We’re hearing this word quite a lot lately: RECESSION. Doesn’t that have negative energy about it? Even just saying the term causes many faces to frown.

But what does it mean when we talk about a recession? What is it, and perhaps more importantly, what is it not?

In its most basic sense, a recession means a time of decline–it’s when economic activities fall. It is when trade and industrial activity decrease and GDPs go down a slope continuously.

When we look back on 2008, Singapore fell right into the recession back in 2008 as an impact of the global financial crisis. America’s 4th raised interest rates in 2022 alone, and one couldn’t help but think if the country will follow suit shortly.

I know, that doesn’t sound good. But before we homeowners squirm at the thought of a down-turn for all of our investments, let’s consider this: recession does not mean a housing crisis. And more so, Singapore does not expect a recession any time soon.

You may be doubting that at first since we have been experiencing rising interest rates since the start of the year, not to mention an increase in average private property rates.

These two things have made would-be homeowners pause investing due to our uncertain times. Danielle Hale, a chief economist, said, “The housing market is at a turning point.” She adds, “We’re starting to see signs of a new direction, but the ball is still in sellers’ courts in most housing markets.”

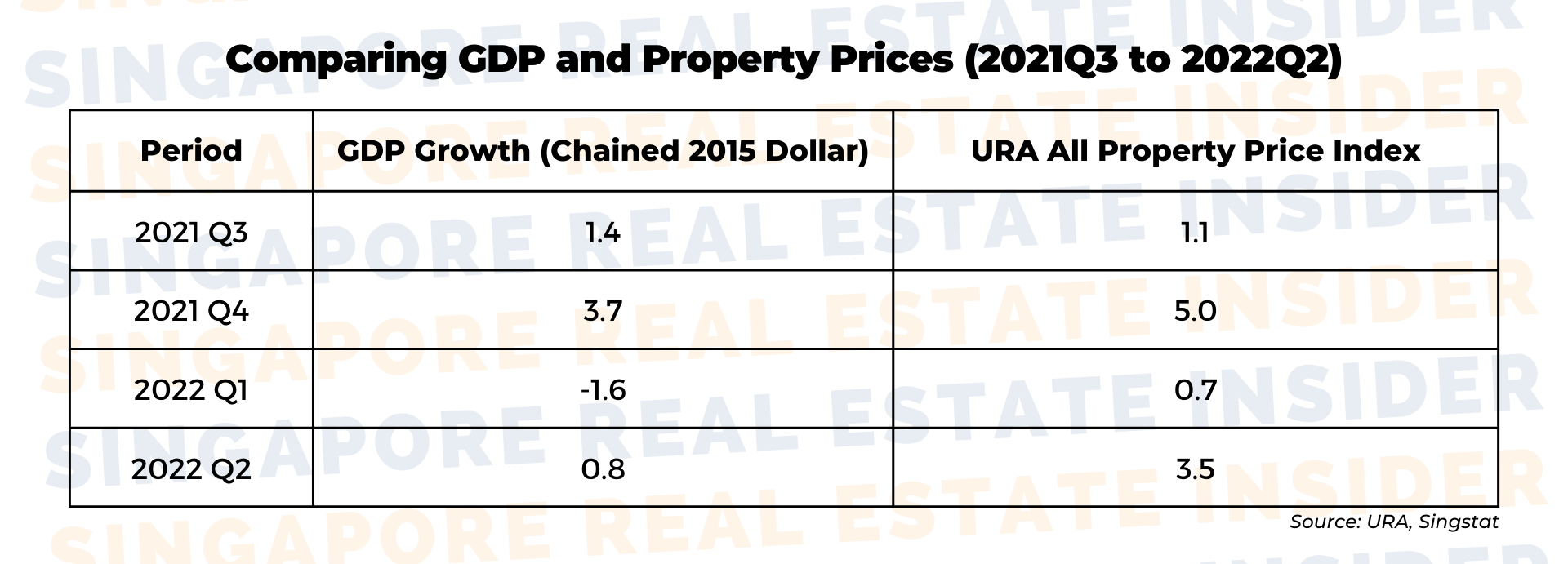

We witnessed the decline of Singapore’s GDP in the first quarter of 2021, however, as I mentioned many times in my other videos, the real estate property market remained resilient, and is even growing, therefore becoming a beacon of hope that the economy will also bounce back.

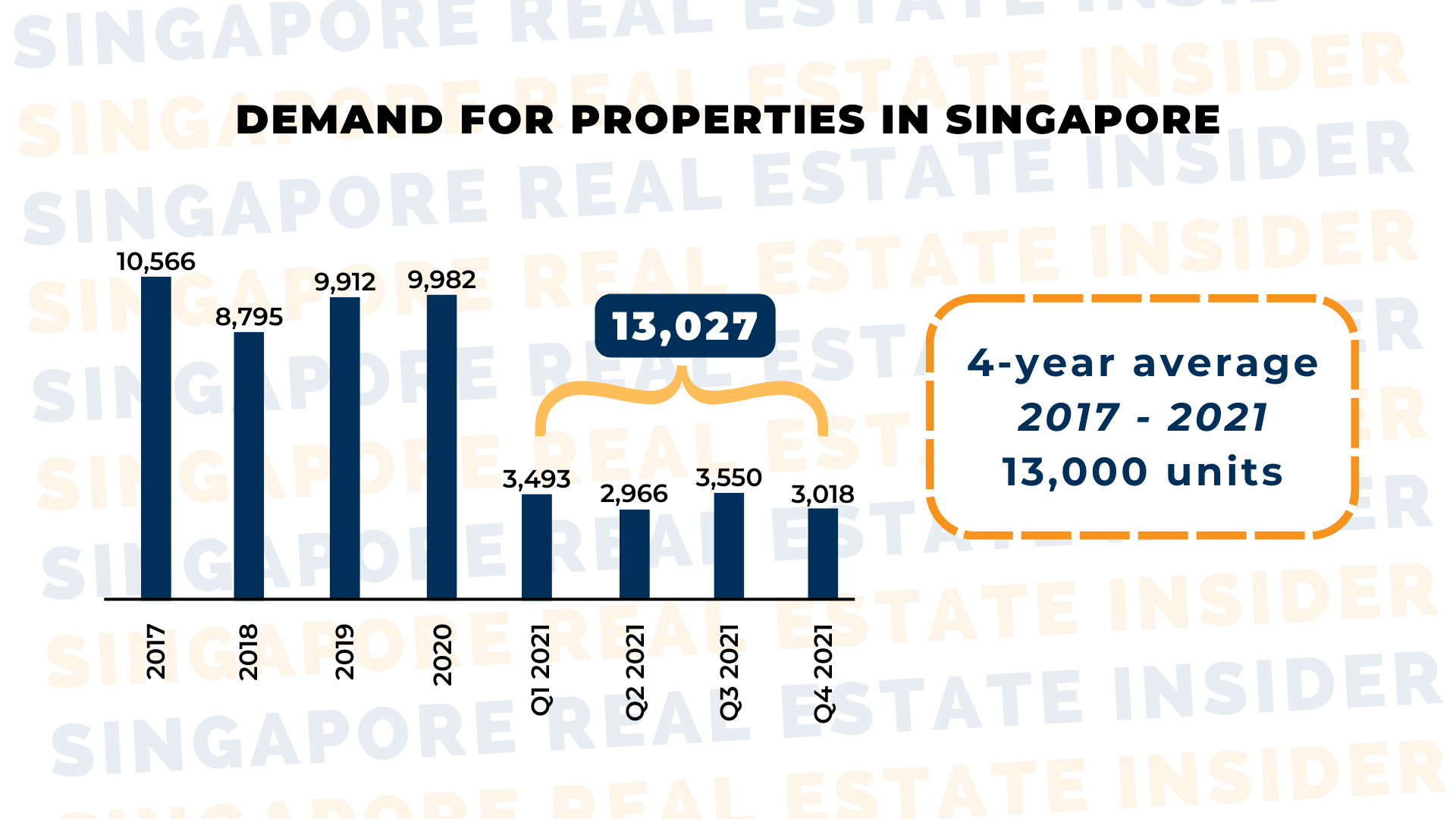

At the end of 2021, we saw the demand for new homes or upgrades in the country, and the government made a way to slow the rapid increase in the market by rolling out cooling measures. Globally, 2021 brought the highest number of home sales since 2017.

“When the US sneezes, the whole world catches a cold,” so they say. And interestingly so, America has experienced six recessions since 1980, yet home prices have increased four times throughout that period. It shows that during tough times such as these, it doesn’t mean that properties will always lose their value too.

So we can rest assured that even if a recession hits our economy, we can rest assured that our property investments will remain intact. Property experts predict properties will incur at least a 9% increase within a year. Also, historically speaking, Singapore has weathered many storms before, so it’s only fitting that we’ll be rising back up again.

There you have it! I hope our current situation doesn’t dampen your appetite for investing because, as you saw in the data, the best time to purchase a property and let your money work for you to grow is now. The best part is that Singapore Real Estate Insider is with you!

Contact us to book a consultation!

Buy property and Wait

Not wait to buy property!

Click here for a complimentary call with us.

***

Join us in our private group where we help busy professionals and homeowners make six-figure profits in their property, safely.

Property is an ongoing process and journey because they are constantly changing and different strategies must be applied at different times.

Therefore in this group, we not only do weekly live coaching on property, we also cover a wide range of property knowledge and information that we as homeowners must know and be educated on to make informed decisions.

Just click on the button below to join.

Disclaimer: All information presented is based on personal opinions. Singapore Real Estate Insider is not liable for any losses and expenses whatsoever related to investment decisions made by the audience. The ideas presented are here for reference and educational purposes only.