential through your property, the next step is to choose the right private property unit: THE ONE that has the most potential to get you that six-digit capital safely and securely.

Property options can sometimes be overwhelming, but there is an easy way to filter them to get the best unit, and it's by considering changes, you might have seen before.

Here are the 4 Things or Tips that could help you maximize your property.

Development within the area

You’ve probably already heard this from me, But I cannot stress it enough.

Transformation is the key to successful property value growth.

It is one of the top factors to consider in buying a property.

Surveying the location and its surrounding upcoming developments gives you a good insight if your target property is worth the investment.

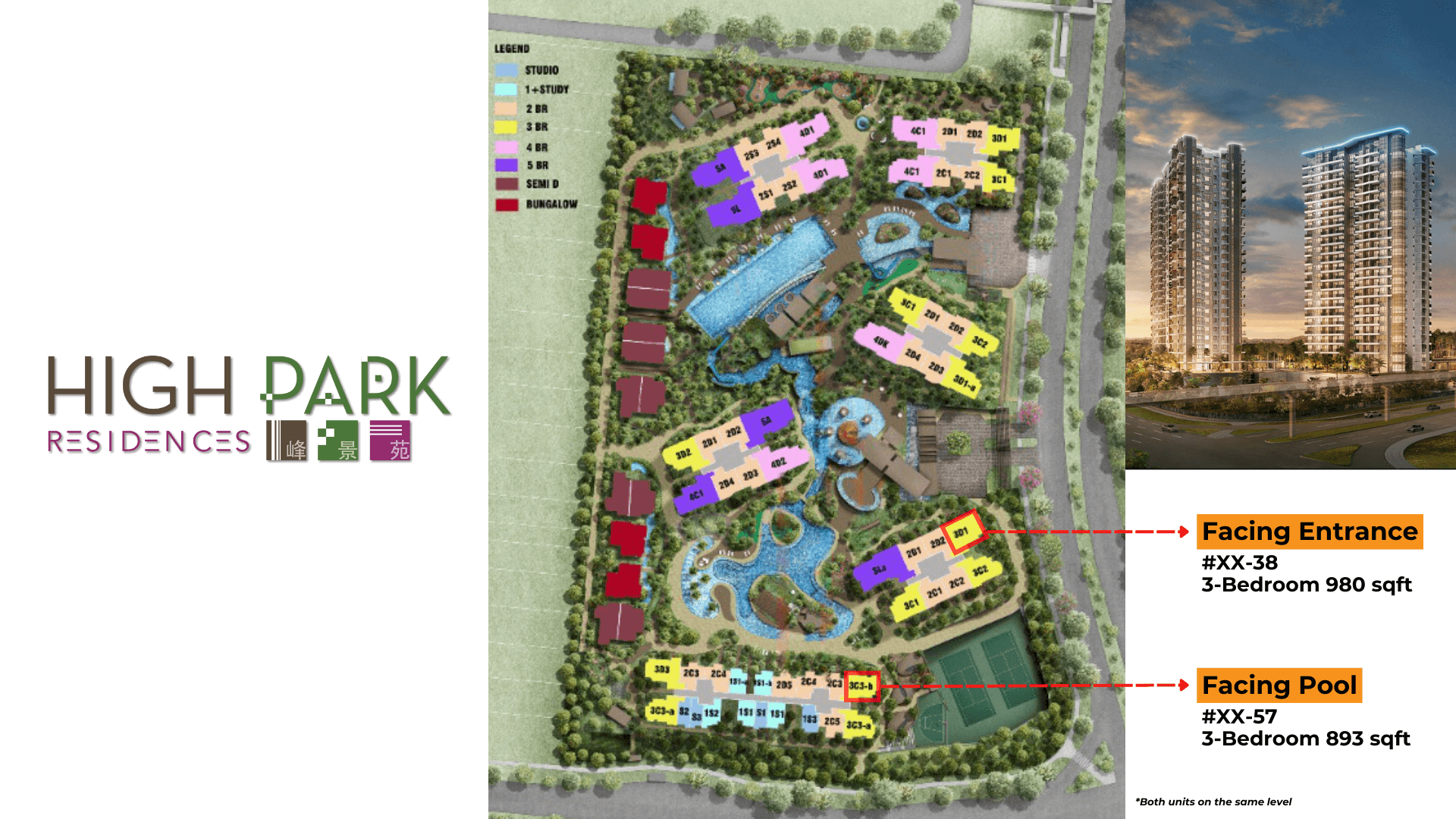

Take a look at these two stacks in the High Park Residences.

One offers a view of the pool, and the other faces the entrance.

The two units from both stacks were purchased on the same day for $854,000.

It's almost a reflex reaction to opt for the pool facing unit.

But based on what I said earlier, should we jump in?

Let's look at the numbers, shall we?

Upon selling, the units with the pool view profited $181,000.

Not bad, right? But look at the entrance-facing stack: it earned up to $346,000!

How is this possible?

It's about the entrance-facing stack's location. You see, Fernvale is teeming with HDBs.

And From there, we can predict that there will be so many HDB upgraders in just a matter of time.

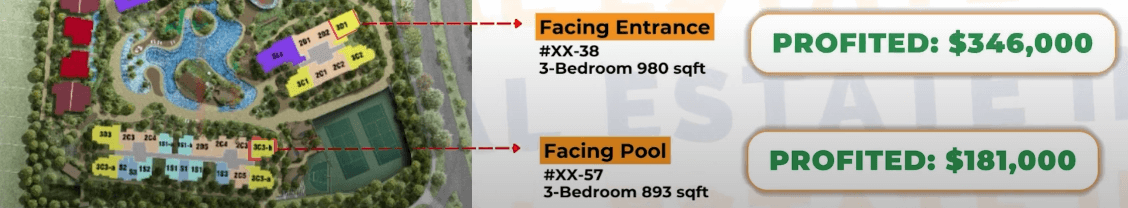

Layout

If you were an HDB upgrader, what's an ideal unit for you? Spacious rooms, perhaps?

Let's look at the layouts in the same property.

The entrance-facing stack is a 980 sq ft unit.

According to the floor plan, the latter can only accommodate a single bed, with no utility room or other features.

The entrance-facing units are much more attractive as their layout allows occupants to bring in a queen-sized bed in their smallest room.

Plus, there's a utility room, which makes sense for families.

This is why the entrance-facing units are more enticing.

People looking for similar units to this are families who intend to settle in, compared to the pool-facing ones that are most likely purchased for investment.

Demand and supply

So, building on the previous point -

We know that people who plan to settle-in long term opt for functionality and they look for properties that have higher market potential in the future.

And we already know what this type of pattern can lead to.

This situation means that more pool-facing units will be available for sale when the TOP time comes, while the entrance-facing units won't have as many slots for selling.

Taking in this factor should be elementary for you my friends.

Entry price

This will be the key difference between making 6-figure capital vs NONE.

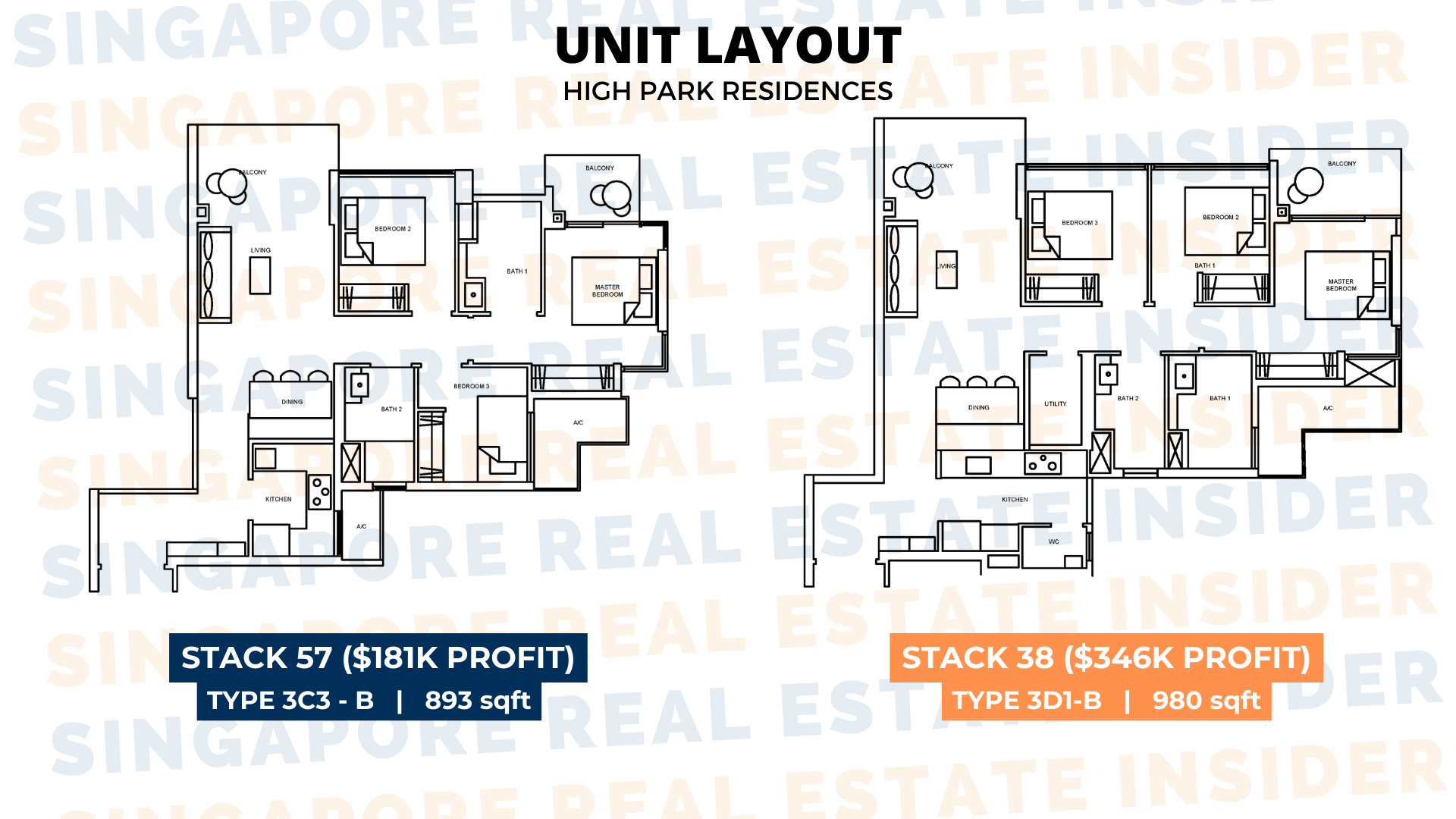

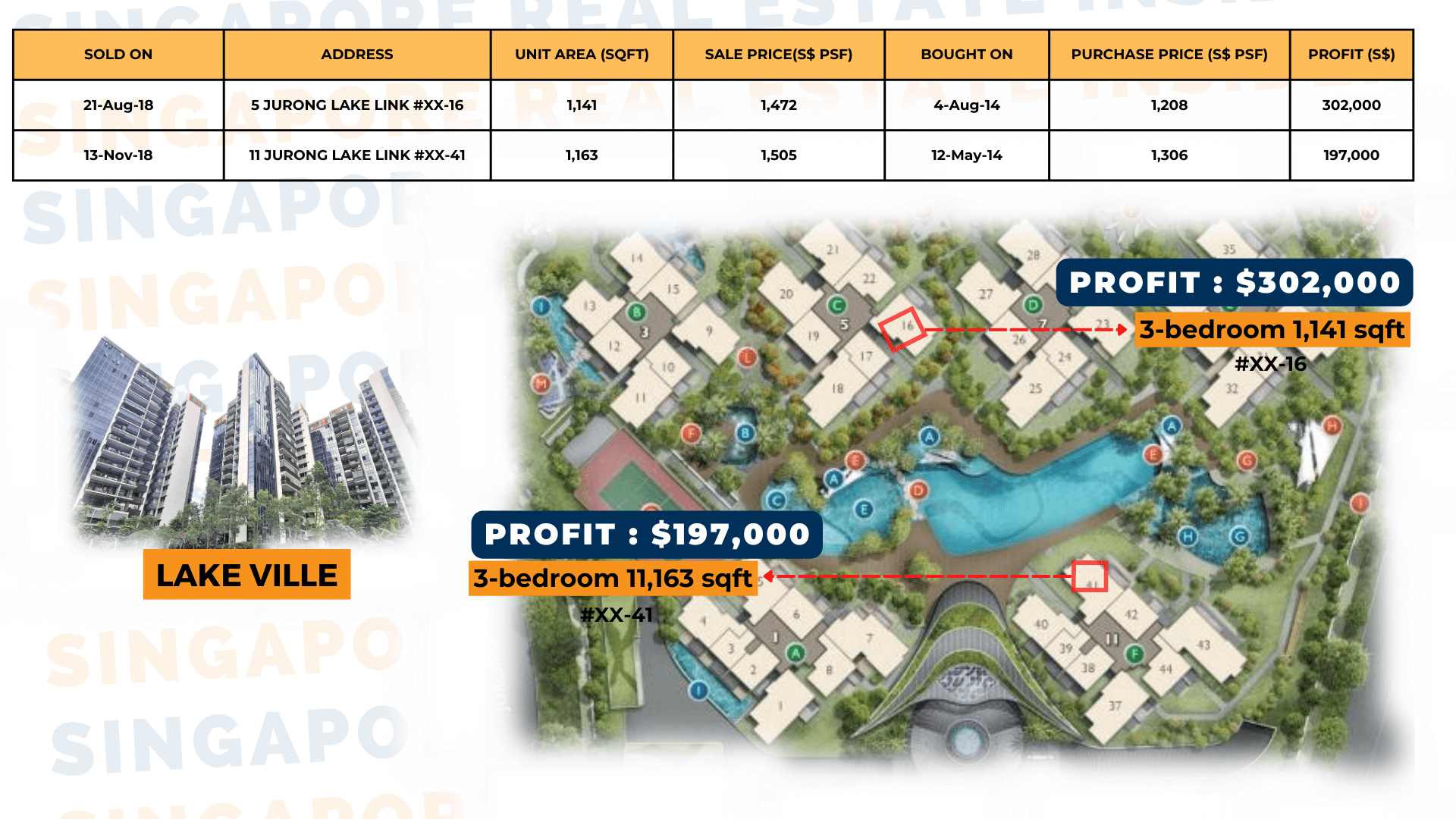

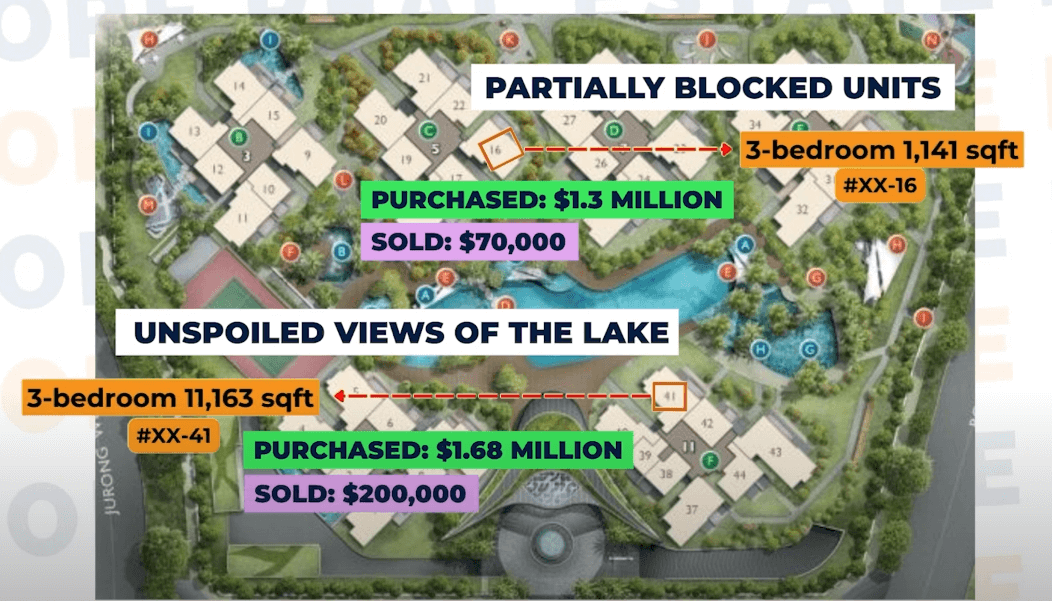

Let’s use Lakeville for a better visual - we will compare two stacks to see how the demand and supply play out.

Stack A has partially blocked units, while stack B has unspoiled views of the lake.

Look at the numbers!

The partially blocked units sold up to $302,000 in profit. But the lake-view units only made $197,000.

If you think that an undisturbed nature view would bring in many buyers -

Then you’re overlooking another factor, which is Entry Price.

Both units from Lake Ville were bought at $1.3 million and $1.68 million, respectively. The stack A units were sold at a premium of $70,000, while stack B that were paid with a higher fee of $200,000 at the launch.

The units with unblocked views had less profit because of the complexity of three things:

- Demand

- Supply

- Location

Keep in mind that these 3 things always change upon a buyer’s appetite, and that each site has a different demand and supply situation.

To make the most profit from every unit, we must make a careful study of its location's potential, demographics, and ongoing supply and demand.

You do not want to blindly choose a unit, hoping to hit the jackpot without doing your homework.

Unlike the lottery, real-estate investment has more than just one risk involved.

This is also the reason why those who follow us in their property journey are confident in their selection, by adopting our checklist - you too can walk with us in this journey, to start, just click here to book your 20-min complimentary property consult with us.

For all of your private property investment concerns, Singapore Real Estate Insider is here for you!

So, invest wisely and stay tuned!