If only we could consult a magic crystal ball about the future, maybe making life decisions would be easier.

Does this thought ever cross your mind? How great could it be if the future could flash in a shiny glass ball by simply chanting a few lines?

But as you know, that's not how we roll here in Singapore Real Estate Insider. We don't leave everything to fate and luck.

Everyone who follows us knows that we prefer making smart moves through research and data instead of relying on gut feeling or 2nd guessing our way when it comes to property decisions.

So, let me answer this for you: “Will there be a housing crash in 2023 and beyond?” This question has so many hits in Google search alone, so let's look at what the future holds

Before anything else, let me remind you that no one can predict how the market will behave in the future with a hundred percent accuracy. But we can always check facts and figures and listen to trusted experts about their thoughts. Nonetheless, these ideas can help us create realistic expectations about the market in the coming months or years.

Do note as well that these factors should not get a significant share of control when making investment decisions. What should sway it, however, is your current situation and financial health.

Let's look at past data so we'll have a glimpse of what the future holds for Singapore Property Market.

Houses are selling like pancakes

Yes, they're coming in hot! In America, home buyers' stress is high due to the scarcity of available homes. In fact, sellers get an average of 20 inquiries per home, offering thousands of dollars above the published rate!

And the same is true for Singapore. In January 2022, the Urban Redevelopment Authority reported that developers sold 13,027 private residential units in 2021. We already saw a 3.5% increase in home sales at the start of 2022 alone.

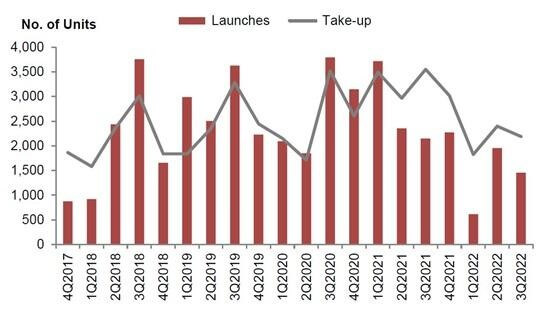

This year, the URA states that in the 3rd quarter of 2022, were already launched by developers, compared with the 1,956 units in the previous quarter.

As for numbers of residential units sold, developers closed 2,187 (excluding ECs) residential units in the 3rd quarter of 2022, compared with the 2,397 units sold in the previous quarter.

Photo Courtesy of URA

Prices are high

As we learned in economics, low supply, and high demand are the recipe for high prices. Singapore is currently facing a housing shortage, comparing the number of new possible owners with the country's current number of available homes (upcoming launches, included!).

Check out this data from the URA on how the prices of private residential properties grew by 3.8% in 3rd Quarter 2022, compared with the 3.5% increase in the previous quarter.

Photo Courtesy of URA

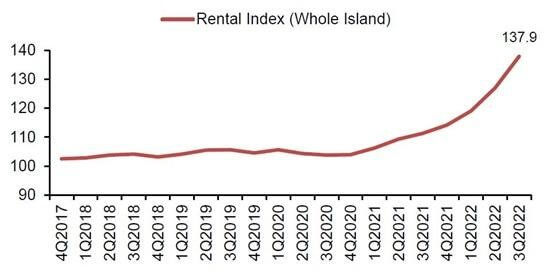

As for rentals, URA reports that the figures have increased by 8.6% in 3rd Quarter 2022, compared with the 6.7% increase in the previous quarter. Rentals of non-landed properties increased by 7.0%, compared with the 7.7% increase in the previous quarter.

Photo Courtesy of URA

Non-landed property rentals in the CCR, on the other hand, increased by 7.0% in 3rd Quarter 2022, compared with the 7.7% increase in the previous quarter.

While RCR rentals climbed by 9.6%, compared with the 5.9% hike in the previous quarter.

Rentals in OCR increased by 8.8%, compared with the 7.7% increase in the previous quarter, as per URA.

This has not been seen before in the past where sale prices and rental prices climbed at the same time.

We are in a unique situation now.

But there are still opportunities we have uncovered amidst all these. Key is to stick to data and numbers to guide us properly.

With everything going on, we have to be careful in our property plans.

This dilemma of supply and demand will be the main driver of the prices, despite the cooling measures implemented by the government.

But we can assume that prices will increase slowly compared to the other countries.

If you have been renting and are worried about the rising rental. Now could be a good time to explore how you can own 1 instead of renting. The cost of renting has surpassed the cost of owning. And the switch will potentially help you save more too.

Interest rates are climbing up

The U.S. Federal Reserve brought the interest rates down to near zero at the start of the pandemic in early 2020. These affordable credit opportunities have led many buyers to grab them before they're gone.

Will Singapore interest rates continue at such a high rate? How do interest rates react with inflation?

If you are unsure of this, it would be good to jump to this other article where I covered in depth about our rising interest rate environment and most importantly where does this go in the future.

I also revealed a Secret Strategy that even with rising interest rates, we have no fear of our increased mortgage loan as we have ways to keep them in check.

Demand for homes will still be high

Will Buyer Demand for Housing Remain Strong? Despite the pandemic's consequences and everything happening in the world, experts have noted how houses are sold quicker in 2021.

Singapore developers claim that they sold 13,027 residential properties last year alone. That's 3,000 more units compared to 2020. While it has toned down a bit by 2022, the demand is still higher than in pre-pandemic years.

This demand is mainly caused by the next generation coming to their prime home-buying age and HDB upgraders. More families have upgraded from HDBs to more spacious private properties to accommodate remote work and learning.

With better earning power in each family household. Instead of the traditionally 1 person income in the past, we have majority dual income parents now. With greater capacity of income, it's a natural progression many will also start looking at more leverage through property to grow their wealth.

Did you know that 25,000 HDB flats MOP'd in 2021? This fuelled the demand for larger spaces like private condos. Even HDB resale prices are at a peak!

Then there's an on-slough of Singaporeans returning to the country and needing their own spaces after years of work abroad.

House inventories will still be low

Singapore is experiencing a huge gap between the demand and supply of homes.

The past years haven't been great for most of Singapore's construction sector. They had to shut down during the peak of covid-19 cases and are experiencing a lack of manpower. Stricter measures are still in place for everyone's safety, which slows down the completion rate. Sigh! We can't wait for this pandemic to be over!

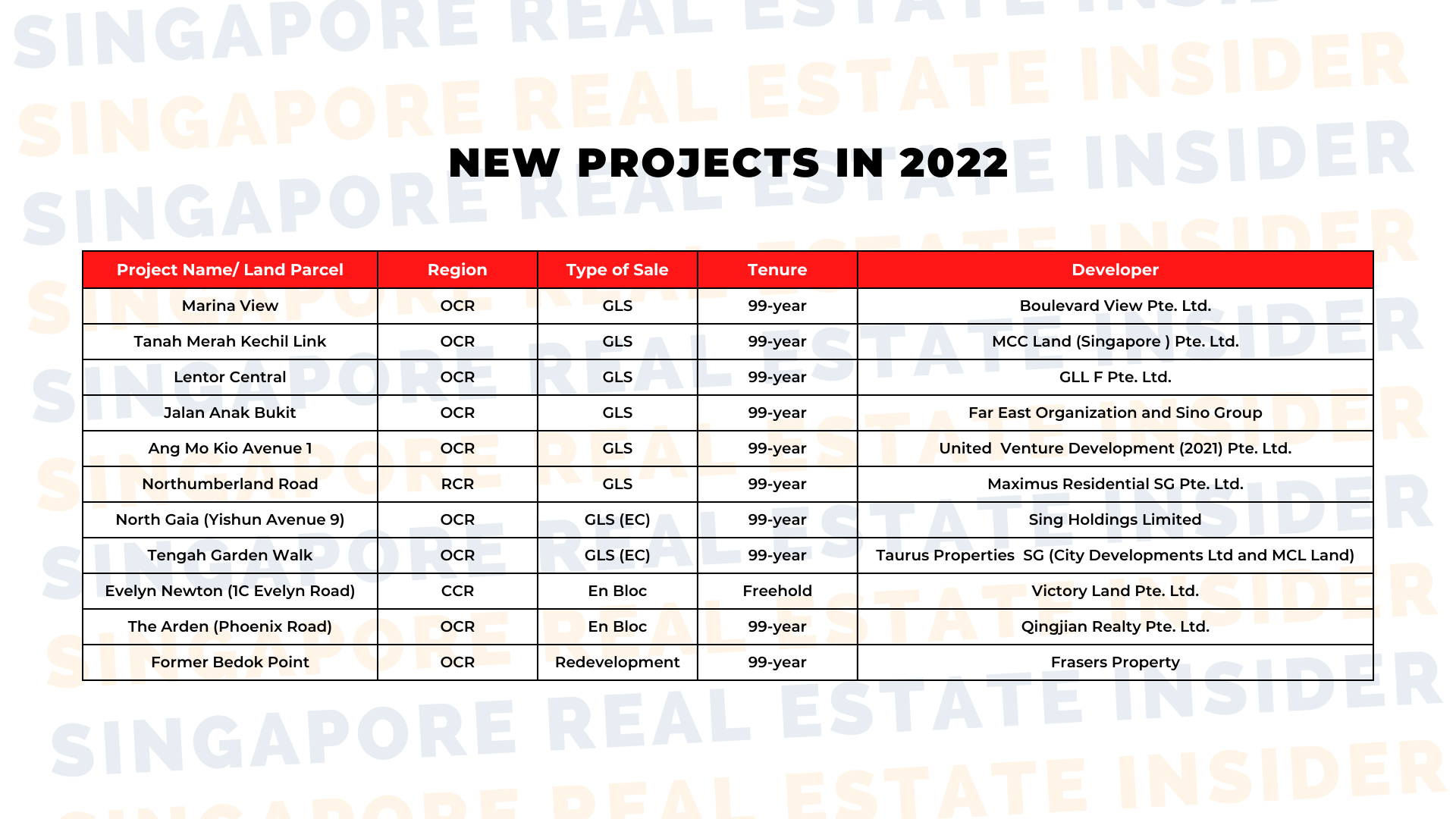

In 2022, we only have 11 new launch projects, and the government is scrimping on land sales.

With lesser supply, PRICES WILL INCREASE.

So, will there be a housing crash in 2023?

The signs are not pointing to a housing crash. Its chances are very, very low. Experts say that the market has changed tremendously since the recession in 2007-2009.

Stricter loan policies are also implemented since 2013 Cooling Measures to restrict 3 things:

- Over Borrowing

- Over Commitment

- Over Leverage

This is to ensure buyers will be able to pay, and most of all, the housing supply will still be insufficient for the following years and might not catch on to the demand for a while.

Want to know what to do with your property with this information in mind?

If you have been holding on to yours for a while, now might be a great time to explore what else you can do for better leverage.

Click here to book a complimentary consult with me and let’s discuss what’s the ideal property plan for you and your current situation now moving forward.